Indicators Suggest Modest Growth for Craft Brewers That Evolve, Connect and Prepare Now for Post-Pandemic Re-Start

In this article, we discuss the state of the craft brewing business today, where it stood at the start of 2020 and how brewers’ own experiences and actions throughout this crisis may well be the key to unlocking a profitable future for their operations as the category recovers later this year.

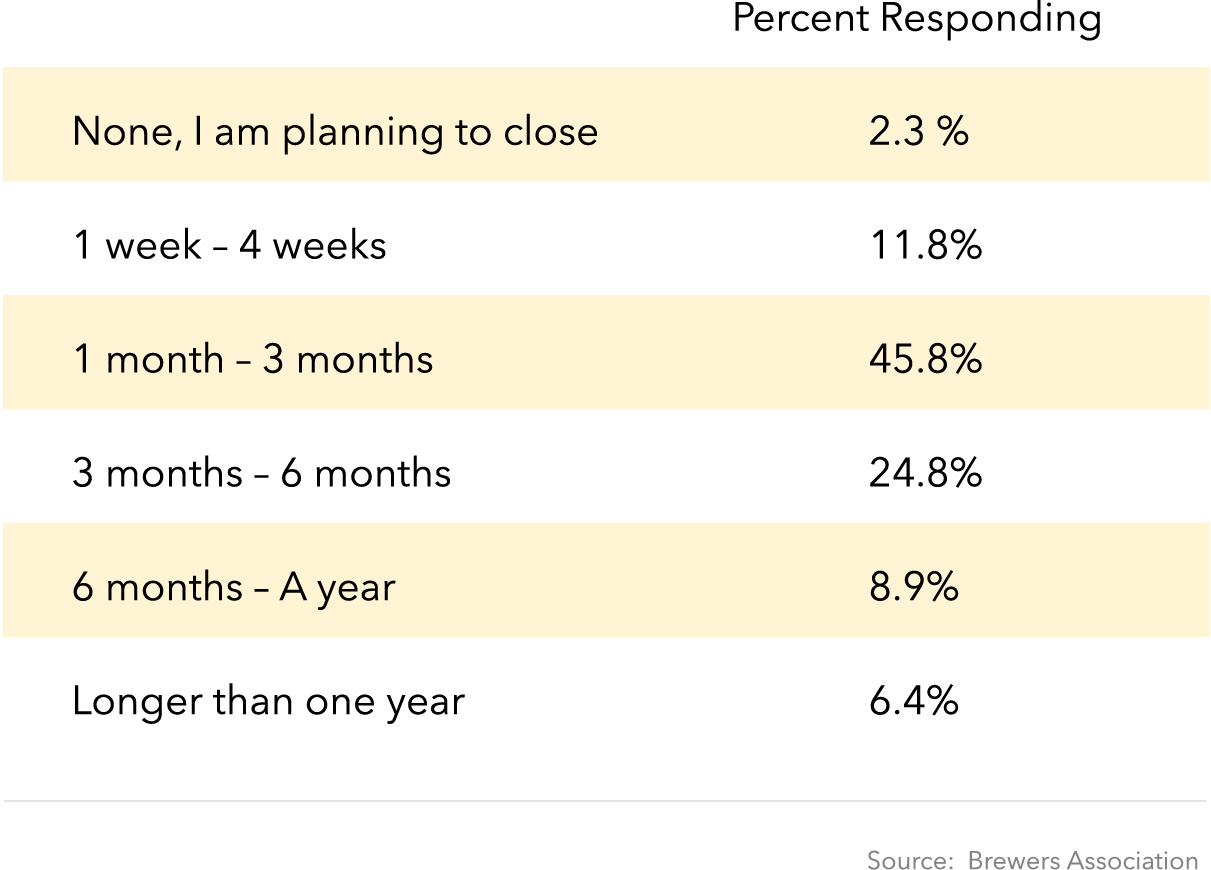

At the start of March 2020, there were more than 8,000 active breweries in the U.S. Based on market trends leading into Q2 and market forecasts, it was likely that only 4-5% of the breweries in the country would have closed in 2020 prior to this current crisis. Now, faced with the ramifications of stay-at-home orders, closure of on-premise locations and little or no revenue for an extended period of time, it is logical to assume that this percentage will be significantly higher. How much higher? Data from the Brewers Association, starting with the fact that the majority of brewery workers have now been laid-off, may provide some insights. Given their costs, revenues, and the level of state and federal aid at the time, nearly 60% of craft brewers indicated at the start of April that they would be forced to close their doors within three months if social distance measures remained at then-present levels.

