Rolling With the Changes. Can the RV Industry Sustain Momentum Beyond the Pandemic?

In this article, we discuss sales growth in the RV industry during the pandemic with an eye toward understanding the potential for the market to sustain and/or build upon the that momentum moving ahead.

The onset of the COVID-19 pandemic in early 2020 caused a significant shift in how people live and work. With stay-at-home orders and a newfound appreciation for the great outdoors, the demand for recreational vehicles (RVs) skyrocketed. Although the industry encountered challenges meeting the initial demand surge, data surrounding pre-pandemic RV demand and sales through 2021 and 2022 paint a somewhat optimistic picture of the RV industry going forward.

How were RV Sales Affected by the Pandemic?

In the early days of the pandemic, many people turned to RVs as a way to socially distance themselves and take a break from the stress and uncertainty of daily life. RV sales increased significantly, with some dealers reporting record-breaking numbers. According to the Recreational Vehicle Industry Association (RVIA), RV shipments grew by 23.6% in the first quarter of 2020 when compared with the same period in 2019. Another report from the RVIA shows that total RV shipments in 2021 were 39.5% higher than the 2020 total, with travel trailers and motorhomes comprising the majority of RV sales in 2021.

RV Supply Chain Issues Related to Increasing Demand and Shortages of Components

The pandemic surge in RV sales created several challenges for the industry, particularly regarding the supply chain. As demand skyrocketed, manufacturers and dealers struggled to keep up, leading to a record level of shortages and long wait times for customers anxious to take possession of their RVs.

Initially, RV manufacturers dramatically increased their purchase orders with their suppliers to meet growing customer demand. However, many suppliers struggled to meet these new purchase order levels because they either did not have enough inventory, or the right inventory, on hand at the time.

The primary challenge for suppliers and manufacturers has been obtaining the necessary materials, parts, and –distinct from the vast majority of other vehicle types – the compact and specially designed onboard appliances needed to build RVs. The pandemic’s disruption of global supply chains has made it particularly difficult for these manufacturers who rely upon everything from lumber for cabinetry, bed and seating framing to semiconductor chips that are integral to both their vehicles’ powertrain and safety systems as well as the operation of the appliances used onboard. The inability of many manufacturers to obtain the required components has resulted in long delays and made it impossible, in some cases, to deliver certain models and highly desirable features.

Many RV component suppliers lost potential sales to the RV manufacturers in the first 12 months of the pandemic surge in demand, due to their inability to meet these higher purchase order levels. In turn, many manufacturers resorted to switching to alternative suppliers or ordering more than needed because of the uncertainty in delivery. This created even more issues as demand started to level off or even decrease.

RV Demand and Sales Toward the End of the Pandemic

As the pandemic wore on and people began to adjust to the new normal, including a return to work, the demand for RVs started to level off. In 2021, RV shipments dropped by 3.6% in the first quarter compared to the previous year.

The softened demand, combined with the increased inventory, caused a slowdown in the industry in 2022. Many manufacturers have been forced to reduce production, leading to layoffs and factory closures and consolidations. According to a January 5th article in RV Business, “two of the industry’s largest publicly held retail companies, Camping World and Lazydays, were down 46% and 42.6% in the 12 months ending Dec. 31, 2022. Meanwhile, OEM’s THOR Industries and Winnebago Industries were down 38.4% and 30.8%, respectively, and suppliers Lippert and Patrick were down 42% and 25.7%, respectively.”

