Challenges and Opportunities Along the Road to Electric Vehicle Proliferation

An abbreviated version of this article also appears in the June/July ‘21 issue of SFNet.

In this first in a series of upcoming articles on the electric vehicle (EV) market, we take a look at plans by global auto manufacturers for continued, aggressive expansion of their electric offerings as well as the technologies that are competing for dominance in the market.

Over 10 years ago, Nissan launched its all electric Leaf automobile, becoming the first automaker to mass produce such a vehicle. Since that time, a plethora of legacy manufacturers from Toyota and Honda to Mercedes, Audi and Ford, have introduced a host of hybrids and Electric vehicles (EV’s). General Motors has now announced that it is making a $27 billion investment in electric and autonomous vehicles and has committed to introducing a minimum of 30 EV models through 2025. Volvo recently revealed its aggressive plans to transition to an all EV company by the year 2030. And Volkswagen has put a stake in the ground, publicly stating that its mission is to become the world’s largest manufacturer of electric vehicles. While multiple automakers plan to eliminate new vehicles with gasoline and diesel engines entirely in the next 15 years, it is worth noting that many longstanding brands have yet to fully commit to an EV platform-based future.

Historical Perspective

The reluctance to commit is somewhat easier to understand when we consider the evolution of personal vehicles overall, dating all the way back to the transition from horses to the first automobiles. With advances in technology in the 1800s came experimentation with not only gasoline but steam and even electric powered engines. Steam was, in many ways, the most promising technology of the time because it was so widely used to power train locomotives, ocean-going ships, mining and factory equipment. An engine powered by steam is, in fact, widely believed to have propelled the world’s first “automobile” in the late 1800s. Steam engines, however, had a number of drawbacks including the time needed to warm up prior to use and their constant need for water, which limited the distance they could travel in many circumstances.

Electric cars of the time lacked many of the issues that plagued steam and gasoline-propelled vehicles. They didn’t make a lot of noise, they were comparatively simple to operate, and they did not generate excessive heat or emissions. Some popular electric models were actually produced as early as the late 1880s in Germany and in England, where an entire fleet of electric taxicabs filled the streets. The popularity of electric cars continued to grow, particularly in urban areas, as more cities became electrified for the first time and charging became a less arduous task. As a result, auto pioneers, notably Ferdinand Porsche, continued to experiment with electric and even early hybrid creations. Around this time in the U.S., Thomas Edison was busy developing vehicle batteries that could deliver better performance. He and Henry Ford even partnered together in an effort to develop a viable low-cost electrical car. Ultimately, however, many consider the introduction of Ford’s own $650 Model T in 1912—a credit to the efficiencies of his innovative production line process—as the pivotal event that stalled the future of electric vehicles of the era and led to the meteoric rise of the combustion engine. In fact, it wasn’t until over 80 years later, in 1996, that the first production electric vehicle was brought to market by General Motors. Toyota’s Prius hybrid was introduced the following year, and in 2004 Tesla motors was founded.

The Modern Era

As referenced above, the past several years have featured numerous announcements by manufacturers across the globe pertaining to their plans for EV rollouts. Even under the restrictions of COVID-19 conditions, since the start of 2021 we have seen GM release its completely redesigned 2022 Chevrolet Bolt EV and a compact sport utility variant badged the Bolt EUV. Production is scheduled to begin later this fall on GMC Hummer’s highly anticipated EV. According to Stellantis, by year end it plans to introduce up to 10 hybrid or electric models across its brands, among them a highly anticipated Jeep Wrangler plug-in. The latest front page news for electric vehicles is Ford’s introduction of an electric-powered version of the iconic Ford F-150 pick-up truck to be badged the Ford Lightning. Only five years ago, Ford used its iconic F-150 pick-up to make headline news when it jettisoned the rugged, conventional steel body in favor of a light-weight, all-aluminum body. There is no better way for Ford to demonstrate its commitment to the cause than to introduce a zero-emission variant of the most popular vehicle in America, the Ford F-150.

