Q3 2023 Student Housing Update

In this article, we discuss recent performance and developments in the U.S. student housing market and the importance of remaining highly informed and connected to borrowers in the current market environment.

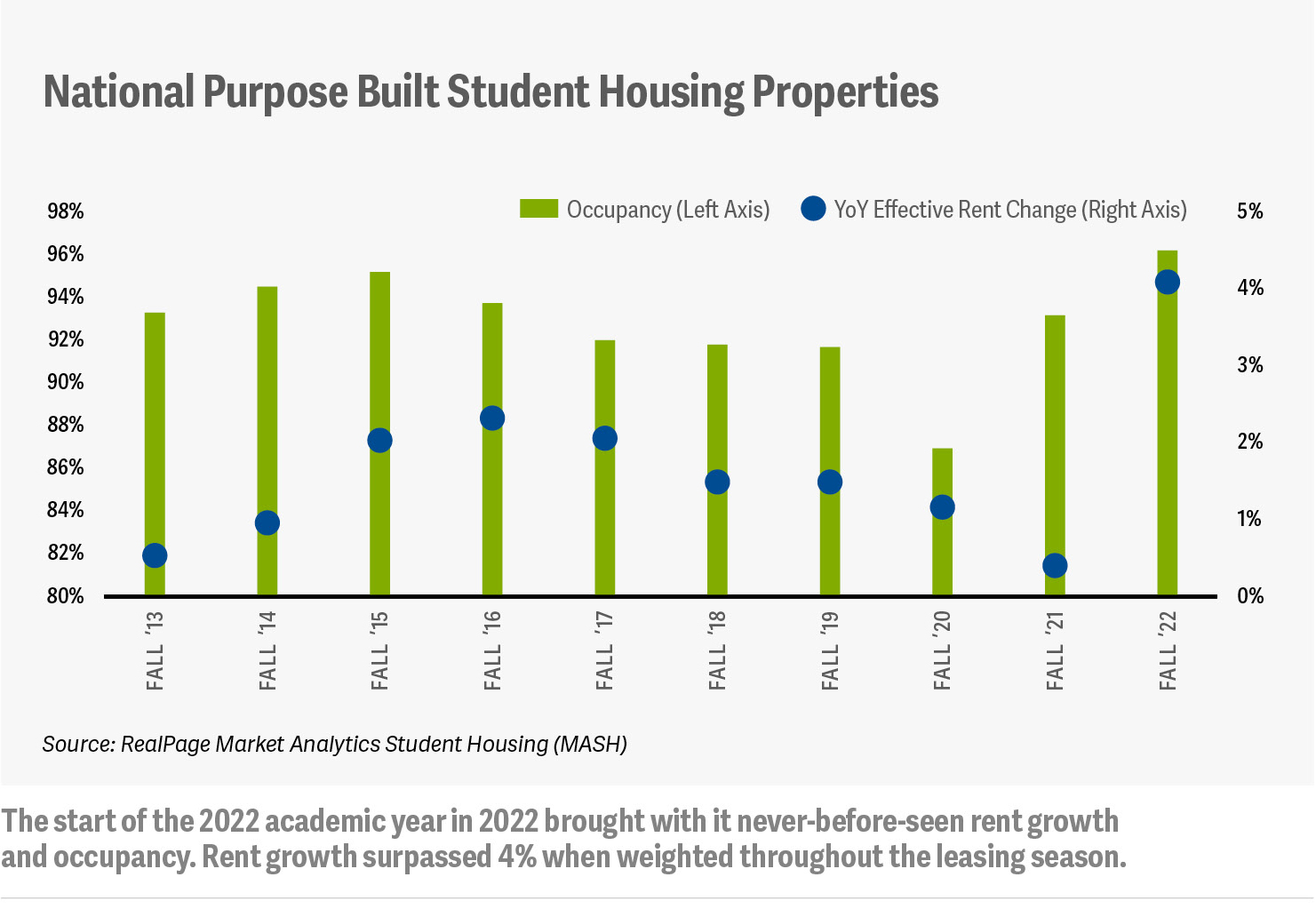

After a tumultuous couple of years beginning with the onset of the pandemic in March 2020, U.S. student housing market volatility stabilized somewhat in 2022, as more students returned to campuses for in-person classes and preleasing rates for the school year exceeded 96 percent across the top two hundred academic institutions in the country, based on data from real estate software company, Yardi.

