From Hindsight to Foresight – Lenders Revisit Loan Sales to Quickly Monetize Non-Core CRE Assets

According to World Bank forecasts, the global economy will shrink by at least 5.2% this year. That would represent the deepest recession since the Second World War, with the largest fraction of economies experiencing declines in per capita output since 1870. Its downside scenario, however, predicated on the pandemic not receding sufficiently worldwide to allow the lifting of domestic mitigation measures by around mid-year, could lead the global economy to shrink by as much as 8% in 2020, followed by a sluggish recovery in 2021 of just over 1%. With corporate bankruptcy filings increasing by 52% in July over the year prior, according to U.S. court records and figures from legal-services firm Epiq Global, the list of pandemic period bankruptcies after only four months already includes the likes of J. Crew, Neiman Marcus, J.C. Penney and GNC Holdings; each major holders of retail leases across the U.S.

Considerations

While the current market is presenting many new challenges for portfolio managers, the fact that there is an abundance of liquidity currently chasing distressed assets across multiple markets is fortuitous for sellers. Those on the sell side most likely to experience the best outcomes are the parties that possess a solid understanding of the source of an asset’s underlying distress, can clearly articulate a path to resolution, and successfully identify a loan buyer that is uniquely suited to achieving that outcome. Experience, however, has shown us that this can be a difficult task as each step in the process is critical to success and for many involved this is uncharted or murky territory at best.

We view the existing unstable market conditions as likely to substantially increase the volume of loan sales, but also have seen first-hand the many pitfalls that can stand between buyers, sellers and the achievement of maximum asset value under such circumstances. As the country works its way through the COVID-19 crisis, we expect more lenders will begin to seek alternatives to monetize their assets in order to obtain liquidity. From a best practices perspective, it is highly advisable for these parties to seek out experienced third-party partner firms with demonstrated success in strategically and expeditiously marketing real estate loans to both established loan buyers and new market entrants. Firms whose teams also bring practical career experience from across real estate, banking and elsewhere are often among the most qualified when it comes to asset valuation and maximizing the full potential value of loans to be sold.