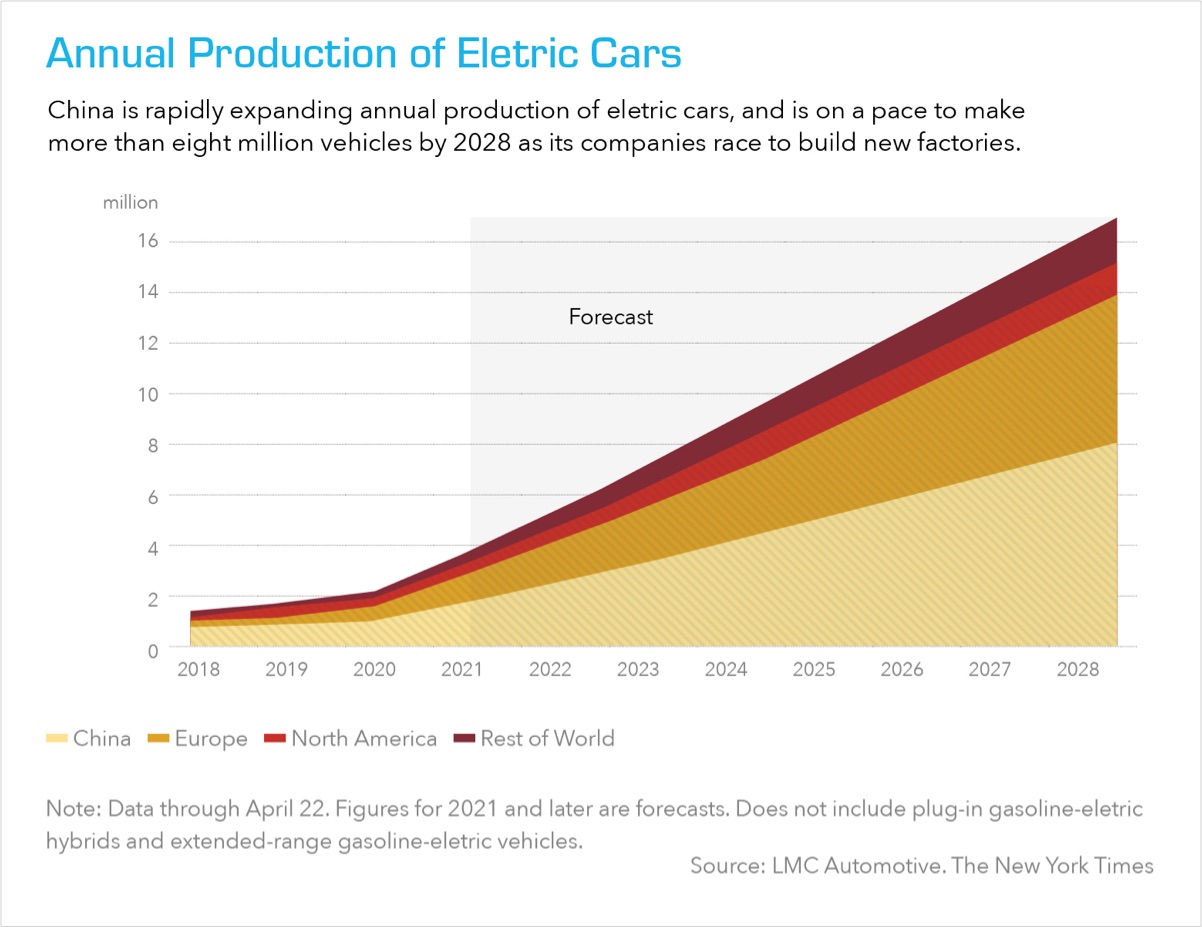

The new car market in China is by far the largest in the world. According to estimates by global automotive firm LMC Automotive, China will produce over eight million electric cars annually by the year 2028. Europe and the U.S. will be hard pressed to ramp production at anything approaching a competitive rate. Meanwhile, China’s projected rate of growth for “new energy” vehicles in 2021 is 40%, with total sales expected to climb to 1.8 million units, based on data from the China Association of Automobile Manufacturers.

At present, there are 22 EV makers doing business in China. All but Tesla are home-grown China-based companies, including one which is joint venture with Volkswagen. While U.S.-based Tesla is the only outlier, the company actually leads the market in units shipped to-date.

Technological Crossroads

Reducing emissions is a top priority for most major automakers today, but determining how best to accomplish that task remains a topic of some significant debate. While hybrid electric vehicles (HEVs) have paved the way for the industry since Toyota’s Prius debuted nearly 25 years ago, their reliance on petroleum-driven combustion engines makes HEVs an unlikely long-term candidate for survival in an increasingly environmentally conscious, sustainability-focused world. With this in mind, meeting consumer expectations and achieving zero emissions – which states including California have now mandated be accomplished by specific future dates – will require further refinement of two notably different technologies: battery electric vehicles and hydrogen fuel cell vehicles.

