Chassis Market Update: A Slow Start to 2023 with a Predicted Q3 Uptick

This interim update on the Chassis market provides our topline insights on the most current industry developments and considerations at the conclusion of Q1 ’2023.

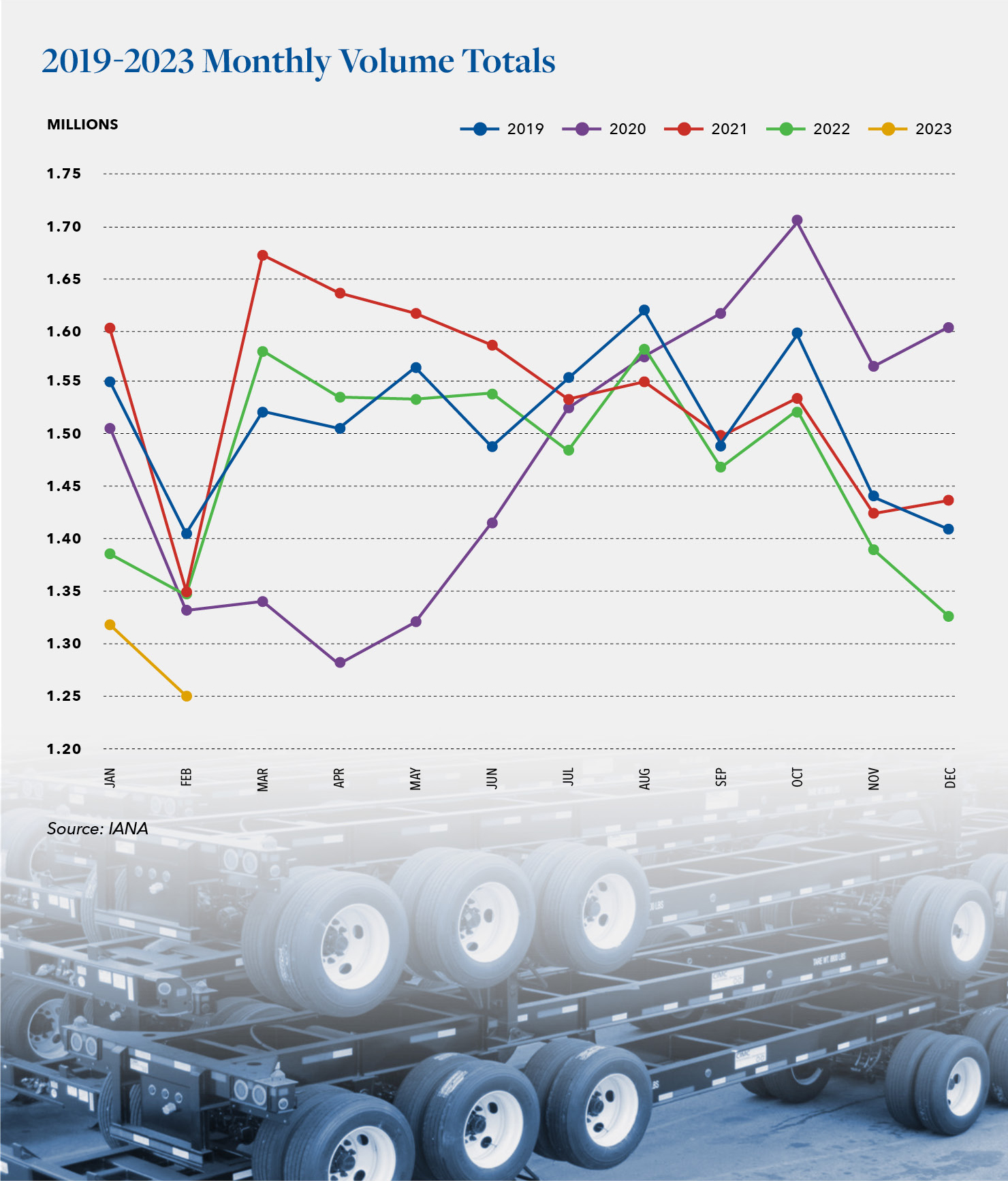

During the first quarter of this year, we observed a return to lower shipping levels, reminiscent of the pre-pandemic period. Intermodal Equipment Providers (IEP’s) are reporting lower monthly shipping totals, reflective of the current state of the North American market where consumers have adjusted spending habits due to high interest rates, and economic uncertainty.

