This Holiday Season Presents a Number of Retailer Challenges and a Golden Opportunity to Initiate Change

This article discusses factors impacting retailers headed into the holiday season and provides informed insights on steps that those operators can take to help ensure their own success through the end of the year and into 2024.

Consumer stress is coming from all directions as the holiday shopping season is upon us, and this can be expected to have a notable impact on retail performance.

The Federal reserve Bank’s Quarterly Report on Household Debt and Credit, released in early November, indicates that U.S. household debt increased by $228 billion (1.3%) in the third quarter of 2023, to $17.29 trillion, driven primarily by mortgage, credit card, and student loan balances.

Suspended student loan payments resumed at the start of Q4 this year, which is widely expected to inhibit spending among the more than 45 million consumers still holding those debts. This, in turn, will effect a wide range of retail businesses this season across the apparel, fitness, home furnishings and other categories that cater heavily to these same borrowers.

Consumers also stand to be more inhibited by the recent reduction in free delivery options and return fees by many of the retailers they have frequented both in person and online in recent years. To recover losses stemming from generous policies instituted in the past, some retailers have begun marking items as final sale, while others have reduced the number of days during which an item is eligible for return, and in some cases restocking and return fees are being charged even when items are returnable.

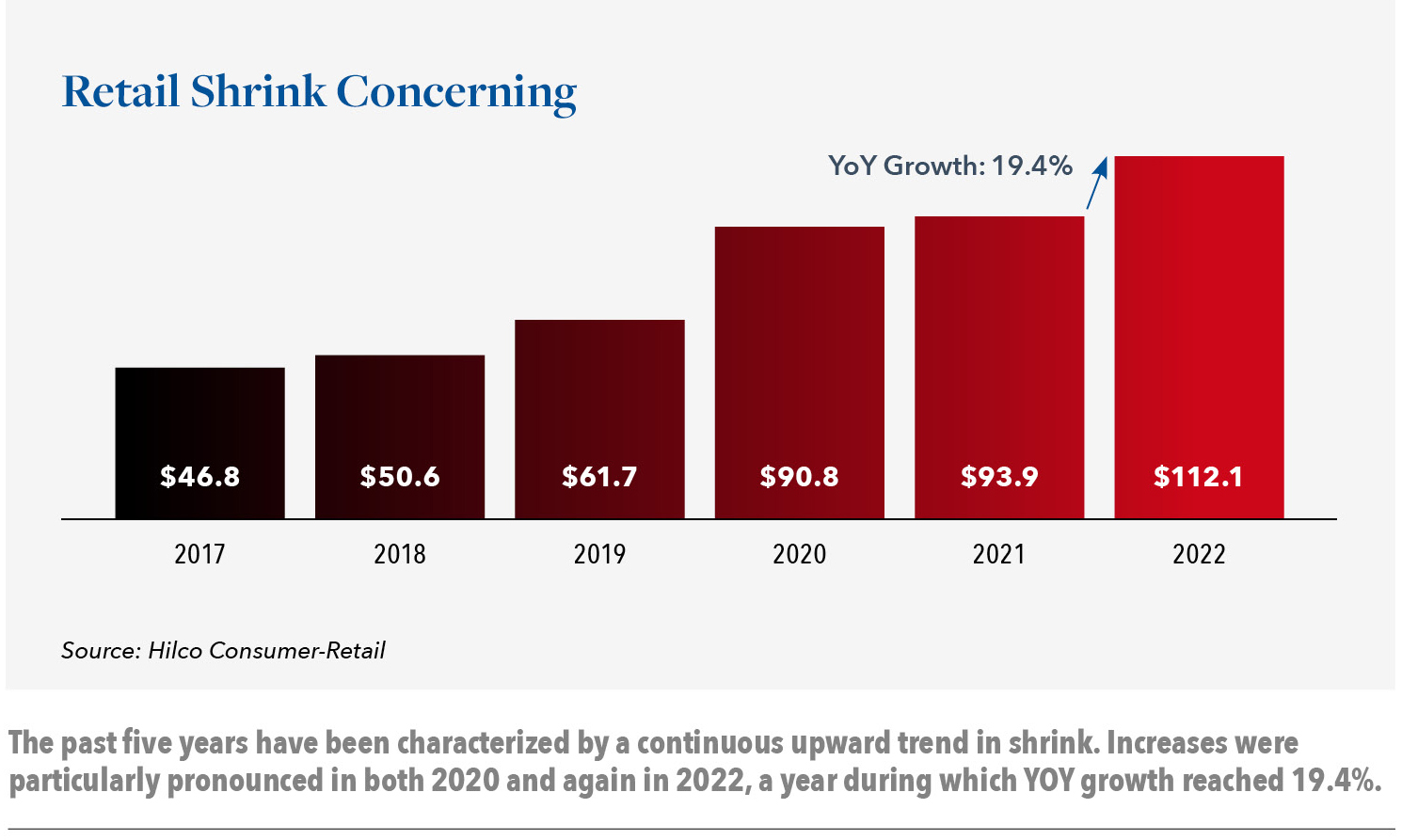

Retail shrink — inventory that is stolen, otherwise unaccounted for, or not saleable — has also become quite a serious issue for retailers with a continued upward trend taking place over the past five years and one of the most substantial periods of increase seen just last year and through the first 3 quarters of 2023. Thefts are reported up at many stores including Walmart, Home Depot, and Target, requiring more security resources to be hired and various preventative theft measures to be implemented, all adding substantially to operational costs. These developments have caused retailers to close stores at a more rapid rate than at any time in recent history. Target, for example, has now closed stores in major cities across four states due largely to unprecedented levels of organized criminal vandalism and theft.

Sellers, many of which once flourished on Amazon, are being challenged like never before by the marketplace’s increasingly costly FBA fees, which are inextricably tied to their ability to offer Prime shipping and gain competitive storefront placement. To make matters worse, sellers interested in working around FBA via Amazon’s Seller Fulfilled Prime (SFP) have only recently been offered the chance to enroll in the program again and must achieve and maintain a record of 99% on time order delivery to attain a prime badge when participating via that option in the marketplace.

Beyond Amazon, our overarching view having worked with both healthy and distressed operators pre- and post-pandemic, is that ecommerce is not — and frankly never was — the silver bullet to improve retail. This challenge is particularly acute for those who were slower to invest in an e-tail platform and omnichannel integration prior to the COVID-19 outbreak. This is not to say that the online marketplace doesn’t or won’t have an important place for retailers moving ahead. Rather, it should be viewed as just another “store” and must perform profitability — including all applicable costs — or be significantly scaled back. There are, however, other faster and less capital intensive ways to drive sales while also simultaneously solving for critical industry issues such as talent retention right now.

