Class 8 Truck Market: Q2 2023 Preliminary Update

In early February of this year Hilco published our report, “Where the Class 8 Truck Market is Heading in 2023.” In our observations, we compared and contrasted effects of the Great Recession with the COVID-19 pandemic and discussed the truck market’s linear progression from a 2019 cyclical low point in pre-pandemic America to unprecedented premium value levels for roughly 2 years during the shutdown. This was immediately followed by a late Q3/Q4 2022 material downward correction in used values.

As we approach the mid-point of the second quarter, used Class 8 trucking is still trading above pre-pandemic levels. In many ways this is a clear indication of how far the market still has to go in the post-pandemic downward correction. Things are playing out as we have expected but the sticker shock occurring on adjusted values for fleets that were appraised 6 – 12 months ago is now very real. Based on the unsustainable trend that began at the end of Q3 2020 and continued well into Q3 last year, the Hilco team anticipated what is now occurring.

While many companies took advantage of expanded borrowing bases on the back of a stronger market with premium fleet values, we are now seeing many in the industry grapple with how best to manage the value correction and more gradual dilution that we fully expect to continue through 2023. In fact, we feel it is important to emphasize that at the present time, it would be unrealistic and irresponsible for any parties to have an expectation that the transportation market’s multi-year cyclical behavior will include future appreciation of value in truck and trailer fleets.

This assumption is well supported by market data. 2016 model International Prostars, for example, were wholesaling during the middle of 2020 for $20,000 – $30,000. Today, prior to drafting this article, our team sat down to review public information pertaining to auction results from the past 30-day period and noted that those same model year Prostars are now selling for anywhere from $10,000 – $30,000 depending on spec, condition, and mileage. Many 2016 year models are selling for the same price they commanded three years ago, and those now selling on the lower range have high mileage and are in rough condition. Read that again… 2016 models are selling in the same range as three years ago. The market has not yet fully corrected! Falling truck values typically hit the auction market first with a trailing effect on wholesale and retail sales. Monitoring auction sales month to month is the most real time indicator of tangible market trends.

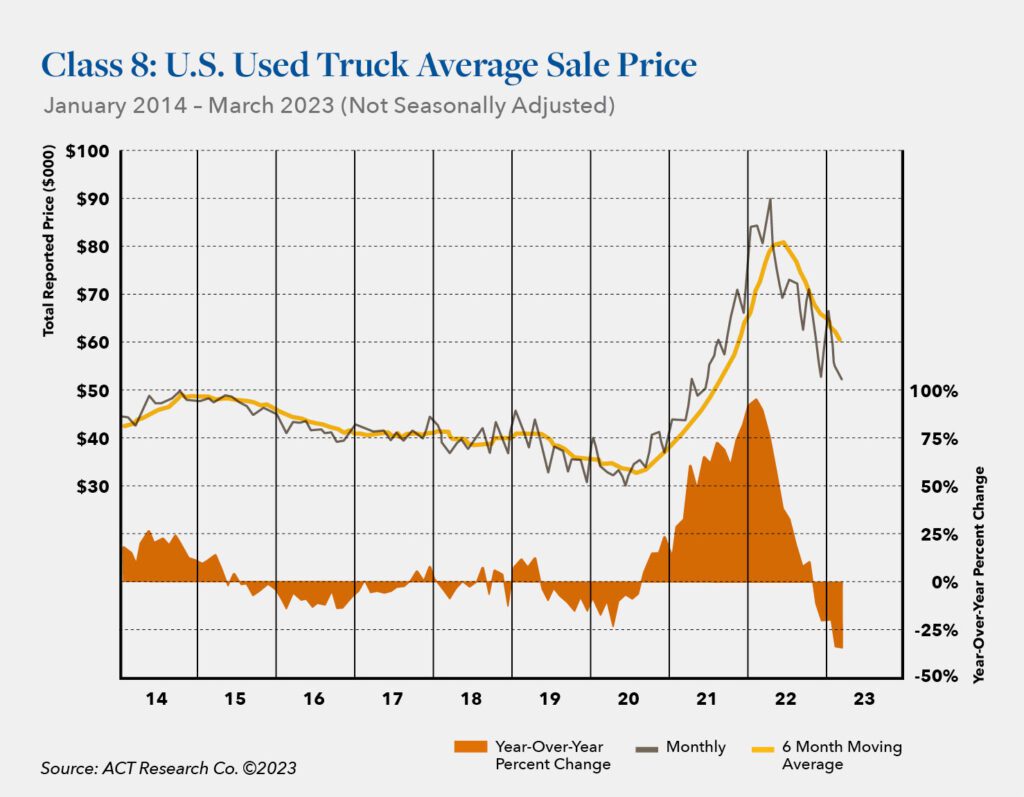

The above graphic is an updated version of the one shared in our article from February of this year. The year-over-year change for Q1 of 2023 is striking. Used Class 8 values were down 8% month over month January – February. Softening is traditionally seen at the very beginning of the year but the decline is a bit steeper than anticipated. The most dramatic corrections have already occurred in this space, and continued correction is the reality for the duration of 2023. However all of this is happening in front of the backdrop that trucking is still very much the backbone of domestic logistics.

In summary, we do not expect anything overly dramatic to affect the market for the foreseeable future. Truck production is ramping back up and new units are more expensive than ever before. The savvy buyer is keen to purchase in the used space but not just anything with a steering wheel. Mileage is proving to be THE driving factor of fleet values today, closely followed by quality of care and maintenance. As pricing adjustments continue, understanding the utilization of specific fleets and how they are maintained can place individual carriers above or below industry value trends. Please reach out to our team with any questions you may have about the market or to discuss specific needs pertaining to your business or businesses within your portfolio. We are here to help.

Hilco Valuation Services is one of the world’s largest and most diversified business asset appraisers and valuation advisors, and the largest in the market-driven value space. A trusted resource to countless companies, their lenders and professional services advisors, the company provides value opinions across virtually every asset category imaginable, including extensive expertise across transportation, construction, material handling and related asset categories. Our proven track record in liquidation of fleet assets and direct investment in the ownership and operation of trucking and over the road fleet leasing companies makes Hilco uniquely adept at understanding current markets and how they affect asset value.