Rising Costs on Dual Fronts Create Troublesome Outlook for Ecommerce Retailers

In this article we examine how two distinct factors, one based on increased scrutiny around the collection and use of personal data for marketing purposes and the other directly tied to pandemic exacerbated supply chain interruptions, are adding complexity and cost for ecommerce retailers (e-tailers) as the year draws toward a close.

SLIGHT DECELERATION IN THE ECOMMERCE WORLD

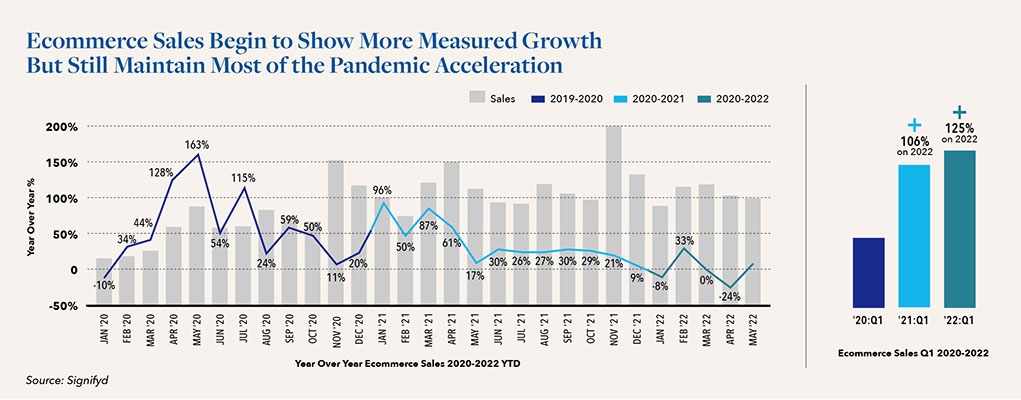

A bevy of positive news about record setting ecommerce growth filled the ecommerce trend reports of 2020 and 2021. This year has delivered as well, with year-over-year online sales continuing to grow, albeit at a somewhat slower rate. Regardless, consumers say they are not going back to their old offline purchase ways. In fact, a majority of consumers surveyed in June 2022 for Signifyd’s “The State of Commerce 2022 Inside Retail’s Reset after the Chaos of COVID,” report reported that their COVID driven online shopping habits have now become permanent. The data, however, also show that the pace of online sales growth is somewhat decelerating, and some key factors are reshaping and placing downward pressure on the ecommerce landscape simultaneously.

A ONE-TWO PUNCH

As the end of 2022 approaches, online retailers are finding themselves squeezed by two unrelated but challenging issues, namely increasing customer acquisition expenses and rising fulfillment costs. Part one, what we call the “customer conversion conundrum,” stems from the fact that digital ad outlays are not translating into the same number of sales as they did just one year ago. With conversion rates down, e-tailers now find themselves spending more — by upwards of 20-40 percent — to effectively reach their target consumers. So what is part two? Once e-tailers do convert on a sale, they are now being faced with the difficult decision of whether to pass on a greater percentage of the also rising fulfillment expense to that hard-earned customer. It turns out that the free and flat shipping rates that attracted customers in 2020 and 2021 are proving more and more difficult to sustain in 2022. As a result, many e-tailers are being faced with the cumulative effects of under charging for shipping over the course of this year, which has had a notable negative impact on their bottom lines.

DIGITAL ADS NOT DELIVERING LIKE THEY USED TO

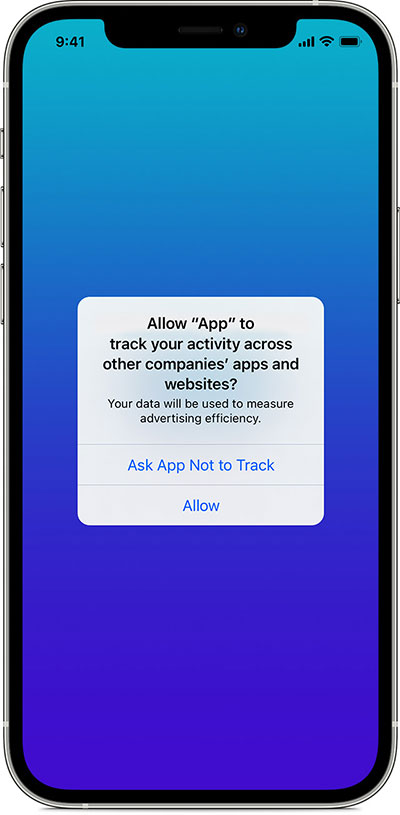

One of the key drivers pushing up the cost of digital advertising is a significant privacy policy change that Apple put into effect in 2021. Called App Tracking Transparency (ATT), the policy allows Apple users to easily opt out of having app companies track them and link data about them to information collected by other app companies and data brokers. The onus is now on the app companies to get permission from Apple users, which is unique in the third-party advertising space. While the policy only affects third-party data (the data collected for use across companies or linked by third parties), that is where the rubber meets the road for the companies that sell consumer demographic and psychographic data that is tailored for ecommerce sellers. While companies can continue to collect first-party data (what they collect from direct engagement with a customer) from their Apple product using customers, they are finding that it takes a lot more effort and investment to capture new customers without the access to third-party data.