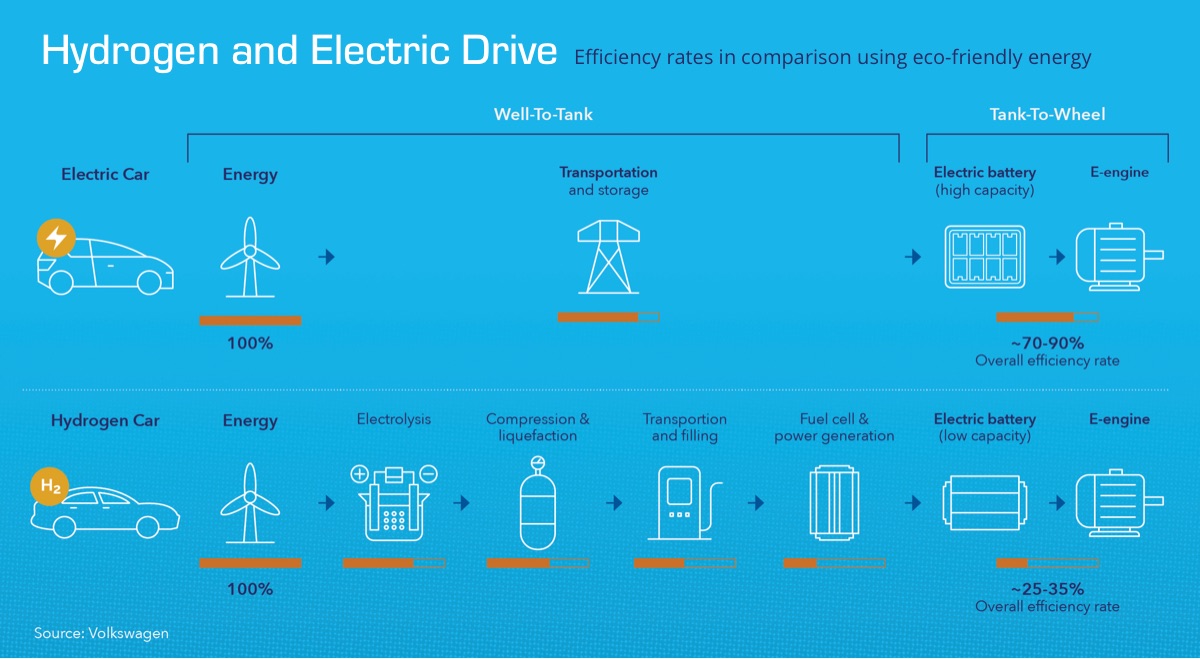

While both harness electricity to generate vehicle propulsion, the way each stores that electricity is dramatically different. In battery-electric cars, that power is stored directly in a vehicle’s battery packs. Storage is accomplished quite differently, however, in hydrogen fuel cell cars. Here, a car’s fuel cells store electricity in the form of gaseous hydrogen, which when released via a chemical reaction in those cells, generates propulsion.

In a recent self-funded study, “Automotive Industry 2035 – Forecasts for the Future”, management consultancy firm Horváth & Partners explored which of these technologies is likely to become most established in the years ahead. Its findings indicated that based on the specific model, a battery-powered electric car is capable of achieving a level of efficiency somewhere between 70% and 80% percent. This means that approximately three quarters of the total electricity generated by the car’s own grid is actually able to be applied to vehicle propulsion.

By comparison, the study found that losses are significantly more extensive in hydrogen-powered electric cars, which are only capable of attaining an efficiency range between 25% to 35% percent. The study also showed that when alternative fuels to hydrogen are burned, efficiency drops even further. So, while hydrogen and other fuel cell-based electric cars can offer extended range, fast refueling and reduced weight over their battery-on-board counterparts, they would appear to have one distinct disadvantage; their comparative inefficiency. That said, while current offerings from Volkswagen, BMW and Ford underscore those manufacturers’ commitments to battery-electric cars, others including Hyundai, Toyota and Honda strongly support fuel cell technology, with each presently offering such a vehicle in the California market where that fueling infrastructure currently exists.

Commodities Impact

With the pace of electric vehicle adoption overall increasing at a rapid rate, major implications lay ahead for industries that supply the automotive industry. This includes the mining and metals as well as the energy sectors. Demand for metals including lithium and cobalt can be expected to dramatically increase as more widespread adoption of electric vehicles takes place across the globe in the coming years. Furthermore, as automakers are being regulated into reducing the emissions footprint along their supply chains, the pressure will be on for greater use of renewable energy and sustainable manufacturing techniques such as electrification of mining operations and implementation of green initiatives.

