The Good, Bad and Ugly of the Chemical Market in the Age of COVID-19

With a pre-COVID workforce of more than 800,000 in the U.S., based on data from the Bureau of Labor Statistics, the chemical industry faces critical challenges in the wake of the global pandemic. For starters, the fall in crude oil prices back in mid-April 2020 significantly impacted the competitiveness of North American polymer producers using gas-based ethylene for cracking and has since narrowed margins and increased pressure to cut expenses. With the closure of hundreds of automotive factories across the globe and cessation of thousands of airline routes daily, the downside impacts have been extensive. There continue to be bright spots for the industry, however, including demand upticks in both the packaging industry and medical/healthcare. In this article, we take a closer look at these developments and the landscape they paint for the industry overall during the balance of the year, into 2021, and beyond.

The U.S. is the second-largest chemical producing nation in the world, outpaced only by China. With more than $200 billion in production investment over the past 10 years and exports of more than $140 billion, the industry accounts for nearly 10% of all goods exported from the U.S. It also supports an immense supply chain and drives economic activity in the communities in which its facilities are located. Offerings from the industry are utilized in the production of 96% of manufactured goods on a global basis, and help to provide a safe and plentiful food supply, clean air and water, safe living conditions, efficient and affordable energy sources, as well as life-saving medical diagnostics, treatments and protective equipment. According to the American Chemistry Council, for every job in chemical manufacturing, more than seven are created elsewhere across the economy.

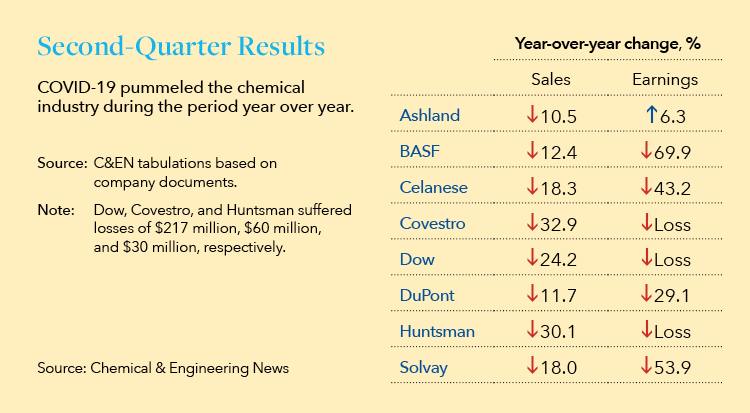

As COVID-19 persisted, second-quarter results from chemical companies were not favorable, with drops in sales ranging from over 12% to more than 32% for companies such as BASF and Covestro, respectively. In posting a loss for the quarter, polyurethane maker Dow announced that it would cut about 6% of its workforce. And while DuPont reported profits of $514 million, it also took a $2.5 billion charge related to its transportation materials business, which experienced a 34% drop in sales during the quarter. The company did, however, see growth in electronic materials and a significant 60% increase in sales associated with protective garments.

Titanium Dioxide (Ti02) is the most utilized colorant in the chemical industry. The most common applications for Ti02 include utilization in paints and coatings, including glazes and enamels, plastics, paper, inks, fibers, foods, pharmaceuticals, and cosmetics. Consumption of Ti02 tends to follow general economic trends. Chemours, the world’s largest producer of Ti02, saw volume decline of 20% in the second quarter, with mid-May representing the lowest point of demand. Similar to the chemical industry, Ti02 sales are now seeing strong recoveries led by rebounding automotive and construction related sales. Also similar to the general chemical industry, sales into packaging related applications have been strong. It is worth noting, however, that Chemours has formally delayed some planned capacity expansions until the 2022, 2023 timeframe. According to the American Chemistry Council (ACC), about 75% of chemical companies have now cut capex because of COVID-19, and about 60% have delayed or canceled investments. Not surprisingly, nearly 50% of chemical companies have either fully or partially shut down some production lines.

