The U.S. Automotive Industry Hits Bottom in Second Quarter?

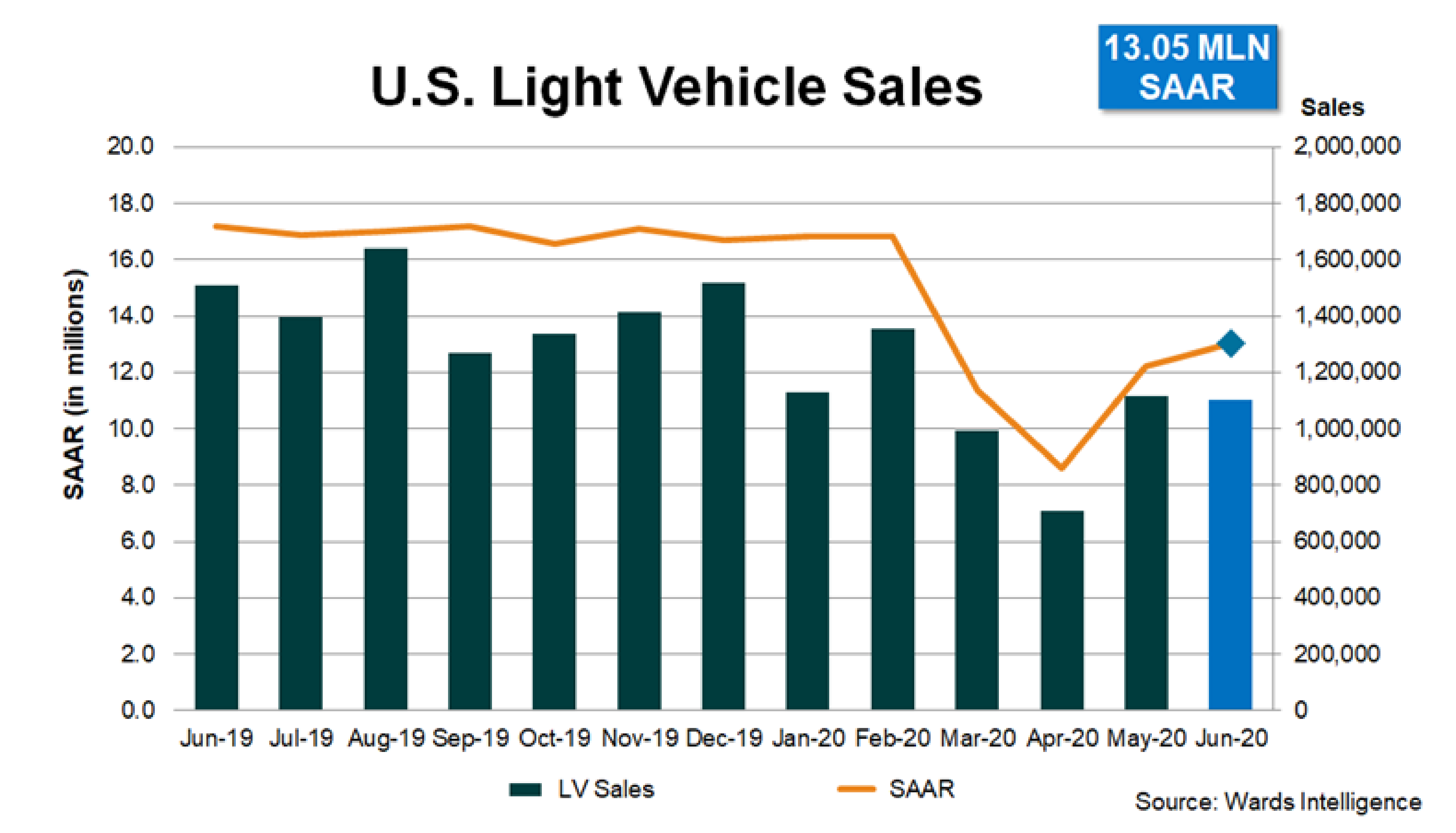

July 14, 2020 – After a 50% drop in U.S. deliveries of light vehicles, the seasonally adjusted, annualized rate of sales (SAAR) for April had fallen to 8.6 million vehicles. Anxious to generate some cash flow, automakers offered generous incentives to encourage nervous would-be buyers to get back in the market. After all but disappearing in March, zero percent finance offers represented a record high 25.8% of all new financed purchases in the month of May according to Edmunds.com. The rich sales incentives, coupled with the government stimulus program and the relaxing of government imposed shelter in place orders, were enough to lift sales from their April lows. The SAAR for May came in at 12.2 million vehicles, higher than April but substantially lower than the 17.4 million SAAR recorded in May 2019. June closed out the second quarter with a SAAR of 13.1 million vehicles. In the end, U.S. light-duty vehicle sales fell 33 percent in the second quarter from year-ago levels.

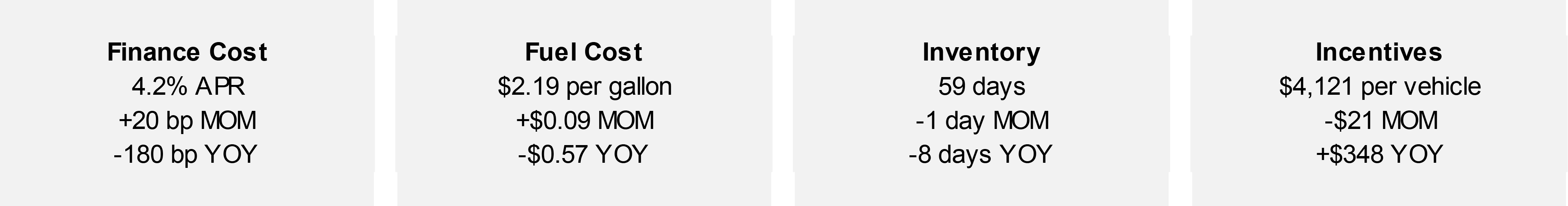

In a recessionary environment, the automakers tend to be slow to adjust production, which allows inventory to grow at the very time it should be decreasing. In the current recessionary cycle, prompted by government imposed restrictions on business activity, the automakers had no choice but to curtail production. Most vehicle assembly plants have since resumed production but not soon enough to avoid an aggressive sell down of industry inventory. Only 2.6 million vehicles remained in dealer stock at the end of June, down significantly from 3.5 million in mid-March and 3.2 million at the end of June 2019. The national days’ supply stood at 59 at the end of June which is well below the industry target of 65 days. More distressing, the days’ supply for pick-up trucks, which the industry relies on for much of its profitability, were among the lowest days’ supply at the end of the quarter.

Most industry forecasts for the full 2020 calendar year are between 12.5 and 13.5 million light-duty vehicles. That would make 2020 the first in six years that U.S. light-duty vehicles did not exceed 17 million vehicles. However, most forecasts assume the industry bottomed in April and is now on a steady road to recovery. What will happen when the government stimulus program runs out and/or the automakers rein in their generous sales incentives? The recent bounce in sales was heavily dependent on pick-up trucks and sport utility vehicles which are now in short supply. And, will certain government agencies be compelled to once again curb business and household activity in the face of rising COVID cases? There were 39,907 new COVID-19 cases recorded in the U.S. on June 25, exceeding the level of the peak of 36,188 set on April 24. The concern is that instead of a “V” shaped recession cycle, we may be looking at a “W.”