Sluggish Fossil Fuel Consumption and EV Adoption are Cautionary Flags for Lenders in 2024

In this article we discuss recent developments in natural gas, oil and green energy, with an in-depth look at the drivers of current trends and the impact these are having on industry participants and lenders.

NATURAL GAS AND OIL

NATURAL GAS

Natural gas has long been considered a climate friendly fossil fuel when compared to oil or coal. Used in power generation, natural gas emits half as much carbon dioxide as typical coal fired plants and is now the dominant fuel for power generation in the United States. It is estimated that carbon emissions from power plants in the U.S. have shrunk by 40% as many coal fired plants have been taken out of service.

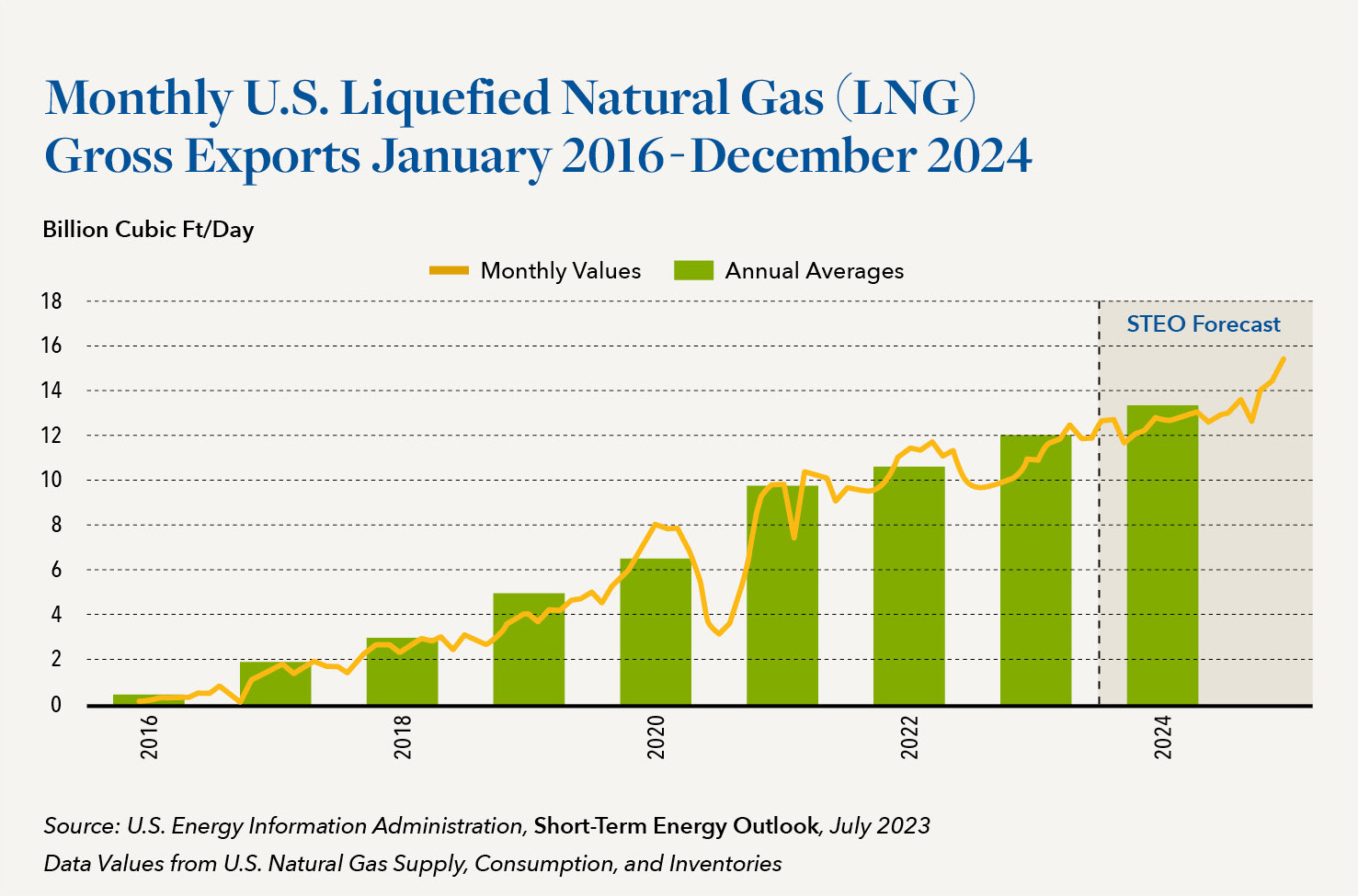

The shale boom which involves hydraulic fracturing (fracking) has allowed the U.S. to become the world’s top exporter of natural gas. Export is via LNG — Liquefied Natural Gas — a process in which the gas is cooled to minus 259 degrees Fahrenheit and then loaded at export terminals onto specialized ships. There are now seven export terminals for this purpose, primarily on the Gulf Coast. However, some see export activity via LNG as an environmental detriment due to extensive processing and transport necessary to get to its end customer, which is typically Europe. In December 2023, more that 87% of U.S. LNG exports went to European Union, United Kingdom and Asia, replacing Russian exports that ceased after the Ukraine invasion.

In January of this year, the Biden administration announced a pause on pending decisions for permits to export liquefied natural gas (LNG) to non-free trade agreement countries so that the U.S. Department of Energy could update the underlying analyses justifying such authorizations. The announcement included the following statement from Energy Secretary Jennifer Granholm: “We must review export applications using the most comprehensive, up-to-date analysis of the economic, environmental and national security considerations.” According to data from the Center for Strategic & International Studies, the U.S. catapulted from a baseline of zero LNG exports to become the world’s leader in just eight short years and was even able to surpass Qatar and Australia due to the reintroduction and addition of new LNG plants in 2023.

As of this writing, the winter of 2023-2024 has been exceptionally mild, leading to reduced consumption of natural gas in a period of increased production. While this has been good news for consumers, both households and industry, it is quite the opposite for producers. Natural gas futures recently fell to their lowest level since trading began on the NYMEX almost 35 years ago, with March futures now standing at $1.732 MMBtu. The warm winter along with the pause of increased export permitting are likely to suppress natural gas pricing for the foreseeable future, which also will be dependent on spending and production in light of export limitations.

