So, is COVID-19 Good or Bad for Aftermarket Parts?

December 5, 2020 – By the middle of November, the last of the six companies comprising the Hilco Parts Index (HPI) had reported their financial results for the third quarter. The common, albeit unexpected, refrain was “We are pleased with our results for the quarter”. After listening to several of these positive earnings calls, one industry analyst finally asked the uncomforable question “So, is COVID-19 good or bad for aftermarket parts?” The question was artfully dodged. Who wants to go on record as saying “a pandemic is good for business” and, if given the choice, who would volunteer to relive the last six months. Nonetheless, the aftermarket parts industry has fared better than most during the past six months and proved once again to be resilent in a recessionary environment.

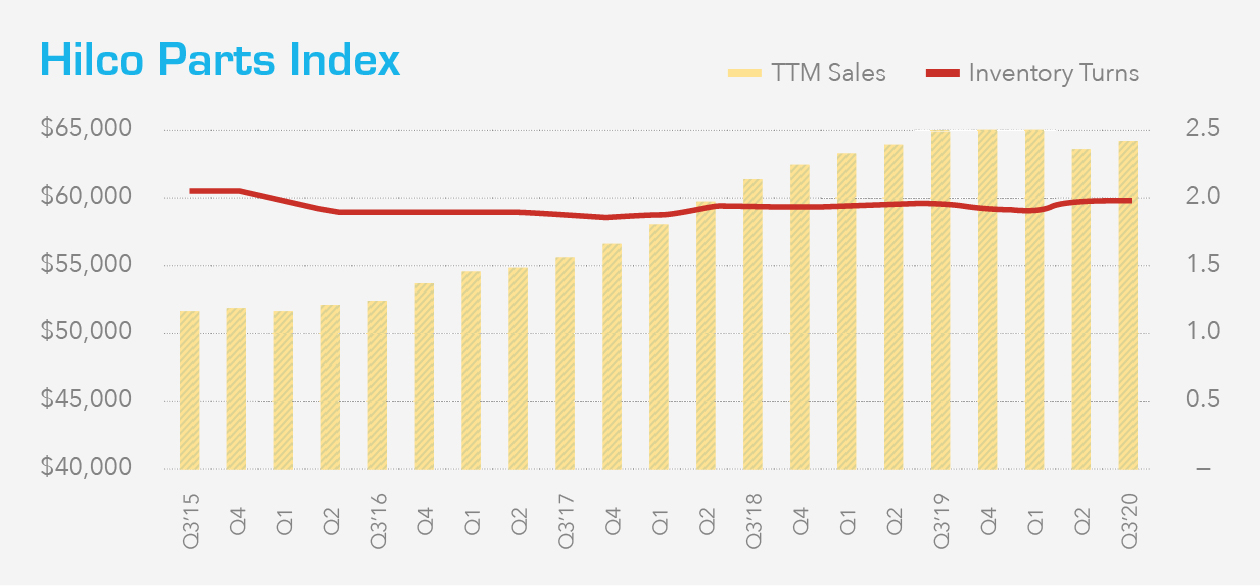

Demand for aftermarket parts is highly correlated with miles driven. According to the Federal Highway Administration, Americans have driven 355.5 billion miles in the first nine months of the year, down 14.5% from 2019. At the height of the state-at-home orders in March/April, miles driven had fallen 40% and, as you may recall, the Hilco Parts Index contracted for the first time ever in the second quarter. Since then there has been steady improvement in miles driven and demand for aftermarket parts have responded. The year-over-year deficit in miles driven was less than 10% for September and total net sales for the Hilco Parts Index was $64.4 billions, an increase of 0.8% from the second quarter.

None of the companies in the index have resumed providing investor guidance for the 2020 calendar year – too many unknowns remain. What level of governmental assistance will be available? How long before a vacine is widely available? What, if any, consumer behaviors were changed permanently? Investors were cautioned the current environment would most likely extend well into 2021 and that full recovery to pre-COVID levels is more than a year away. Longer-term, Company’s expressed more optimism. One executive pointed out that in the past three decades, the periods of strongest, sustained sales demand for their company all followed recessionary periods. And, after each of these periods of outside sales growth there was no general correction that followed. The Company believes these periods provide an opportunity to introduce new customers to their product and service offering.

About the Index: The Hilco Parts Index is comprised of six publicly traded companies that distribute aftermarket parts, namely Advance Auto Parts (Advance), AutoZone, Genuine Parts (NAPA), LKQ, O’Reilly Auto Parts (O’Reilly), and Uni-Select. Advance, AutoZone, NAPA, and O’Reilly are the four traditional parts distributors in North America with strong commercial (do-it-for-me or DIFM) and retail (do-it-yourself or DIY) programs. Uni-Select is a much smaller distributor with a strong presence in Canada and LKQ is largely a distributor of recycled (used) parts, as opposed to new parts.

For Further Information, Please Contact: Keith Spacapan | 847.313.4722 | kspacapan@hilcoglobal.com