Tire Industry Treads Carefully Forward in 2023

This 2023 industry update is a follow up to our 2022 examination of a number of challenges, opportunities, and changes within the U.S. and Canada passenger, light truck, and commercial tire industry.

Lingering impacts from the COVID-19 pandemic, including container shortages, port activity, increased ocean freight costs, rail and trucking disruptions, and extended transit times continue to impact the market. The war in Ukraine and tight labor supply have also affected raw material and tire pricing.

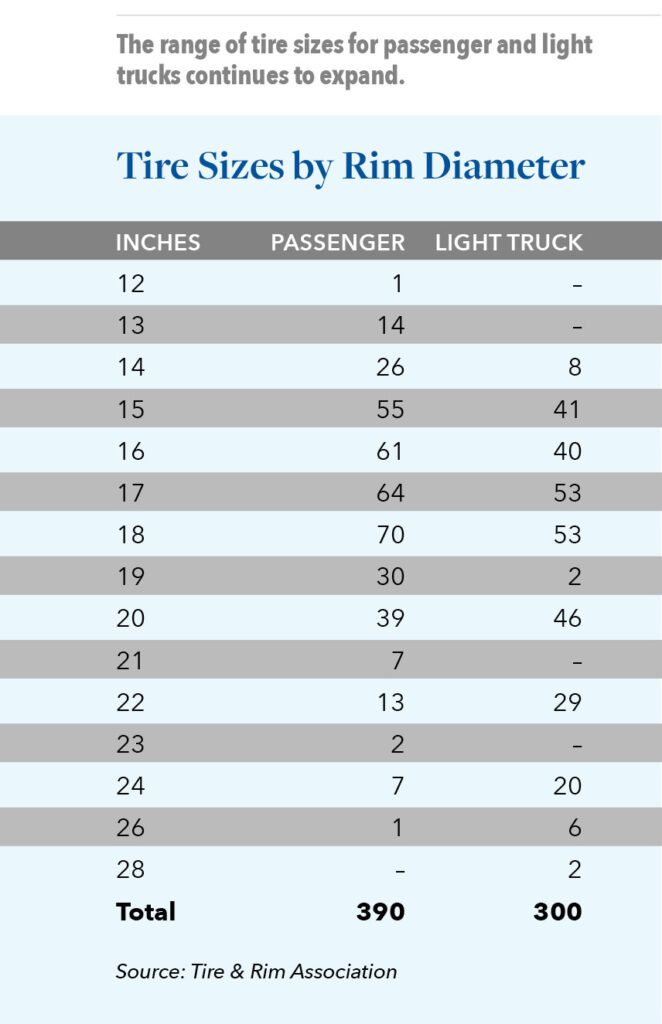

Tire manufacturers operate in an intensely competitive international marketplace with diverse needs and specifications that make production more complex and costly. This, in turn, trickles down to distributors, who also now must carry an increasing variety of tire sizes and labels to meet the expanding needs of installers around the world. These factors, combined with an active merger and acquisition environment, make the tire industry a highly intricate landscape right now, not just for those along the supply chain, but also for asset-based lenders who must navigate how to best support their tire portfolio companies and limit their own downside risk.

The U.S. Department of Transportation (USDOT) reports that cumulative travel on all roads in 2022 versus 2021 increased by 0.9%, or 29.3 billion vehicle miles to 3,169.4 billion vehicle miles. The first half of 2023 recorded a 2.3% increase over the same period in 2022. Overall road travel figures remain well below the pre-pandemic 2018 and 2019 years, as consumer driving behaviors changed dramatically when many employers began allowing office staff to work from home.