OIL

U.S. oil production in 2023 was, on average, 1 million barrels per day over 2022. Production increases in 2024 are expected to be more limited, however, at less than 200 thousand barrels per day. The number of U.S. operating rigs at the end of February 2024 stood at 626 (oil and gas combined) representing a year-over-year decline of 17%. Output growth in the past several years has primarily originated in the Permian Basin of West Texas, where the most lucrative fields in the continental U.S. are located. Energy research firm Enverus, however, estimates that Permian Basin oil productivity will stabilize in 2024, with wells in progress signaling declining densities.

During the past year, as both operators and investors sought more return and questioned increased drilling expenditures, there was major M & A activity with significant focus on Permian area companies. Publicly traded Diamondback Energy of Midland, TX, for example, recently announced its acquisition of Endeavor Energy Partners– the largest privately held oil and gas producer in the Permian. The cash and stock transaction is valued at $26 billion including debt, with a combined enterprise value of over $50 billion. Diamondback, itself, went public in 2012 and has been one of the fastest growing frackers on record, with crude production surpassing 250,000 barrels per day. Interestingly though, the merger of these two Permian firms will signal slower output growth there. According to East Daley Analytics, Endeavor has operated 13 to 15 rigs consistently in recent years, dropping to 12 rigs in Q4 of 2023. At the same time Endeavor’s crude output grew rapidly at a five-year compounded annual growth rate of 31%, averaging 220,000 barrels per day in 2023. Analysts noted that Diamondback recently updated its production guidance to between 470,000 barrels and 480,000 barrels per day after the two companies merge. This is only 1.6 % higher at the midpoint than the stand-alone guidance provided for each firm in 2024.

Exxon announced the acquisition of Pioneer Natural Resources, one of the biggest publicly traded players in the Permian, during Q3 of 2023. This deal, still pending approval, would be the largest oil and gas transaction in two decades and make Exxon the biggest player in the Permian. The transaction closely followed Chevron’s acquisition of the Hess Corporation, a leading independent, for $53 million, which would increase Chevron’s international holdings along the Bakken shale (Eastern Montana and Western North Dakota). December saw the acquisition of Crown Rock, another independent Permian producer, by Occidental Petroleum for $11 billion.