According to the Association, these findings suggest that with social distancing as it is today, in the first three months of this crisis, approximately 190 to about 3,735 may shutter. Furthermore, faced with little or no revenue, about a third of breweries say they won’t re-hire workers until they can re-open and 35.1% will only partially re-hire. Only 12.4% plan to fully re-hire workers. Although news coverage has promoted the notion that people are drinking more during the lockdown, this remains to be fully proven. Data from inMark suggests that the growth of affordable beers that are also light in calories and carbohydrates are experiencing the most significant uptick in package sales. Nielsen measured growth in the budget beer category at nearly 8% from mid-March to mid-April 2020. By comparison, one Guggenheim analyst who covers the category told CNN Business that craft beer, which is pricier, is not seeing the same increase in sales. He did note, however, that around 70% of sales in the craft category come from taprooms or bars – which are both currently closed in much of the U.S.

The only thing that is fully apparent today is that beverage alcohol buying patterns are shifting by necessity. People cannot go to their local tasting rooms and brewpubs, and so some have substituted curb-side pickups of their favorite beverages instead. Still, while they may be drinking more at home than usual, in aggregate it is undetermined – but unlikely – that they are drinking more overall than they would be if their favorite establishments were open for socially non-distant consumption and camaraderie.

Many brewers indicate that their business can survive only matter of weeks, while the majority say that they can only last a few months based on current trends.

