How GOB and Store Closure ‘Augment’ Efforts Benefit Both Retailer Stakeholders and Suppliers

In this article we discuss the dramatic increase in retail bankruptcies and store closures that is taking place in 2023, why integrating an “Augment” strategy into liquidation efforts is important for retailers, and how suppliers can benefit from that process.

Consumer desire for convenience, speed and the type of tailored online shopping experiences that proliferated during, and expanded further following the pandemic, has dramatically altered the retail landscape. With greatly diminished foot traffic in stores and retail spending now strapped by inflationary pressure on consumer pocketbooks, we have seen record numbers of retail bankruptcies, restructurings, and associated store closures in 2023.

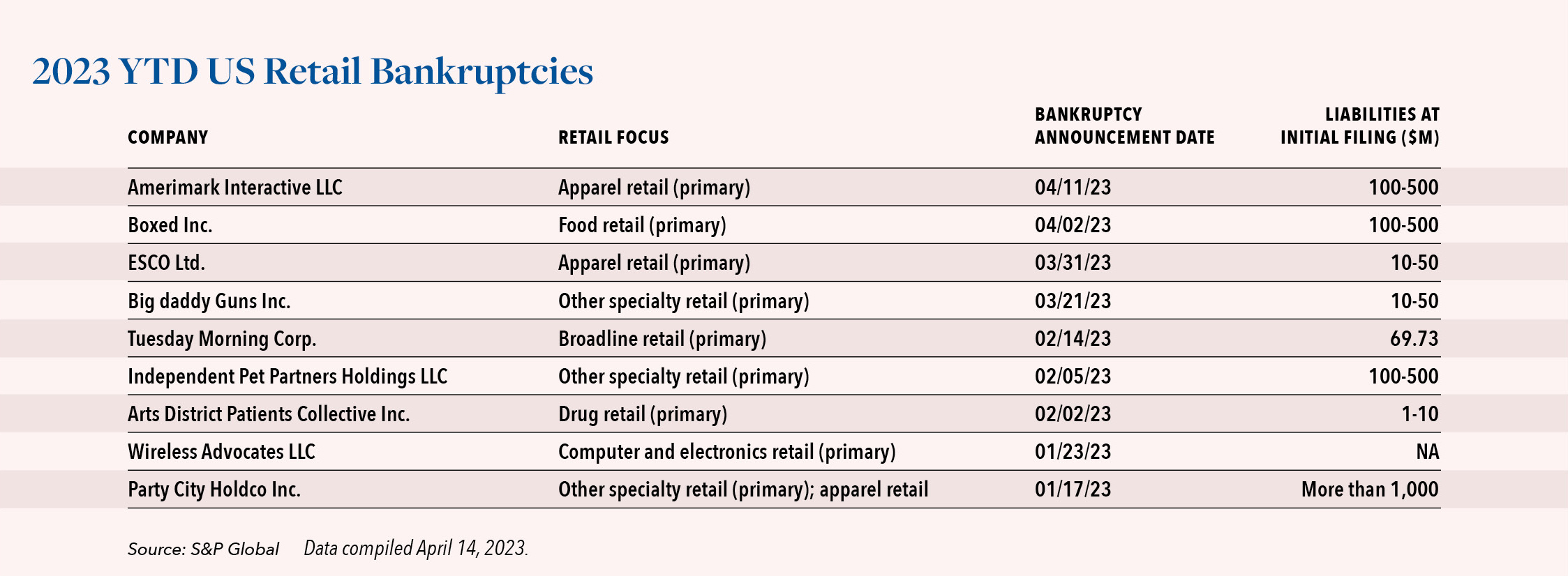

In fact, according to S&P Global Market Intelligence, the first five months of the year yielded more corporate bankruptcy filings than at any time over the same period since 2010. Consumer discretionary companies account for the vast majority of these, with more than 37 filings already this year. Included among these have been retail giants Bed Bath & Beyond, Party City, and Tuesday Morning.

