Metals Pricing Trends Positive Amid Industry Consolidation and Gains in Efficiency

In this article we discuss the continued decline of steel prices throughout 2023, the outlook for 2024, and explore factors that will shape the year ahead, and discuss considerations for lenders with metals market portfolio exposure.

While residual supply chain disruption stemming from the pandemic largely resolved during 2023, steel and aluminum markets faced global challenges ranging from the continuing war in Ukraine to the slow recovery in China, inflation and associated monetary policies. These and other factors have, in turn led to the following:

- Strength in certain economic sectors continues to benefit producers, distributors and manufacturers.

- Consumption patterns have largely returned to pre-pandemic levels.

- Oil and gas production in the United States is at all-time highs but falling energy prices and a worldwide

surplus in supply have restricted further exploration, resulting in a decrease in the active rig count within North America from 1008 in February 2023 to 851 in February 2024. - High interest rates have negatively affected new home construction, reducing demand for appliances, steel roofing, electrical conduit, and other construction related steel goods.

- Political and economic uncertainty (referenced above) continue to add risk to industrial inventories.

- While market prices have generally trended downward there have been periods of increasing prices. Buyers are reluctant to purchase foreign goods with long lead times when domestic pricing is constantly changing.

- Continued consolidation in the domestic steel industry has reduced competition, while market prices have decreased from their highs, they generally remain above pre-pandemic levels.