It should be noted, however, that the U.S. higher education market is experiencing declining enrollment overall. This has been a consistent long-term trend and is likely to accelerate based upon, but not exclusively due to, what has widely been described as the “enrollment cliff.” This dramatic drop in the college-age population is expected to begin in 2025 and is predicated on the exceptionally low birthrates that occurred between the years 2008 and 2011, a period of economic stress and uncertainty driven by the Great Recession. As a result, the overall pool of young adults which would normally be heading off to school at that time has been significantly reduced.

Separately, there has also been a so-called “flight to quality” taking place in higher education for a number of years, both at the public and private levels. Flagship institutions within many state systems are now experiencing an increase in demand from prospective students, while other, smaller and less prestigious schools in those systems are seeing declining demand and enrollment. A similar trend has been observed across private institutions as well. As a result, the schools seeing the windfall are admitting more students and carrying larger class sizes than they have historically. Not surprisingly, this is straining the existing infrastructure and resulting in a shortage of student housing in those locations.

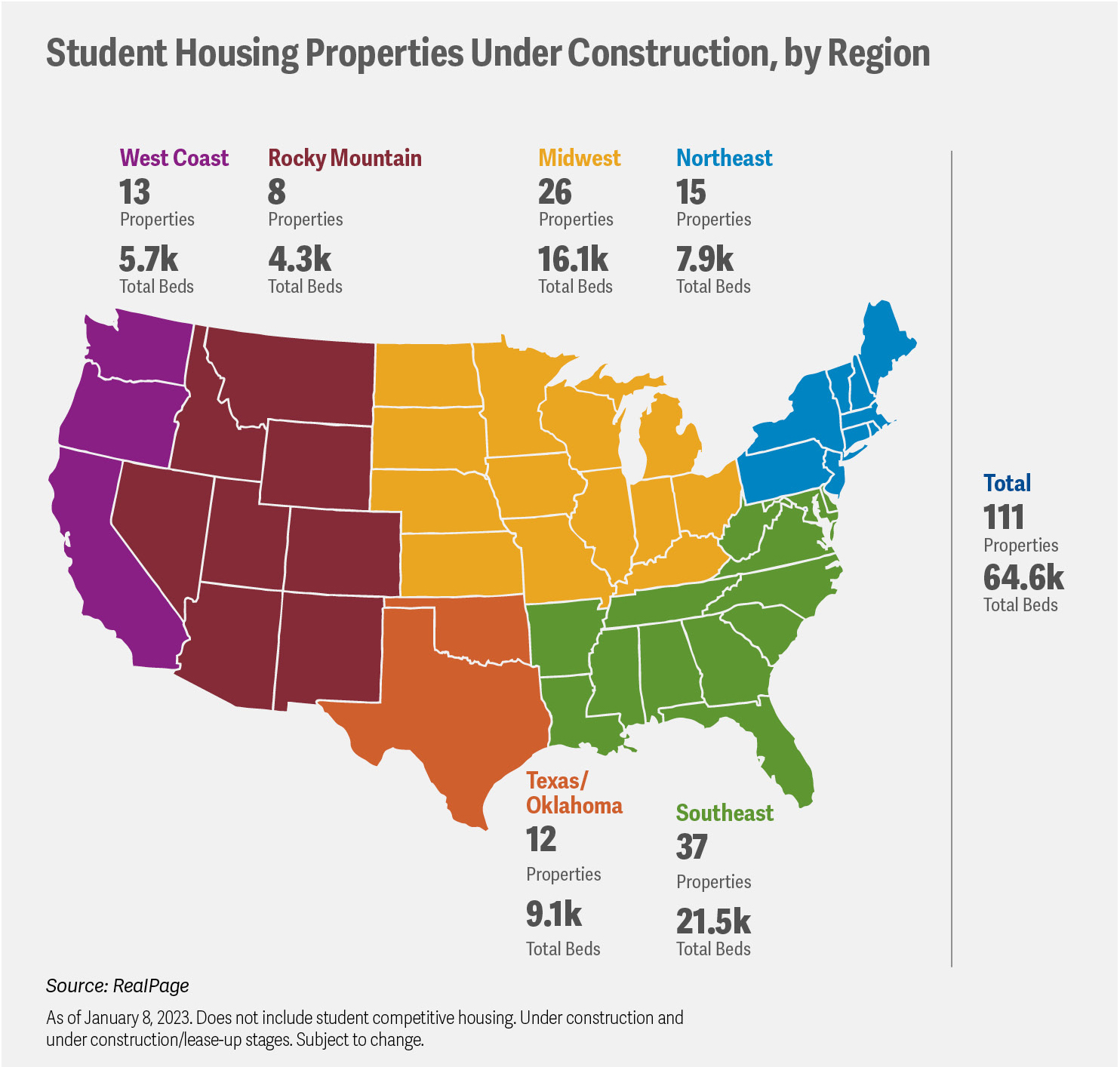

Another trend driving the composition of student housing demand is an acceleration of the population migration trend that has been occurring for a number of years driven by the COVID-19 pandemic. With many families relocating from Northeastern and Midwestern states to the South, Southwest and West, schools in those now desirable locations are experiencing sizable growth and, as a result, a need for expanded student housing options. This development is supported by data from DIY College Rankings, which finds that over half of all college students attend schools that are located less than 100 miles from their home, and only 16% travel 500 miles or more to attend a school.

While a challenging economic environment characterized by high interest rates and increasing inflation took a toll on the broader housing market last year, student housing managed to sustain more robust transaction activity, with the pipeline for new student housing developments continuing to flourish. As of October, more than 31,000 bedrooms were under construction at the ten largest U.S. universities. The University of Texas in Austin led with 4,726 units in development.

There was significant activity in student housing in 2022. 470 properties were sold with aggregate sales volume of $22.8 billion, and an average cap rate of 4.87%. The largest transaction was the sale of University Village of Tuscaloosa, Alabama, with 455 units and 1,164 beds. The University of Texas at Austin, the University of Wisconsin-Madison, and University of Maryland were the most active in terms of the number of beds under construction in 2022, with 5,522, 2,814 and 2,648 in the works, respectively.[1]