As a result of this softening, the current trend being observed has IEP’s shying away from the type of large bulk purchasing that took place during COVID-19. Instead, we are continuing to see these providers focusing instead on rebuilds and refurbishing existing fleet. What is contributing to this? While the cost of new chassis essentially doubled over the past several years as a combined result of tariffs, rising cost of materials and labor shortages– Hilco’s clients and contacts across the industry are reporting that they expect the current chassis cost structure to stay in place, with no potential reductions in sight.

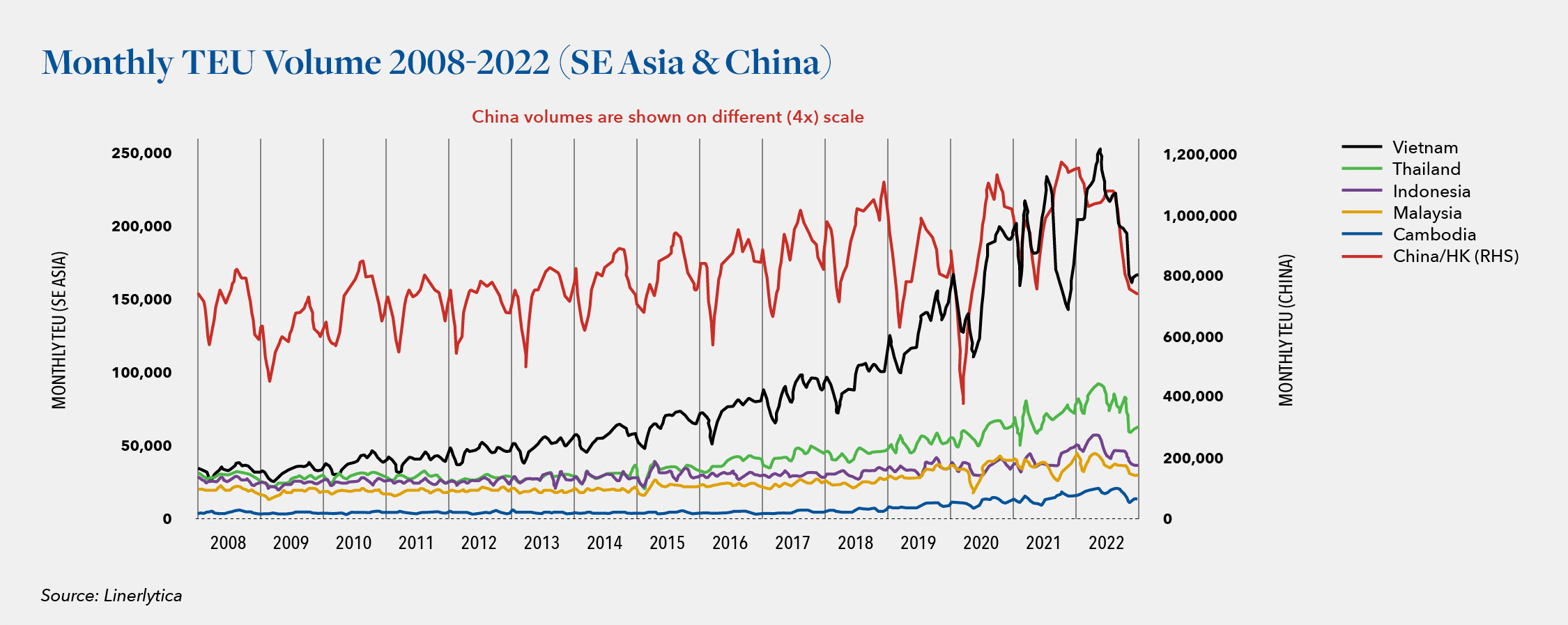

It is also important to point out that inflation, combined with more normalized demand from across retail, electronics, home improvement, furniture and other segments has resulted in the continuation of an overall drop in North American imports. U.S. congestion overall has improved and is likely to remain manageable in light of expected continued soft demand. Those across the industry are, however, keeping a watchful eye on port negotiations, where negative fallout could potentially result in added bottlenecks.

