Lender Considerations in a Meme-Stock Environment

Recently, a new phenomenon in the public equity markets has emerged, commonly referred to as “meme stocks.” This article explores the events that culminated in the liquidation of Bed Bath & Beyond (BBBY), and the disruption caused by meme stock market dynamics on conventional valuation metrics. As discussed below, these market dynamics effected a shift in the leverage typically exerted by a company’s secured lenders and other creditors, resulting in a diminution of collateral values. In this article, we examine the key events leading up to and through BBBY’s liquidation, the public market dynamics throughout that time, and the broader lessons for secured lenders to publicly traded borrowers.

WHAT IS A MEME STOCK?

Public equity markets have existed for centuries, but it is only recently that the mass availability of information technology provided retail investors the power to influence those markets in any significant way.

Meme stocks — the hallmarks of which generally include popularization of underperforming or volatile stocks driven by online communities on social media platforms such as Reddit and Twitter (now “X”) — began to emerge in force in 2020 via the Reddit forum r/wallstreetbets. Stoked by calls to disrupt institutional market participants, retail participation in meme stock pumps reflects an intentional challenge to entrenched institutional financial supremacy and perceived inequities in the equity markets. While focused on these equity market participants, the meme stock phenomenon has challenged conventional valuation models and reshaped the dynamics between equity holders and lenders.

An early meme stock was video game retailer GameStop (GME). GME saw its stock price surge more than 1,600% between December 31, 2020, and January 29, 2021, at a time when it had generated YoY revenue that was $1.28 billion less than the prior year (-21.3% YoY) and net losses for fiscal 2020 of $215.3 million. (1) The GME meme trade provided a rocky road to say the least. After rallying from $4.42/share on January 8, 2021, to more than $81/share on January 29, 2021, GME plummeted to $10.15/share by February 19, 2021. Hedge funds such as Melvin Capital, Light Street, and White Square, which had taken significant short positions against GME, felt the “squeeze,” as did many retail investors who entered the trade at higher valuations. More recently, GME has traded in a narrower band, trading between $16/share and $21/share for the month of August 2023. During this period, GME reported net losses of $381.3 million and $313.1 million for fiscal 2021 and 2022, respectively. (2)

THE BBBY MEME STOCK

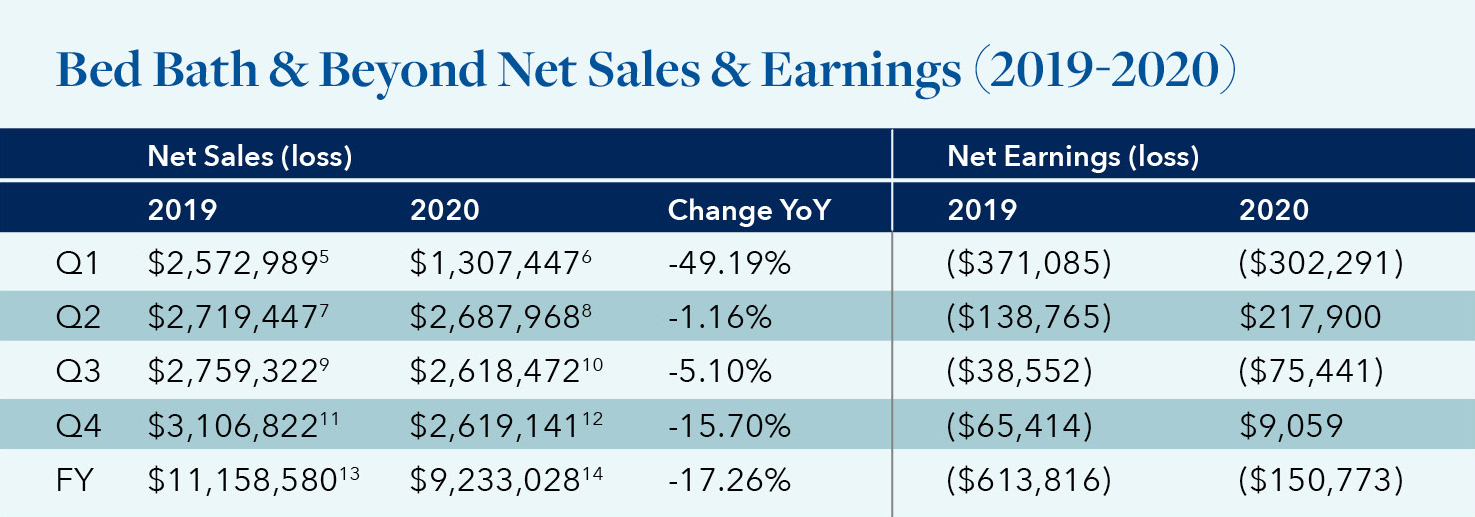

BBBY’s fiscal 2020 Q1 performance sank nearly 50% compared to the same period in fiscal 2019. (3) While COVID-19 impacts were obvious culprits, the company actually reported higher net losses in 2019. (4) Coming on the heels of fiscal 2020 Q1 results (three months ended May 30, 2020), by April 3, 2020, BBBY’s opening stock price came in at $3.94/share, its lowest point throughout the 2000s as a publicly traded company.

BBBY posted fiscal 2019 net losses in excess of $613 million. (15) Notwithstanding these poor results, the stock caught the meme stock fever with its stock price eventually rising to $35.33 on January 29, 2021, a nearly 800% jump from its April 3, 2020, low. Its market capitalization, which saw a high in 2012 of approximately $16.99 billion, had plunged to a low of $487.6 million on April 3, 2020. When the meme trade took off, BBBY’s market cap rocketed to $4.42 billion on January 26, 2021. Other critical meme pumps affected BBBY in March and August of 2022, as we will discuss below.