MARKET PRICING

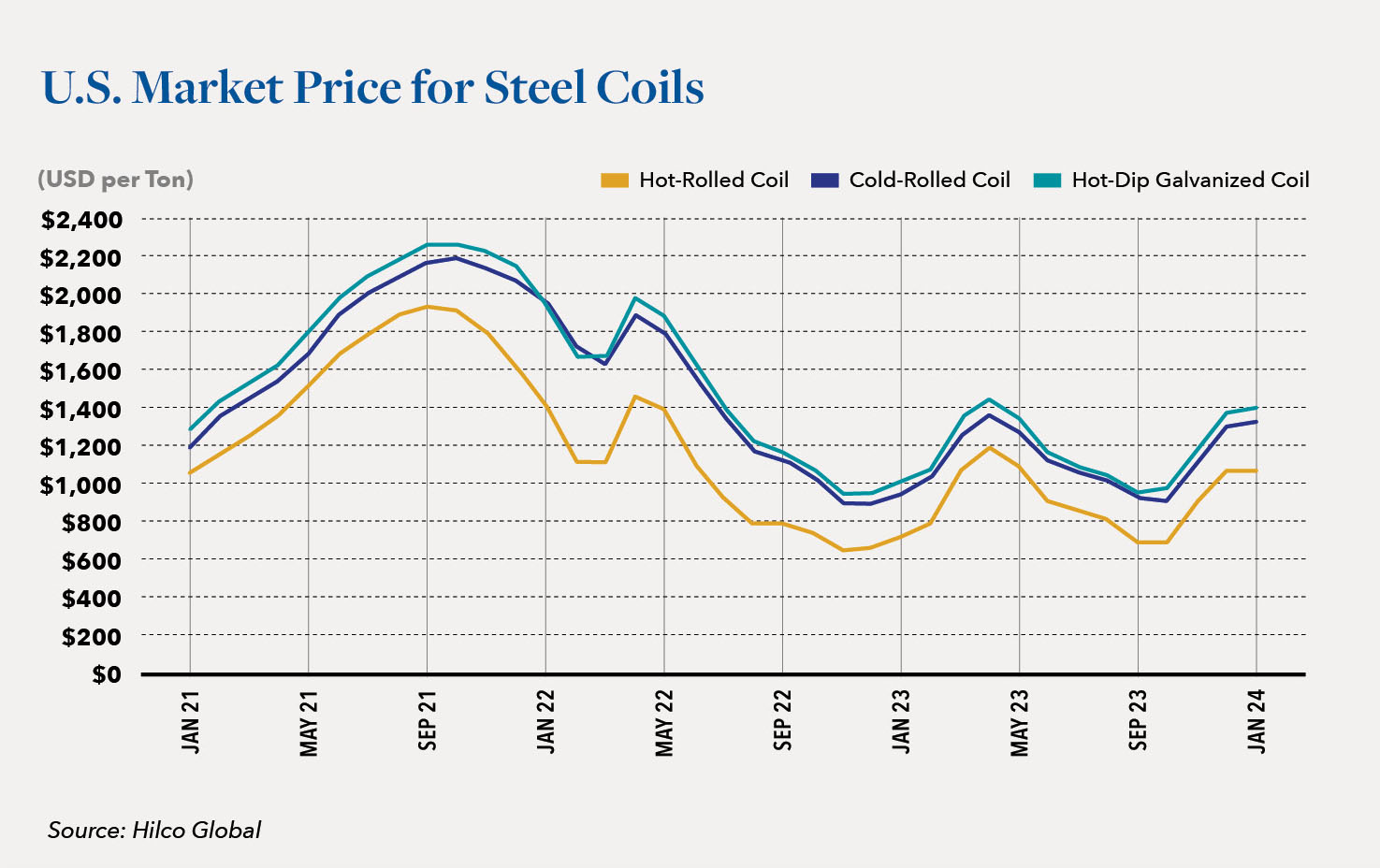

Market prices for steel coils currently remain more volatile than that of other product types. Coil market prices did trend downward in September and October 2023, and then increased rapidly in the new year with January month-end prices about $400 per ton above those in effect in October.