In an April 2022 paper titled, “Mobile Advertising and the Impact of Apple’s App Tracking Transparency Policy,” Kinshuk Jerath, a business professor at Columbia, pointed out that, “The $300 billion mobile advertising industry relies on vast amounts of consumer data to serve up targeted ads.” He also noted that Apple began enforcing ATT at a time when, “consumers wanted more transparency and control over how their personal data are used.” The privacy backdrop of the policy change is one that is hotly debated among different camps, from the digital advertising industry to consumer privacy advocates. Regardless, Apple is clearly committed to the policy and one of the consequences, intended or not, is that it is now costing e-tailers more to reach their target audiences and acquire customers. With U.S. and global digital advertising spending expected to increase dramatically over the next couple of years, the challenge for e-tailers will be getting a consistently worthwhile return on their mounting digital ad spend.

FULFILLMENT COSTS UNPREDICTABLE AND GROWING

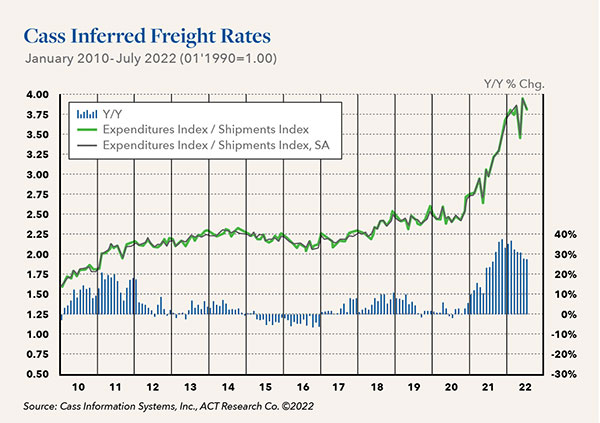

At the other end of the ecommerce transaction, there is consternation about what feels like the ever-rising cost of delivering a package to a customer’s front step. E-tailers have endured rising fuel costs, the supply chain crisis, a truck driver shortage, and a pandemic, all of which have contributed to higher freight costs. Omnichannel retailers who can offer buy online/pick-up in store (BOPIS) or in person shopping as well as a complete online experience, have an advantage over those that are 100 percent ecommerce, but the increase in fulfillment expense is being felt by all. As the team at Freightos Group Solutions noted in a recent round up about the industry, these challenges range from supply chain constraints and rising fuel costs to sanctions on Russia, railway backlogs and warehouse space scarcity. Looming labor disputes also make the list. As a result, even with declining fuel prices easing pressure on shipping costs to some degree in Q3, calculating the cost of fulfillment going forward is unpredictable at best.

Case in point, Amazon has now announced that it will raise third party seller fees for the 2022 holiday season to manage through inflationary pressure. Will this step to recoup some of its increasing cost by passing along costs to the millions of merchants on its site result in those costs then being passed along to consumers?

RUN RATE AND CONTRIBUTING FACTORS AS A BELLWETHER

The growing cost of acquiring customers and converting a sale in the world of digital advertising, combined with rising freight and related supply chain costs that are difficult to pass without alienating customers, is increasing the run rates and threatening the health of many ecommerce businesses. For lenders with current ecommerce exposure within their portfolio, we urge that close attention be paid to those rates and how the aforementioned factors may be impacting costs, operational efficiencies and inventory aging within those businesses. In many cases, our team is now observing slower retail inventory turns which, in turn, can impact net orderly liquidation value (NOLV). With this in mind, we advise lenders to ensure that they remain in close communication with these portfolio businesses to gain a thorough understanding of the challenges they now face and how those are being addressed. The Hilco Valuation Services team is currently engaged in numerous retail client valuations and welcomes the opportunity to discuss your situation and share our insights. We are here to help.

ABLs, retailers, e-tailers, and manufacturers alike have achieved a high level of success across numerous industries in partnership with Hilco Valuation Services, based upon our disciplined process, industry-leading bench strength, systematic and highly collaborative approach. This success is a testament to our commitment to excellence. By understanding past cycles and performance, documenting historical data points across the sectors and industries, and continuously exploring and assessing the path that is being paved ahead, Hilco Valuation Services consistently delivers reliable, accurate and actionable valuations for our valued customers.