Foresight and Timely Action Can Maximize Positive Outcomes for Distressed Auto Suppliers

In this article we discuss the numerous challenges facing auto suppliers, the areas of focus that can help prevent situations of distress from further developing, and the options that exist when and if such situations do occur.

A number of pressing challenges are confronting automotive suppliers in the current charged economic and industry landscape. From volatile markets, surging inflation, technology disruptions and evolving consumer preferences, to the most recent and highly concerning development– the UAW strike against GM, Ford and Stellantis – many suppliers are finding themselves in unprecedented waters. To survive and potentially thrive in the future, they must adapt to the seismic transformation that is taking place.

After over two years of production disruptions, surging material costs, and fluctuating demand, suppliers are facing extreme pressure on their profit margins just as the industry is undertaking a massive and costly transition to electric, autonomous, connected, and shared vehicles; all highly dependent upon software as a defining component. Furthermore, even as expenses for many suppliers are increasing as part of their initiatives to tool up for the long-anticipated increased volume of EVs, there has been a slowing demand for vehicles overall and, in particular, EVs given the lag of infrastructure and continued limited range performance, among other factors.

Although light vehicle sales are up – with an SAAR of 15.90 for July 2023 vs 13.47 for the same period last year – and OEM profit margins are much improved, suppliers are not sharing in the wealth. With resistance by OEMs to renegotiate contracts and costs, in many cases right now T1 suppliers are carrying the burden for their T2 and T3 counterparts. Interestingly, the total U.S. supply of available unsold new vehicles as of July 31 was 1.96 million equating to a 56-day supply. Although this is 39% higher than the same period one year ago, it is still below the ideal 60- day historical level.

While some suppliers are meeting these challenges via a clear vision for their evolution, a solid growth strategy and both the ability and willingness to take timely steps that may be painful or disruptive in the short term, others are not. We view a focus on the following areas as critical to success for suppliers in the current environment:

- Cost management and operational excellence to ensure the structural viability of their business, including procurement and manufacturing optimization as well as SG&A cost reduction.

- Effective OEM contract negotiation, with an emphasis on transparency and value demonstration, to enable recovery of cost increases and help ensure ongoing financial stability.

- Balance-sheet flexibility and cash management practices including utilization of best practices associated with liquidity forecasting, working capital management, and debt maturity oversight.