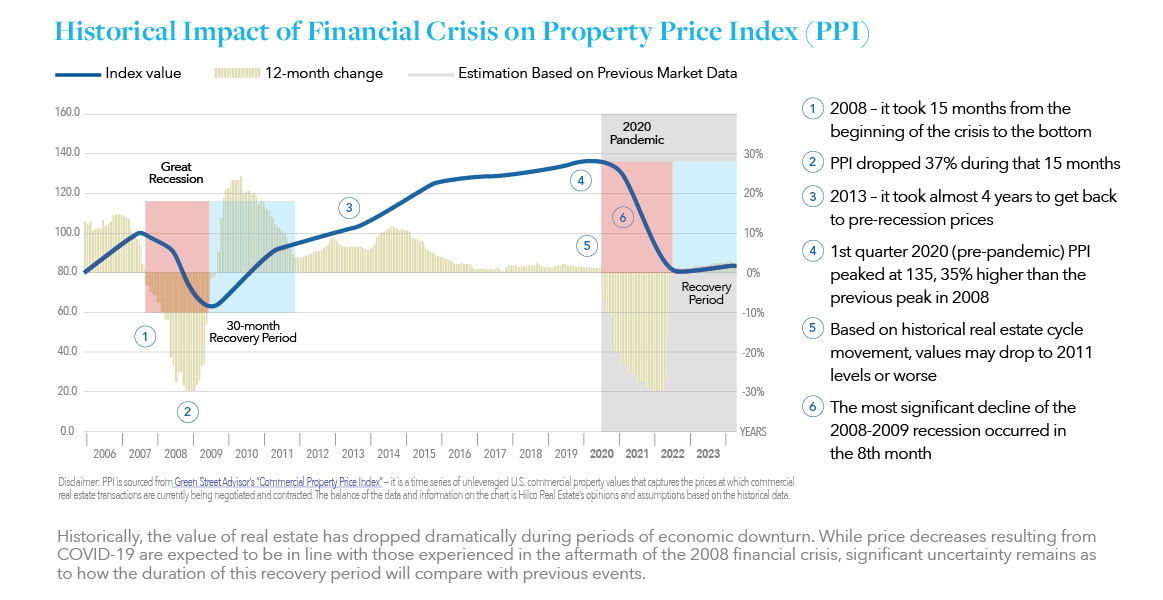

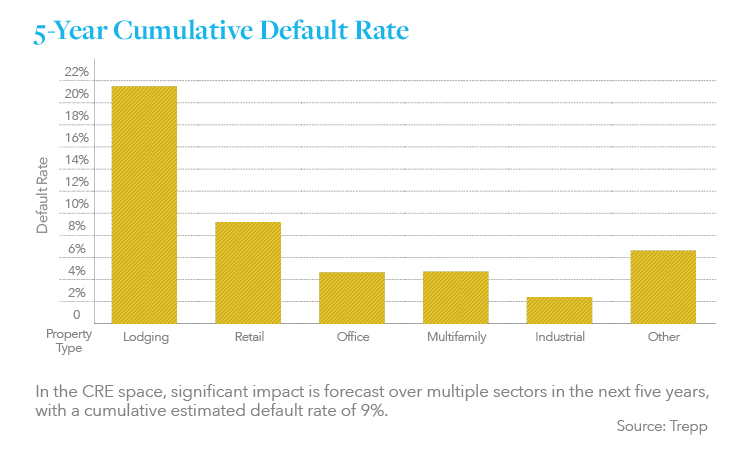

Banks throughout the country are telling us that they are now seeing asset quality weakness across many of their portfolios. Hospitality and retail asset classes have been dramatically impacted, and it is certain that others are not far behind. As in other economic downturns, we expect, and have begun to witness, rapid collateral valuation erosion associated with impacts of the global pandemic.

To their credit, banks are almost single-mindedly focused on getting money out the door during strong economic periods. But when an event occurs that causes portfolios to be weakened – as in the early 1990’s when regulators stepped in and forced valuation methodology changes, triggering an underperforming asset class – basic risk decisioning dictates actions, and banks have historically sold loans to minimize the greater losses they would otherwise be forced to take. More than 15 years later, another global financial crisis resulted in the sale of a significant volume of notes during the heavily distressed debt years from 2008 through 2010. This was followed by a gradual tapering of these sales and by 2015, banks and lenders simply didn’t have as many notes in a distressed state or in default and the market gradually slowed.

