Unforeseen Complexities of Industrial Asset Disposition Warrant Careful Selection of a Turnkey Buyer

The Situation

By the summer of 2019, the increasingly competitive global landscape in Aluminum Foil production, driven in large part by increased pricing pressure from Asia manufacturers, had made it economically unfeasible for one of the world’s leading industrial aluminum companies, Novelis Inc., to continue profitable production at its Lüdenscheid Germany aluminum foil mill. In August of that year, about 12-months prior to ceasing full time production, the company announced publicly that the plant would close.

As a major producer of rolled aluminum and a subsidiary of the Indian aluminum and copper manufacturing giant Hindalco Industries, Novelis serves customers in sectors including beverage cans, automotive, consumer electronics, construction, foil and packaging. The company’s Lüdenscheid mill was located about 50 miles outside of Düsseldorf in an older industrial area, amidst other longstanding companies also engaged in the production of high alloy steel and metal products.

Hilco Commercial Industrial is highly experienced and very active in providing monetization solutions for manufacturers across a wide range of industries and sectors. As such, when we became aware of Novelis’ plans to shutter its facility, we proactively contacted their management team to engage in an initial dialogue to determine how we might be able to assist them with the many aspects of

such an undertaking.

We quickly learned that Novelis was looking for a one stop solution; a single company which could purchase its assets, handle the laborious steps involved in their removal, and thoroughly clean the facilities in preparation for sale. Based on these early discussions, we recognized that Hilco Industrial Acquisitions would be able to serve as an ideal partner for Novelis in its asset disposition efforts for the mill based on our business model which, unlike the vast majority of monetization firms, is structured with the ability to leverage our access to capital to help facilitate customer transactions.

While there were multiple bidders for the project, Novelis ultimately selected Hilco as its partner for this critical endeavor in December 2019 based on 1) our demonstrated interest and ability in sharing both risk and reward by using our own capital for an outright, up-front purchase of its high value machinery equipment assets; 2) our experience in providing hands-on project management for the timely removal of those assets from its premises—many of which weighed several hundred tons and exceeded the height of the mill itself— and; 3) our ability to deliver back the vacant plant/real estate in broom-swept condition, ready for sale.

The Solution

We first conducted an on-site inspection of the Lüdenscheid facility and its assets in October 2019, well prior to the start of the COVID-19 crisis. Upon doing so, we quickly discovered that the machinery and equipment identified for disposition was located within a number of different buildings constructed over time as the company had expanded. Furthermore, most of those structures were now over 100 years of age. Based on our extensive experience in managing projects of similar scope, Hilco realized that these factors would add significant complexity to the effort. Extra care and resources would need to be dedicated to the painstaking dismantling and removal of these assets in a manner that would ensure the safety of those involved while protecting the functional integrity of the machinery and equipment, as well as the aging mill structures themselves.