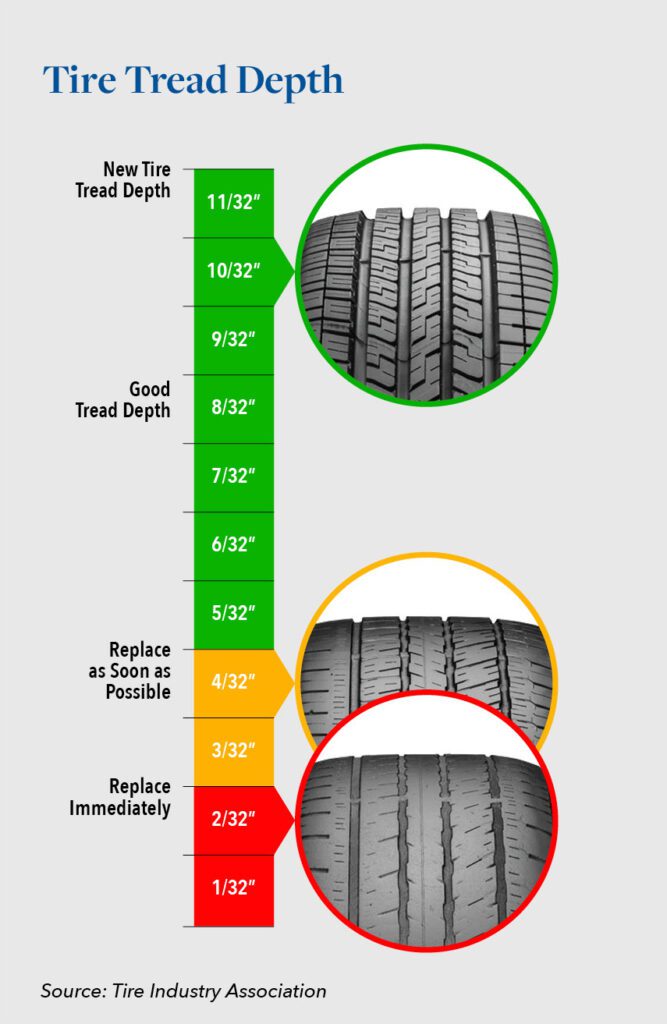

The largest subset of the tire market is replacement tires, or those tires purchased to replace a vehicle’s OEM tires due to wear or age. In May 2023, S&P Global Mobility reported the average age of vehicles on the road in the U.S. increased to 12.5 years. Older tires with many miles driven, equate to the need for a greater number of replacement tires overall. This ongoing trend, during which we have seen vehicles stay on the road longer, reflects both the increased durability of automobiles, the pandemic related vehicle supply chain issues referenced earlier, as well as the higher cost of tire replacement in today’s inflationary market.

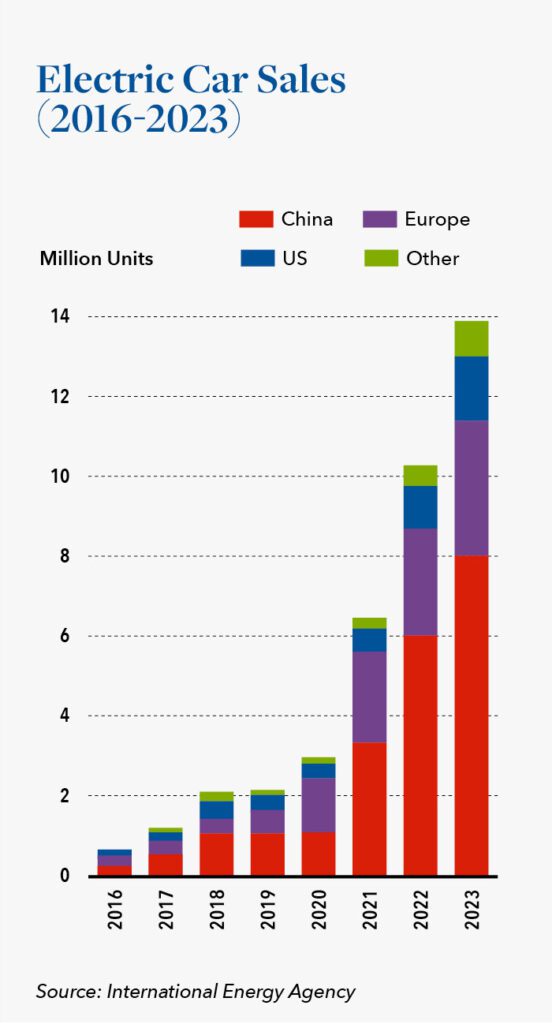

The growth of the electric vehicle (EV) market brings along with it certain unique tire requirements that differ from those of ICE vehicles, and are necessary to accommodate an EV’s heavier weight, noise reduction and other needs.