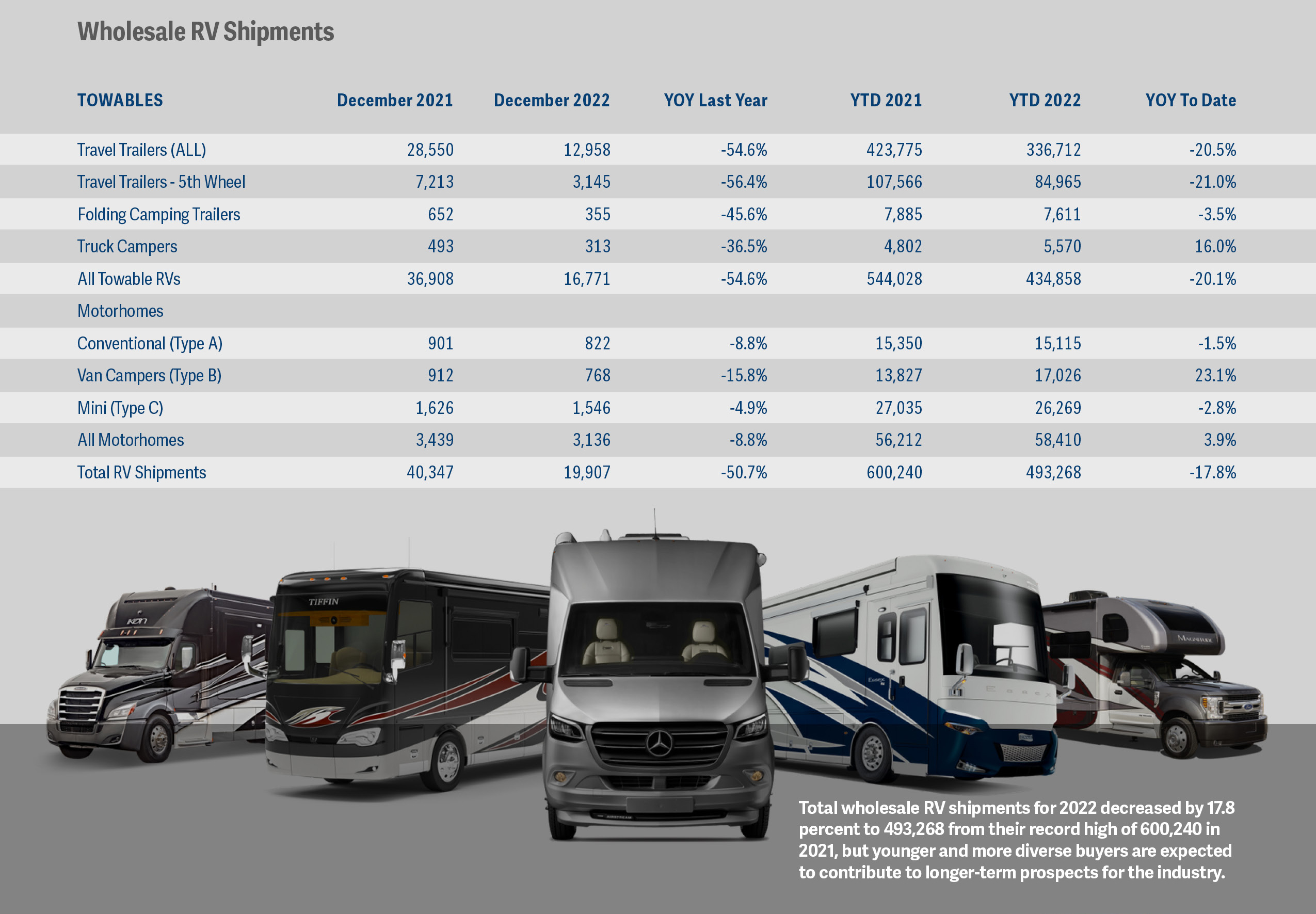

RVIA reports that 2022 ended with the third best shipment year on record – normalizing off strength through the first half of the year as the industry returned to production numbers seen prior to the pandemic.

Major OEM Predictions for 2023 and Beyond

Despite the industry’s challenges, many major OEMs remain optimistic about the future of the RV market, and some have predicted that the demand for RVs will continue to grow, albeit slower than in 2020.

To prepare for the future, we view it as essential for RV manufacturers and suppliers to focus on improving their supply chain and inventory management. This will ensure their ability to meet future demand for RVs, without building up costly excess inventory. It will, of course, also be necessary for manufacturers to continue to innovate and offer new and exciting features to attract customers. This is particularly relevant given that the IDS 2022 RV Industry Trends Report emphasizes purchases by Millennial and Gen Z buyers, noting that 22% of RV owners are now between 18 and 34 years of age, and that percentage is likely to keep growing.

Post-Pandemic RV Sales and Outlook

Although post-pandemic sales have now returned to a more historically steady level. the stream of RV enthusiasts is far from drying up. In fact, some industry insiders predict that the RV market will increase as compared to pre-pandemic levels.

One factor that has driven interest among younger buyers and may continue has been the growing popularity of “van life,” a movement that advocates for a minimalist, nomadic lifestyle centered around traveling in converted vans or RVs. With social media platforms like Instagram and TikTok flooded with videos and posts, more and more people have been drawn to the idea of hitting the road in a van or RV, particularly since the Pandemic’s arrival in early 2020.

Another factor is continued, increased interest in domestic travel. Even with the dollar remaining strong against European and other currencies, given consumer wariness about the uncertainties of international travel in the COVID era and fuel costs impacting the price of lengthy international flights, many Americans are opting to explore the U.S. instead. And what better way to do that than in the comfort and safety of an RV?

While the dramatic spike in RV sales that occurred during COVID’s peak may have passed, the easing of supply chain constraints and a continuing stream of interest and purchasing power among enthusiasts of the lifestyle has suppliers and manufacturers hopeful for the future. However, they should continue to closely monitor both demand and supply to avoid the problematic impacts that mismatches caused earlier in the pandemic. Also, lenders with exposure to the industry should closely monitor their borrower’s performance and inventory levels during this period, being sure to update asset appraisals regularly to minimize downside risk.

Getzler Henrich provides a full array of turnaround, workout, crisis and interim management, corporate restructuring, bankruptcy, financial advisory and distressed M&A services. We work with public and private corporations as well as family-owned businesses, under a variety of capital and debt structures. Our worldwide client base spans the full spectrum of industries, from the healthcare and retail sectors to oil and gas, to manufacturing and distribution.