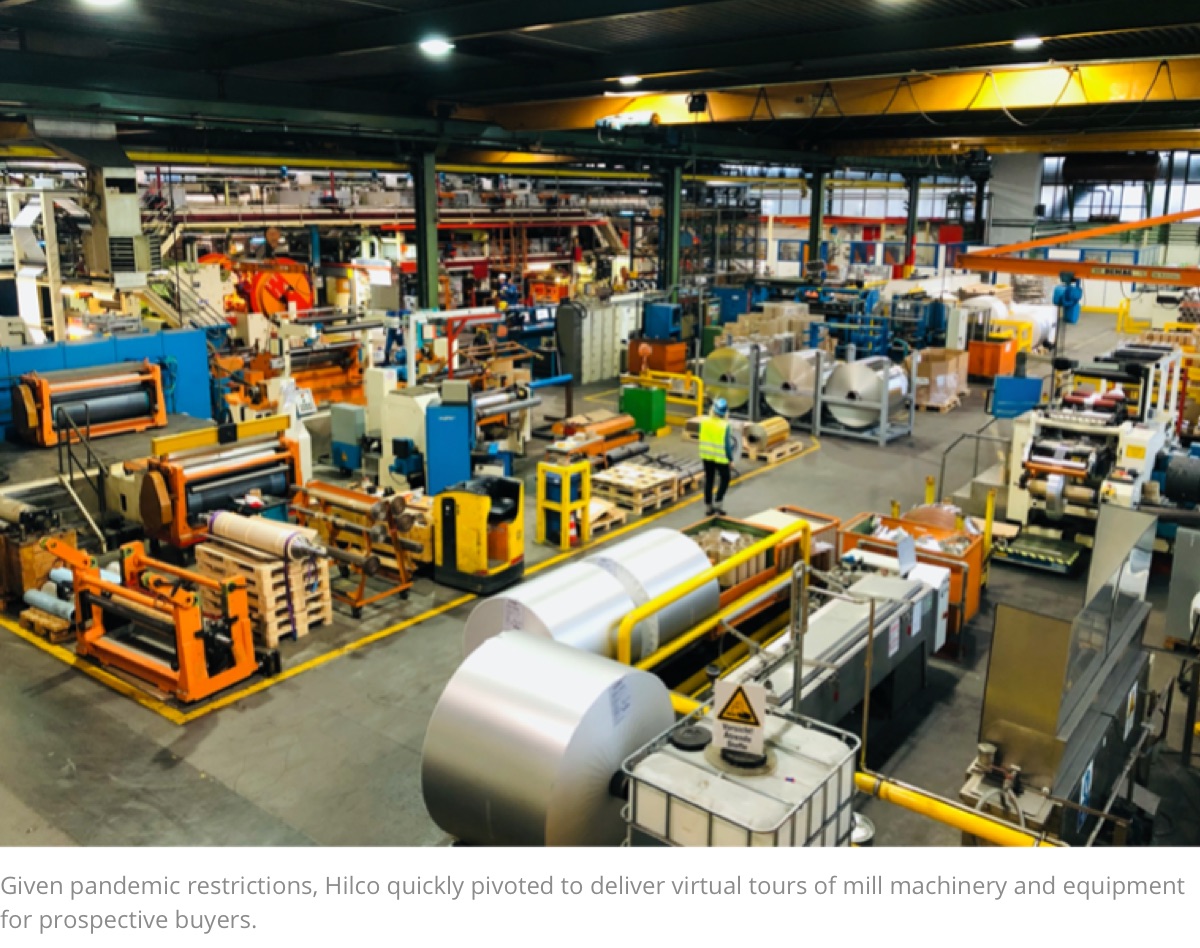

By March 2020, as we began our worldwide marketing activities for the sale of the Novelis equipment we had by then purchased, the global pandemic had reached Europe. Although the Novelis plant was still in production mode, this meant that most potential buyers desiring to inspect the offered machinery and equipment in person, were not able to physically visit the site, as they were located in other countries and travel restrictions at the time prevented them from entering Germany. Recognizing that photographs and video, alone, would not provide adequate detail for remote buyers, Hilco coordinated “virtual inspections.” These engaging live interactions were conducted via videoconference featuring our Hilco project manager together with a Novelis technician. This innovative approach enabled us to showcase and demonstrate real time operation of machinery and equipment and answer any and all questions posed by potential buyers.