Prior to Covid

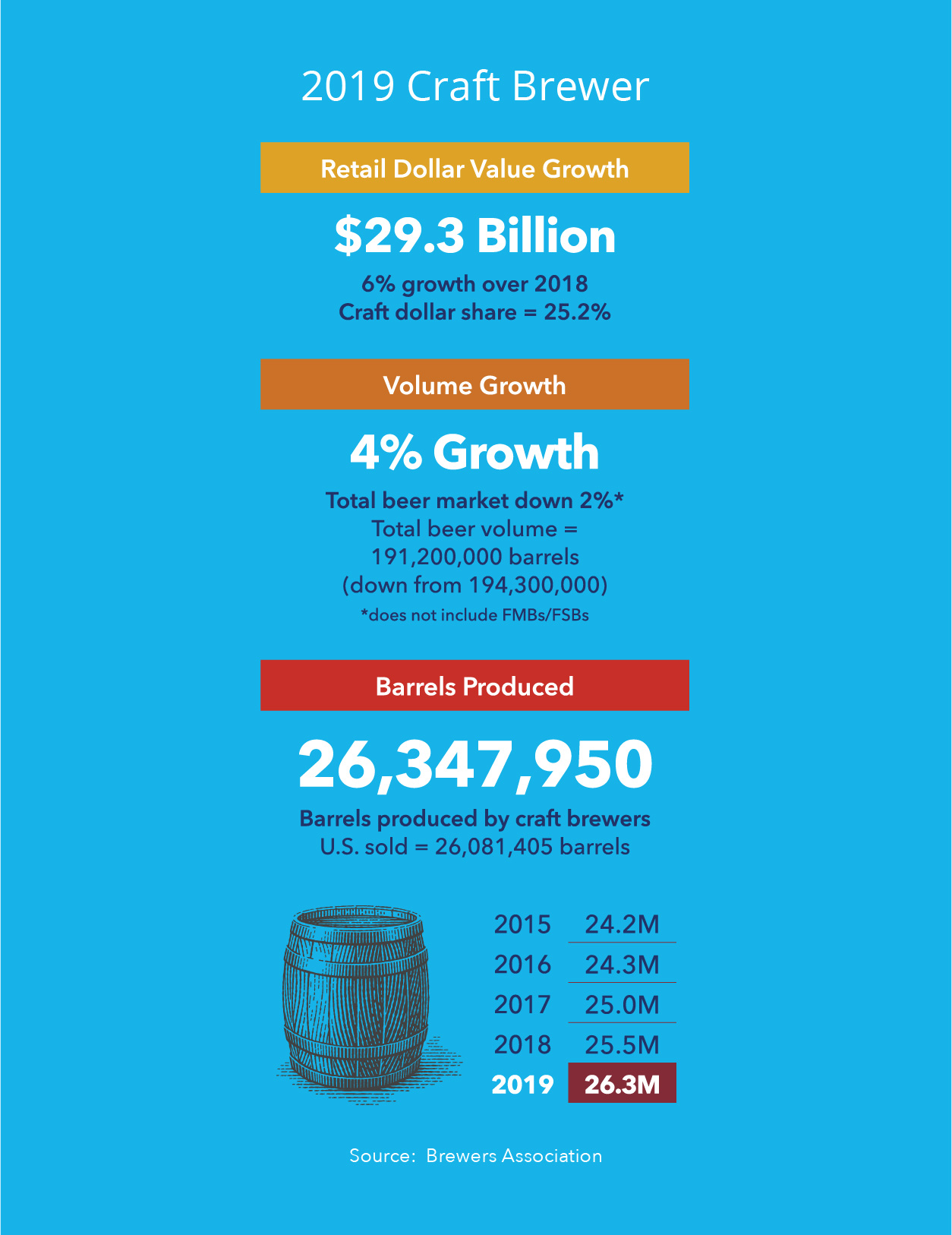

The market had been looking positive in early 2020. Small and independent brewers produced over 26 million barrels of beer and realized total growth just short of 4% in 2019, which continued the year-over-year trend of increasing craft’s overall beer market volume share, according to the Brewers Association. Retail dollar value was estimated at $29.3 billion, representing 25.2% market share and 6% growth over 2018. Notably, this growth for small and independent brewers occurred in an overall down beer market, which dropped 2% by volume in 2019. Craft brewers provided more than 160,000 direct jobs last year, an increase of 7% over 2018.