When a retail operator goes out of business or strategically closes certain stores, sales events are conducted in those stores to sell off remaining inventory. The goal in such instances, of course, is to sell as much merchandise as possible within a limited time frame, while maximizing return for the business or its creditors and stakeholders before ceasing associated operations.

Third party providers, such as Hilco Merchant Resources (HRM), specialize in the monetization of these assets in such scenarios and are brought in by operators to assist with this process. In addition to assessing the quantity, composition and value of the inventory on hand, these experts help set the pricing strategies that will be most effective in enticing consumers to purchase the remaining inventory during the limited store closing sale period. Additionally, they frequently assist with modifying the store layout, placing displays and signage associated with the event, and marketing it to consumers to maximize foot traffic.

There is also another, very highly specialized, aspect of these closures that plays a critical role in delivering the best possible outcome for retail operators and, at the same time, can greatly benefit their suppliers and other manufacturers/distributors in possession of excess inventory.

When a major retailer such as Bed Bath and Beyond, for example, declares bankruptcy and embarks on efforts to close hundreds of its stores, our team at Hilco Wholesale Solutions (HWS) is frequently called upon to help augment the merchandise that an operator has in-stores and at distribution centers. This augmentation serves to ensure there will be enough merchandise and variety to appeal to consumers over the course of the going out of business (GOB) or store closing sale.

Whether an operator is shuttering all of its retail stores, is simply closing non-productive and end of lease locations, or is exiting a geographic portion of a state or the country as a whole, augmenting existing inventory is an important part of a liquidation strategy for retailers. Supplementing that inventory with relevant merchandise that is consistent with the type of items loyal shoppers have seen and purchased over their years of shopping in those stores (and that first-time shoppers coming specifically for the event might expect to find) is critical to ensuring successful GOB and closing event execution. This augment merchandise can include highly desirable third-party brands, the store’s own private-label brands and, under certain circumstances, merchandise that has been meticulously debranded to avoid conflict.

Interestingly, while retailers under these circumstances need this merchandise to ensure a successful outcome for closing sales, their suppliers frequently have a need to dispose of certain merchandise that can be an ideal fit for that purpose. Saddled with completed inventory that was never shipped when POs were cancelled by their distressed customers, manufacturers are often in possession of the very merchandise that can be used to augment closing stores. Due to its specialized nature and certain competitive restrictions, we have seen that recovering value from this type of branded and private labeled merchandise can present quite a challenge for a supplier, manufacturer or distributor on their own.

Because Hilco has handled hundreds of GOBs and store closings for many of the largest and most highly recognizable retailers over the years, and because we work regularly with many of these companies across a wide range of advisory and other capacities, our team enjoys close relationships not only with the retail operators themselves, but with many of their vendors as well. As a result, by the time that a major retailer is ready to embark on efforts to close dozens or hundreds of stores, our team has frequently already acquired the augment inventory needed directly from their own suppliers and/or our other many sources. In fact, in many cases, a retailer or its creditors ask us to acquire that inventory on their behalf for that purpose. As a result, to-date in 2023, we have already purchased over $100M (at cost) of augment inventory.

Given the current environment, and the complexities mentioned above, we are also now hearing directly from more suppliers than ever before who are realizing that this channel of disposition can be an ideal means of quickly monetizing these unproductive assets, thereby freeing up valuable warehouse space and enabling the redeployment of capital toward the production of new customer orders and other profitable endeavors. If you are a vendor or supplier dealing with current or iminent excess inventory concerns, we encourage you to reach out to our team today to discuss how we can assist in developing a timely, customized augment or other solution to monetize those assets on your behalf. We are here to help.

Hilco Wholesale Solutions assists retailers, manufacturers, and trademark holders in re-marketing unproductive, aged, and out-of-season inventory. Leveraging Hilco’s global disposition capabilities, infrastructure, and expertise, Hilco Wholesale Solutions is able to re-market these aging merchandise assets under a variety of circumstances into the off-price retail and wholesale market while also avoiding channel conflict. The end result is a tailored disposition program geared toward maximizing recovery and providing liquidity.