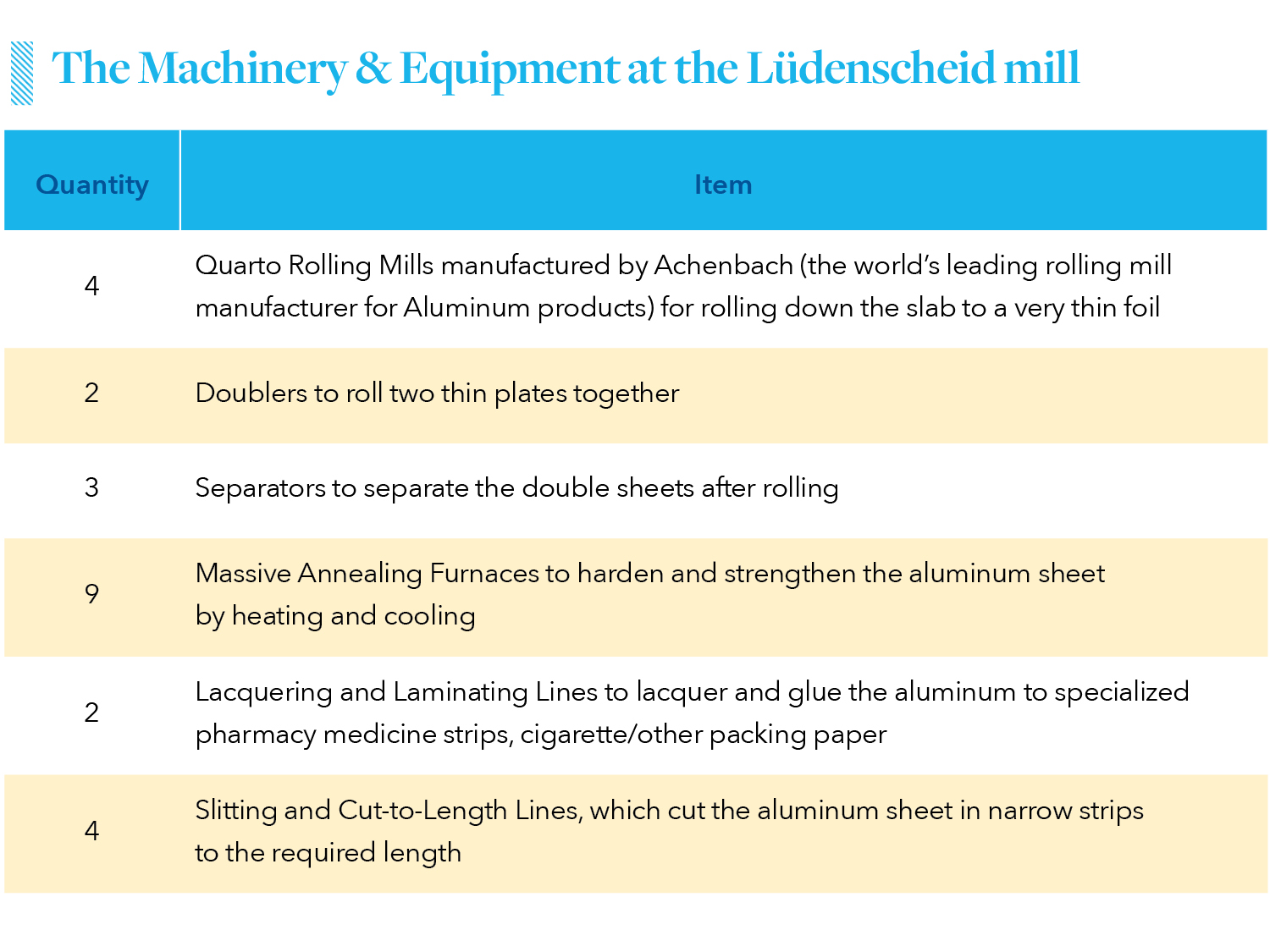

The assets at the Lüdenscheid mill were utilized for many years in a manufacturing process involving the use of Rolling Aluminum Slabs produced and shipped to that location from other Novelis plants. Production at Lüdenscheid focused primarily on aluminum-foil for pharmacy medicine strips, beverage cans, food packaging, and cigarette packing paper.

Our thorough marketing efforts and quick shift to implement virtual asset tours enabled the project to move forward at a pace that would otherwise not have been possible under the restrictive pandemic conditions at the time. These tours and the associated negotiations with prospective buyers kicked off during May 2020 and continued into October of that year, resulting in the successful sale of all assets by private treaty at projected or greater levels of return to two separate buyers based in Turkey. Each utilized representatives in Germany for final on-site inspections and sign off prior to closing.