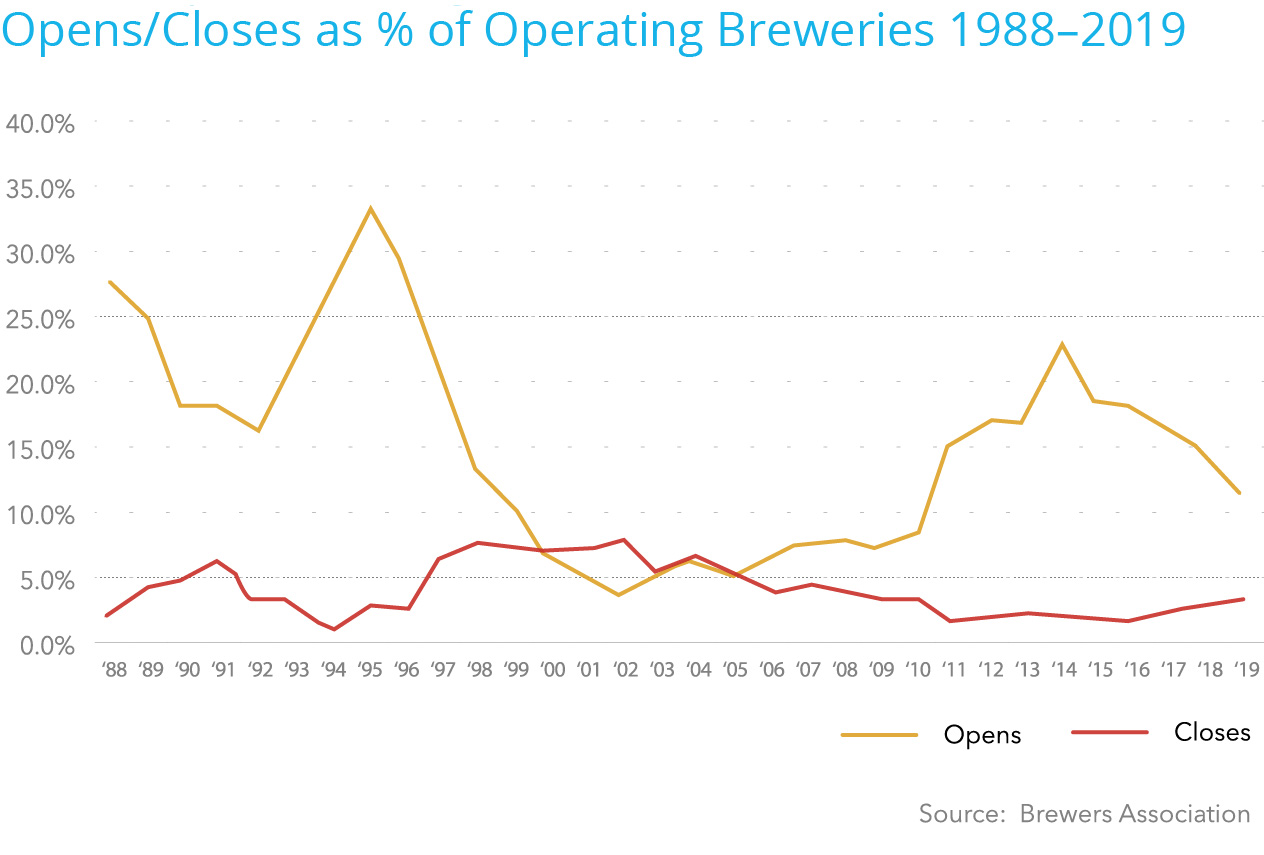

From 2009 to 2019, a level of divergence between the number of Craft Brewery openings and closings, not seen since the 1990’s, has occurred.From 2009 to 2019, a level of divergence between the number of Craft Brewery openings and closings, not seen since the 1990’s, has occurred.

The Association reports that small and independent brewers were job creators in 2019 as well. With expansion at many facilities and close to 1,000 new brewery openings throughout the year, direct jobs increased by 7%. Notably, less than 300 facility closings occurred during the year. Over most of the past decade in fact, there has been a significant divergence taking place in craft beer between the number of new breweries opening and those closing; something that has not been as prominent in many other industries.

Notwithstanding the shorter-term impacts of COVID-19, over the next 5 years, Hilco expects to see a more mature pace of growth where openings and closings become more balanced and stabilized, leading to modest growth overall in craft beer. In the near term, however, given the mandated closure of on-premise locations due to COVID-19, we are likely to experience a disproportionately high level of closures. For those brewers who are able to weather the storm from a cash flow perspective and readily adapt, there are likely to be new opportunities for greater share of the market and expanded revenue channels. There is no disputing that the beer landscape, like those of multiple other industries around the world, is vastly different today than it was just a couple of months ago, and there is significant uncharted territory ahead. Examining the historic trendline and the momentum seen carrying over from late 2019 into the first two months of this year, can help provide a baseline for just how much change COVID-19 and the associated financial and social impact bring to the industry moving forward.

The High Growth Years

In terms of historic precedent for assessing the potential impact of a recessionary period following the current crisis, according to the Brewers Association, it is interesting to note that the periods of growth and recession since 1995 do not exhibit significant differences. The 10 quarters that were covered by recessions during this period average 0.08% growth for the industry, while the 88 covered by growth average 0.27% – so growth quarters were better, but that difference isn’t statistically significant. While beer did decline after the 2008 financial crisis and as the ensuing “Great Recession” wore on, it was more likely due to factors associated with consolidation than anything else.

Tracing craft beer’s trajectory during the decade leading up to 2019 (from 2008-2018), shows tremendous growth followed by a period of more moderate growth and stabilization that we anticipate will continue following near-term fallout from COVID-19. In less than a decade, during the period from 2008 to 2016, the number of small brewery establishments in the U.S. expanded by a factor of six, while the number of employees at those breweries grew by approximately 120 percent. As this ascent took place, a simultaneous decline occurred in the overall U.S. beer market with major brewers’ shipments dropping precipitously.

By 2016, though, shipment volumes had declined for the majority of the top/largest craft-style U.S. brewers. Based in part on some well-known craft expansion success stories, more were trying to push into regional and national markets but most hit a wall at around the 100,000-barrel mark. In the process, some stretched their resources so thin that they lost traction in their own backyards or simply extended themselves too far from a debt perspective. The lure of expanded brewing capacity was strong but many were paying the price in more ways than one; finding out the hard way that as you grow, you also risk losing the kind of uniqueness associated with being home-grown and hard-to-get, that tends to draw many craft beer customers to truly local offerings.

Today and Forward

Just as the quest for new and unique flavors, varieties and the appeal of homegrown brands propelled the craft beer industry to great heights through much of the past decade, consumer preferences will likely drive the fortunes of the industry as it embarks into the decade ahead. These will be informed by both the experiences of seasoned craft loyalists as well the emerging palate of those consumers just entering the craft world. Breweries that opened their doors between 2015 and 2019 contributed a combined 94% of total craft growth last year, according to Brewers Association data, while those established in 2014 or earlier contributed only 6%. This illustrates just how difficult it is becoming for long established brewers and their aging management teams to compete with evolving consumer preferences for the new and different in an increasingly competitive, youthful and creative marketplace.