Increased labor cost to maintain chassis fleets and increased real estate needs required to match expanding fleets at ports are among the most pressing issues facing the industry right now. That said, the consensus is that the capacity push over the past couple of years has enabled North American-based chassis manufacturers to reach near-desired capacity to meet demand levels moving ahead. With an expected return to normalized supply chain pressure later this year, a continued positive growth trend is expected.

Financial market uncertainty, most recently amplified by the collapse of several banks across the country, and the continued prospect of a true recession are among the variables that will impact the chassis market in the coming quarter. Enforcement of tariff violations on Chinese steel and manufacturers involved with its use, as well as developments pertaining to galvanizing steel alternatives, will also be key factors.

With the prospect of continued disruption moving ahead, independent equipment providers (IEPs) including TRAC Intermodal, Flexi-Van, DCLI and others have come out strongly against changes to the current business model. Presently, ocean carriers are able to dictate the chassis requirements on carrier haulage (“door to door”) and certain merchant haulage (“port-to-port”) businesses. Altering that practice, the EIPs argue, would result in more equipment shortages as well as issues with invoicing that would ultimately harm, rather than help, cargo owners.

As reported by the Journal of Commerce, this February, the Federal Maritime Commission’s (FMC) chief administrative judge ruled that although ocean carriers can, in fact, dictate which chassis to use under a carrier haulage agreement, they cannot force chassis decisions in any merchant haulage deals.

In March, the Ocean Carriers Equipment Management Association (OCEMA) appealed the FMC decision. The IEPs’ brief (see excerpt below from the Journal of Commerce) stated that the decision would reduce chassis availability because without access to ongoing information on cargo movement, they would be unable to properly allocate equipment across the country, which would likely lead to further supply chain disruptions moving forward.

Presently, the average age of in-service chassis in North America is hovering around 15-17 years. The economic service life of a chassis is 25-30 years when refurbished at an average of 17 years in service.

As IEPs look to cut back on labor costs for maintenance and repair, which is typically a major percentage of annual CAPEX for fleets, galvanized chassis are thought to be a viable alternative to standard painted chassis. The cost of blasting to remove old paint, and then priming and painting again in the chassis mid-cycle refresh is eliminated, while also essentially doubling the potential life of the chassis. Additionally, with IEPs and trucking companies becoming more concerned with fleet appearance, galvanizing becomes more and more appealing.

Our Valuations team has continued to experience record levels of engagement across a wide range of providers, lenders and our many partners, each of whom rely upon our expertise and appraisal accuracy as part of their industry work. During this continued transitional period, we encourage ABLs with chassis industry exposure to gain (or maintain) a current and comprehensive understanding of the operational issues and evolving market challenges impacting those portfolio businesses. Please reach out to our team today to discuss a current situation or learn more about fleet valuation, disposition and/or acquisition . We are here to help!

Hilco Global is one of the world’s largest and most diversified business asset appraisers, valuation advisors, and monetization experts. A trusted resource to companies, their lenders and professional services advisors, Hilco Valuation Services provides value opinions across virtually every asset category. Our extensive experience in valuing and monetizing chassis assets is unsurpassed in the industry, with our valuation and M&E teams working closely together to deliver maximum accuracy and efficiency on behalf of our clients. With a dedicated team focusing on truck, trailer and chassis fleets, we have performed valuations on well over 1 million assets across transportation and logistics, covering $2 billion in deployed capital. Hilco’s track record in the liquidation of fleet assets for maximum valuation based on its understanding of realistic value and real challenges to an actual orderly liquidation process, is highly regarded across the industry. Hilco Valuation Services has the ability to affirm asset values via proprietary market data and direct worldwide asset disposition and acquisition experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures our clients more reliable valuations, which is crucial when financial and strategic decisions are being made.