It is expected that spending overall by U.S. producers will increase by 2% to $115 billion in 2024 as compared with a 19% spending boost in 2023. It is worth noting that even that 2023 figure was below the annual average of $150 billion during the industry’s heyday period from 2010 to 2015, according to survey data from Evercore.

Clearly, investment in quality companies with assets located in desirable locales can be expected to continue despite persistent green energy initiatives and global headwinds. However, these influencing factors may also suggest that it will be more prudent to buy existing production versus new E & P activities moving ahead.

GREEN ENERGY

Ever-increasing efforts across green energy, especially those pertaining to transportation, continue to pose both long- and short-term challenges to fossil fuels. However, the move towards widespread EV adoption continues to face many challenges, whether from a manufacturing, infrastructure, adoption or technology standpoint. Electric vehicle sales in the United States have, in fact, been much slower to accelerate than in the world’s two other major markets, Europe and China. In China, nearly 27% of the new cars sold are now EVs, while in Europe that percentage is 15%, according to GlobalData. In the U.S. EVs presently account for only 7.6% of all new cars sold, according to data from Kelley Blue Book.

The slower adoption of EVs in the U.S. is starting to have consequences for both international and domestic manufacturers. Tesla, the world’s most valuable automaker by market capitalization, recently warned of lower growth in 2024, even after various price cuts and given the fact that it holds a 55% market share of EV sale in the U.S. Hertz, an earlier adopter of rental cars in its fleet, recently announced that it would sell off 20,000 vehicles (about 1/3 of its EV fleet) comprised primarily of Teslas. This move was attributed to limited demand, high repair costs and lower resale value brought about by new car price reductions.

Ford Motor Company reported an 11% fall in the sale of EVs this January (down to 4,674 from 5,247 during the same period in 2023) a further indication that the industry is facing shrinking demand for cars that are frequently more costly than their gasoline-powered alternatives.

Slower than anticipated consumer acceptance due to these cost factors as well as charging infrastructure limitations and the continued high interest rate/loan payment environment has prompted some automakers to cut production and/or offer special discounts or incentives. The price of the Ford Mustang Mach-E, for example, has seen reductions of up to $8,100. The company has also cut one of just two shifts at its Dearborn plant that is dedicated to production of the Ford Lightening pickup, based on lower than anticipated demand. Ford also temporarily halted production of the vehicles in early February due to quality issues.

General Motors, meanwhile, has backed off of its stated goal of producing 400,000 EVs in 2024 and now plans to manufacture a combined 200,000 to 300,000 of its Ultium-based Chevrolet, GMC and Cadillac EVs and Brightdrop Zevo commercial electric vans in North America. Similarly, Mercedes Benz, which had planned to sell only electric vehicles by 2030, now believes that only half of its sales will be comprised of EVs by that date, indicating that the pace of its transformation will now be dictated by customers and market conditions. Perhaps most disconcerting, Apple’s secretive and nearly decade-old Titan EV project was recently and abruptly canceled, with many of those resources redirected to generative AI efforts.

Newer EV startups such as Rivian and Lucid have reported disappointing outlooks for the year. Rivian recently downgraded its 2024 production numbers to be similar to 2023 levels at just 57,000 vehicles. Shortly after reporting significant losses in 2023 on revenue of $4.4 billion, the company announced its third major job cut since 2022, which will result in 10% of its salaried staff being laid off. Lucid, in turn, now expects to produce only 9,000 units, a fraction of its original forecast and just slightly more than rolled off its factory floors last year.

Summary

As the energy landscape continues to evolve based on the many factors present in the market today and developments, including those outlined in this article, it becomes more essential for lenders to truly understand how global influences, regulatory pressures and the competitive landscape are impacting their portfolio borrowers. Our team can provide added perspective on the associated operations, cost and margin challenges that these and other developments are presenting to a variety of businesses right now. We have a wealth of information and insight to share, based on current and past engagements, that can help you address immediate or evolving needs among your borrowers. We are here to help.