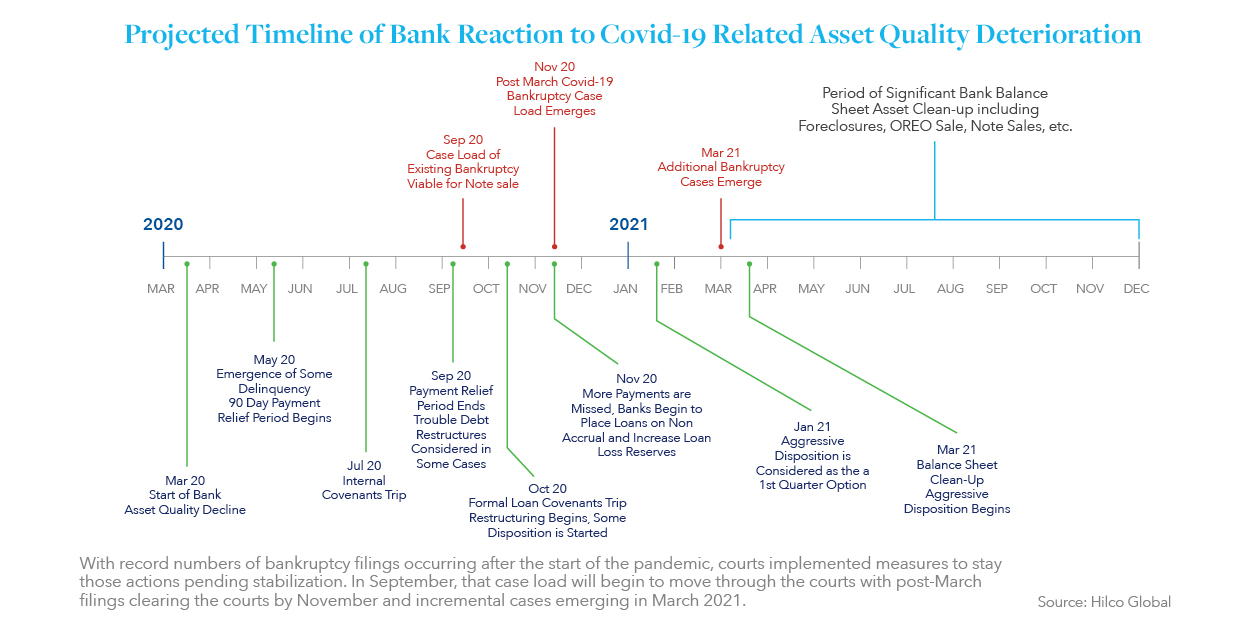

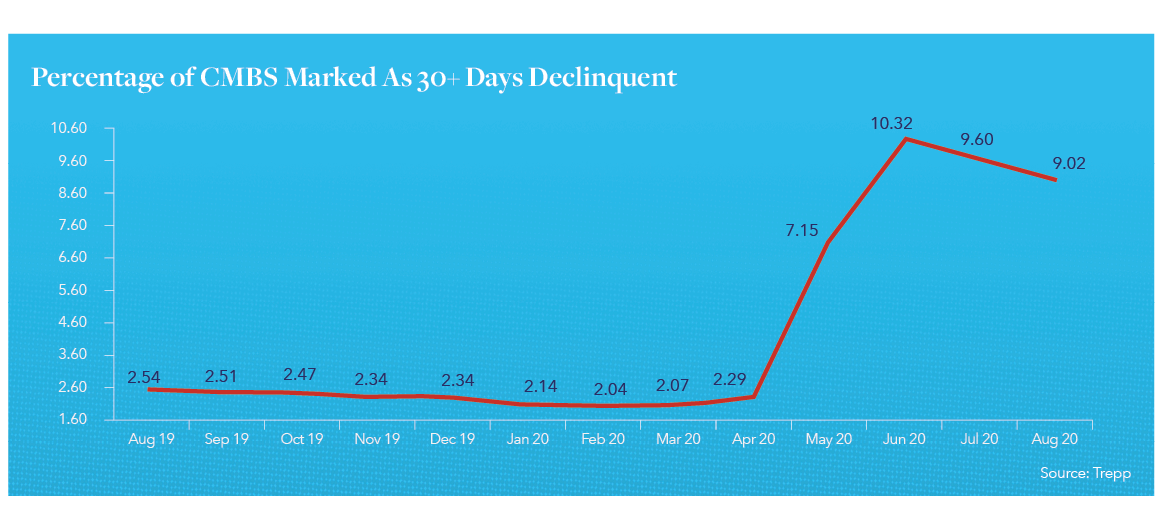

Today, we are faced with the consequences of COVID-19 and because of the unprecedented nature, scope and unknown duration of the pandemic, there appears to be a greater than usual level of hesitation across businesses and among lenders pertaining to the difficult next steps that must be taken. Based upon factors such as hotels’ continued low occupancy levels, the unavoidable shift away from retail to online – which may forever change how consumers shop – and the associated bankruptcies in progress or around the corner, banks with exposure in these areas are now approaching the point of needing to take action once again; and the pace of the effort this time around stands to become as, or more, frenetic than it was back in 2008. Case in point: For the month ended Aug 31, the Trepp CMBS delinquency rate was 9.02%, a drop of 58 basis points from the preceding month, but an increase of 648 basis points year-over-year.

