Is This The Calm Before the Storm?

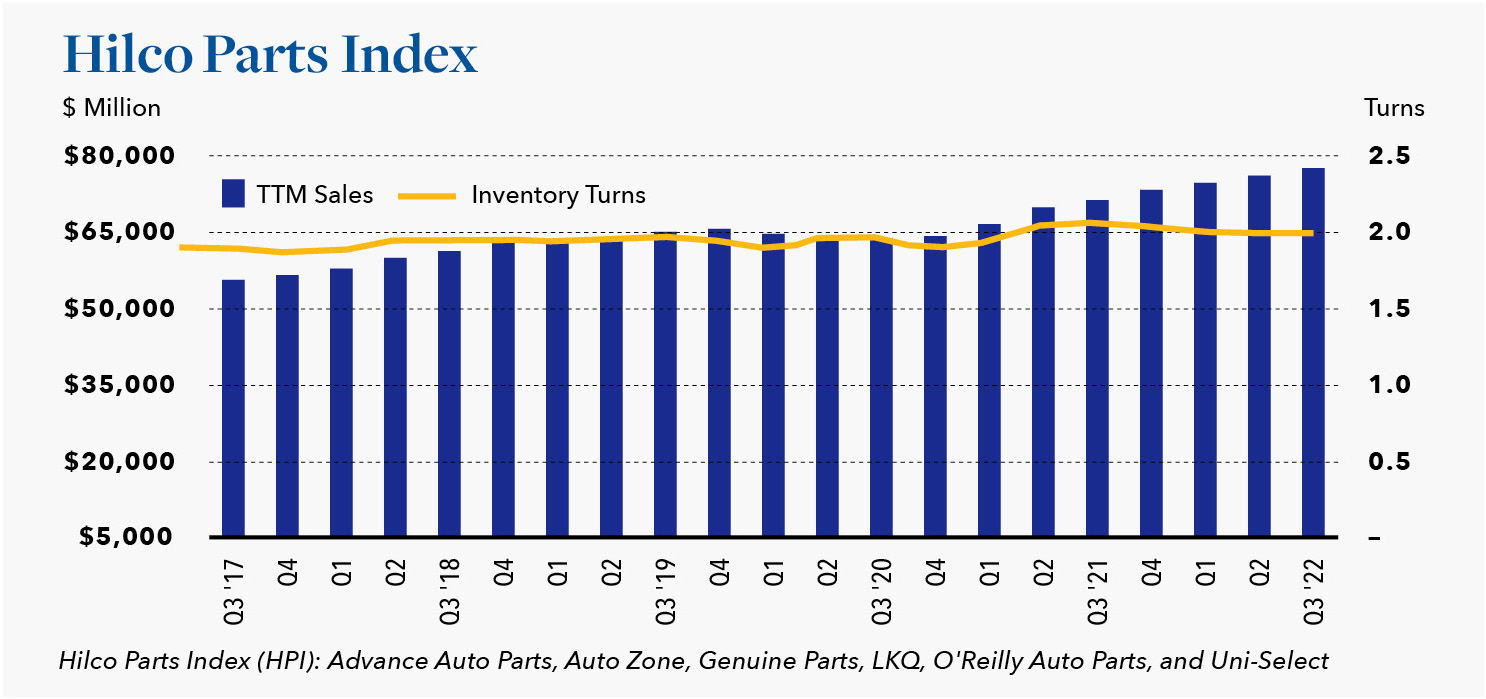

December 2, 2022 For the six companies in the Hilco Parts Index (HPI), net sales for the 12 months ended September 2022 increased 8.8% when compared to the 12 months ended September 2021. The increase in sales is really not enough to offset the increase in the cost of goods sold from rising raw material pricing, labor, and transportation costs, particularly after factoring in the number of new stores that have been opened in the past 12 months. From a pricing perspective, the industry typically does not adjust prices when costs spike like they did for sea containers and then drift back to more normal levels over time. Container costs have since moderated but now the bottleneck has migrated to the domestic side of the supply chain– rail carriers and truckers. The industry is being advised by third-party experts to expect these domestic challenges to continue into the first half of 2023.

Despite the ongoing challenges related to the supply chain, the industry has had some success restoring its inventory fill rates by increasing its threshold for safety stock. There is a penalty to be paid for holding the additional inventory but there is no talk in the industry about dropping safety stock levels before the lead times from suppliers are more consistent. In the interim, the industry is benefiting from the opportunity to accelerate the uptake of private label product offerings. The periodic scarcity of nationally branded product has provided the industry an opportunity to offer a private label alternative. The gross margins are considerably higher on the private label product which is helping to offset whatever cost increases the industry was unable to pass on to the consumer.

In general, the final 4-week period of the third quarter was the strongest. Early results in the fourth quarter have been promising as well. The increase in year-to-date miles driven, aging of the car park, limited new car inventory, and elevated used car prices are all conducive to healthy demand for aftermarket parts. Furthermore, continued strong employment and wage growth mean consumers are in a stronger position now than in other recent periods of economic uncertainty. However, the inflationary outlook is vague, the geopolitical tension unabated, the supply chain constraints lingering, and fuel prices remain stubbornly high. For years economists have been forecasting an imminent recession, only to be proven wrong. Is this just another incorrect forecast or is it the calm before the storm?

About the Index: The Hilco Parts Index is comprised of six publicly traded companies that distribute aftermarket parts, namely Advance Auto Parts (Advance), AutoZone, Genuine Parts (NAPA), LKQ, O’Reilly Auto Parts (O’Reilly), and Uni-Select. Advance, AutoZone, NAPA, and O’Reilly are the four traditional parts distributors in North America with strong commercial (do-it-for-me or DIFM) and retail (do-it-yourself or DIY) programs. Uni-Select is a much smaller distributor with a strong presence in Canada and LKQ is largely a distributor of recycled (used) parts, as opposed to new parts.

For further information, please contact Keith Spacapan at 847-313-4722 or kspacapan@hilcoglobal.com.