For example, our team has been working with numerous retailers, and some are engaged in their own efforts as well, to embed and empower digital intelligence across the retail enterprise. This can be accomplished without IT integration and in a way that 1) excites and empowers store teams and managers, 2) enables flexible fulfillment opportunities, and 3) generates immersive and engaging experiences for customers. This approach is well-suited right now to the store environment, where the overwhelming amount of all retail sales have and continue to take place. Although the adoption and cultivation of technology-based intelligence in-store has been slow, its effective implementation has the potential to quickly deliver business insights that can drive more profitable business outcomes.

We have seen first-hand that skilled frontline teams are running thin, with attrition challenges continuing to plague retailers even as the holidays approach. For those team members who do remain, the range of smothering responsibilities include dressing and maintaining store appearance for the holidays and effectively merchandising and refreshing items on the floor during the bustle of high volume traffic. In addition, they are being asked to deal with buy online, pick/shop from store, and online returns, all while still being expected to assist customers in a knowledgeable and helpful way that delivers strong store conversion.

In this challenging environment, arming these frontline workers with the type of tools and intelligence that can make them better able to fulfill their job responsibilities, help them provide and receive feedback efficiently, and gain a sense of involvement and satisfaction that all leads to improved conversion, is more critical than perhaps ever before.

While all eyes right now are on ensuring that this holiday season delivers the strongest performance possible, we urge retailers to commit now to educating themselves on how this type of embedded digital intelligence could benefit their store fleets and take timely steps toward implementation when they see the vast potential of what they learn from that process. Critically, start the education TODAY so you can hit the ground running early in 2024. This holiday season is not going to “save the year”; rather, the same problems that exist today will still be there three to four weeks from now.

As for the immediate near-term, with Amazon reporting that its October Prime Day orders increased to 150 million from 100 million last year and Walmart, Target and others holding their own well-publicized discount events timed to coincide with Amazon’s, we expected that many retailers were also planning their own early discount efforts. This outlook was proven accurate as we observed even deeper than expected discounts leading up to, and over, the Black Friday shopping weekend. The fact is, however, that moving up discounts to earlier in the calendar year or holiday season does not necessarily deliver incremental sales. Rather, it is likely to simply reallocate those same sales to a different performance cycle. For retailers still finalizing or considering changes to their holiday strategies — and we know there are many out there — we would encourage minimal levels of discounting, to the extent possible, until after the season. Our belief right now is that, ultimately, regardless of how much margin retailers end up sacrificing to ensure revenue through the end of this year, the overall outcome for 2023 is likely to be flat to slightly negative performance on an inflation adjusted basis.

Our team will continue to maintain a close eye on store traffic, sales volume and other trends throughout the balance of the year and plan to issue our outlook for Q1 of 2024 early next January. In the meantime, we encourage you to reach out to us to discuss any of the points raised above or to explore how we can assist with any current challenges you are now facing. We are here to help.

The Hilco Consumer-Retail team has deep expertise in all retail sectors. Our seasoned professionals deliver a wide range of analytical, advisory, asset monetization, and capital investment solutions to help define and execute client strategic initiatives.