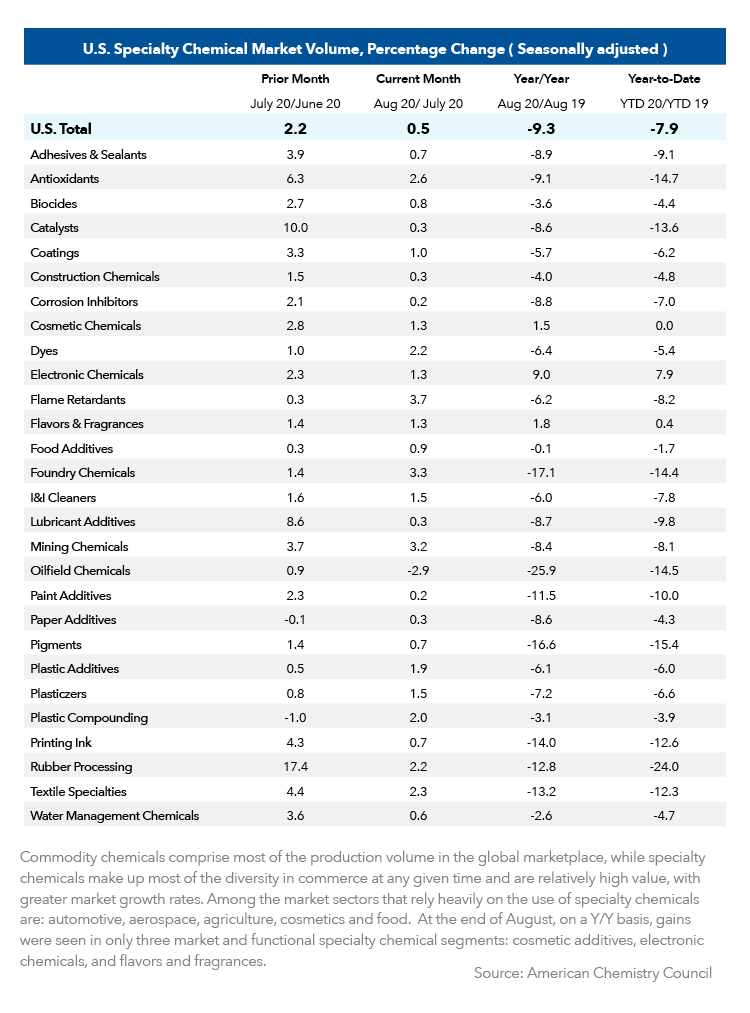

While a global industry rebound is now broadly anticipated as we enter Q4, its magnitude is uncertain as the faltering economy, steep declines in employment and sharp demand falloff from historically high-demand chemical industries persist.

The good, the bad and the ugly

The Good – Packaging & Medical/Healthcare

Packaging

During the ongoing pandemic period, packaging has remained one of the least impacted market sectors, seeing continued growth over the past many months. This can be attributed to not only a notably increased reliance upon ecommerce transactions over brick and mortar, but also to an explosive expansion in use of the various packages and containers that have become an essential part of our social distancing, hygiene and care efforts during these trying times.

While the panicked hoarding of food and some consumer goods has tapered since the onset of the pandemic, according to ICIS Packaging Outlook, food, beverage and tobacco production is forecast to be down only 0.7% for 2020. Along with dairy, home care and healthcare, these have remained as standout performance categories for packaging throughout the crisis and are expected to remain strong for the foreseeable future. Case in point, cleaning products have continued to be in high demand and remain hard to get, well after stay at home orders eased across the country.

Just as the corrugated and paperboard markets have seen immense growth based on the dramatic increase in online shopping orders that has resulted from the pandemic, the chemical market, too, is riding that same wave. Fulfilling those orders from Amazon and others requires the use of chemical-based packing tapes, bubble wrap and polystyrene. Accordingly, demand for the raw materials needed to manufacture these and other items now in heightened use during the current crisis has remained strong. Despite bans on single use plastic that were set to begin in various states around the country, single use plastic containers and plastic wrapped utensils are also now being used in record numbers by restaurants to fulfill the takeout orders that are helping their businesses to survive social distancing, and by grocers who have evolved their in-store offerings to capitalize on shopper demand for more pre-prepared, individually packaged salads, soups and meals.

Medical/Healthcare

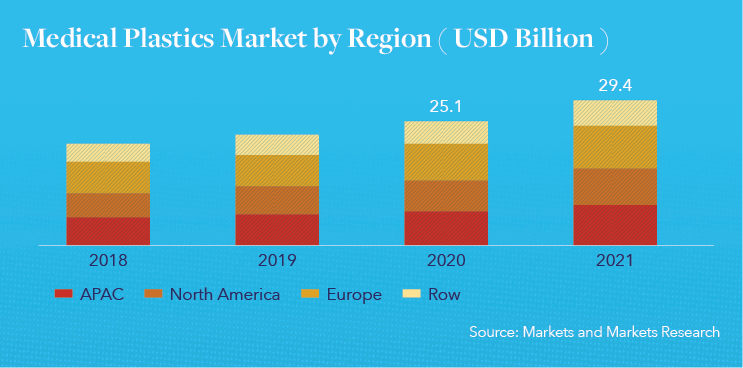

Medical equipment and supplies in the U.S. are now made from roughly 50% plastic, according to ICIS Chemical Business, and demand for plastics in medical/healthcare applications has, of course, ramped-up significantly during the crisis as well. With need outstripping supply for a wide-range of Personal Protective Equipment (PPE) required by front-line healthcare workers and first responders, manufacturer demand for the raw materials needed to produce and package protective masks (often made from nylon fibers), gloves, shields, garments, hand sanitizers, thermometers, inhalators, ventilators, and more, continues—but can be expected to dissipate to some degree —as COVID cases and concerns about the spread of the illness diminish over time.