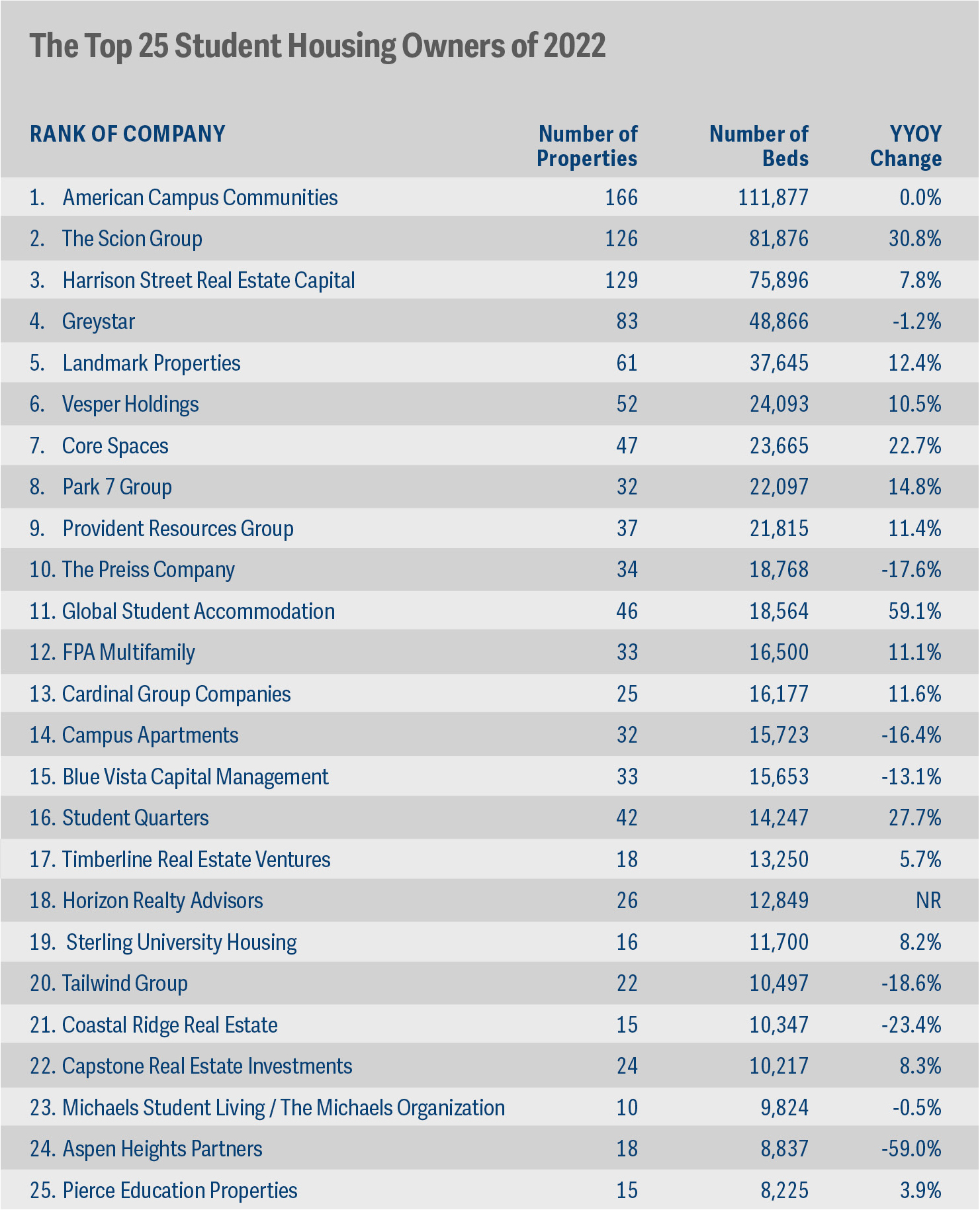

The five most active student housing developers are Landmark Properties, Core Spaces, Peninsula Investments, Harrison Street, and Subtext, with a combined total of 113,118 beds planned through 2026, with the top 25 developers having a total of 251,921 beds planned for the same time frame.[2] The top 25 student housing owners, listed below, own a total of 659,208 beds in 1,142 properties.[3]

Recent notable projects announced or breaking ground are a 2,000 bed project at the University of Tennessee, a 1,200 bed project at William & Mary, and an 859 unit project at FSU-Tallahassee.