BBBY’S TRAJECTORY LEADING UP TO & THROUGH ITS CHAPTER 11 (16) — HOW MUCH WAS LOST?

In fiscal 2022 (year ended February 25, 2023) BBBY became a cash-burning cauldron, posting net losses of nearly $3.5 billion, coming on the heels of net losses exceeding $559 million in fiscal 2021. (17) As described below, much of these losses were comprised of new money. Eventually, $1.8 billion to $2.4 billion of creditor claims and new equity will be wiped out through its Chapter 11. (18) A slew of factors contributed to this outcome, including stock repurchasing programs starting in 2004, (19) which ultimately totaled approximately $11.73 billion of buybacks at an average cost of more than $44/share. (20)

LEADERSHIP SHAKEUP; OWNED BRANDS STRATEGY

In early 2019, BBBY reported its seventh consecutive quarter of declining same-store sales and reported its first annual loss in nearly three decades. (21) Dissatisfied activist investors saw to the ouster of 16-year CEO Steven Temares, effective May 13, 2019. (22) On November 4, 2019, the BBBY board tapped a new CEO, Mark Tritton, (23) who had been widely credited with turning around Target’s lagging performance with the introduction of new private brands and collaborations that were well-received by Target’s customers. Mr. Tritton and his team announced that they would spearhead similar new initiatives at BBBY, replacing well-recognized licensed and third-party brands with brands created by BBBY’s merchant team (fully launched in fiscal 2021 Q1 [24]). Looking back, a portion of declining sales and “slower than expected traffic trends . . . across stores and digital” (25) can likely be directly attributed to this change in merchandise strategy. Fiscal 2021 Q4 further saw a 22% decline in net sales (26) as BBBY’s customers rejected the company’s newly created owned brands.

SELLING ASSETS & BUSINESS UNITS FOR CASH NOW

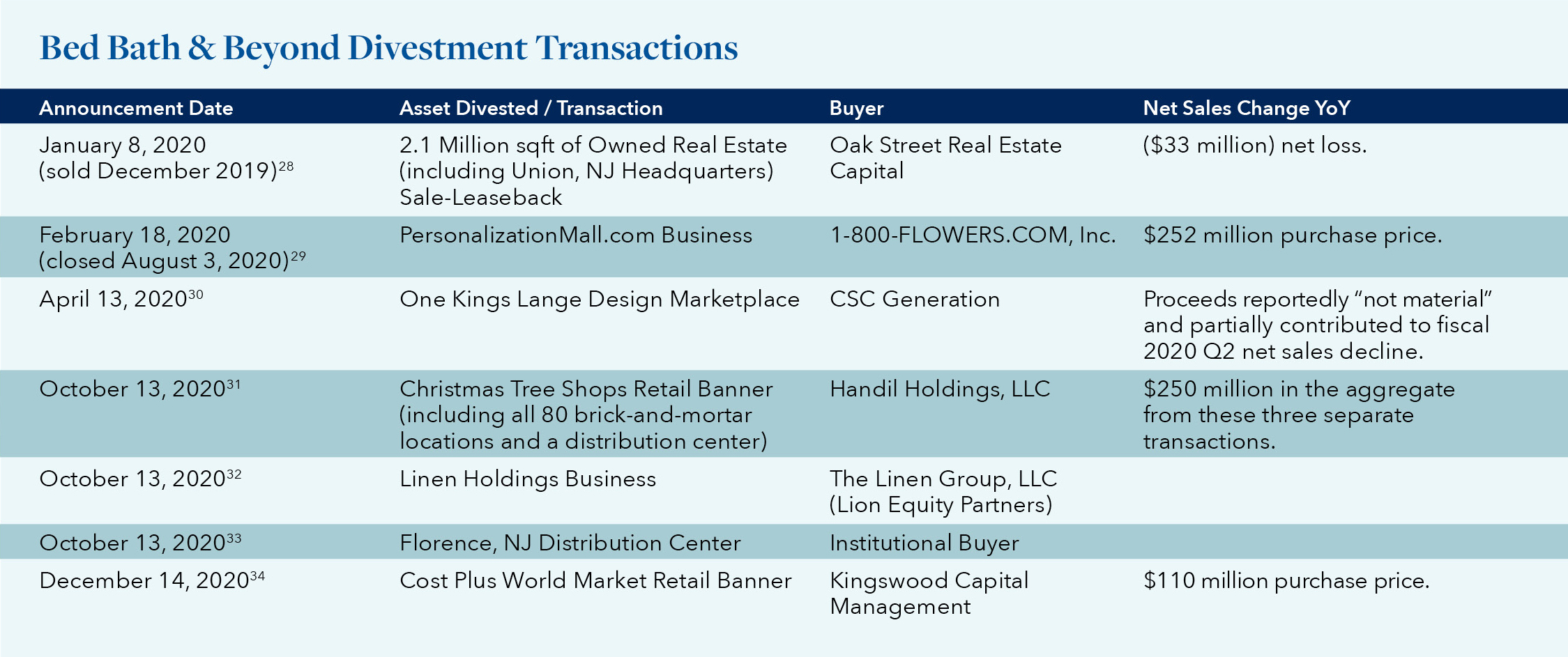

To fund operations and working capital investments during this period, among other strategies, the company announced it “divested of five non-core banners…generating approximately

$534 million in net proceeds, which [were] expected to be used to reinvest in our core business operations to drive growth, fund share repurchases, reduce our outstanding debt, or some combination of these… .” (27) These transactions are summarized below.