From the start of the pandemic in the U.S., the chemical industry played a critical role in safeguarding those frontline health workers and first responders. Of equal importance, the increased production of petroleum-based cleaning solutions and sanitizers has served to better protect the health of those on the receiving end of that care and assistance as well. Alongside social distancing guidelines and quarantine requirements, these cleaners, disinfectants, soaps and related items have become indispensable in mounting the fight against the Coronavirus. Various other specialty chemicals continue to be in high demand for use in pharma, diagnostic and healthcare maintenance applications. At the same time, plastics are being utilized in the manufacture of the packaging and containers used to deliver these products as well as in the components of various medical equipment and testing instrumentation.

Moving ahead, the chemical market may likely benefit from the production and distribution of the vast quantity of vaccines currently in development. Multiple pharma companies including GlaxoSmithKline, AstraZeneca, Johnson & Johnson and Pfizer have committed to produce millions of doses even before final FDA approvals are granted. Ultimately, the volume of specialty cleaning resins that will be required to create sterile environments, as well as the plastic syringes used to administer the dosages and the sealed packaging in which they are stored and dispensed, will be substantial.

Multiple factors are expected to drive significant compound annual growth rate (CAGR) in the range of 17.2% by 2021 in the medical plastics market. Among these are: 1) significantly expanded demand from both medical device/equipment manufacturers and OEMs engaged in the production of critical care and diagnostic equipment; 2) enhanced consumer and workplace awareness and adherence to best practices in maintaining appropriate hygiene and health, and; 3) the increasing use of standard plastics in the manufacture of a growing array of medical disposables. Ranging from PPE such as masks, gloves and gowns, to syringes, catheters and surgical tools, we see current and future demand for these and other items in the medical disposables segment driving significant, ongoing demand for PP, PE, PS, PMAA, PVC and EVA into 2021 and beyond.

The Bad- Automotive & Aerospace

Automotive

The transportation industry accounts for approximately 17% of the total value of U.S. plastics sales. In both the U.S. and globally, the automotive industry consumes significant quantities of petrochemicals, which account for more than one-third of the raw material cost of an average vehicle today. Excluding elastomers, key polymers used for the automotive market include PVC (9%), PE( 94%), PC (4%), PP (35%), ABS/SAN (8%), Polyamides (11%), PUR (19%), and PS/PMMA/Nylon (10%).

When the pandemic reached the U.S. in mid-March and automakers began to idle their plants, auto sales here were already trailing levels from the previous year. Those closures contributed to a significant 45% decrease in light vehicle sales in April, with polypropylene sales to the automotive sector at Braskem, a major PP supplier, bottoming out down about 20% from pre-COVID levels. By mid-year, the auto market had rebounded to some degree with the help of manufacturer incentives but was still down by 23.1 percent overall as compared with the first half of 2019. Moody’s Automotive Sector Outlook indicates that global auto unit sales will drop by nearly 20% overall in 2020, with global sales reaching 85-88m units by 2022; still well short of their 2017 peak of 95m. Notably, fleet sale declines have far exceeded those of retail vehicles, as rental car companies and corporations adjusted their programs to compensate for the impacts of travel restrictions. Cox Automotive now projects that fleet sales will fall to 1.3 million units by the end of 2020, a decline of some 2 million units overall from 2019. Based on these developments, demand in the chemical market related to the production of additives, corrosion inhibitors, parts and other items for the automotive industry was down 12.2% July 2020 vs 2019, with key suppliers including Trinseo, Axalta and Huntsman forecasting a gradual recovery into 2021. Ironically, further production disruptions associated with a lengthy, W-shaped recovery could weigh severely on the automotive industry’s demand for the very materials – such as polypropylene, styrene, urethane – that have become so indispensable in aiding it to achieve significant cost, weight and mileage efficiencies over recent years.