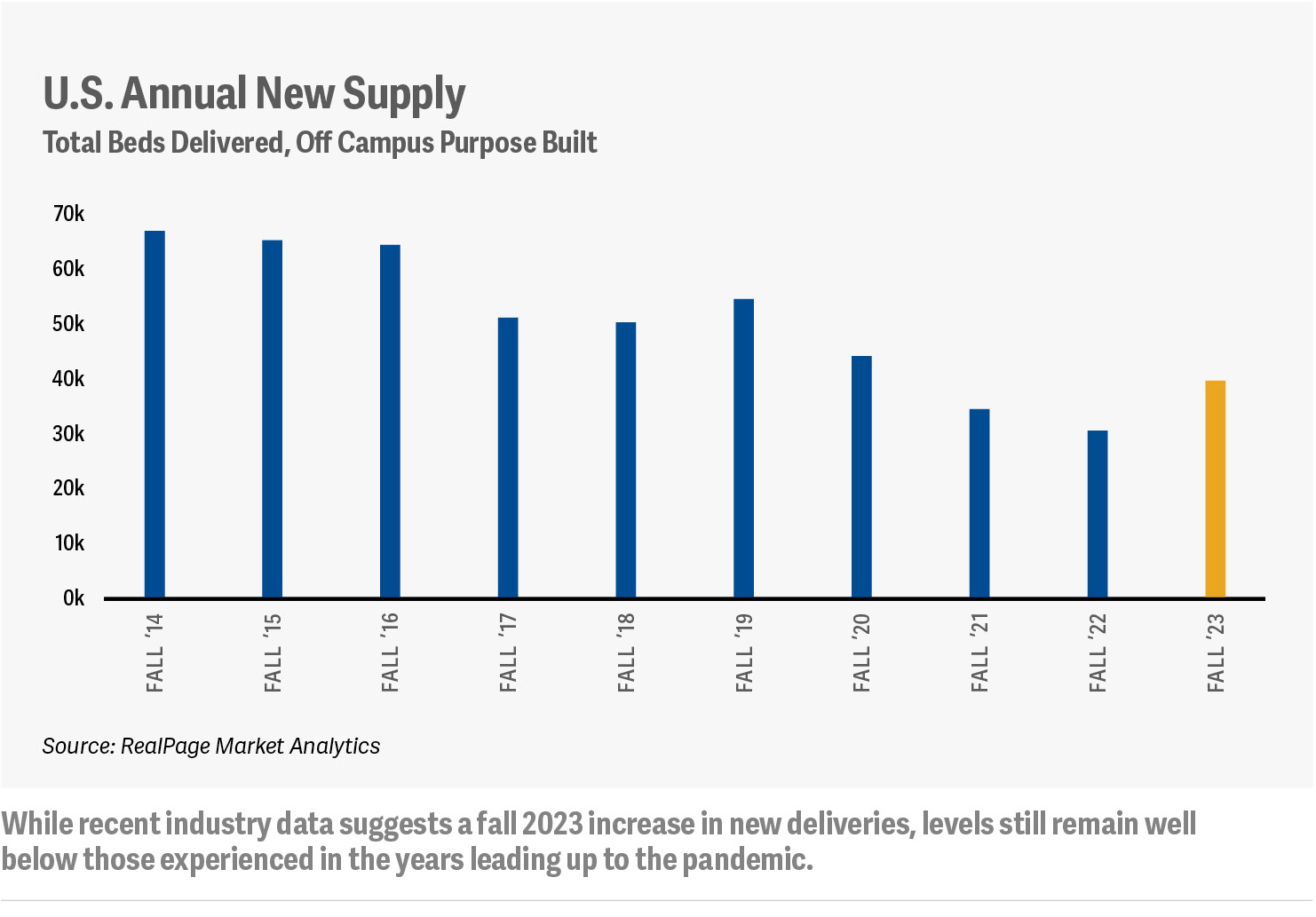

As increased interest rates have impacted investment activity and development since they began to rise in early 2022, larger financing transactions have become more challenging, with the majority of investors focusing on somewhat smaller deals due to increased liquidity in the financing markets. That said, there have been exceptions, significant refinancing deals and financing for larger student housing projects. As fall semesters begin in 2023, the overall outlook for student housing remains positive, driven by enrollment growth, evolving student preferences, and the aging existing inventory.

Amenity-rich offerings with trendy community spaces, wellness facilities, a range of study space options, coffee and juice bars and state-of-the-art technology are in high demand. Architects and designers are focusing on these and other features as they create spaces designed around sustainability, community experiences and merging interior and exterior environments.

The continued growth of the middle class worldwide, which has historically invested more of their overall income on education, is expected to fuel the continued expansion of higher education facilities across the U.S., including a growing need for undergraduate and graduate student housing and faculty accommodations in close proximity to those institutions. Notably, the Organization for Economic Co-operation and Development (OECD) forecasts that there will be nearly 8 million internationally mobile students by 2025, up from 5 million in 2019. Many of these are expected to matriculate to U.S. schools from China (where lockdowns and political considerations could impact mobility) and India, both of which boast significant middle class populations and have become top sources of international students for the U.S. colleges and universities in recent years.

Student housing is now among the most in-demand commercial real estate asset classes, and as demand has continued to outstrip supply, student housing has become more and more expensive. With an estimated 20.5 million enrollments by 2027, and the top 175 American universities only able to house 21.5% of their undergraduates in on-campus housing, according to CBRE Research published just prior to the start of the pandemic, significant opportunities remain for investors in student housing.

It is important to point out here that, as with many categories of commercial real estate, disparities in student housing demand exist based on location and demographics. Although many schools around the country are continuing to grow, some are facing declining enrollment.