Battery powered EVs are generally 20-30% heavier than their gas engine counterparts, yet EVs typically create no noise when driven. Additionally, since EVs have strong initial acceleration and high output from the moment a driver steps on the pedal, EV tires must also have stronger traction, steering and braking performance. To meet these challenges from heavier weights (stiffer and stronger sidewalls), quieter rides (enabling tire noise to be more easily heard), and the need for improved handling requirements, EV tires are designed with specific stiff and wide center rib patterns, more durable compounds, specialized tread patterns and sound-absorbing foam and rubber compounds.

EV tires are also contributing to the continued growth in the number of tire sizes offered in the market. In 2022, a number of additional 17 and 9 sizes were added, with those now totaling 390 for passenger vehicles and 300 for light trucks, respectively, as reflected in the chart below. When factoring in all brands and private label options, distributors and retailers now have tire options for equipping vehicles that total in the 1,000s.

The U.S. Tire Manufacturers Association (USTMA) is the national trade association for tire manufacturers that produce tires in the U.S. Twelve member companies operate 57 tire-related manufacturing facilities in 17 states. U.S. tire manufacturing has an annual economic footprint of $170.6 billion and is responsible for more than 291,000 U.S. jobs in manufacturing, distribution, and retailing. The industry supports more than 510,000 additional U.S. jobs in supplier and induced activities, totaling more than 801,000 jobs nationwide.

In February of this year, the USTMA projected total U.S. tire shipments of 334.2 million units for 2023, as compared with actual shipments of 332.0 million units in 2022 and 332.7 million units in 2019. When Compared with 2022, Original Equipment (OE) shipments for passenger, light truck and truck tires were expected to change by 2.3%, 1.3%, and -0.6% respectively, with a total increase of 1.0 million units. Replacement passenger, light truck and truck tire shipments were also projected to change by 1.0%, 1.6%, and -5.5% respectively, with a total increase of 1.2 million units. On August 4, however, the USTMA lowered its total U.S. tire shipment projections to 325.4 million units, which is below 2022 levels. Although OE is projected to be higher by 2.3 million units, the replacement market is now expected to decrease by 8.9 million units, with only OE passenger tires expected to increase.

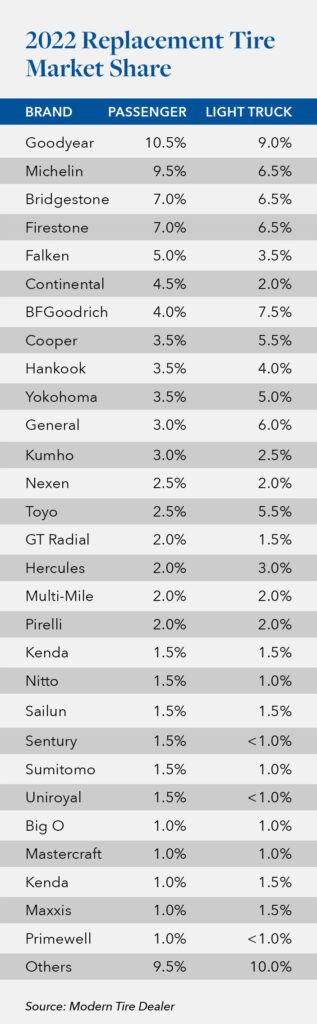

Competition between domestic and foreign tire manufacturers is based on a number of factors including product design, performance, price and terms, reputation, warranty terms, customer service and consumer convenience. Brands such as Michelin, Bridgestone, and Goodyear, enjoy a high recognition factor and have built a reputation for performance and product design. Leading producers offer various house brand tire lines as well as the tires they manufacture and sell to private brand customers. These house brands compete primarily on the basis of value and price.