Less than two weeks after the PersonalizationMall.com sale, BBBY announced on February 27, 2020 a restructuring program that would reduce its workforce by 500 positions, reducing annual SG&A by approximately $85 million. (35) Though these asset sales produced some short-term liquidity and cost savings, they ultimately contributed to a net sales decrease in fiscal 2020 Q3 of 5%, (compared to a gross margin increase of only 340 bps), an overall net decline in sales across the business, (36) and served to shrink the balance sheet. At the time of BBBY’s second COVID-19 store closure announcement on March 22, 2020, the company had $1.4 billion in cash and investments and access to an additional $250 million revolver, (37) which it decided to fully draw in April. (38)

THE PREPETITION ABL FACILITY & SHARE REPURCHASES

Seeking to shore up liquidity during the height of COVID-19-induced disruptions, BBBY entered into a three-year ABL facility on June 19, 2020 (the “Prepetition ABL”) with aggregate revolving commitments of $850 million and a then uncommitted expansion feature in an aggregate amount up to $375 million. (39) Nearly concurrently, BBBY announced plans to close approximately 200 mostly Bed Bath & Beyond® banner stores. (40)

August 10, 2020 saw BBBY lift its suspension of planned debt reductions with the commencement of cash tender offers to purchase up to $300 million of its senior notes due 2034 and 2044. (41) The company followed this with an October 28, 2020 accelerated share repurchase agreement of $225 million (the “ASR”) as a part of its $675 million share repurchase authorization, leaving $450 million in remaining available repurchases (42) (trading around $12/share at the time), a further expansion of the nearly $12 billion in repurchases effectuated between December 2004 and September 2015. (43) BBBY aggressively expanded the ASR buyback target to $825 million on December 14, 2020 (trading around $18/share), concurrently with the announcement of the sale of its Cost Plus World Market® banner. (44) BBBY announced another $150 million ASR on January 7, 2021 (45) (trading around $19/share) and again increased the original ASR from $825 million to $1 billion on April 14, 2021 (46) (trading around $25/share).

The company negotiated an amendment to the Prepetition ABL to expand its capacity from $850 million to $1 billion (inclusive of a $375 million FILO facility) and to expand its 2023 maturity to 2026, effective August 9, 2021. (47) The ASR buyback program ($1 billion in the aggregate) was completed at the end of fiscal 2021 — ahead of schedule, (48) which vendors viewed unfavorably, concerned with the program’s continued impact to BBBY’s liquidity position and a perceived inability to pay vendors. As matters played out, it proved that vendors were right to be worried.

THE MEME PUMP & DUMP, MANAGEMENT DISRUPTION, HEIGHTENED BORROWING, & DELAYED FINAL FREEFALL

Enter activist RC Ventures LLC’s Ryan Cohen, who took a 9.8% stake in BBBY and entered into a cooperation agreement on March 24, 2022, attempting (successfully) to elevate BBBY to meme stock status (stock was hovering around $16/share at the beginning of March and north of $22/share by the time of the cooperation agreement), and through various ploys gaining three independent director seats. (49) The meme pump was short lived, and a combination of factors, including COVID-19-induced blows, overall financial headwinds, mounting supply chain issues, and a tight liquidity position continued to significantly exacerbate BBBY’s situation. (50)

Supply chain and fulfillment issues continued to cripple BBBY, which reported net losses of more than $559 million by the end of 2021. (51) Mr. Tritton departed from his role as president and CEO on June 29, 2022, and board member Sue Gove was named interim CEO (52) (subsequently appointed as permanent CEO (53), who would embark on an uphill battle to right-size the company. Comparable sales were down 23% at the time of Ms. Gove’s appointment, (54) and Berkeley Research Group (BRG) was simultaneously retained to advise on cash, inventory, and balance sheet optimization. (55)

Between August 16-17, 2022, five months after taking its stake in BBBY, “meme lord” Ryan Cohen’s RC Ventures capitalized on another market rally and sold all of its shares (approximately 11.8% of then-outstanding shares) and call options, (56) which he originally purchased at an average of roughly $15.34/share and sold for between $18.68/share and $29.22/share, making an estimated $59 million. (57) Share value decreased 20% after the announcement, plummeting an additional 35% in after-hours trading.

With BBBY in freefall and in need of liquidity, the company announced on August 31, 2022, among other things, (i) an amendment to upsize the Prepetition ABL revolving commitments from $1 billion to $1.13 billion, (ii) a new$375 million FILO facility as a part of the Prepetition ABL amendment, to be fully drawn on or prior to September 2, 2022 (the “Prepetition FILO”), (iii) an at-the-market offering program (“ATM Program”) for up to 12 million shares of common stock, (iv) an exit from a third of its owned brands, substantial reduction in the remaining six owned brands, and a move back to consumer-resonating national brands, and (v) an additional closure of 150 Bed Bath & Beyond® banner stores.(58)

In this time of turmoil, on September 2, 2022, BBBY also tragically lost its CFO, Gustavo Arnal. (59) At this point, it seemed likely that BBBY would need to commence a Chapter 11 to address its ongoing operational and liquidity issues.