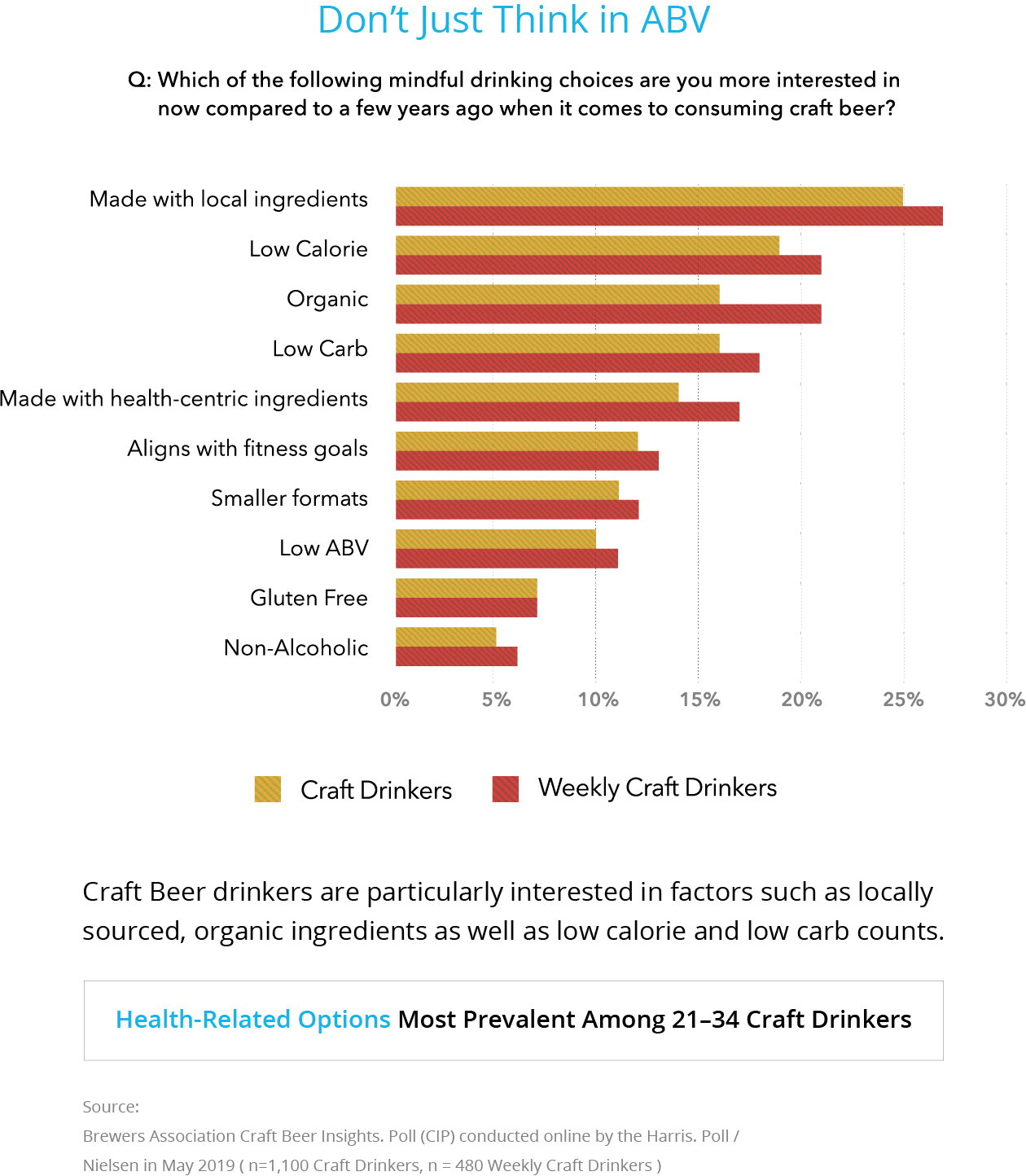

Millennials, who comprise a sizable portion of the craft consuming public, will be in their 30s and 40s a decade from now, and as part of an overall U.S. population are likely to drive increased preference for premium beer between now and then. While some may choose to trade down during the early period following COVID-19, we believe premiumization will remain the driver of growth in craft beer. And the health-centric focus of many consumers in this and other age ranges is making its way into craft beer as well based on data from the Brewers Association, which demonstrates a noteworthy and growing interest in the sourcing and type of ingredients in the beer they consume.