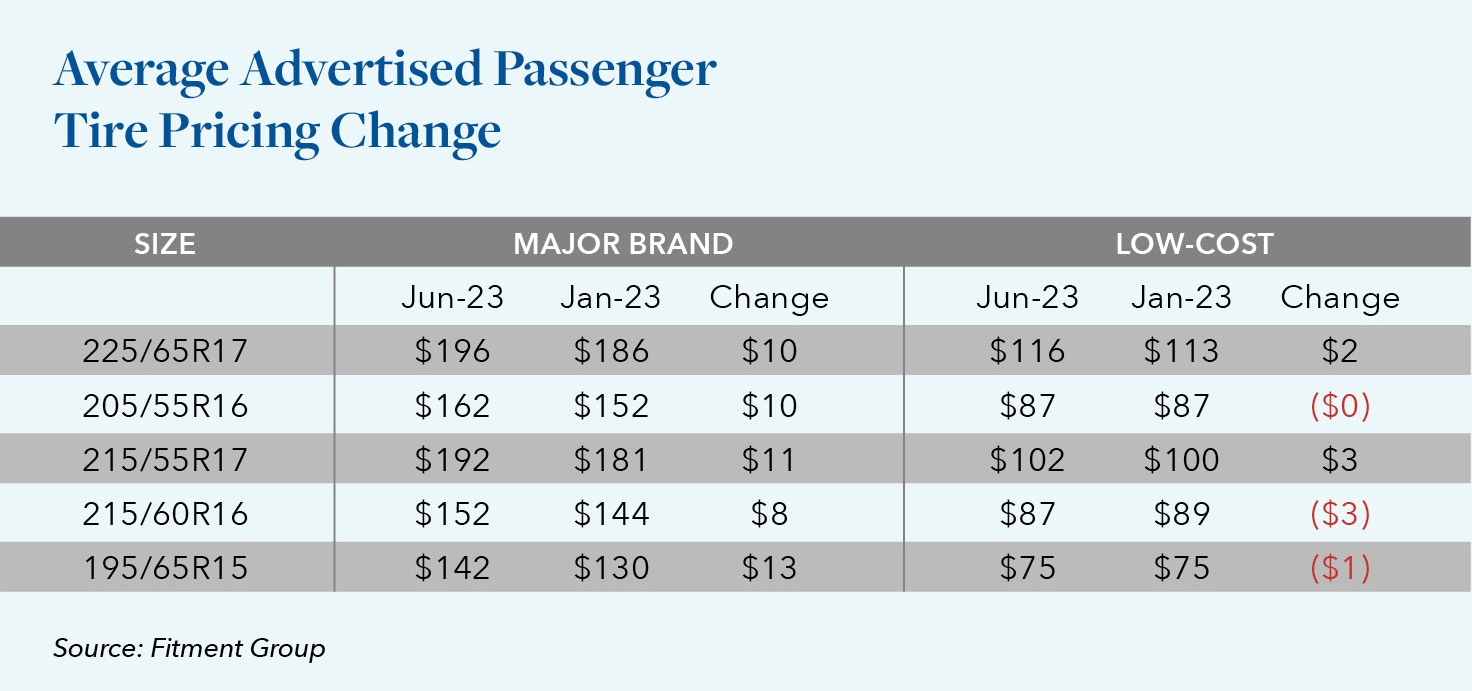

According to the 38th Global Tire Report from Tire Business, the number of U.S. passenger tire imports for the first half of 2023 saw an 11.6% reduction from 86.8 million units in the first half of 2022 to 78.7 million, as the market continued to adjust to pandemic-driven shipment impacts. The Fitment Group reported a general increase in the average advertised passenger tire prices from January 2023 to June 2023 based on these popular tire sizes:

