Tips for Piecing Together Intangible Assets and Maximizing Value in a Sale

Intangible assets — including trademarks, patent portfolios, software, data, domain names, and social media assets — are often the crown jewels of a company. Laying the groundwork in anticipation of a sale of these assets requires a keen understanding of how the customer or market has previously interacted with them and which assets enhance which element of the value proposition. Once that is understood, the next step requires creativity to identify how those assets, combined or sold separately, can be redeployed under a different business model or to a different customer.

Case studies that demonstrate a selection of practice pointers can be used to harness intellectual property to maximize the returns for the seller.

CREATIVELY ASSERTING RIGHTS

Known for its soups, sandwiches, and salad offerings, Hale & Hearty had achieved recognition in New York and Boston as a nourishing fast casual lunchtime mainstay for the busy professional. Following the COVID-19 pandemic, the increase in hybrid and remote workforces led to reduced demand for these outlets in cities. Hale & Hearty suffered along with many others, and in 2022, creditors pushed the company into Chapter 7 bankruptcy. The Chapter 7 trustee and his counsel turned to preserving the remaining assets. They discovered that, shortly before the bankruptcy, a third party had allegedly entered into an oral agreement with the company. Pursuant to the oral agreement, the third party purported to take assignment of rights under a commissary lease and purchase the personal property therein, as well as the company’s principal assets — its intellectual property including brand name and recipes. The consideration was to be $50,000 cash plus an assumption of the commissary lease liabilities. The commissary purchaser alleged that it rightfully owned the company’s intangible assets (and, in fact, it was utilizing the brand name), although there was no evidence that the cash portion of the consideration was ever paid or that the agreement pertaining to the intangible assets had been reduced to writing.

The trustee determined that the Hale & Hearty brand continued to resonate with the consumer and that a potential buyer had the opportunity to cultivate value by expanding into packaged foods, wholesale, catering, and additional categories. Accordingly, preserving the brand — as well as the soup recipes — was required. Of all the intangible assets, the brand was likely to generate the greatest value because most restaurants, first and foremost, rely on customer recognition of their brand name. Typically, only secondarily do they rely on supporting assets such as websites and social media accounts.

To unlock this value for the benefit of the estate, the trustee creatively argued that the commissary purchaser did not rightfully purchase the company’s intangible assets, and therefore use

of such assets was a violation of the automatic stay. Contemporaneous with this, the trustee filed a motion to sell the intangible assets, because potential buyers continued to express interest notwithstanding the stay violation. The filings brought the commissary purchaser to the table, allowing for a resolution that brought $50,000 into the estate in consideration of the lease assignment and equipment purchase, and paved the way for the trustee to continue the sale process for the intangible assets.

The trustee received interest from restaurant owners, packaged food companies, and supermarkets. Following a spirited auction at which the closing price more than doubled the opening bid, the trustee declared the commissary purchaser as the successful bidder for the intangible assets. The trustee’s determination to preserve the value-driving asset — the brand — led to a creatively executed and streamlined legal strategy that steered a resolution that achieved meaningful value for the estate.

PROTECTING A BRAND & PRESERVING AN ONLINE PRESENCE

In 2017, various entities associated with the Bikram Yoga brand voluntarily filed Chapter 7 petitions following sexual assault and discrimination allegations against the eponymous founder of the companies, Bikram Choudhury. The brand had become synonymous with hot yoga, combining a fixed sequence of 26 postures and two breathing exercises with a heated room with elevated humidity.

The Chapter 7 trustee had access to various tangible materials supporting the brand — importantly, the copyrighted teacher training manuals — but she did not have access to the credentials for the registrar that housed the BikramYoga. com domain name. While a domain name undoubtedly is an intangible asset, the owner must have access to the username and password at the registrar at which the domain name is registered, or must commence litigation to obtain those credentials if they are not handed over voluntarily or if the owner does not know who has the credentials. (An important distinction exists between domain ownership and possession of login credentials, similar to how having a set of keys to a house does not grant ownership. Here, it was as though the Bikram Yoga trustee was the owner of the house but did not have the keys and was locked out while someone else was inside and would not open the door.) In the case of Bikram Yoga, the trustee did not know who had access to the login credentials for the domain registrar, and the domain name was subject to privacy protection.

This posed various risks for the trustee and her ability to monetize the brand’s remaining intangible assets. First, given the exact match nature of the domain name (that is, the domain name exactly matches the brand’s registered trademark), a third party utilizing the domain name would be deemed an infringer of the trademark owner’s rights. Second, a buyer of the brand would undoubtedly view the domain name as valuable and a necessary piece of the puzzle because it provides the ability to consolidate studios under one digital presence, allows for online booking, creates a platform for hosting content, and opens the door for an ecommerce presence. More generally, the domain name provides consistency and credibility with customers, reinforces brand identity, and provides an unpaid form of search engine optimization.

Allowing a squatter to continue to utilize the domain name would adversely impact the value of the trademarks, because any potential buyer would have had to commence litigation to retrieve the domain name and preserve the brand. Accordingly, the trustee took the proactive step of commencing an action under the Uniform Domain-Name Dispute-Resolution Policy

(UDRP). A UDRP proceeding provides a process by which a trademark holder can reclaim a domain name that unfairly targets its trademark. Upon the filing of a URDP complaint, the holder of domain registrar credentials is unmasked, even when it has opted for privacy protection. If brought to a successful conclusion, the outcome of a UDRP proceeding is that the World Intellectual Property Organization (WIPO) overrides the domain name registrar and provides domain name access to the rightful owner. In this UDRP action, the trustee claimed that the third party’s unauthorized use of BikramYoga.com violated the estate’s trademark rights in the Bikram Yoga brand.