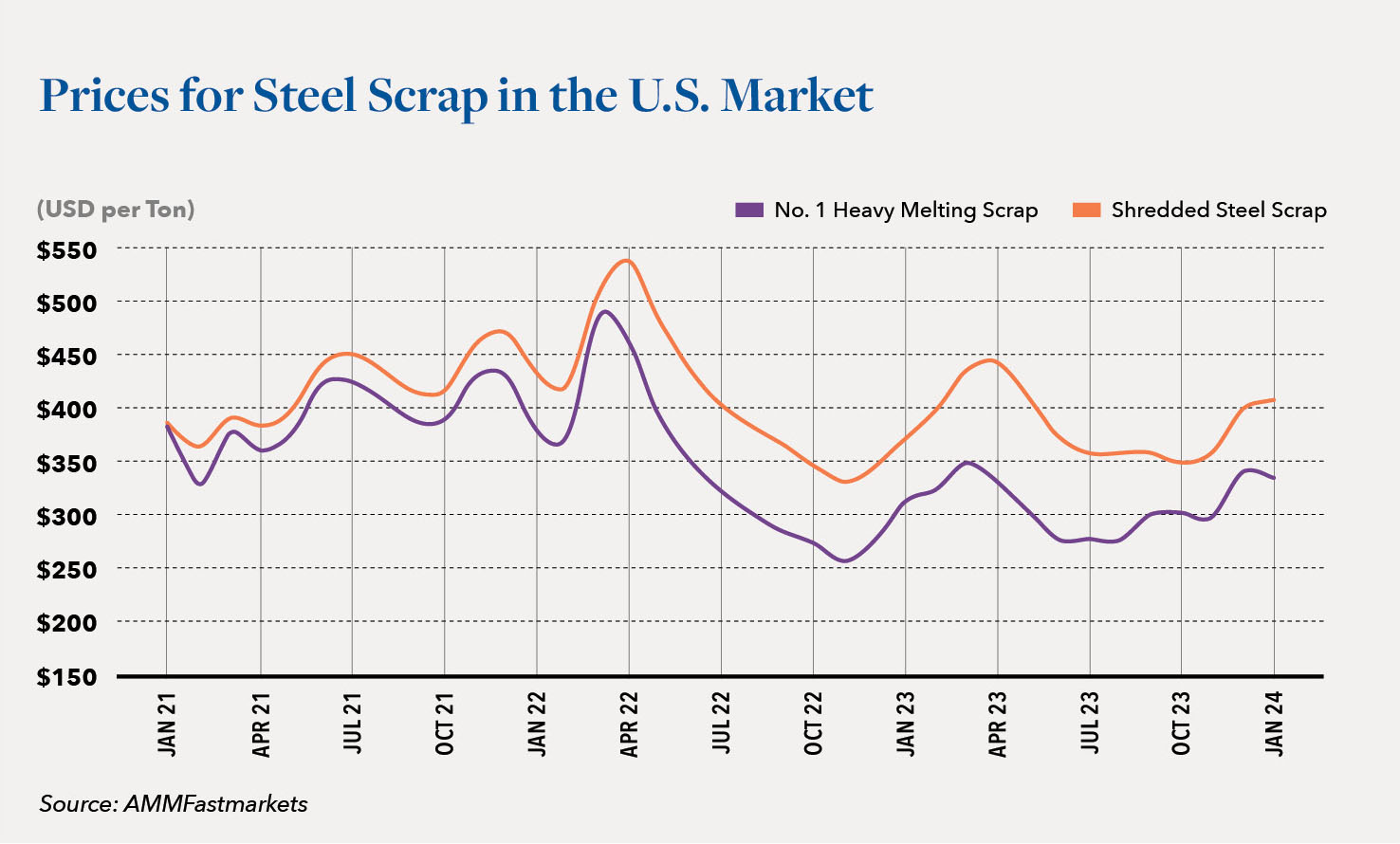

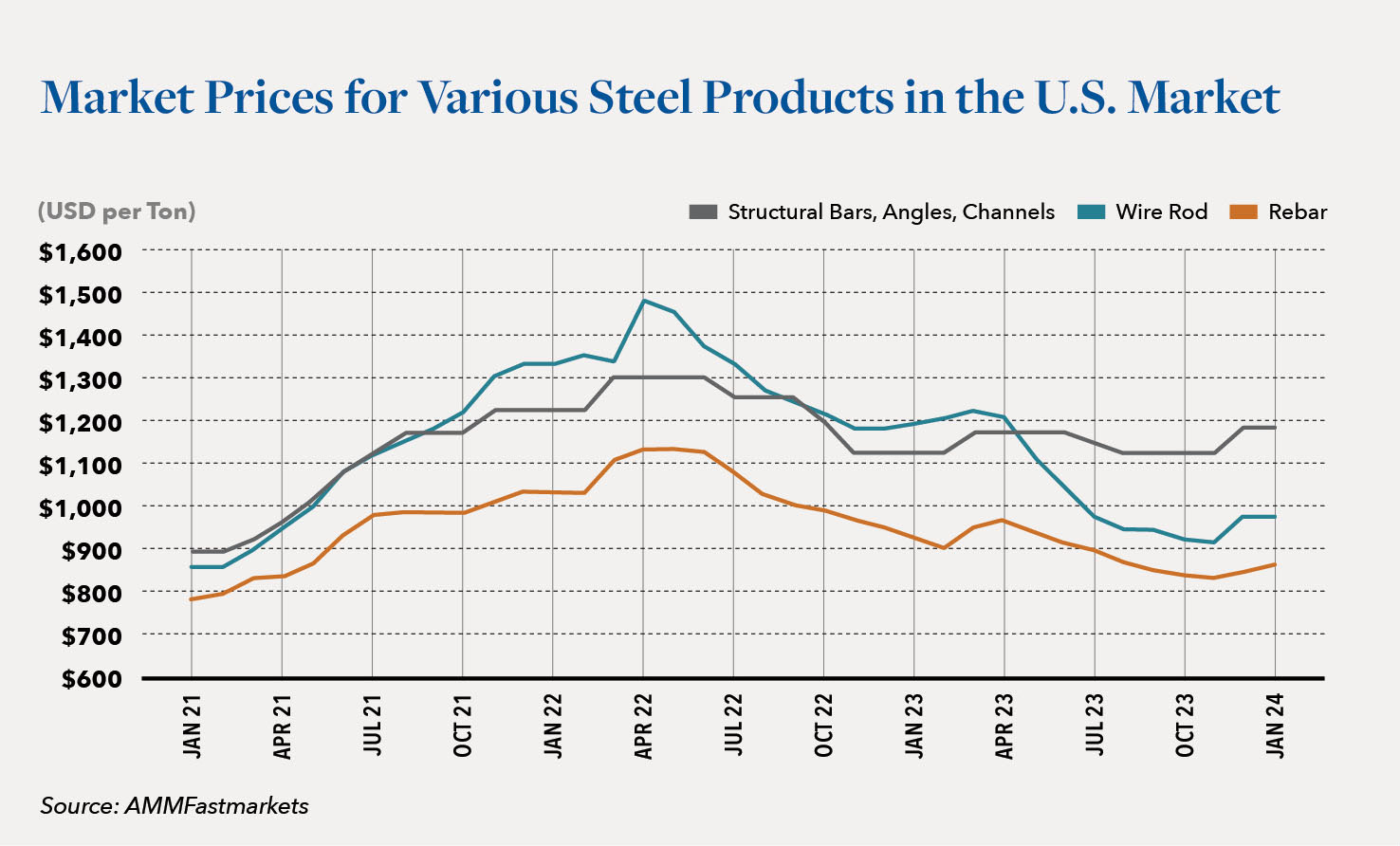

With about 80% of the steel made in the U.S. derived from recycled scrap, changes in scrap prices affect market prices for goods derived from the recycled raw material. Scrap prices peaked in 2021, trended downward in 2022 and market prices remained volatile 2023, trading in a plus or minus $50 per ton range for most of the year. The market price for shredded steel scrap, one of the largest scrap types, was $345 per ton in December 2022, and $408 per ton in January 2024. Recent scrap pricing trends are shown below as well as market prices for certain steel products.

Market prices for steel coils are typically more volatile than other products. Market prices for hot rolled coils trended downward for much of 2023 before surging during December 2023 and January 2024. Market prices for hot rolled coils were $715 per ton in January 2023 before increasing to $1090 per ton in May of that year. Prices then trended downward, decreasing to $700 per ton that September. In January 2024, prices then rallied again reaching $1090 per ton. Remarkably, the range in cost was almost $500 per ton in that overall 12 month period.

Hot rolled coils are the substrate used to create cold rolled and galvanized coils. As a result, any increase or decrease in hot rolled coils immediately leads to similar increases and decreases for both cold roll and galvanized coils as well. Cold rolled and galvanized coil spot market pricing rose sharply from less than $1000 per ton in October 2023 to $1400 per ton in January 2024. Hot rolled coil is also the substrate for most pipe and tube products and those manufacturers typically increase prices immediately with each increase in coil prices.

In previous Hilco reports we have suggested that the merger of AK Steel and ArcelorMittal’s U.S. operations into Cleveland Cliffs, the merger of Big River Steel into U.S. Steel, and other noteworthy mergers and acquisitions would likely lead to more discipline in terms of both production volume and pricing. Rather than sell steel at a loss or reduce prices to gain volume, we are seeing that this smaller pool of competitors now seems content to sell fewer tons at higher prices.