However, the meme stock trade still had life, and the ATM Program ultimately generated aggregate gross proceeds of approximately $115 million. (60) The company continued to throw long

and seemingly increasingly desperate passes, announcing an exchange offer (ultimately extended five times) of any and all of its outstanding (i) 3.749% senior notes due 2024 for new 3.693% senior second lien secured non-convertible notes due 2027 and/or 8.821% senior second lien secured convertible notes due 2027, (ii) 4.915% senior notes due 2034 for new 12.000% senior third lien secured convertible notes due 2029, and (iii) 5.165% senior notes due 2044 for new third lien convertible notes. (61) While some existing holders did bite, after five extensions, the exchange offer was terminated on January 4, 2023. (62) After delayed fiscal 2022 Q3 results, BBBY posted net losses of nearly $393 million for the quarter. (63)

By January 19, 2023, BBBY had triggered multiple events of default under the Prepetition ABL and the Prepetition FILO. (64) On January 25, 2023, the ABL agent delivered an acceleration notice. (65) BBBY’s stock price fell below $3/share. In a concurrent announcement, on February 6, 2023, BBBY announced its board had appointed Alix Partners’ Holly Etlin as interim CFO on February 2, 2023 and was initiating on February 6, 2023 an underwritten public offering of (i) Series A convertible preferred stock, (ii) warrants to purchase shares of Series A convertible preferred at $1.50/share, and (iii) warrants to purchase common stock, with an expectation of generating approximately $225 million in gross proceeds through the public offering and $800 million through the issuance of securities to exercise warrants to purchase shares of Series A preferred. (66) With meme stock blood in the water, on February 7, 2023, Hudson Bay Capital Management, LP took a gamble on the depressed share price and closed an underwritten public offering, and between February 7, 2023 and March 27, 2023, the company received, in total, approximately $360 million. (67) Stock prices fell from less than $3/share to less than $1/share during this time.

These maneuvers did position BBBY to obtain various waivers and amendments from the prepetition secured lenders, which also resulted in a paydown of the Prepetition ABL facility from $1.13 billion to $565 million. (68) The paydown depleted much if not all of the proceeds from the February Hudson Bay offering. By March 30, 2023, the company was again in default and again entered into a waiver and amendment with the Prepetition ABL and Prepetition FILO lenders, with the reduced $565 million Prepetition ABL commitment further reducing down to $300 million. (69) At the same time, BBBY terminated the previous public offering and announced another ATM offering to attempt to identify new sources of liquidity. (70) BBBY stock was trading around $0.59/share.

After a fifth Prepetition ABL and Prepetition FILO amendment, BBBY finally filed Chapter 11 in the District of New Jersey on April 23, 2023, armed with a debtor-in-possession (“DIP”) facility agented by the Prepetition FILO agent in the form of (i) a new money single draw term loan facility consisting of $40 million, and (ii) a roll-up of Prepetition FILO secured obligations in the amount of $200 million. (71) Ms. Etlin was also appointed to serve as Chief Restructuring Officer. (72) The Friday before the filing, stock was trading at $0.29/share. As of the petition

date, BBBY reported approximately $1.8 billion in total funded debt obligations. (73)

Seemingly undeterred by all of this bad news, retail meme stock investors remained in the game. Between the April 23, 2023, filing date and the May 3, 2023, stock delisting, daily share trading volume ranged from 82 million to 540 million. Investors have traded an average volume of 24 million shares per day on the over-the-counter (OTC) market since the delisting.

WINNERS & LOSERS

There are few winners here. The debtors’ disclosure statement filed on August 1, 2023, reveals that the only unimpaired classes of claims are “Other Priority Claims” (74) projected to be $8 million and “Other Secured Claims” (75) projected to be $7 million. (76) At the petition date, the Prepetition ABL had been paid down to approximately $80.3 million in aggregate principal plus $102.6 million of outstanding letters of credit, which was narrowly repaid in the normal administration of the Chapter 11. (77) As of the petition date, $547.1 million remained outstanding under the Prepetition FILO, $200 million of which was rolled up and converted to DIP obligations. (78) The $200 million rollup plus the $40 million of new money under the DIP, totaling $240 million, are potentially impaired, with recovery estimated at 8% – 100%. (79) The remaining $349.6 million Prepetition FILO claims are projected to recover 42.2% – 100%. (80)

An estimated $1.8 billion to $2.4 billion of junior unsecured and general unsecured claims and equity will be completely wiped out. (81) The retail meme stock investors also lost (except for RC Ventures LLC, which, along with Ryan Cohen, are now defendants to a billion-dollar securities fraud class action (82). The amended Chapter 11 Plan — inclusive of full releases of claims against, among others, the Prepetition FILO and DIP lenders, explicitly preserving claims against RC Ventures and Ryan Cohen — was confirmed on a final basis on September 14, 2023. (83)

The impact of these machinations was to defer the BBBY Chapter 11 filing, during which time the highly recognizable Bed Bath & Beyond® and buybuy BABY® banners lost significant value. Overstock.com (OSTK) acquired the Bed Bath & Beyond® intellectual property for $21.5 million. (84) The transaction closed June 28, 2023, (85) and immediately upon the news, OSTK stock price rose more than 27%, equating to a $190 million market cap increase between June 27, 2023 ($1.09 billion market cap) and June 29, 2023 ($1.28 billion market cap). Two months after the news, as of August 31, 2023, OSTK still enjoyed a stock price of $26.11/share and a market cap of $1.18 billion. Infant furniture vendor Dream On Me acquired buybuy BABY® for $15.5 million. (86)

The Creditor-Shareholder Dichotomy, Management’s Master, & The Perverse Incentives Induced by Irrational Public Markets With the benefit of hindsight, it seems appropriate to ask whose interests were served by the equity offerings that delayed the commencement of the BBBY Chapter 11 case. Should the company have availed itself of bankruptcy protection sooner, or did the willingness of the public equity market to absorb additional issuances lead to an inversion of the typical ordering of leverage in the capital structure of a cash-hemorrhaging enterprise? This is perhaps simply a familiar story playing out with new characters.

