The Green Energy Horizon Takes Shape

In this article we take a look at developments in green energy, including a range of recent initiatives, their drivers and the associated industrial and consumer impact.

Origins: Genesis of Recent initiatives

On November 6, 2016, the Obama administration became a signer to the Paris Agreement. Shortly thereafter, in June of 2017, newly elected President Donald Trump announced that the U.S. would exit the Agreement indicating that it would undermine the country’s economy and place the U.S. at a permanent disadvantage. In 2019, the Trump administration gave formal notice of withdrawal, and that withdrawal ultimately took place one day following the presidential election in November of 2020. The tables turned again, when a newly elected President Biden signed an executive order in January of 2021, rejoining the Paris Agreement.

So what exactly is the Paris Agreement? In summary it is an addition to the United Nations Framework Convention on Climate Change, agreed to by all 195 member countries in December of 2015. The main agreement’s purpose is to limit the global temperature increase during this century to a maximum of 2 degrees Celsius above pre-industrial levels. Initial financial commitments by the U.S. to the Green Climate Fund, which itself has a goal of raising $100 billion, were $3 billion.

Present U.S. initiatives

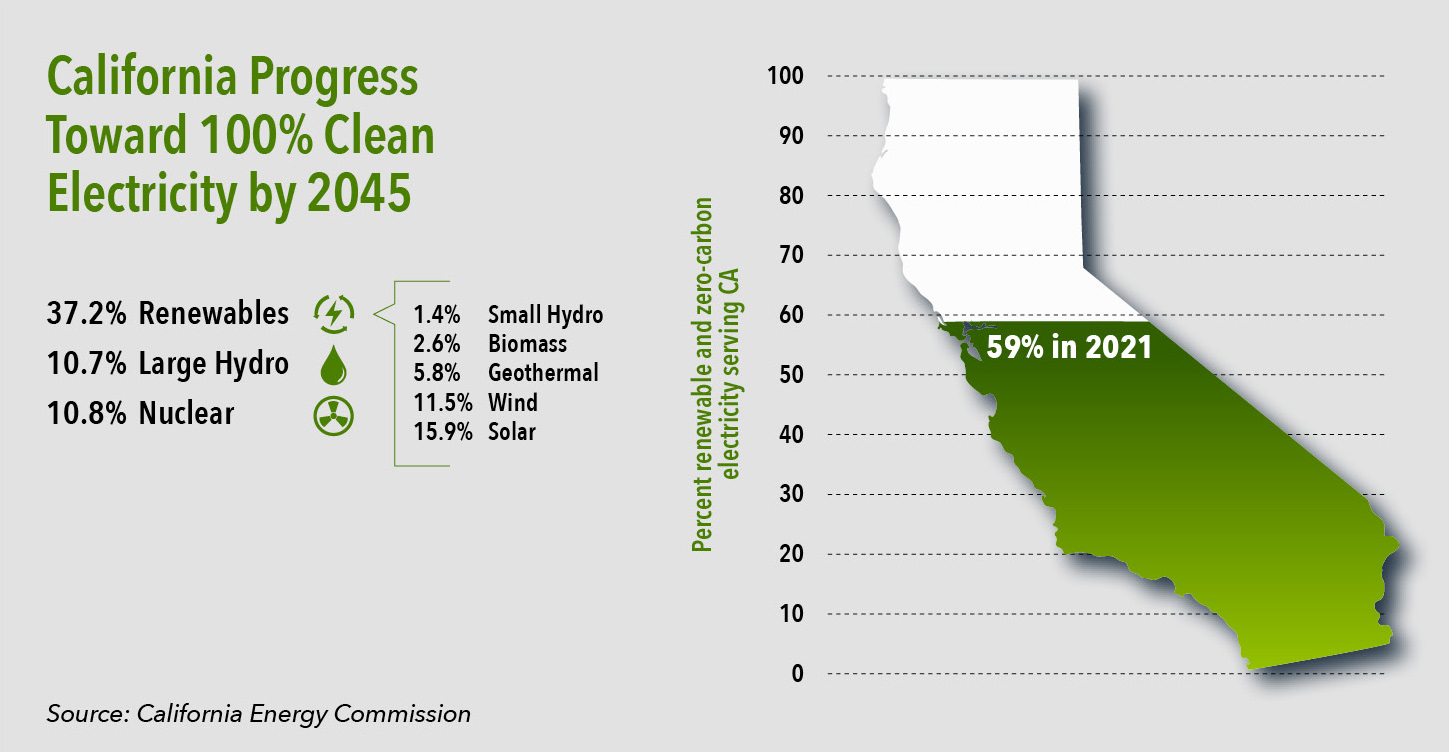

The present administration has announced plans to eliminate fossil fuels as a form of energy generation in the U.S. by 2035. A goal has been set to have a target of 80% renewable energy generation by 2030 and 100% carbon free electricity by 2035. Funding to achieve these goals was included in the U.S. Inflation Reduction Act signed into law on August 16, 2022. Funding for various energy and allied initiatives in the Act is estimated to total $391 billion. Some states such as California, however, which has established one of the most ambitious climate goals worldwide, are being tested. Had the state’s 2022 Proposition 30 ballot initiative passed, it would have created sustainable funding for such efforts over the course of the next two decades. Now, California is facing added challenges in its efforts to meet green economy goals, including a range of ambitious plans to evolve its transportation system.

