2023 Will Be a Test

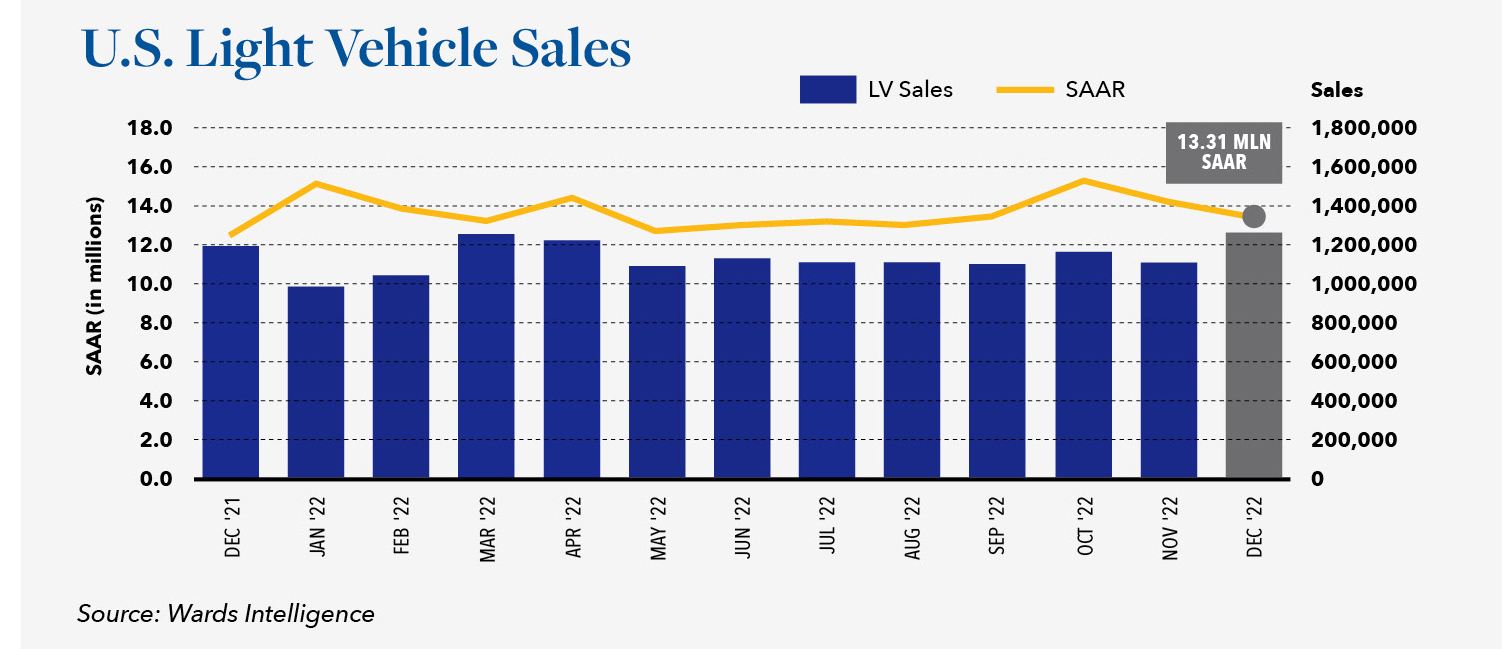

January 30, 2023 After five consecutive years of sales in excess of 17 million light vehicles, the U.S. market shrank to 14.6 million vehicles in pandemic plagued 2020. The seasonally adjusted annualized rate (SAAR) remained above 16 million vehicles for the first five months of the following year until the lack of computer chips ultimately limited the availability of inventory. Sales in the second half of that year were the worst in a decade and the industry only managed to sell 15.1 million vehicles in 2021, a scant 3% increase over 2020. The SAAR somehow managed to recover to 15.2 million vehicles in January 2022 and once again gave hope that the market would resume its recovery. Unfortunately, the industry struggled to rebuild depleted inventory and this early optimism did not last as long as it did the previous year. Inventory levels did eventually begin to improve, but not in time to salvage the year. Full-year 2022 sales of light-duty vehicles ended at 13.9 million units, down 8% from 2021, and the lowest level since 2011.

After struggling for 16 consecutive months to build inventory, retail inventory finally exceeded one million vehicles in September 2022 and has increased steadily each month since. Current domestic inventory levels are nearing the 60-day supply mark considered ideal by industry standards. According to the Cox Automotive Dealer Sentiment Index, interest rates and the economy have displaced inventory at the top of the list of factors that franchised dealers view as holding back their businesses. The average annual percentage rate (APR) to finance a new car was 6.5% in the fourth quarter of 2022, as compared to only 4.1% one year earlier. With the increase in finance cost, coupled with a greater availability of inventory, dealers are less successful charging a premium over the manufacturer’s suggested retail price (MSRP). Currently, only about 40% of vehicles sold exceed the MSRP as compared to 50% as recently as July 2020. For now at least, incentives remain at historical lows ($1,122 per vehicle) but that could change if the premium that dealers are currently enjoying over MSRP is further squeezed. Once the price premium is depleted, dealers and manufacturers may be tempted to resort to traditional incentives to maintain sales. Another important metric to watch is the number of units sold to the fleet market. Prior to the pandemic nearly 20% of sales were to fleet customers. In response to the production disruptions in 2020 and 2021, manufacturers redirected more production to more profitable retail customers while fleet customers were left to turn their fleets less frequently. As an example, fleet sales in December 2021 were little more than 10% of total sales. If sales continue to languish, the temptation will be to pump up the numbers with fleet sales and to resort to the heavy incentives that characterized the past. In September 2019, before the pandemic, the average incentive was $3,975 per vehicle. Over the past two years, the industry has learned to live with less inventory, less incentives, and less fleet sales, and still make money. If demand remains soft, will the industry resort to its old ways, or adjust production in line with demand?