CONTINUED STEEL INDUSTRY CONSOLIDATION

As we have outlined in previous Hilco updates, the U.S. steel industry is comprised of both fully-integrated steel mills using iron ore and blast furnaces to produce steel as well as “mini-mills” using electric arc furnaces to melt steel scrap to produce new steel. The last “new” fully integrated mill began casting operations in 1975 at Bethlehem Steel’s Burns Harbor, Indiana location, which is now part of Cleveland Cliffs.

Since 1995, integrated steelmakers have been losing their dominant share of U.S. raw steel production to mini mills. According to a report published by ArcelorMittal, the movement of U.S. raw steel production from integrated mills to mini-mills continues, with blast furnace production share slowing from 72% in 1980 to 60% in 1995, and down to 32% back in 2018. The older blast furnace-based mills are slowly being phased out as newer more efficient EAF based mills come online. In recent years the industry has added, or is in the process of adding, more than 13.5 million tons of EAF flat-rolled steelmaking capacity — at a cost of at least $6.3 billion.

Consolidation has been ongoing for decades but accelerated in December 2019 when Cleveland Cliffs purchased the assets of AK Steel and its fleet of blast furnace-based steel mills in the Midwest. Less than a year later Cleveland Cliffs purchased most of the assets of ArcelorMittal USA, itself a roll up of LTV, Bethlehem Steel and

other legacy steel makers. With the acquisition Cliffs became the largest integrated steel maker in North America, followed by U.S. Steel.

More recently U.S. Steel accepted an offer to be acquired by Japan-based Nippon Steel. U.S. Steel has multiple facilities throughout North America producing coils, plate, tubes, structural long products and other goods. It shipped 15.5 million tons of various products in 2023. Cliffs was an interested buyer but federal regulators did not want to see virtually every blast furnace in the U.S. owned by a single competitor.