Notable Developments Across the Industry:

Manufacturers

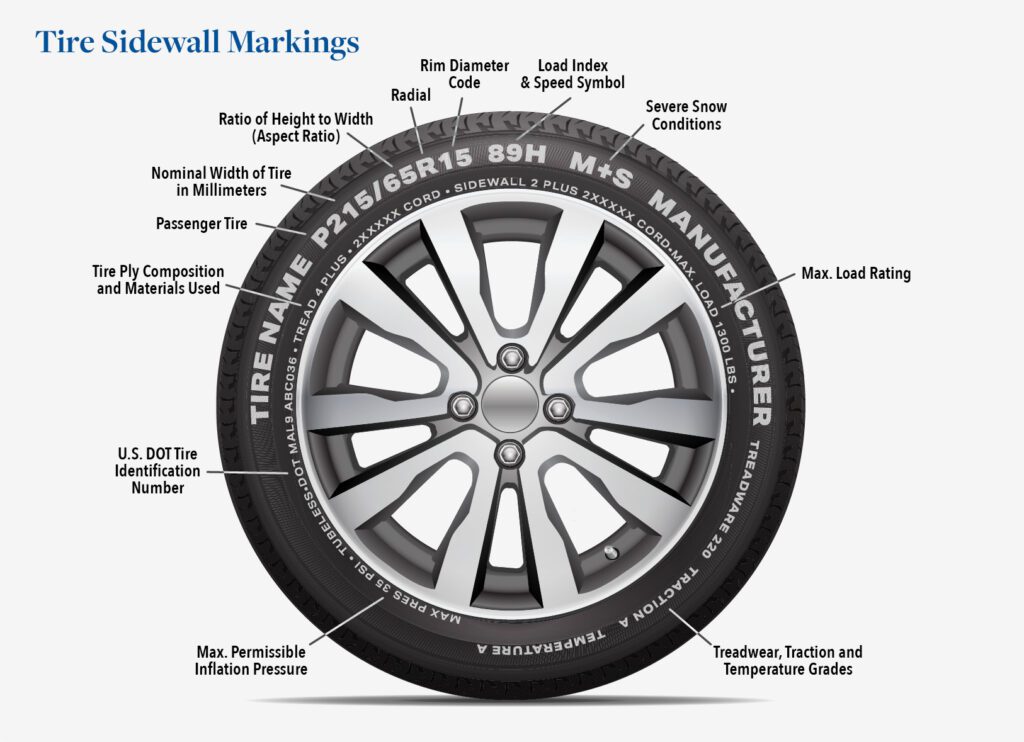

Tires contain many rubber compounds and other materials which enable them to safely perform in the face of a wide range of demanding conditions and safety regulations. Materials include natural and synthetic rubber, carbon black, steel cord, fabrics, and petrochemical-based commodities. Increased demand has contributed to inflationary cost pressures, as higher priced raw materials, transportation costs and energy costs remain. Substantial quantities of fuel and other petrochemical-based commodities are used in the production of tires, synthetic rubber and other products.

The Goodyear Tire & Rubber Company recently announced results for the first half of 2023, noting that looking ahead to the third quarter of 2023, they expect the industry will continue to face uncertain macroeconomic conditions as a result of the ongoing effects of inflation. Replacement demand is also expected to be impacted negatively through at least the third quarter based upon tire dealer and distributor channel destocking and weak industry conditions in many of their markets. Additionally, Goodyear anticipates that inflationary cost pressures will persist throughout the second half of the year, particularly with respect to transportation, labor and energy costs. The volume of tires expected to be produced in the U.S. moving forward continues to grow as various foreign manufacturers such as Giti Tire Group and Nokian Tyres expand capacity at their first American plants in Richburg, South Carolina (opened 2017) and Dayton, Tennessee (opened 2019). Various other foreign manufacturers are reportedly studying the possibility of new U.S. factories