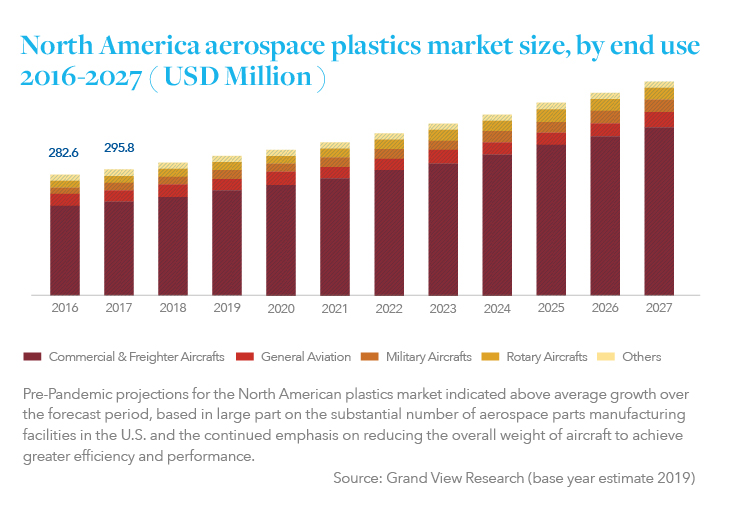

Aerospace

In 2019, over 100,000 commercial flights carried 4.5 billion passengers globally and the global aerospace plastics market size was valued at over USD $770 million. While demand for new commercial aircraft has all but evaporated in the wake of COVID-19, in the majority of cases, committed existing orders for those planes are merely on a delayed schedule that will advance as progress in the fight against the pandemic is realized; although some negotiations are resulting in pushed-back deliveries of up to five years. Airlines and leasing firms are, though, obligated contractually to take delivery of orders, with many already having made pre-delivery payments. Citigroup has estimated that Airbus will deliver only 500 of the 630 aircraft it plans to complete this year. This commitment to continued production, however, is actually somewhat of a silver lining in an otherwise cloudy short-term outlook. This is particularly true for aerospace supply chain partners such as 3M, BASF, Exxon Mobil, Sherwin-Williams and others specializing in the raw materials, finished plastics components and chemical products used to maintain and aid in the efficient operation of aircraft. According to data from Technavio, while CAGR growth in the global aerospace plastics market is forecast to accelerate at almost 6% over the period 2020-2024, the market is not expected to normalize prior to Q3 2021. This does not bode well for the production of coolants, coatings, adhesives, additives, sealants, lubricants, paints and cleaning products heavily utilized in the aviation market. On a positive note, airlines are actively looking to reassure passengers that their planes are sanitary and safe, and are investigating the adoption of various practices that may lead to sourcing additional plastics and chemical-based materials for aircraft. Options currently under exploration range from installation of plastic partitions between seats on aircraft and automated sanitation of lavatories between use, to issuance of airline-branded PPE and hand sanitizer to boarding passengers. Developments such as these could serve to bolster the market both in the short- and long-term. Additionally, under the current administration, military spending has seen an uptick which should continue to provide incremental chemical demand within aerospace for the foreseeable future. That said, with fewer parts needed from suppliers, the impact on the chemical industry and market is significant. Regardless of the near-term impact of the pandemic, however, an all-but-certain continued focus on the manufacture of durable, lighter weight, fuel-efficient aircraft – featuring the use of carbon fiber reinforced polymers and composites that can reduce aircraft weight by up to 20% – is still likely to drive increasing demand for aerospace plastics as we move beyond the stifling effects of the pandemic.

The Ugly – The Economy

It comes as no surprise that the “Ugly” in this equation is the economy, itself. While economic growth accelerated in the third quarter following a Q2 annualized rate contraction of 31.7 percent, significant uncertainty remains as to the sustainability of a recovery beyond that. According to the U.S. Bureau of Labor Statistics, the number of permanent job losers in September increased by 345,000 to 3.8 million. This measure has risen by 2.5 million since February of this year. Yelp’s latest Economic Impact Report, which is based on input from primarily small business operators across the U.S., indicates that as of August 31, 163,735 such U.S. businesses have closed, a 23% increase since mid-July. Perhaps even more concerning is the finding that permanent closures have reached 97,966, which represents 60% of closures overall. With much of the money previously granted via government stimulus already exhausted by those who received it, the outlook for consumer spending on discretionary items such as new cars, vacations and associated air travel is relatively bleak.

