Rising Inflation the Industry’s Primary Headwind

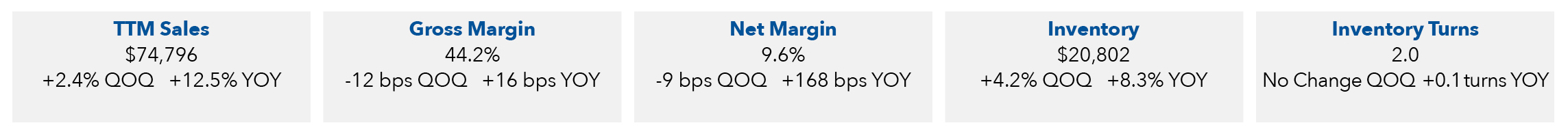

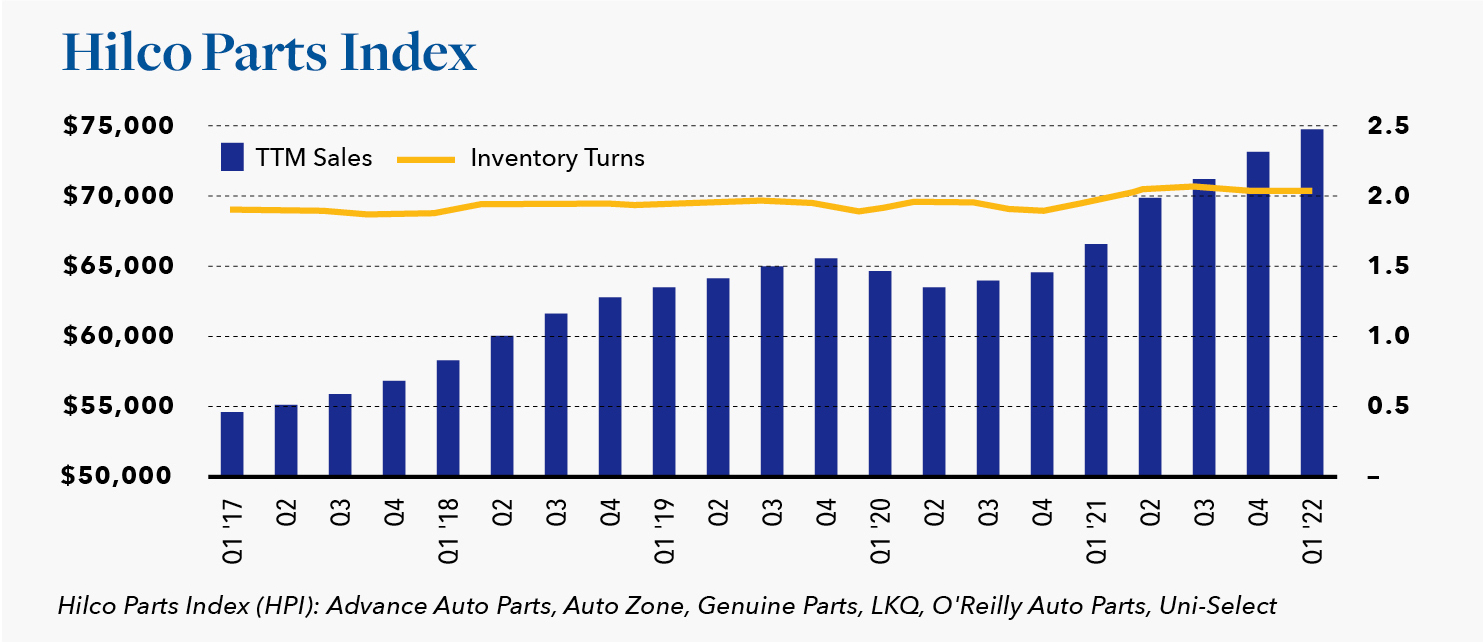

June 16, 2022 Advance Auto Parts was the last company in the Hilco Parts Index (HPI) to report first quarter earnings on May 24, 2022. For the six companies in the HPI, net sales for the first quarter increased 12.5% when compared to the first quarter of 2021. While there were several puts and takes that contributed to continued sales growth, based on management comments during earnings calls, roughly half of the increase can be attributed to organic sales growth and the other half to inflation.

During the typical quarterly earnings call, the question and answer session that follows management’s comments does not last much more than 30 minutes, but it can often seem to last much longer.

Analysts fixate on understanding things such as the impact of the weather on sales, on quantifying the month-to- month cadence, and on knowing which product categories led the charge. It can often seem like the same questions are asked over and over, as if no one is listening. During the earnings calls for the first quarter of 2022, however, there was noticeable shift in the focus with questions including: What additional color can you provide us on inflation? What is your inflation expectation for the back half of the year? For inflation are we talking mid-single digits, high- single digits, or low-high single digits? In response, executives relayed the fact that first quarter inflation ranged from 5% – 7% with at least that much expected during the balance of the year. They seemed to be delivering to the Federal Reserve (the Fed) a clear message that supply chain challenges have now been replaced with rising inflation as the industry’s primary headwind. Jerome Powell, the current chairman of the Federal Reserve, is a disciple of Paul Volcker, an earlier chairman of the Fed credited with reining in runaway inflation during the 1980’s. Jerome Powell is rumoured to carry copies of Mr. Volcker’s biography that he freely distributes to his colleagues.

For now at least, excutives representing the HPI are seeing no evidence of demand destruction from inflation. Industry fundamentals, much like miles driven, are improving. The number of vehicles in service is growing, and the average age of a vehicle in service is increasing as well. That, combined with a tight supply of new and used vehicles, bode well for the industry.

In the meantime, let’s hope that Fed chairman Powell clings as tightly to Mr. Volcker’s monetary policy as he does to his biography.

About the Index: The Hilco Parts Index is comprised of six publicly traded companies that distribute aftermarket parts, namely Advance Auto Parts (Advance), AutoZone, Genuine Parts (NAPA), LKQ, O’Reilly Auto Parts (O’Reilly), and Uni-Select. Advance, AutoZone, NAPA, and O’Reilly are the four traditional parts distributors in North America with strong commercial (do-it-for-me or DIFM) and retail (do-it-yourself or DIY) programs. Uni-Select is a much smaller distributor with a strong presence in Canada and LKQ is largely a distributor of recycled (used) parts, as opposed to new parts.

For further information, please contact Keith Spacapan at 847-313-4722 or kspacapan@hilcoglobal.com.