UAW Trades Assembly Lines for Picket Signs

UPDATE! – This article includes information about the UAW strike and its impact on the automotive industry’s performance over the past quarter. Since initial publication of the article, the union has reached an agreement with General Motors, effectively concluding negotiations and ending the strike.

October 26, 2023 Union members of the United Auto Workers (UAW) recently traded assembly lines for picket lines at five plants that make midsize pickups, midsize sport utility vehicles, and large crossovers. Initially, the UAW intentionally spared the industry’s plants where highly profitable full-size pickups and sport utility vehicles are built, the implied threat of “Listen to our demands, or we (UAW) can hit you where it really hurts,” has been there from the very outset. Singling out high executive compensation packages, the Union demanded that its membership be similarly rewarded. Among the demands, an increase in wages of 36%, reinstatement of an automatic cost-of-living adjustment, return to defined-benefit pensions, elimination of the two-tier wage system, and tighter limits on the use of temporary labor. After six weeks, there are now more than 40,000 UAW members on strike and the list of idled plants now includes some of the industry’s coveted full-size truck plants.

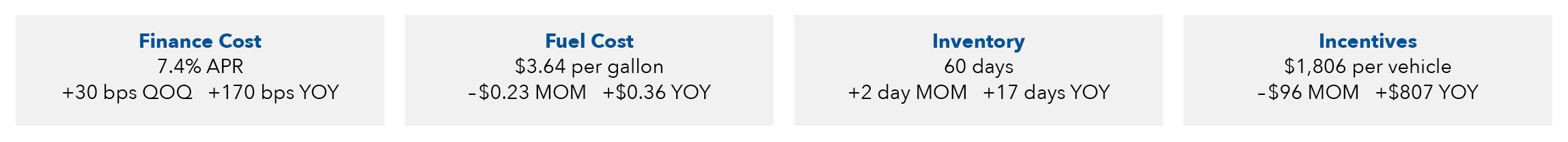

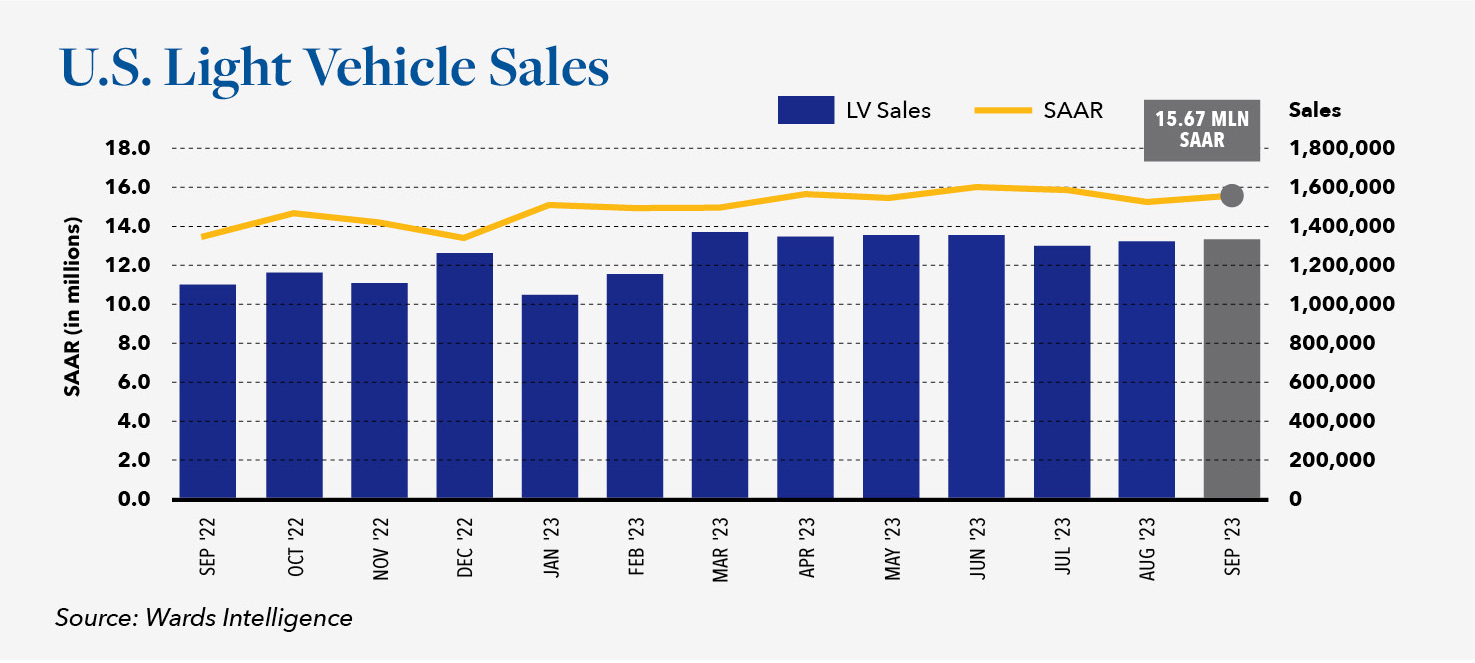

Prior to labor negotiations, it was not unusual for manufacturers and their suppliers to carry extra inventory as a form of insurance against a protracted strike. This year, the manufacturers did not have that luxury. A year ago, hobbled by supply chain constraints, the industry struggled to maintain an inventory of one million vehicles. Since then, the manufacturers have steadily replenished dealer stock to nearly two million vehicles. While that is enough to support a seasonally adjusted annualized rate (SAAR) of 15 million vehicles, it is certainly not enough to weather a protracted labor strike. The SAAR for U.S. light-duty vehicles has been at, or above, 15 million vehicles for nine consecutive months. Light-duty vehicle sale for this year’s third quarter are up 16.6% as compared to the third quarter of last year, while total year-to-date sales through September are up 14.1% as compared to the same period last year. Sales of 15 million units a year may seem a long way from the 17 million units the industry was selling annually prior to the pandemic, but it is also a long way from the 13.9 million vehicles the industry managed to eke out in 2022 based upon lack of adequate inventory.

Dealers currently have about 60% more vehicles on their lots than they did just one year ago and there appears to be sufficient pent up demand from retail and fleet customers to offset any affordability headwinds caused by high interest rates and high sticker prices. Finance costs are nearly two percentage points higher than one year ago and the average transaction costs remains above $45,000. It is even difficult to find a used car less than 5 years old for under $20,000. Tentative agreements have recently been reached between the UAW and both Ford and Stellantis, providing some hope that a resolution may be in hand. As a sign of good faith, it is possible the UAW may send some of their members back to work, particularly at some Ford plants. Industry analysts, having been burned first by the pandemic and then by the weaker than expected supply chain, are being very cautious this time around. The forecast range for 2023 remains at 15.0 – 15.5 million units, albeit now toward the top end of that range.