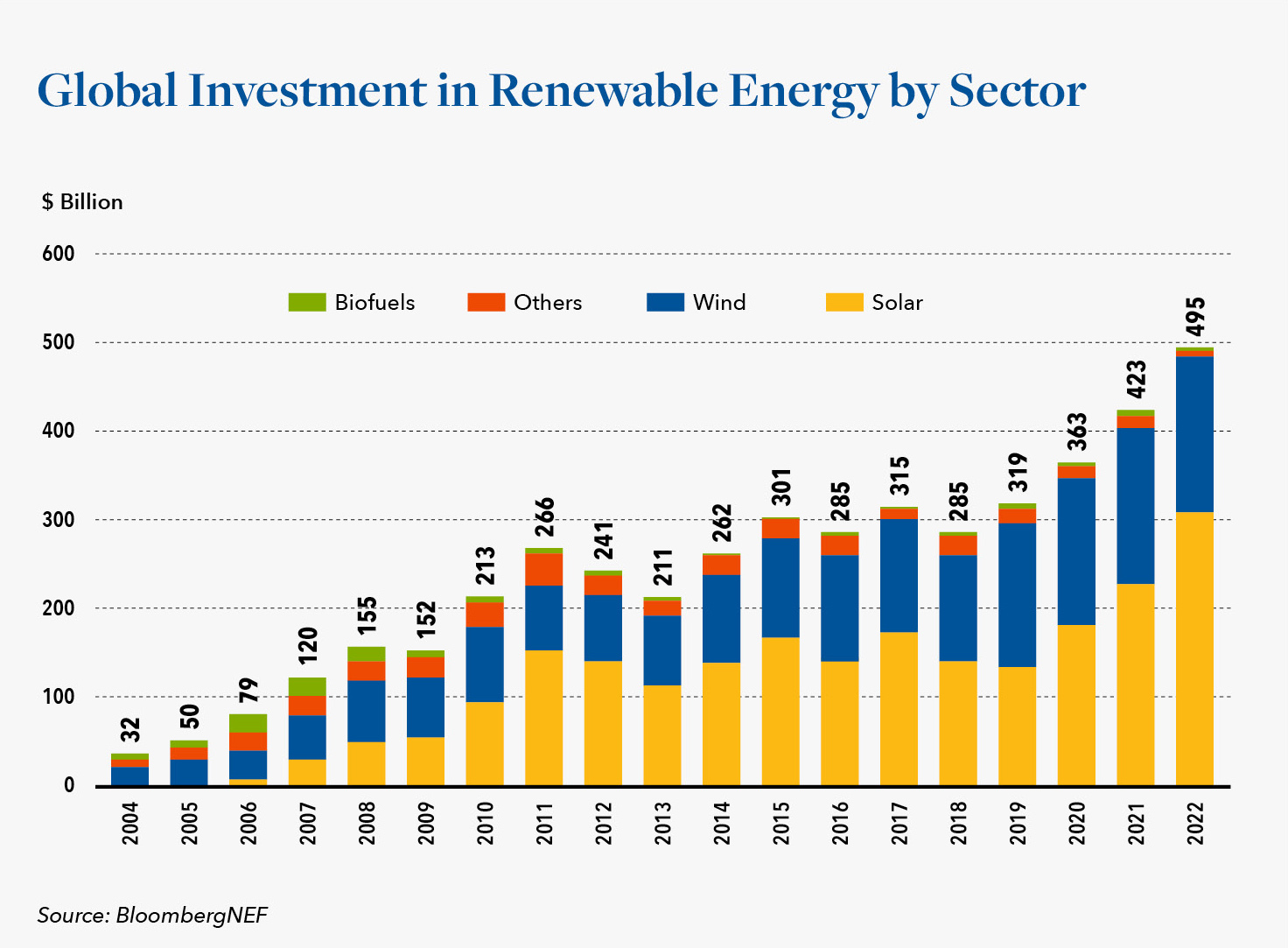

With 79% of the total U.S. energy production still being derived from fossil fuels, a goal such as the one set by the White House will necessitate billions of dollars in investment. Last year, per BloombergNEF, investments in America’s energy transition hit a new record of $141 billion. Investments scheduled to-date for Electric Vehicle (EV) battery plants exceed $40 billion. A reliable power generation system in the U.S. is something many take for granted, however various recent power interruptions and supply shortcomings may be foreshadowing the challenges of transitioning away from fossil fuels.

Adding additional power transmission facilities is not an easy or quickly accomplished task and it goes beyond power generation to include transmission. New EPA standards will require all coal fired power plants to use carbon capture and storage to reduce 90% of greenhouse gas emissions by 2035. Similarly, natural gas plants must adhere to the same standards by 2035. Carbon capture and storage is a new technology not yet widely adapted nor perfected. It was noted recently in The Wall Street Journal that over the past 10 years, 400,000 megawatts of coal generated electricity was idled. That figure represents a third of the total 1.2 million megawatts generated in 2022. It is expected that another 40,000 megawatts of coal fired generation will be idled within the next 6 years, potentially endangering grid reliability.

It should also be mentioned that while overall energy jobs in the U.S. grew 3.8% during 2022, many, especially unions, fear that a substantial number of the jobs created by new green energy may be only temporary ones. While refineries and power plants require a large number of employees round the clock, solar and wind farms, once built, require little, if any, staffing at all.

The following provides an overview of recent, noteworthy green energy initiatives and their impact on various consumer and industrial segments.

Automotive and Commercial Vehicles

Much of green energy’s focus has been on the evolution and eventual transition to EVs. Expenditures and investments on EV’s and allied supply chains, including those associated with new entrants such as Rivian, Fisker, Lucid, Lordstown and others, have chewed up over $100 billion to date. Investments on battery plants, of which there are 10 currently under construction, amount to over $40 billion.