Prior to 1939, the year in which the Chandler Act was implemented, amending the 1898 Bankruptcy Act, (87) management in reorganization proceedings played a central role to bankruptcy proceedings. Suspicions were confirmed through the Douglas Report, a multi-volume SEC study (88) concluding that management exerted a tremendous deal of control over these proceedings and frequently operated in a self-serving fashion or in a fashion aligned with various stakeholders to the detriment of others. Post-1939, Chapter X of the Bankruptcy Act required appointment of a trustee (89) in corporate bankruptcy cases.

The Bankruptcy Reform Act of 1979 repealed Chapter X of the Bankruptcy Act. (90) The modern-day Bankruptcy Code was implemented, and the trustee system was replaced by a general

rule that left a Chapter 11 debtor’s management in place post-filing, the debtor-in-possession. (91)

For decades, scholars and practitioners have grappled with the conflict between senior interests and juniors and their respectively bipolar risk appetites. Professors LoPucki and Whitford discussed the dilemma 30 years ago:

To illustrate, assume that the value of a debtor’s assets are equal to the amount of its liabilities, all of which are unsecured. If the assets are preserved and invested conservatively during the reorganization case and distributions are then made in accord with the absolute priority rule, creditors will recover approximately the full amounts of their claims and shareholders will recover little or nothing. If the assets are invested aggressively, they might increase or decline in value. If they decline, the shareholders will recover nothing and the creditors will receive less than they would have if the assets had been invested conservatively. If the assets increase in value, the creditors will still recover only the full amounts of their claims while the benefit of the increase accrues to shareholders. It can thus be seen that when a marginally solvent company engages in high risk investment, the risks are borne primarily by creditors while the benefits accrue primarily to shareholders. (92)

Examined in this light, it seems that the decisions made by BBBY in the leadup to and immediately after its Chapter 11 filing reflected a trade of collateral recovery value for a speculative equity bet to the detriment of BBBY’s creditors.

Between August 16-17, 2022, RC Ventures unloaded its stake, dropping share value precipitously. (93) As of February 25, 2023, BBBY operated several e-commerce businesses and 696 Bed Bath & Beyond® retail locations in all 50 states, the District of Columbia, Puerto Rico, and Canada — as well as 5 Bed Bath & Beyond® stores through a joint venture in Mexico — 131 buybuy Baby® stores in 37 states and Canada, and 45 Harmon stores in 2 states. (94) At the end of August 2022, the company completed the Jefferies-agented ATM issuance (95) and shortly thereafter triggered the Prepetition ABL and Prepetition FILO defaults. (96) Despite these defaults and its worsening financial performance, sufficient meme stock interest remained such that on February 7, 2023, the company was once again able to access the public equity markets through the Hudson Bay-led public offering. (97)

Where, in other circumstances objective minds and fiduciaries could have pointed to a number of crossroads beginning at, perhaps as early as the height of COVID-19-induced shutdowns in mid-2020, management was empowered by the public market’s appetite for its equity, a trade seemingly detached from grounded valuation principles. At a point in time where creditor stakeholders likely would have tried to carve out true Bed Bath & Beyond® and buybuy BABY® going concerns to preserve value and reduce losses, the company was able to gain a handful of precious seconds each time the meme trade was extended. During this period, the company burned through the working capital that would have been needed to support going concern outcomes, and assets were bundled up and sold off at substantial discounts to their going concern values.

THE MEME-STOCK TRADE INVERTS STAKEHOLDER LEVERAGE: LESSONS FROM BED BATH & BEYOND

Leading up to the Chapter 11, BBBY was divesting assets and taking on new debt to fund negative operations, pay dividends, (98) and repurchase stock. While the balance sheet was shrinking, the market capitalization — detached from reality — was increasing, enabling the company to continue on its path. From the date that the BBBY meme trade started (January 27, 2021), until the liquidation and sale of the company’s flagship banner, the company burned more than $4.05 billion in cash. (99) Could this outcome have been avoided, or at least ameliorated to reduce the erosion of value? What levers could have been pulled to induce decisions that would have preserved asset recovery values?

VALUATION TEST TRIGGER COVENANTS

Introducing valuation-based triggers could prompt timely assessment of a company’s financial health and operational systems, requiring actions when stock prices deviate significantly from fundamental valuations. The temporal and trigger pieces of valuation covenants are key. Where a lender’s loan documents may currently only allow for valuation rights annually, semiannually, or so on, they should consider amending those forms to allow for more frequent and/or dynamic rights, perhaps upon certain public market movements, even.