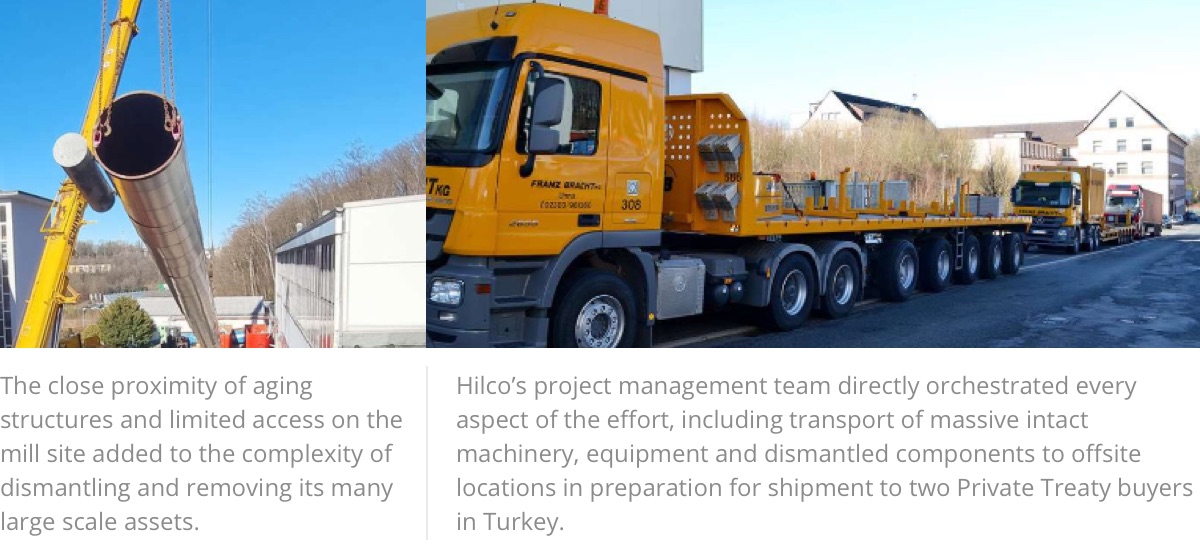

removal of the assets was a difficult and intricate task. The mill’s older buildings were located on a hilly area within the city of Lüdenscheid. These structures were connected both on different levels and via small alleyways. Certain equipment, some exceeding 100 tons in total weight, necessitated dismantling. Even after this step, the weight of many of the components removed to the exit location still required the use of cumbersome cranes and lifts. With only three areas accessible for loading, two of which were particularly small, we had to take the step to close off streets in order to park the mobile cranes brought in to load the heaviest components onto a group of awaiting trucks. Additionally, large towers of up to 45 meters in length and 5 meters in diameter that had been utilized in the extraction of production fumes also had to be removed from the back of the buildings, lifted over the surrounding structures and on to those vehicles as well.

The real estate was sold to a development company, and we are pleased to report that Hilco was able to remove all assets from the facility well in advance of that transaction date. All structures were formally returned to Novelis on March 30th of this year in a vacant and thoroughly cleaned state, ready for the company to deliver to the buyer as promised. Upon closing, all assets were shipped to Turkey for use

in those companies’ facilities in that country.

Takeaways

Among other factors, we credit our success with this and other engagements to a series of best practices which includes: highly sophisticated and targeted worldwide marketing, a very experienced team of sales professionals dedicated to painstaking buyer outreach and negotiation of a final sale, the use of our own proprietary database to track and benchmark the sale price of machinery and equipment across virtually every industry and sector, our ability to both invest our own capital to acquire assets upfront and project manage our deals directly, and our focus on private treaty sales to industry-specific end users vs. auctions to sell acquired assets.

If your company, or a company in your lending portfolio has a desire or need to monetize any or all of its assets, we urge you to seek out a partner with best practices that have a proven track record of success for clients; one that can clearly demonstrate its experience, financial capability, ethics and project management expertise. Hilco Industrial Acquisitions is a true turnkey buyer/partner, and has sold thousands of plant assets around the world. Our team members, who are thoroughly trained in Health, Safety and Environment, each average between 10 and 25 years of industry experience.

We serve clients in many industries, including Metalworking, Process, Electronics, Construction & Transport. Pervasive in our work across every industry is our commitment to providing exceptional service and our ability to achieve outstanding results time and again. When you work with Hilco Industrial Acquisitions, we already know your industry, speak your language and understand your challenges. This serves to ensure accuracy, efficiency and delivery of maximum monetization value for you and your organization.

Our reputation has been earned by helping both healthy and distressed companies identify and derive that maximum value for their tangible and intangible assets. Our ability to provide capital to help facilitate many transactions, demonstrates our willingness to share risk and reward. Hilco Industrial Acquisitions is part of Hilco Global, a unique platform of more than twenty integrated business units located around the world and focused on three core corporate solution areas: Valuation, Monetization and Advisory Services. Each Hilco Global company is recognized as a leader in its respective field. These businesses on their own, or collaboratively, are able to provide customized services to determine the market value of your business assets, monetize those assets, or enhance their overall worth to your organization through innovative strategic solutions.

Whether your company is in a healthy or distressed state or you are a lender with exposure in one or more industrial markets, during these challenging times we encourage you to reach out to our Hilco Industrial Acquisitions team to discuss your needs and options in regard to the disposition of plant machinery and equipment. We are here to help!