In response, some craft breweries are producing hard seltzer, hard kombucha and are offering canned cocktails for wider distribution, while others remain locally focus on their core beer offerings in local markets and taprooms. According to the Association, 21% report some production of non-beer alcohol. Regardless of the products they choose to produce and offer, Hilco expects that craft brewers that do emerge from this crisis will be highly focused on operational aspects of their business like never before. There will be a delicate balance needed between ensuring that tight controls are placed on where and how money is spent as compared with previous cash flow practices, while at the same time remaining nimble and figuring out where to invest in order to attract patrons back to brewpubs and deliver product configurations that make the most sense in the new world order.

We also see the likelihood of more buyouts and strategic partnerships evolving from the crisis; some by necessity just to stay afloat and others by choice as a strategic move to drive growth. This may mean even fewer brewery brands overall in the coming years. Whether this will help to stabilize and motivate a resulting base of more successful brewery operators or simply diminish innovation and variety across the category remains to be seen.

Throughout this crisis, it has been that spirit of innovation that to a large degree has helped keep the lights on for many brewers, particularly those operating taprooms or brewpubs. Since the first days of the lockdown, many have devised innovative ways to sell outside the taproom, taking full advantage of relaxed regulations within their states to package product and offer it for sale on their websites and via curbside, “touchless” pickup. The most successful have updated their sites to reflect these changes and communicate with their loyal local following. They have stepped-up or initiated their use of social media channels to remain relevant and to emphasize their commitment to the communities in which they do business.

Delaware’s Dogfish Head Brewery which opened in 2002, began producing hand sanitizer for the state in March, with profits going to a fund for residents affected by Coronavirus. Similar efforts around the country including those by the Pretoria Fields Collective in Georgia and elsewhere are now donating large quantities of alcohol-based sanitizer to police and other front-line responders. Those who utilized stalled capacity as an opportunity to generate some replacement revenue while helping their communities during the crisis, may find ways to build upon those endeavors; just as those who beefed-up their branded merchandise efforts may find that channel can bring an added layer of revenue moving forward as well.

On the other hand, with more states legalizing cannabis, greater innovation than ever before may be needed to keep existing and attract new customers both on premise and at point of sale. The pre-COVID momentum of unique on-premise experiences built first and foremost around socially engaging activities, such as ax throwing and ping pong, may also be critical in building and sustaining long-term on-premise traffic. In the short term, however, businesses that have invested in these types of facilities may pay an expensive price. Balancing the cost of labor needed to deliver these on-premise experiences with diminished guest levels, and under the limitations of whatever social-distancing guidelines remain in place, may prove to be a slippery slope for operators.

Some craft brewers will not be able to meet their capacity levels, while others with loyal followings and solid distribution relationships may quickly ramp up capacity once again. For those in need of additional production, we expect to see fewer assuming the inherent risk of building out the associated infrastructure in favor of establishing partnerships to leverage others’ underutilized facilities and engaging with contract brewers, who may benefit greatly in the near term from the fallout of this crisis. That said, based on the likelihood of a significant increase in closures across the craft beer industry, we also expect 2020 to be an active year for acquisition of equipment left behind by those who have been forced to shutter their operations. New breweries already in planning prior to COVID-19 are likely buyers for these used Brew Houses, Fermenters, and related components. We anticipate some will step in to assume existing leases and acquire equipment in place as a means of jumpstarting their operations.