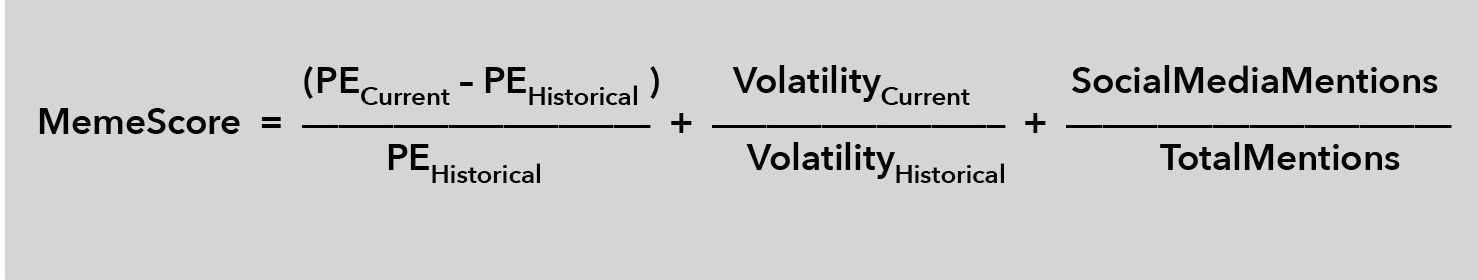

It would be difficult, if not impossible, to develop a single formula to determine that a stock is being traded as a meme stock rather than according to rational and fundamental valuation methodologies (e.g., the company’s P/E ratio as compared to similar companies, trading volume and volatility, news and social media sentiment, short interest, lack of fundamental price change catalysts, and other market behavior trends), though a simplified, high-level framework could function as indicated in the equation above.

Where:

1. PECurrent is the current price-to-earnings ratio of the stock.

2. PEHistorical is the historical average price-to-earnings ratio of the stock.

3. VolatilityCurrent is the current volatility of the stock’s price.

4. VolatilityHistorial is the historical average volatility of the stock’s price.

5. SocialMediaMentions is the number of mentions related to the stock on social media platforms.

6. TotalMentions is the total number of mentions across all sources (news, financial reports, etc.).

The equation would then function as follows:

1. The first term ( PECurrent – PEHistorical / PEHistorical ) measures the relative increase in the current P/E ratio compared to historical levels. A significant positive value suggests the P/E ratio is elevated compared to its historical average, which might be due to speculative behavior.

2. The second term ( VolatilityCurrent /VolatilityHistorical ) compares the current volatility to historical volatility. A higher value indicates increased current volatility, which could be indicative of speculative trading.

3. The third term ( SocialMediaMentions / TotalMentions ) represents the proportion of social media mentions related to the stock. A higher proportion suggests that social media is playing a larger role in driving attention to the stock, potentially indicating meme stock behavior.

So then, take a handful of recent meme stocks, including GameStop (GME), Bed Bath & Beyond (BBBY), Blackberry (BB), AMC Entertainment (AMC), Clover Health Investments (CLOV), and Zomedica (ZOM). We calculate MemeScore beginning January 1, 2018 (except in the case of CLOV, which went public in 2020) through September 1, 2021, (100) paying particular attention to price spikes in 2021.

As highlighted in the below tables (101) for emphasis, the snapshots in time in which stock prices surged — seemingly without a rational market basis — are all associated with significantly higher MemeScores than produced historically. What we have dubbed a MemeScore may also be aptly thought of as the option value ascribed by retail investors — and sometimes larger institutional short-sellers — to flailing stocks; retail investor lotto tickets.

Lenders may wish to adopt and refine this framework and customize assumptions based on their unique risk preferences and requirements, and then set a MemeScore percentage change threshold relative to the historic baseline of a specific borrower, at which point a valuation test or other action may be triggered.

COVENANTS & DIRECTOR SEATS

When underwriting a deal and preparing loan documentation, the lender should consider what appropriate remedies for breaches of covenants related to valuation or MemeScore triggers should be. One obvious remedy could, and likely should, be a debt paydown, the effect of which would be to lessen the lender’s exposure in a BBBY-like scenario. As we saw in BBBY, the Prepetition ABL lenders narrowly escaped impairment, which likely would not have been the outcome had they not negotiated significant paydowns following the early 2023 defaults.

Another, albeit drastic and less palatable, mechanism in the eyes of the borrower and shareholders would have to do with independent director seats. It appears likely that the management of a stressed or distressed borrower that is enjoying a meme stock pump not founded in traditional valuation principles may feel emboldened to take the Hail Mary passes the retail investor desires to get their lottery payout, to the potential severe detriment of the secured lender. In this case, for instance, RC Ventures quickly and forcefully leveraged its position to obtain three independent director seats and unceremoniously ousted BBBY’s then CEO. (102) While not appropriate in all (or maybe many) cases, when extending a potential lifeline on the order of magnitude of hundreds of millions and often exceeding a billion dollars, it seems appropriate that corporate governance safeguards should be triggered to protect a lender’s position.

HEIGHTENED PROXY PENALTIES

Naturally, if the secured lender wishes to safeguard against potentially incalcitrant management by ensuring its own voice is louder in the board room, the lender may worry about proxy battles led by unexpectedly powerful Reddit-led retail investors with the same strategy as the lender. To hedge against potential unexpected future proxy battles, lenders may want to consider including heightened proxy penalties that are substantial enough to virtually forbid meme-shareholder-friendly management changes at critical junctures in a borrower’s lifecycle.

CONCLUDING THE BBBY SAGA

The case of BBBY as a meme stock presents unique challenges posed to institutional secured lenders in a market driven by social media frenzy. The disconnection between stock prices and fundamental value, coupled with the allure of quick equity gains, can hinder rational decision-making and distort creditor control dynamics. As the financial landscape continues to evolve, creditors should consider how similar events have unfolded historically and adapt their structures to make the unpredictable waters churned by meme stock-driven markets a bit more navigable.