That said, according to the Yardi Matrix National Student Housing Report and RealPage Market Analytics, the fall 2023 school year is looking like a good one for student housing. As of June, 86.6% of beds at Yardi 200 universities were preleased for the fall term, a 0.4% increase over the same period last year. Additionally, June was the fifth consecutive month of annual rent growth over 7% at those universities where average rent per bed reached $846 at quarter-end, an all-time high. This data is particularly impressive given that 2022 had held the previous rent record for student housing.

While three universities (Ohio University, the University of Southern Mississippi and the University of Mississippi) each achieved greater than 20% growth in preleasing as compared with their same period performance in the previous year, rent growth at two of those schools (Ohio University and the University of Southern Mississippi) declined during that same period.

Understanding performance nuances such as these is of critical importance to investors and lenders who are actively engaged in the space. Staying close to borrowers and understanding the drivers of financial performance trends is essential to being able to take timely action to both capitalize on upside market opportunities or intervene during periods of concern to best minimize downside risk.

Ultimately, to be successful investing or lending in student housing participants need to understand both the traditional drivers in each local market (e.g., supply, rents, pre-leasing rates, etc.) as well as the short and long-term operating trends of the local schools (applications, selectivity, enrollment, financial performance, etc.). This has become all the more important given the flight to quality, declining enrollment, and migration trends that have, and will continue, to impact higher education institutions over the next decade.

About Getzler Henrich

As a pioneer in the turnaround and restructuring space, Getzler Henrich is tuned in to the objectives and sensitivities of all parties and helps companies identify and work toward optimal solutions. It is in that context that the firm provides a full array of turnaround, workout, crisis and interim management, corporate restructuring, bankruptcy, financial advisory and distressed M&A services to publicly held companies, private corporations and family-owned businesses — many in the middle market (annual revenues up to $1 billion) — with a variety of capital structures and a range of debt structures.

[1] Source: 2023 Berkadia Student Housing Report

[2] Source: Student Housing Business

[3] Source: Student Housing Business