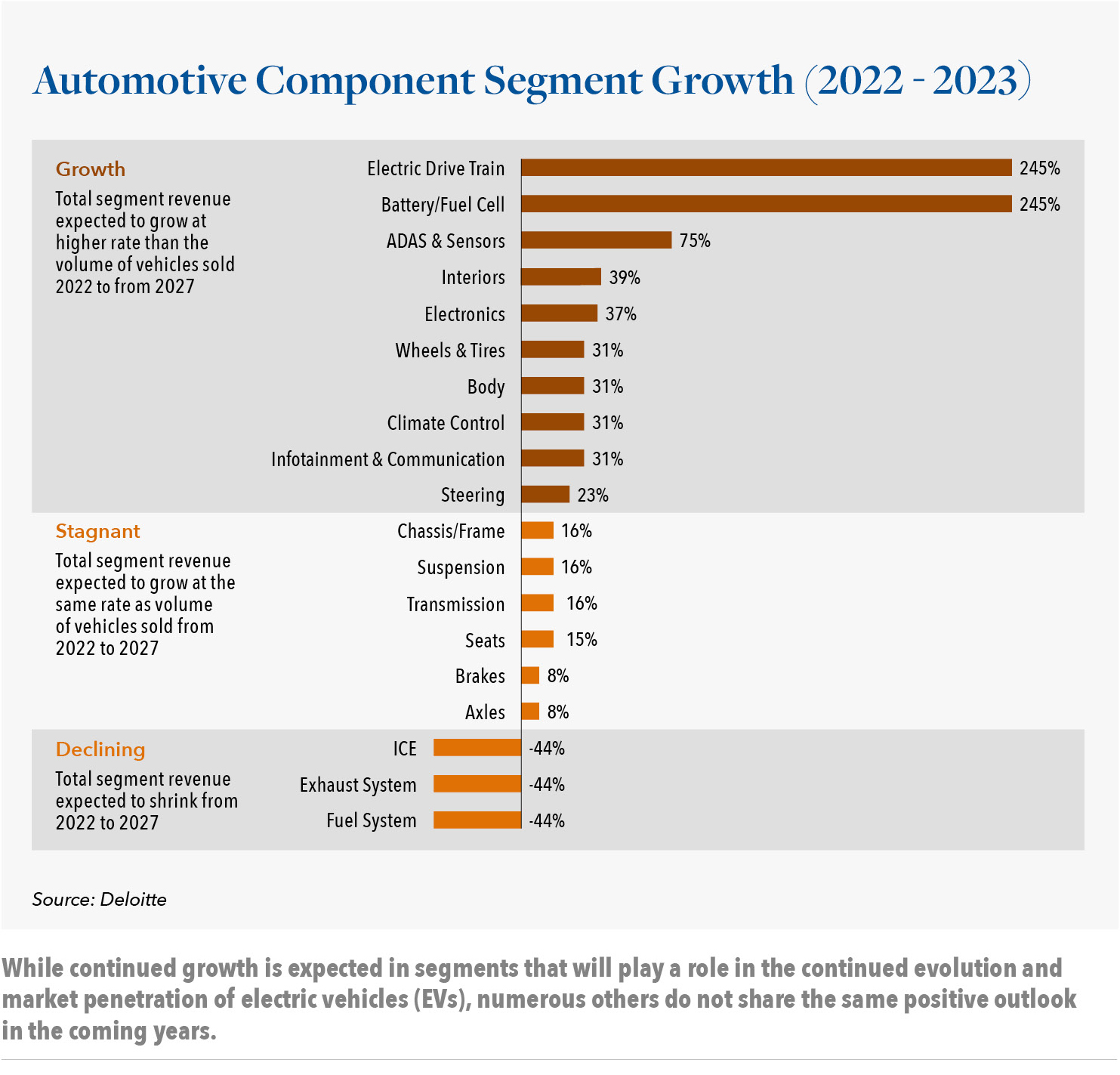

- Strategic alignment with, and business segment focus on, areas of development most likely to feed the future of the automotive industry, its march toward EV dominance and lead to supplier profitability. A key emphasis here should be on software-driven technologies and mobility services – whether through associated strategic investment, mergers or acquisitions that can help the company better position itself to competitively participate in those areas.

We have seen greater success in recouping costs among suppliers that have established a long-standing track record of trust and transparency with their clients, and particularly among those who are able to substantiate their position, and any associated client impact that serves to reinforce their case, via compelling data. Suppliers who are in distress and willing to undertake these types of proactive efforts may well be able to improve their long-term competitiveness and supply chain position.

Suppliers should also be aware and prepared to take advantage of funding options that can help improve liquidity. Currently, there are a wide range of federal grants available to suppliers across the EV and autonomous vehicle market. The Department of Energy, for example, has presented awards during 2023 that support development and production of EV battery technology in the U.S. market. A multitude of other such opportunities exist as well.

Detecting and addressing issues that have the potential to contribute to distress among suppliers early is critical. In our many years of working across the automotive landscape we have advocated for, and seen the positive impact of continuous diligence in assessing the financial health of both a business’s customers and suppliers. Doing so can provide tactical intelligence that enables a business to take timely actions to address evolving situations that, if left unattended, have the potential to lead to business distress.

Without question, suppliers already in distress are faced with tough decisions right now. Is investing strategically in technology, equipment and/or people the smart approach? Or might the business and its stakeholders actually be better served via a decision to wind down the company or undertake a disposition of its tangible and intangible assets?

Our team at Hilco Commercial Industrial has assisted a multitude of Tier 1, 2 and 3 suppliers, as well as OEMs, to address the complex challenges associated with distress. Our platform merges expertise from across Hilco Global’s more than 20 operating companies to provide comprehensive, next-level special situations capital and operational expertise. Our priority is to continue operations for automotive businesses facing headwinds and carry the long term exit burden once a business has run its course.

Collectively, our experts underwrite investments, identify opportunities for strong equity returns, provide C&I insight, and support complex multi-asset transactions. Our work frequently includes the divestiture of powertrain component, tooling and plastic injection molding equipment and facilities to deliver maximum return, create liquidity and enable reallocation of capital to BEV and EV products, technology and other growth areas.

HCI invests alone, and with other Hilco Global operating companies, in asset-rich businesses across the capital structure. HCI and Hilco Global are well capitalized and make decisions expeditiously.

Our ability to determine highly accurate valuations for unique assets together with extensive knowledge of the channels best suited to their monetization, a thorough understanding of the business operations and companies that utilize those particular assets, and an unsurpassed reputation for certainty of close, combine to create unmatched optionality for our clients.

If your business or a supplier company within your automotive portfolio is experiencing distress, we encourage you to contact our team to discuss the most appropriate and timely steps forward. We are here to help.

Hilco Commercial Industrial provides both capital and operating solutions to middle-market businesses that are experiencing an unpredicted challenge or want their business to seize on the next opportunity. HCI’s extensive experience and capabilities enable delivery of the operational creativity to find and deliver solutions and the financial resources to infuse capital when needed to unlock value and overcome distress. Vast experience in determining the most optimal channels through which to monetize specialized assets at any given time – and a working knowledge of the intricate business operations that utilize those assets – provides clients with unrivaled optionality.