Record Online Holiday Sales Suggest Growing Need for Omnichannel-Driven Valuation Methodologies

In this article, we examine the significant momentum occurring in non-brick and mortar retail, including growth in both the online Resale and Rental categories as well as the growing popularity of BOPIS offerings, and how these developments can best be monitored and understood by ABLs that are active in the Retail space.

In 2019, holiday shoppers in the U.S. spent significantly more of their money in the online channel than they have in previous years. E-commerce sales this year made up 14.6% of total retail, rising 18.8% from the 2018 period, according to Mastercard’s data tracking retail sales from Nov. 1 through Christmas Eve. That’s more than 7.3% higher than 2018’s record breaking 11.5% increase. Excluding autos, holiday retail sales overall increased by 3.4%.

Because Thanksgiving fell nearly a week later than usual, the “holiday shopping period” was six days shorter in 2019 as compared to the prior year. Yet, sales still managed an increase overall from 2018 of 3.4% excluding autos. And that shortened window of holiday buying may actually have fueled consumer concerns about getting to a physical retail store in time, leading to more online purchases.

With wages continuing to outpace inflation, unemployment at record low levels and consumer confidence high, shoppers flexed their holiday spending muscle at the end of 2019 to the delight of retailers, which often rely upon the season to put them in the black for the year. Those that forecast a robust holiday season and managed inventories accordingly, likely reaped the rewards. Department stores, however, which rely heavily on end of year sales, fell 1.8%.

As retailers look to modify their store footprints to maximize foot traffic and revenue p/square foot, the café/eatery has proven to be one viable consideration. Often executed via a partnership with a proven foodservice or restaurant brand, it can attract incremental foot traffic, introducing new or past consumers to the host store brand and its current offerings. For mall operators and other landlords, it enables existing retail tenants to maintain their existing square footage and meet their lease commitments.

Retail continues to evolve. Today, millennials aren’t interested in shopping the way Baby Boomers and even more recently, Gen-X’ers have before them. They have a different vision of how they want to spend their time and it often centers around engaging primarily in “experiences” that they believe will bring them fulfillment and emotional value, rather than just the tangible value of accumulating the goods they’re shopping for.

In each case, these companies have taken a step toward infusing the traditional shopping experience with characteristics that demonstrate that they are committed to and in touch with Millennials, the customers that are likely to make or break their business in the decade ahead.

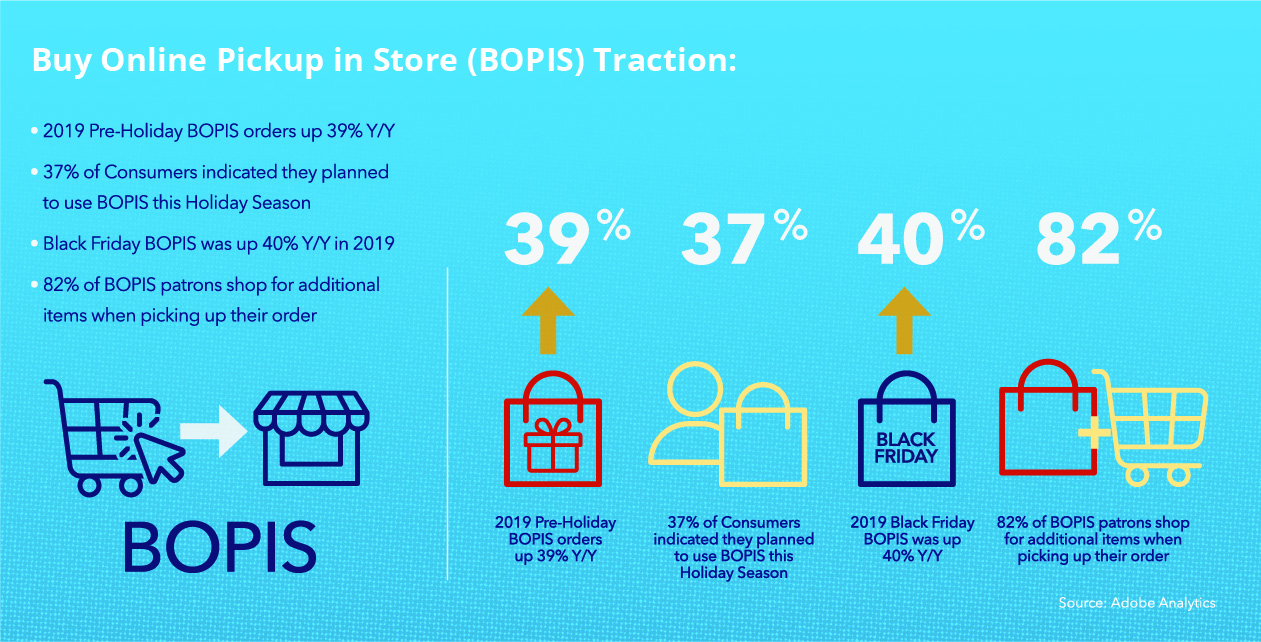

“About 90% of the cost goes away”when customers order online and pick up at a store, use curbside pickup or select shipping via Shipt, according to Target CEO Brian Cornell in an interview published in November 2019.