Yet, consumer acceptance of EVs at this point in time could best be described as tepid. Pricing and range continue to be at the forefront of studies on consumer attitudes towards these vehicles. In order to incentivize buyers and improve sales, Tesla (Which holds a 60% share of the U.S. EV market) has cut prices from between 14% and 28% depending on the model. Such moves have improved sales, but reduced margins.

Ford also has recently announced price cuts on its F-150 Lightening pickup truck by 17% due to both increased dealer inventories and lower supplier costs. Other entrants, including Lordstown Motors, have had limited market success and filed for bankruptcy. Some, such as Rivian have seen their market capitalization reduced to a fraction of its high point.

Charging stations and compatibility continue to impact consumer demand at least as much as price. Industry pioneer, Tesla, has the largest nationwide network of charging stations but these feature Tesla-specific plugs. In order to encourage more EV adoption, Tesla has now allowed Ford, GM, Volvo and Mercedes to use their plug type and charging stations in hopes that it will become the industry standard.

Regardless of consumer adoption, the auto industry is under a mandate to sell more EVs as a result of increasing regulation– including much more stringent fuel economy standards globally. Recently, the Biden administration proposed rules that would require 2/3 of all new vehicles sold by 2032 to be EVs. California, the largest U.S. auto market, has even gone a step further requiring all new cars sold by 2035 to be zero emission vehicles. Such mandates are also impacting the medium to heavy truck market with leading manufacturers such as Volvo Mack, Paccar (Kenworth, Peterbilt) and Freightliner recently rolling out electric trucks alongside new market entrants such as Bollinger and Nicola. Similar to the California rule on regular vehicles, all heavy and delivery trucks must be zero emission by 2036, with the exception of garbage trucks which must meet the requirement by 2039.

California has gone so far as to develop an incentive plan to help truck owners transition to electric platforms. HVIP (Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project) provides funding for 152 Class 3 to 8 vehicles initially that are either electric- or fuel cell-based. Incentives range from $20,000 for a Class 4 to $240,000 for a Class 8. Truck manufactures believe incentives such as these will help drive zero emission truck adoption.