Some have expressed concern for the steel market as penetration of electric vehicles continues to advance. According to Ernst & Young, automotive sector demand for steel can be expected to remain relatively flat with the incremental volume of EVs produced offsetting the reduced volume of steel needed for each unit. A demand increase is also forecast for aluminum as the push to reduce vehicle weight continues. Both metals will be essential in the growth of the global charging infrastructure and EV battery production. Copper demand is also expected to grow at a significant rate given that an EVs construction involves approximately five times more of that metal than an equivalent combustion engine vehicle. Copper is also an essential component in the expanding EV charging infrastructure. Demand for cobalt, graphite and nickel is also expected to grow alongside the lithium widely utilized in EV battery technology.

Infrastructure

The new administration has prioritized a national EV charging network, with a goal of installing at least 500,000 devices nationwide by the year 2030. Similar efforts have been proposed, with some well underway in countries around the world. This is an aggressive undertaking for the U.S. and one that clearly looks toward the future of a carbon footprint-friendly roadway. With EVs and hybrid electric vehicles currently accounting for only about 2% of the new vehicles sold domestically in 2020, demand for a large network does not exist today. Yet, adding future capacity is clearly critical as evidenced by a recent Consumer Reports survey. Findings indicated that about half of drivers would be interested in an EV that could travel further than 300 miles between charges, yet most offerings on the road today do not deliver that range. Less than half of those surveyed who indicated that they definitely do not plan to obtain an EV as their next vehicle, indicate that an inadequate charging infrastructure is a key factor holding them back. 28% state that they lack a place to charge an EV at home.

Not surprisingly, while automakers are heavily vested in evolving their EV offerings to meet consumer expectations and government regulations, they are not as zealous about following the Tesla model of building out, owning or operating their own charging networks. As a result, most have entered into partnerships with third-parties to provide those capabilities. Companies such as ChargePoint and EVgo have adopted distinct business models in building out large charging networks, both of which place the majority of the cost burden on area businesses. While these and other suppliers/operators have, to-date, concentrated on installations at highly trafficked urban and suburban shopping and entertainment locations, we expect to see a growing number of fast charger installations at intervals between major population areas to make longer trips more practical for EV owners and EV ownership more appealing to the masses.

Consumer Acceptance

With mounting legislation and regulation worldwide supporting clean initiatives and the reversal of climate change, automobile manufacturers have little choice but to continue the acceleration of their efforts toward an EV-focused future for their vehicle offerings. The risks, however, at least in the near-term are very real. EV sales comprise under 2% of new vehicle sales in the U.S. and only 3% globally. While overall awareness of EVs and their distinct benefits is high among consumers here in the U.S., multiple studies indicate that current range limitations, charging station scarcity and expensive pricing continue to inhibit many from making the leap to EVs. As a result, while a global production shift to EVs is all but certain over the course of the next decade, the rate of future adoption remains more in question.

For more than a century, man has toyed with the concept of electric vehicles. Ironically, electrification of the industry is anything but the flip of a switch. Swamy Kotagiri, the newly appointed chief executive of Magna International, likened the process to a marathon. All the work up until now should be viewed as training for what now is the race. With that in mind, Hilco urges lenders with current portfolio exposure to the industry to actively engage with their borrowers to 1) ensure that a company’s strategic plan anticipates the continued emergence of EV technology; 2) assess the sense of urgency of a company’s leadership with respect to EV technology; 3) determine the percentage of a company’s R&D budget that is related or dedicated to EV Technology; 4) determine the percentage of a company’s capital expenditures that are related or dedicated to EV Technology and; 5) become as knowledgeable as possible about the details of the strategic partnerships that a company has formed or is considering in the future.

Throughout this pandemic period we have continued to work closely with our clients and contacts across the industry and have amassed critical insights and data that enable us to deliver highly accurate valuations across automotive manufacturing and the associated supply chain. Whether you have a simple question or a more in-depth need, we encourage you to reach out to our Automotive Practice team. We are here to help!

ABLs and manufacturers alike have achieved a high level of success across numerous industries in partnership with Hilco Valuation Services based upon our disciplined process, industry-leading bench strength, systematic and collaborative approach. This success is a testament to our commitment to excellence. By understanding past cycles and performance, documenting historical data points across the sectors and industries, and continuously exploring and assessing the path that is being paved ahead, Hilco Valuation Services consistently delivers reliable, accurate and actionable valuations for our valued customers.