In the omnichannel world, retail has evolved into much more than traditional brick and mortar. Essentially, resale, rental and traditional retail are all becoming one “retail”. And as a result, traditional retail evaluation methods are becoming less relevant. Metrics such as same store sales, sales per square foot are now likely to be less accurate measures than metrics that deal with more universally applicable revenue by transaction and by individual customer.

Hilco Insights Looking Forward Based on Continued Ecommerce Sales Growth

It’s time to reevaluate the role of stores:

- More existing stores are forecast to close in 2020 compared to 2019

- But the trend is starting to move away from just simply closing stores to shrinking per-store square footage.

- More consumers shopping online means retailers don’t need huge stores.

Reconfiguring existing/smaller spaces to include new services such as tailoring, bars and cafes; leveraging BOPIS (Buy Online Pick Up In Store); reducing inventory and creating experiences to increase foot traffic.

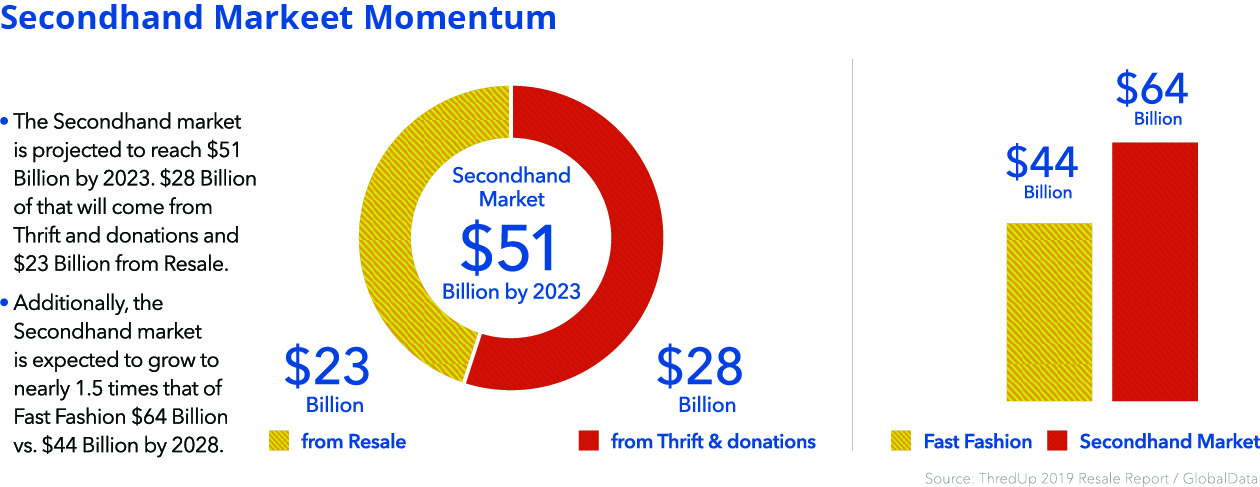

Resale and rental, particularly online, are gaining steam:

- Resale (secondhand apparel):

J.C. Penney and Macy’s announced in August 2019 with ThredUp.

Therealreal went public in 2019. - Rental:

Rent the runway, Fernish and Feather etc., are taking hold with major brands coming on board.

Considerations & Monitoring Points in Valuations:

Unique to Rental/Resale Inventories:

- Any damaged product would require greater discounts to sell through compared to new or lightly used goods.

- A build-up of aged product could require a greater level of discounting than a newer assortment reflecting the latest fashion trends.

- The current mix, rental history, and status (active versus saleable), as well as the company’s historical self-liquidation results, are important to review and analyze to determine sale discounts.

- Pockets of less-desirable inventory would likely remain toward the end of the sale. All remaining product would be bundled and sold to opportunity buyers and/or liquidators.

- Ensure that during the normal course that samples, damaged and slow-moving goods are purged on a regular basis.

For Traditional Brick and Mortar Retail Inventories:

- On an ongoing basis, it is necessary to understand changes in metrics such as sales, open orders, gross margins, inventory levels, turnover, aging, and product mix.

For Omnichannel Retail / “New Retail” Inventories (In addition to the above “Retail”):

- Ecommerce Metrics such as:

Visitors, bounce rate, conversion rate, cart abandonment rate, percentage of new and repeat visitors, units per order, and dollars per visitor. - The Lender should examine any significant change in the metrics and closely monitor these statistics to ensure decreases are technical and not caused by less-compelling product assortment or an aggressive competitor gaining market share.

Understanding and modeling the different sales channels is key to finding the most appraised value in this omnichannel retail market and at Hilco we are leading the charge. One single approach is no longer a viable solution and ABLs with portfolio exposure across both these old line and new line retail channels would be well advised to consider modification to their standard retail appraisal schedules as significant changes that can impact businesses viability can and do occur ever-more rapidly in a quickly evolving market such as the one we are observing at the present time.