In recent weeks we’ve been in contact with lenders who tell us that a sizable number of businesses from among the stressed sectors referenced above, and others, have now missed or stopped paying on their loans. As rent from store owners and restaurant operators goes unpaid, their landlords – including single and multiple property owners, strip center and mall operators – in turn, become unable to pay the banks. It is a cycle that builds and perpetuates itself in times like these, wreaking havoc on industries and market leaders that had previously seemed insulated or impervious to financial concern.

Many businesses will be able to resume payment as they return to more normal levels of operation, but many others most certainly will not. While banks and other lenders have remained supportive of their customers, extending forbearance as warranted and assisting to facilitate the Paycheck Protection and Main Street Lending Programs, we believe the time is fast approaching when their hands will be forced, and we will begin to see prioritized action on the nonperforming loans (NPLs) in question. Particularly when large portions of a lender’s portfolio are involved, most view the sale of loans to non-bank buyers as an efficient method for improving the balance sheet, by decreasing adversely rated assets as opposed to engaging the burdensome process of pursuing foreclosure action, taking on the debt and assuming the operational costs involved in taking control of the property.

Conclusions

The world of non-bank buyers, including private equity and other investment groups that establish debt funds, has been closely monitoring the debt markets and gearing up for opportunities, which are now just around the corner. Real estate investors, too, view conditions such as these as optimal for buying notes and taking possession of properties that they would like to own or develop. Portfolio buyers are not primarily focused on yield. Rather, they want to acquire a group of notes with a 4-5% rate, a loan-to-value in the range of 75% and, importantly, they want to pay something less than par value. In the early stages of a downturn, notes tend to be priced at 97-98% of par value. As time goes on and the market bottoms out, however, discounts typically increase and the return for sellers is reduced, making speed and efficiency critical to achieving maximum value for these assets.

Although banks entered the COVID-19 crisis with the benefit of generally strong capital positions and solid liquidity, given the large supply of nonperforming loans likely to be in play for an extended period, we believe lenders will find it difficult to effectively navigate the market and leverage its full potential at the pace required to ensure continued liquidity and competitiveness. While lenders have now allocated in excess of $100B in loan loss reserves to cover anticipated losses that occurred during the first half of 2020, it is likely that we will ultimately see that amount tripled for the year overall. According to data from S&P Global, the provisions that have been taken suggest that due to the impacts of COVID-19, lenders are likely anticipating an increase in the lifetime losses on their loans in the range of 1.1 percentage point. Larger lenders/banks which have been more aggressive in building allowances and have stronger pre-provision net revenue can be expected to come through the crisis in a better position than will the nation’s many regional and smaller banks.

Our Loan Sale Advisors are actively working with a variety of lenders on loan sale initiatives stemming from the current crisis and continue to have informative and productive conversations with parties on the buy-side and others across the industry as well. If your institution has portfolio exposure within any of the many sectors impacted by the COVID-19 crisis and you would like to learn more about the services we provide, or simply gain some added perspective… give us a call. We are here to help during this challenging time.

Hilco Real Estate is one of the industry’s most respected and accomplished authorities on real estate repositioning, restructuring and sales. From multi-billion-dollar portfolios to smaller group and one-off transactions, our North America Loan Sales team’s experience extends across all asset types. Because our performance consistently delivers extensive investor participation and pricing at the high end of market norms, our clients have achieved exceptional returns during both favorable and challenging economic climates. We advise and execute strategies that help both healthy and distressed clients maximize the value of their assets. Our extensive restructuring experience and creative sales strategies are leveraged through substantial access to capital and a vast and motivated network of buyers and sellers, enabling us to exceed expectations even in the most complex situations. Our full-service dispositions team’s experience extends across traditional/strategic brokerage, online, open outcry and other strategic auctions of all asset classes (retail, industrial, office, hospitality, special-use, land and residential), and is bolstered by the expertise and thought leadership of professionals across the many business lines within the Hilco Global family. Hilco also has the ability to affirm asset values via proprietary market data and direct worldwide asset disposition and acquisition experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures clients of more reliable valuations, which is crucial when making financial and strategic decisions.