While the deal has not yet closed, U.S. Steel is already in the process of reinventing itself, modernizing certain facilities, purchasing Big River Steel (a 3.0 million ton per year mini mill) and ceasing the melting operations of aged

blast furnaces at its Granite City Works near St. Louis. The real effects of the Nippon takeover will likely take shape

five years from now when changes in strategic direction and culture have slowly taken hold. In the short term,

Hilco expects that if/when the Nippon purchase is completed, it will have minimal initial effect.

The Nippon acquisition probably will mean that the U.S. Steel entity will remain independent leaving four major players in the U.S., two that use EAF furnaces to melt scrap and two that primarily produce steel using iron ore and blast furnaces:

- Nucor Corporation was the first to bring mini-mill technology to the U.S. and is now a leader in most

fields that it competes in. It has 23 manufacturing facilities and produced 20.5 million tons in 2022. - S. Steel (Nippon Steel) now operates both its traditional blast furnace locations and the Big River Mini-mill. Like Cliffs it operates its own iron ore mines. In 2022 it produced 15.5 million tons.

- Cleveland Cliffs is both a mining company producing iron ore and a steel maker using that iron ore in its fleet of blast furnaces that previously operated as AK Steel and ArcelorMittal USA. It produced 16.8

million tons in 2022. - Steel Dynamics Inc. was established by former Nucor employees. SDI uses similar concepts and mini-mill technology and competes in many of the same markets. In 2022 it produced 9.7 million tons.

Data Source: MRS Steel Trading and Investment Co.

In addition to the above list, a group of smaller producers typically melt scrap to produce billets, wire rod, beams and other structural products, bars, seamless tubes and other goods. Canada currently has three integrated mills producing coils and plates. One of those mills, Algoma Steel, is currently upgrading its facility and will switch from blast furnace operations to EAF furnaces in 2026.

IMPORTS

The domestic steel industry mill utilization is currently about 78%, producing about 1.7 million tons each week. Historically, steel market prices tend to decline in Q4 each year as seasonal demand decreases and then rebound

in Q1. Thus far, 2024 is following that typical pattern.

In 2018 the Trump administration imposed a 25% tariff on most steel products. It is worth noting that steel mills tend to be located in swing states. Steelworkers vote, and the Biden administration has seen fit to keep most of those tariffs in place, although some have been eliminated for certain countries in favor of import quotas which limited the quantity of goods that could be imported.

According to data supplied by the American Iron and Steel Institute (AISI), steel imports totaled 26.1 million tons in the 12 months ended November 2023, down about 9% from the prior period. Imports of finished steel products (coils, pipe, rebar, etc.) represent about 20% of the U.S. finished steel product usage. Major import categories include ingots, billets and slabs, oil field tubular products, coiled products and other goods. The top exporting countries — Canada, Mexico, and Brazil — together represent more than half of all imported products (based on tonnage).

OUTLOOK

The continued consolidation of the steel industry has eliminated weaker players and reduced competition. While markets prices for most steel products trended down in 2022 and 2023 market prices remained above what was “normal” prices in effect prior to the COVID pandemic.

Consolidation will likely lead to rationalization of facilities providing a leaner more cost-effective market. Meanwhile the Trump era tariffs remain in effect, discouraging imports and potentially reducing market price volatility. Continued market volatility makes any commitment to purchase foreign goods more risky, as by the time those goods arrive, domestic market prices could be significantly higher or lower than the import price.

In times of uncertainty, market participants tend to reduce inventories to stay closer to then current market prices. In past business cycles, we have seen upturns in business volume quickly bring about supply shortages and rapidly escalating prices.

Most participants in the metals industry have a three- to four-month inventory including raw materials, WIP and finished goods and strive for a three month turn to flush out their older, high cost inventory and replacing it with goods at current market prices. Most tend to run leaner in periods of downward prices, reducing risk and more quickly averaging down their inventory cost. However, this like-minded approach tends to reduce inventories throughout the supply chain whereby any real increase in demand brings about shortages and rapid market price increases. Importantly, recovery values for asset based lenders typically decrease in a downward trending market and increase when the market trends upward. Additionally, companies that run lean tend to have more consistent recovery rates, while those that have more significant inventory levels are more subject to risk with more volatile recovery rates.