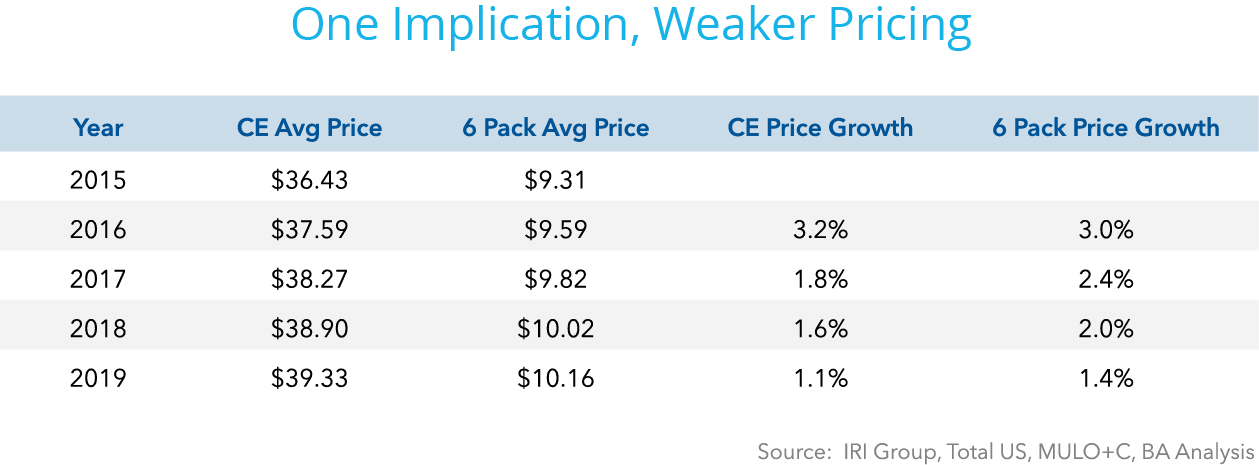

Given that a significant number of bars and restaurants nationwide will likely either never reopen or survive only briefly after they do, we also expect to see a notable decline in craft draft sales and a possible, associated uptick in sales on the package side. Insights into consumer preferences for retail-style pack configurations gained by brewers throughout curbside pickups and deliveries conducted during the lockdown may prove valuable toward building this type of added resilience into their post-pandemic business models. Among other direct to consumer approaches being considered are creation of beer clubs with the potential to engage loyalists and new customers beyond their current reach. Even with smaller brewers experiencing slower price growth over the past five years on each 6 pack they sell, we believe DTC efforts like these may represent an important opportunity for the industry going forward.

Even though the average price of packaged beer sold by craft brewers increased annually from 2015 through 2019, associated price growth decreased year over year.

Additional Observations and Recommendations

Hilco continues to be in close contact with those across the craft beer, restaurant, retail and other related industries during this time period. We believe the brewers that will emerge in the best position to succeed moving forward are those who are spending significant time and resources today planning for the next step by actively: 1) working through scenarios of how to adapt to operating at 50% or less of normal capacity and how their staffing needs and operating requirements will be impacted; 2) looking at how to modify previous purchasing levels and renegotiate contracts accordingly; 3) talking to distributors and customers about retrieving draft kegs that were in place before the shutdown and refilling/returning them before re-openings occur to ensure they maintain control of as many tap handles as possible and capture vacant ones that may come up as competitors fail; 4) exploring avenues for carrying their fledgling pandemic period take-out/curbside business forward and; 6) working with outside consultants and vendors to build on initial stop-gap ecommerce and merchandise programs they put in place during the crisis.

Because some degree of downward pressure may be placed on the commercial craft brewing equipment resale market over the near-term, Hilco cautions against actions by ABLs that would require realization before the end of Q3. If, however, a need exists to assume control of certain assets prior to that time, you should be prepared to hold those until at least the Q4 2020 or Q1 2021 to ensure a market capable of absorbing that equipment to realize a reasonable liquidation value.

If you have exposure in craft beer, we suggest having frequent discussions with your portfolio businesses throughout this difficult period to gauge their preparedness for the future and to protect your interests. In this unusual time, we believe lenders have a distinct opportunity to build upon their relationships with brewers, while protecting their own interests by helping to provide guidance where it may be warranted. If we can help assist you in this regard, or to better understand the current market and what you may be seeing with your clients, please reach out to us. We are here to help!

Hilco Valuation Services is the world’s most experienced, resource-rich appraiser of machinery

and equipment. We have delivered Machinery and Equipment (M&E) appraisals in industries from automotive to high-tech, food processing, brewing, distilling, chemical processing, plastics, forestry and lumber, aerospace, and more. Our reputation for reliable M&E values is built, in part, on the strength of our disposition experience at Hilco Industrial. Regardless of whether the M&E is located at the manufacturing, distribution, or wholesale level, Hilco Valuation Services has the expertise to handle engagements in any sector and of any scope. With a full suite of monetization services, Hilco Industrial has over the years recovered hundreds of millions of dollars for clients on five continents.