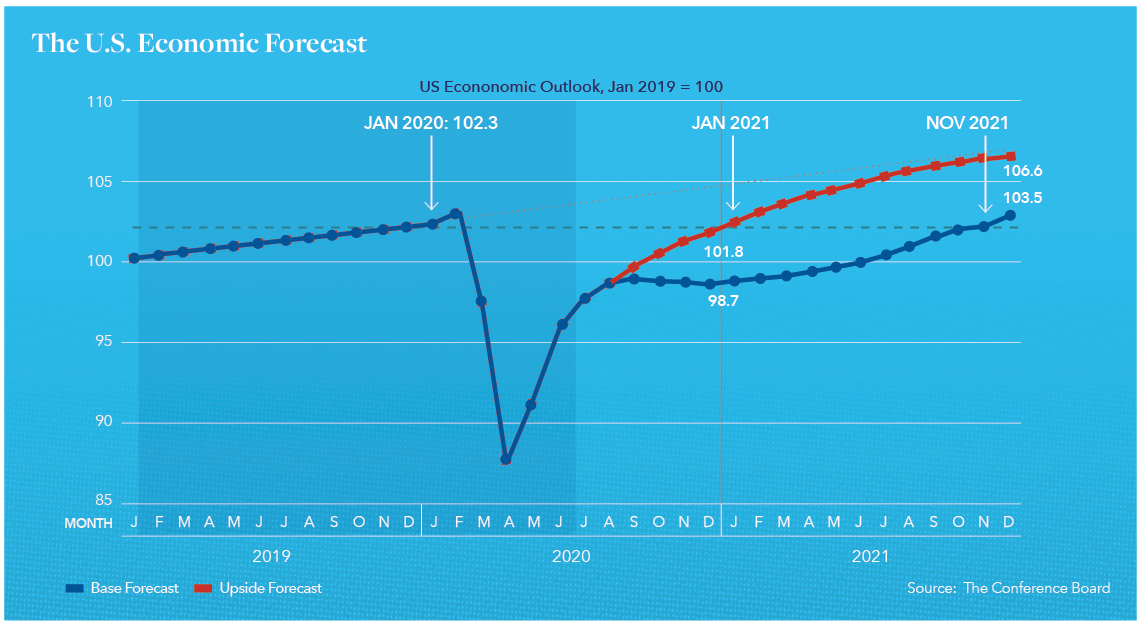

Two recovery scenarios for the U.S. economy, published in September by The Conference Board, paint quite different pictures of what may occur in the months ahead. On the one hand, the upside forecast has the U.S. sustaining momentum toward recovery through the final quarter of this year, enabling a return to January 2020 pre-COVID (monthly) economic output levels by January 2021. On the other hand, its base forecast sees slower GDP expansion and a less aggressive recovery curve which would not achieve those same pre-COVID economic performance levels until some 10 months later, in November 2021.

With the deployment of a vaccine and its potential benefits being developments that will not likely be broadly seen in the U.S., or globally, prior to the first half of 2021, the bottom line is that a great deal of uncertainty remains regarding the path that economic recovery will take, even as we enter the final quarter of what has been a devastating year for both the U.S. and global economies.

Conclusions

Moody’s rating agency has indicated that “the improvement in many downstream industries should support better fundamental market conditions in the broader chemical industry for the rest of 2020.” Recent data from the Organization for Economic Cooperation and Development (OECD) also suggests that the chemical sector has been resilient as compared with the economy overall. That said, for the many reasons articulated here and based upon our current work and expertise not only in the chemical sector – but also across automotive, aerospace, packaging and medical/healthcare – we expect that despite market gains from COVID-driven needs in industries including packaging and medical, the likelihood of a prolonged drag presented by the automotive and aerospace industries will continue to present significant challenges in the chemical industry’s recovery until at least Q3 2021.

At Hilco, we are highly engaged with both our clients, partners and numerous contacts across each of these distinct industries during this difficult period. The many conversations we are having daily and the engagements we are moving forward provide us with valuable insight and perspective. For ABLs with concerns pertaining to exposure within their portfolio at this time, we are here to help and encourage you to reach out to us for guidance.

Hilco Valuation Services

Hilco Valuation Services is the leader in valuation for the chemical industry with more than 300 appraisals delivered on asset values ranging from $10 million to over $1 billion. As part Hilco Global, the company frequently works hand-in-hand with the Hilco Performance Solutions (HPS) management consulting team to provide cross-functional Manufacturing Operations, Supply Chain, People, Mergers & Acquisitions, and Commercial expertise to the chemical and other industries. By teaming highly regarded industry veterans with advisory experts, we are uniquely positioned to deliver optimal solutions that assist businesses to achieve favorable outcomes under a wide range of market conditions and circumstances.