At the state level, the rise of EV’s, along with high inflation and better fuel economy, has initiated calls to find alternatives to the motor fuel tax used by most states to fund road improvements and other budget items. Therefore, states have studied alternatives to make up for this decreased revenue. These include approaches such as charging motorists, including truckers, by the mile. While these states presently only include Oregon, Virginia, Utah and Hawaii, more will surely follow. It is also worth noting here that some states have begun to charge an electricity tax at public charging stations.

In late June of this year, the Biden administration announced a $1.7 billion investment to allow for the purchase of low and no emission buses and related transit projects across 46 states and territories. The is the second bus grant package funded by government on top of the previous $3.3 billion in transit buses and the infrastructure that supports them. Further expenditures for expansion of this investment are expected to total $5 billon over the next three years.

Aviation and Maritime

Since the inception of the jet age in the late 1950’s the aviation industry has become dependent on jet fuel (kerosene). Although progress has been made on electric and hydrogen options for aviation, engineering limitations make this a more far off option than for ground-based transit. Therefore, a more environmentally friendly fuel, called SAF, is beginning to see utilization. SAF is a Sustainable Aviation Fuel that does not have a petroleum base and can utilize many potential raw materials including forestry waste, used cooking oil, food packaging and various biomass. A number of airlines have already pledged to adopt SAF. British Airways, for example, has committed to powering 10% of its flights with SAF by 2030. United Airlines has agreed to buy up to 52.5 million gallons of the fuel, primarily to use on its European flights. The company’s Chief Sustainability Officer, Lauren Riley, was recently quoted as saying “The demand from customers to limit their flying emissions is growing exponentially.”

Shipping via ocean transport is an area not often thought of as a carbon emitter, but studies have shown that it contributes over 3% of the world’s carbon emissions; for comparison purposes, this is equivalent to the countrywide emissions of Germany. Perhaps surprisingly, ships carry 90% of the world’s commerce. As commerce increases, it is expected that carbon emissions generated by shipping could increase in tandem. The International Maritime Organization, a specialized agency of the UN, has a global mandate to regulate greenhouse gas emissions. The agency has established a mandate to reduce emissions by 50% by 2050, a time frame that has received substantial push back from environmental organizations. Separately, over 20 countries, including the United States, Japan, and Germany, announced the Clydebank Declaration. The agreement supports the establishment of green shipping corridors, defined as zero emission maritime routs, between two major ports or trade lanes.

So what have shipping companies done so far to reduce emissions? Royal Caribbean recently became the first cruise line to announce its intention to set a science-based target to achieve zero emissions by 2050. Carnival has plans to reduce emissions by 40% (from a 2008 high) by 2030, through the use of biofuels and liquified natural gas (LNG).

Meanwhile, Maersk, the world’s largest container line, plans to achieve net zero emissions across the business by 2040 through various measures including utilization of methanol as a fuel and LNG. The Matson Navigation Co, the largest U.S. flag line has an ambitious new decarbonization-inspired build program that will include five new container ships capable of running on LNG, at a cost of over $1 billion USD. European container and passenger line MSC (Mediterranean Shipping Co) has announced ambitious plans to use ammonia as fuel in a new Chinese-built container ship. Ammonia is increasingly recognized as a promising alternative zero emission fuel.

Summary

The Green landscape is rapidly evolving, making it essential for lenders to possess a solid understanding of the current regulatory environment and the competitive landscape facing a variety of portfolio borrowers. We encourage you to reach out to our team for added perspective on the associated operations, cost and margin challenges these developments are presenting to a variety of Automotive, Commercial Vehicle, Aviation, Maritime, and other businesses right now. We have a wealth of information and insight to share based on current and past engagements, that may be very helpful to you in addressing immediate or evolving needs among your borrowers. We are here to help.

Hilco Valuation Services is one of the world’s largest inventory appraisers and valuation advisors, serving as a trusted resource to companies, lenders and professional service advisors across virtually every asset category. We have extensive experience in the energy sector, and have conducted a wide range of monetization engagements involving the appraisal, disposition and acquisition of oil and gas industry assets throughout the U.S. and Canada. Hilco Valuation Services has the ability to affirm asset values via proprietary market data gained via its worldwide client experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures clients of more reliable valuations, which is crucial when financial and strategic decisions are being made.