1 See SEC, GameStop Corp., Form 10-K for fiscal year ended January 29, 2022.

2 See SEC, GameStop Corp., Form 10-K for fiscal year ended January 28, 2023.

3 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended May 30, 2020.

4 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended May 30, 2020.

5 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended June 1, 2019.

6 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended May 30, 2020.

7 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended August 31, 2019.

8 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended August 29, 2020.

9 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended November 30, 2019. 10 See SEC, Bed Bath & Beyond Inc., Form 10-Q

for quarterly period ended November 28, 2020.

11 See SEC, Bed Bath & Beyond Inc., Form 10-K for fiscal year ended February 29, 2020.

12 See SEC, Bed Bath & Beyond Inc., Form 10-K for fiscal period ended February 27, 2021.

13 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended November 30, 2019.

14 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended November 28, 2020.

15 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended November 30, 2019.

16 See In re: Bed Bath & Beyond Inc., et al., (Bankr. D. NJ 2023, Case No. 23-13359 (VFP)). Amended Disclosure Statement Relating to the Amended Joint Chapter 11 Plan of Bed Bath & Beyond Inc. and its Debtor Affiliates. Docket No. 1713. Hereinafter, “BBBY CQh 11 Disclosure Statement.”

17 See SEC, Bed Bath & Beyond Inc., Form 10-K for fiscal year ended February 25, 2023.

18 See supra n.17, BBBY Ch 11 Disclosure Statement.

19 See SEC, Bed Bath & Beyond Inc., Form 8-K, December 15, 2004.

20 See Allan Sloan, Yahoo! Finance, “Bed Bath & Beyond: How stock buybacks undermined the company,” (Jan. 11, 2023).

21 See SEC, Bed Bath & Beyond Inc., Form 8-K, April 10, 2019.

22 See SEC, Bed Bath & Beyond Inc., Form 8-K, May 12, 2019.

23 See SEC, Bed Bath & Beyond Inc., Form 8-K, October 6, 2019.

24 See SEC, Bed Bath & Beyond Inc., Form 8-K, June 30, 2021.

25 See SEC, Bed Bath & Beyond Inc., Form 8-K, September 30, 2021.

26 See SEC, Bed Bath & Beyond Inc., Form 8-K, April 13, 2022. Much, but by no means all, of this decline must also be attributed to global COVID-19-related supply chain disruptions.

27 See SEC, Bed Bath & Beyond Inc., Form 10-K for the fiscal year ended February 27, 2021 (emphasis added).

28 See SEC, Bed Bath & Beyond Inc., Form 10-Q for the quarterly period ended November 30, 2019.

29 See SEC, Bed Bath & Beyond Inc., Form 8-K, February 18, 2020.

30 See SEC, Bed Bath & Beyond Inc., Form 10-Q for the quarterly period ended May 30, 2020.

31 See SEC, Bed Bath & Beyond Inc., Form 8-K, October 13, 2020.

32 See SEC, Bed Bath & Beyond Inc., Form 8-K, October 13, 2020.

33 See SEC, Bed Bath & Beyond Inc., Form 8-K, October 13, 2020.

34 See SEC, Bed Bath & Beyond Inc., Form 8-K, December 14, 2020.

35 See SEC, Bed Bath & Beyond Inc., Form 8-K, February 27, 2020.

36 See SEC, Bed Bath & Beyond Inc., Form 8-K, January 7, 2021.

37 See SEC, Bed Bath & Beyond Inc., Form 8-K, March 22, 2020.

38 See SEC, Bed Bath & Beyond Inc., Form 8-K,April 2, 2020.

39 See SEC, Bed Bath & Beyond Inc., Form 8-K, June 19, 2020.

40 See SEC, Bed Bath & Beyond Inc., Form 8-K, July 8, 2020.

41 See SEC, Bed Bath & Beyond Inc., Form 8-K, August 10, 2020.

42 See SEC, Bed Bath & Beyond Inc., Form 8-K, October 28, 2020.

43 See SEC, Bed Bath & Beyond Inc., Form 10-Q, for the quarterly period ended August 29, 2020. 44 See SEC, Bed Bath & Beyond Inc., Form 8-K, December 14, 2020.

45 See SEC, Bed Bath & Beyond Inc., Form 8-K, January 8, 2021.

46 See SEC, Bed Bath & Beyond Inc., Form 8-K, April 14, 2021.

47 See SEC, Bed Bath & Beyond Inc., Form 8-K, August 9, 2021.

48 See SEC, Bed Bath & Beyond Inc., Form 8-K, April 13, 2022.

49 See SEC, Bed Bath & Beyond Inc., Form 8-K, March 24, 2022.

50 See SEC, Bed Bath & Beyond Inc., Form 8-K, April 13, 2022.

51 See SEC, Bed Bath & Beyond Inc., Form 10-k for the fiscal year ended February 26, 2022.

52 See SEC, Bed Bath & Beyond Inc., Form 8-K, June 29, 2022.

53 See SEC, Bed Bath & Beyond Inc., Form 8-K, October 24, 2022.

54 See SEC, Bed Bath & Beyond Inc., Form 8-K, June 29, 2022.

55 See SEC, Bed Bath & Beyond Inc., Form 8-K, June 29, 2022.

56 See SEC, RC Ventures LLC, Schedule 13D Amendment No. 3, August 18, 2022.

57 See Jesse Pound, CNBC, “Activist investor Ryan Cohen completes planned sale of Bed Bath & Beyond stake, stock falls 40%,” (Aug. 18, 2022). 58 See SEC, Bed Bath & Beyond Inc., Form 8-K, August 31, 2022.