Distributors

Alongside manufacturers, various wholesalers/distributers across the industry are actively working to address the ongoing challenges associated with competition and profitability. Of particular note among these are:

- Tirehub: Established in 2019 as the joint venture of Goodyear and Bridgestone (the number 2 and 3 tire producers respectively behind Michelin) just ahead of the pandemic, Tirehub works to more effectively control and ensure continued distribution of those tires’ brands in the U.S. The move resulted in the pair removing their brands from the largest U.S. distributor, American Tire Distributors, Inc. TireHub has now added or relocated 12 of its TireHub Logistics Centers (TLCs) in the last 18 months, bringing the total number of locations in its network to 80. The company plans to add more locations in the coming months and is also slated to open its first regional distribution center later this year.

- Groupe Touchette: Based in Montreal, Quebec and one of the largest independent tire wholesalers in all of Canada, Groupe Touchette notably acquired National Tire Distributors, the former Canadian subsidiary of American Tire Distributors, Inc. in September 2022.

Retailers

On the retail side, the big continue to get bigger.

- In May 2023, Mavis Tire Express Services Corp.’s acquired 595 NTB Tire and Service Centers and Tire Kingdom Service Centers from TBC Corp. Mavis now has more than 2,000 retail stores, including 392 NTB stores and 203 Tire Kingdom locations throughout the Midwest, South and Mid-Atlantic region.

- Tucson, Ariz.-based Sun Auto Tire & Service added stores during the third quarter of 2022 via the acquisitions of TGK Automotive Specialists, a 24-store business primarily based in Minnesota, and Toscalito Tire & Automotive, a five-store dealership in California. As of January 2023, after acquiring Florida-based Tire Outlet’s 14 stores, Sun Auto Tire reached a total of more than 420 locations.

Percheron Capital entered the industry in April 2021 by acquiring 20 Big Brand Tire & Service (Big Brand) retail locations in California. By the end of 2021, several more acquisitions increased its store count to 165 units on the West Coast. Then, during 2022 more than 30 additional stores were acquired across Nevada, Arizona, and Colorado.

Conclusions:

The U.S. and Canadian tire markets are being driven by a variety of diverging factors. These include the growing production and sales of passenger and commercial vehicles, changing consumer preferences favoring premium quality tires to enhance safety and driving experience, and the increasing adoption of electric vehicles (EVs), even as inflation, economic uncertainty and higher fuel prices temper consumer purchasing activity. Additionally, we are seeing significant demand for replacement tires associated with the extensive and continued use of a variety of vehicle types for timely package delivery. The increased availability of tires through more offline and online channels, coupled with the recent resurgence in the popularity of family and other road trips is also further boosting the market. Lastly, leading market players’ investments in research and development (R&D) and the introduction of innovative airless tires designed to support heavy loads while delivering smooth rides, are anticipated to help sustain market growth in the coming years.

As always, we encourage lenders with tire industry exposure to closely monitor borrower inventory levels, product mix and aging to maintain a firm grasp of net orderly liquidation value (NOLV) and best manage and adjust associated borrowing bases. If you or a borrower in your portfolio have any questions or concerns heading into the final quarter of this year, our team’s work across the industry in 2023 has given us numerous insights that we are able and willing to share. We are here to help.

Hilco Valuation Services has significant, validated expertise in the tire marketplace, including production, importation, distribution, and retail installation. Leveraging our deep industry knowledge, we have delivered valuations on dozens of Companies in the U.S. and Canada over the past five years. As one of the world’s largest and most diversified business asset appraisers and valuation advisors, we serve as a trusted resource to companies, lenders, and professional service advisors, providing value opinions across virtually every asset category. Hilco Valuation Services has the ability to affirm asset values via proprietary market data and direct worldwide asset disposition and acquisition experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures clients of more reliable valuations, which is crucial when financial and strategic decisions are being made.