Upon the filing of the UDRP action, a former company employee with unauthorized access to the domain name was identified. The trustee was then able to reach a settlement that transferred domain name access back to the trustee as rightful owner. As this occurred prior to the asset sale, the trustee was able to deliver access to the domain name to the buyer and eliminate the cybersquatter’s potential value-degradation of the trademarks.

SOCIAL MEDIA ACCOUNTS AS KEY TO BRAND PACKAGE

Vital Pharmaceuticals Inc., the manufacturer behind Bang Energy drinks, filed for bankruptcy in 2022 following, among other things, a $293 million judgment against the company for false advertisement and an arbitration award in excess of $175 million in favor of the owner of the BANG trademark, who claimed infringement. Included in the assets available as part of the bankruptcy sale process were three social media accounts, the offering of which was challenged by Bang Energy’s former CEO — an account on Instagram, TikTok, and Twitter. The former CEO claimed the accounts belonged to him because, among other reasons, they marketed his persona as opposed to the brand and its products.

Throughout its decade-long history, Bang Energy harnessed social media trends to reach a millennial and Gen Z audience that catapulted it to the third-highest selling energy drink in the U.S. in 2020. This included taking advantage of new platforms as they have arisen and deploying an army of influencers and promoters, which resulted in millions of followers. In this case, the sheer volume of followers (approximately 4.7 million across the three platforms) — not the name of the accounts — was sure to drive value.

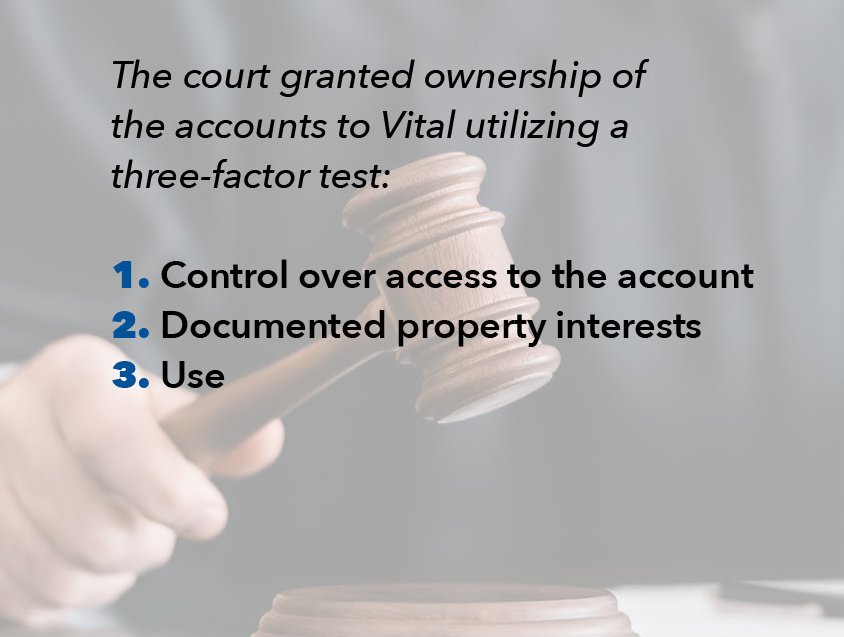

Gaining control of the accounts proved to be challenging. At the launch of the sale process in early 2023, only a few employees of the company, including the former CEO and his wife, formerly Vital’s senior vice president of marketing, had knowledge of the login credentials. Following termination, the former CEO and his wife refused to provide the estates with access and control over the social media accounts, requiring Vital to commence an adversary proceeding. Three months later, the bankruptcy court issued an order granting ownership of the accounts to Vital, paving the way for a sale to Monster Beverage to close.

The first two factors were not decisive, as the former CEO did not have exclusive control over access to the accounts nor was he the sole content creator, and neither party presented a clearly documented property interest in the accounts. In scrutinizing the third factor — use — the court found the accounts were overwhelmingly used to promote Bang Energy — 75% of the posts explicitly marketed the products — and therefore ruled that the accounts belonged to the company rather than to the former CEO.

The decision presents several implications that are important for organizations who rely on social media to promote their brands and drive customer acquisition. To preserve accounts in an asset sale setting, professionals should regularly review employee access and permissions to accounts and remove key holders who no longer require access. These measures should be taken as early as possible in the context of a sale process, so that the process is not delayed or contingent on the delivery of an asset that still needs to be harnessed. This is particularly important in the case of Meta accounts, which includes Facebook, Instagram, and Threads. Meta accounts — even corporate ones — are tethered to a user’s personal Facebook page, meaning that a company’s brand collateral and certain of its employee’s personal social media accounts are intertwined, creating the need for additional precautions and safeguards.

CONCLUSION

Identifying the puzzle pieces and assembling the puzzle are meaningful to each sale process for intangible assets. When it comes to the sale of these assets, experienced advisors are well equipped to identify pockets of value and harness them. Practitioners are best equipped to sell assets when they have harnessed those assets well in advance of closing. Those who can anticipate barriers to a smooth closing and remove them will be well positioned for success.