59 See SEC, Bed Bath & Beyond Inc., Form 8-K, September 2, 2022.

60 See supra n.17, BBBY Ch 11 Disclosure Statement.

61 See SEC, Bed Bath & Beyond Inc., Form 8-K, October 18, 2022.

62 See SEC, Bed Bath & Beyond Inc., Form 8-K, January 4, 2023.

63 See SEC, Bed Bath & Beyond Inc., Form 8-K, January 10, 2023.

64 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended November 26, 2022. 65 See SEC, Bed Bath & Beyond Inc., Form 8-K, January 10, 2023.

66 See SEC, Bed Bath & Beyond Inc., Form 8-K, February 2,2023.

67 See SEC, Bed Bath & Beyond Inc., Form 8-K, March 8, 2023.

68 See SEC, Bed Bath & Beyond Inc., Form 8-K, February 7, 2023.

69 See SEC, Bed Bath & Beyond Inc., Form 8-K, March 30, 2023.

70 See SEC, Bed Bath & Beyond Inc., Form 8-K, March 30, 2023.

71 See SEC, Bed Bath & Beyond Inc., Form 8-K, April 23, 2023.

72 See SEC, Bed Bath & Beyond Inc., Form 8-K, April 23, 2023.

73 See supra n.17, BBBY Ch 11 Disclosure Statement.

74 See In re: Bed Bath & Beyond Inc., et al., (Bankr. D. NJ 2023, Case No. 23-13359 (VFP)). Amended Joint Chapter 11 Plan of Bed Bath & Beyond Inc. and its Debtor Affiliates. Docket No. 1712. “Other Priority Claims” defined as “any Claim entitled to priority in right of payment under section 507(a) of the Bankruptcy Code, other than: (a) an Administrative Claim; or (b) a Priority Tax Claim, to the extent such Claim has not already been paid during the Chapter 11 Cases.”

75 Id. “Other Secured Claims” defined as “any Secured Claim, other than claims arising under the Prepetition Credit Facilities or the DIP Documents, that is secured by a Lien senior to the Lien securing the DIP Claims, the ABL Claims, and the FILO Claims. For the avoidance of doubt, any Allowed Claim of the Texas Taxing Authorities (as defined in the Final DIP Order) that is a Secured Claim under applicable law shall be an Other Secured Claim.”

76 Id.

77 See supra n.17, BBBY Ch 11 Disclosure Statement.

78 Id.

79 Id.

80 Id.

81 Id.

82 See Alison Frankel, Reuters, “Bed Bath & Beyond investor Ryan Cohen must face emoji-inspired shareholder suit,” (July 28, 2023).

83 See In re: Bed Bath & Beyond Inc., et al., (Bankr. D. NJ 2023, Case No. 23-13359 (VFP)). Findings of Fact, Conclusions of Law, and Order (I) Approving the Disclosure Statement on a Final Basis and (II) Confirming the Second Amended Joint Chapter 11 Plan of Bed Bath & Beyond Inc. and Its Debtor Affiliates. Docket No. 2172.

84 See SEC, Bed Bath & Beyond Inc., Form 8-K, June 13, 2023.

85 See SEC, Bed Bath & Beyond Inc., Form 8-K, June 27, 2023.

86 See SEC, Bed Bath & Beyond Inc., Form 8-K, July 11, 2023.

87 See Chandler Act, ch. 575, 52 Stat. 840 (1938).

88 See U.S. Sec. & Exch. Comm’n, Report on the Study & Investigation of the Work, Activities, Personnel and Functions of Protective and Reorganization Committees (1937-40).

89 See supra n.88, at 885.

90 See Act of Nov. 6, 1978, Pub. L. No. 95-598, § 401, 92 Stat. 2549, 2682 (codified as amended at 11 U.S.C. § 101-1501(1988)) (as amended at 11 U.S.C. §§ 101-1532 (2019)).

91 See Lynn M. LoPucki & William C. Whitford, Corporate Governance in the Bankruptcy Reorganization of Large, Publicly Held Companies, 141 U. PA. L. REV. 669, 690-691 (1993).

92 Id. at 683-684.

93 See SEC, RC Ventures LLC, Schedule 13D Amendment No. 3, August 18, 2022.

94 See SEC, Bed Bath & Beyond Inc., Form 10-K for fiscal year ended February 25, 2023.

95 See SEC, Bed Bath & Beyond Inc., Form 8-K, August 31, 2022.

96 See SEC, Bed Bath & Beyond Inc., Form 10-Q for quarterly period ended November 26, 2022. 97 See SEC, Bed Bath & Beyond Inc., Form 8-K, March 8, 2023.

98 See SEC, Bed Bath & Beyond Inc., Form 10-K, for fiscal year ended February 25, 2023. During fiscal 2021 and 2020, BBBY paid total cash dividends of $0.7 million and $23.1 million, respectively.

99 See SEC, Bed Bath & Beyond Inc., Form 10-K, for fiscal year ended February 25, 2023.

100 Calculations rely on the use of Open.ai’s ChatGPT, necessitating the temporal cap of September 1, 2021.

101 Source: Yahoo Finance and Open.ai.

102 See SEC, Bed Bath & Beyond Inc., Form 8-K, March 24, 2022.