Spring 2022 Jewelry Market Update and Lender Monitoring Insights

In this article we provide an update to our previous jewelry market report issued in early 2021, including an examination of the macroeconomic forces that are influencing jewelry industry performance overall at this time. We also provide our thoughts on recommended lender monitoring and considerations relative to procurement, inventories and net orderly liquidation value (NOLV) in the current market.

When examining last year’s cumulative jewelry market results, it is important to first look at the comparable period in the year prior, 2020. At the start of the COVID pandemic, the jewelry sector, like most industries, initially experienced a period of great uncertainty. Concerned about their personal economic situations and general health, the vast majority of consumers transitioned their focus away from discretionary spending in favor of bolstering savings accounts. At the same time, they also shifted their shopping habits away from traditional brick-and-mortar retail in favor of online purchasing. This, understandably, had a significantly negative impact on many jewelers given the higher price point and discretionary nature of the items they sell, coupled with the historic higher concentration of brick and- mortar sales for this industry in general. During this period, jewelers that had a greater ecommerce presence prior to the pandemic benefitted as compared with their traditional brick and- mortar peers. It is also important to note that the second half of 2020 had several favorable shifts for jewelers. Falling unemployment levels, increased savings levels, low interest rates, a stock market that was beginning its dramatic rebound from the March 2020 lows, and government stimulus initiatives all created additional spending capacity for consumers in many sectors, including jewelry. This jewelry revenue growth was further aided by a redirection of consumer spending away from pandemic-restricted areas (e.g., travel and entertainment) in favor of merchandise, including jewelry.

Moving forward to last year, the first half of 2021 year-over-year sales comparison benefitted from a low bar set in the onset of the pandemic, while the second half of 2021 sales had a more challenging hurdle due to sales gains achieved in the latter half of 2020. Overall, the 12-month 2021 performance was strong as the stock market continued its climb back from the lows set in March 2020. The rising stock market throughout 2021 benefited consumers, notably those in the higher economic brackets. Historically low interest rates and a redhot housing market provided additional disproportional benefits to those concentrated in the higher economic brackets. These factors, coupled with low unemployment and a higher-than historical- average wage growth, led to a rise in consumer confidence throughout 2021. Jewelry sales also benefitted during this period, with higher-end jewelry sales outpacing more entry-level price points.

SUGGESTED LENDER MONITORING & DISCUSSION POINTS

With the first quarter of 2022 now closed, a period of general economic uncertainty has swept over the nation and the rest of the world driven by international conflict, inflationary pressures at historic levels, and a declining stock market. These trends in turn have an impact on borrower performance and appraised liquidation values. In light of this, Hilco has prepared a list of key areas of consideration for lenders to review and discuss with their borrowers/appraisers.

Higher end jewelers

Customers in this segment are less affected by inflationary pressure in commodities such as food and fuel. Attention should be paid to areas such as stock market performance, the CBOE Volatility Index (VIX), general consumer sentiment, and interest rates/housing market trends. Unfavorable movement in these areas can create a distraction for customers and subsequently create volatility in financial performance for the borrower.

Lower price point jewelers

This segment should focus more on how changes in everyday living costs — including inflationary pressure in areas such as rent, food, and energy costs combined with changes in personal savings rates — affect discretionary spending.

COVID-19 pandemic

The impact of the pandemic continues to evolve with ever-changing mandates in place around the globe. Industries such as travel and entertainment have rebounded as compared with 2020 levels, which may affect share-of-wallet spend by consumers away from discretionary items, including jewelry. Continued lockdowns in areas such as Shanghai, China, have more recently affected customer buying behavior in that part of the world.

• As jewelry begins to compete further for share of wallet with other high-ticket items, the corresponding impact on jewelry sales should be monitored.

•Any continued COVID-19 outbreaks should be monitored in different parts of the world. For example, beyond China, key semi-precious and precious stone supplier regions such as India (loose diamonds) and Thailand (gemstones) should also be monitored.

Ukraine conflict

The Russian invasion of Ukraine beginning on February 24, 2022, has created a period of general uncertainty for the global economy.

•Sanctions on Russian products/lending should be monitored by the lender. Russian-owned diamond-powerhouse Alrosa, which operates in 10 countries on three continents, is the largest diamond volume producer in the world and accounts for approximately 25% of global diamond output. The lender should understand if there has been any known historical purchasing from Russia by the borrower, and if so, whether there has been a recent change to procurement strategy. Even if the borrower has not historically purchased from Russia it is probable that sanction impacts will influence overall diamond pricing in the latter half of 2022 (regardless of whether the conflict ends in the near term). The lender should monitor changes in diamond pricing, both rough and polished, along with the borrower’s strategy regarding customer pricing.

•The lender should also discuss with the borrower any changes in customer inquiries regarding diamond traceability as it relates to diamond product from Russia. Consumers have avoided conflict “blood” diamonds in the past and it is possible that consumers may begin to reject Russian-sourced stones. Sourcing traceability may become an increased focus of companies in the future.

Supply chain

Jewelry, particularly diamonds, are low cube and high value. Therefore, unlike many industries that have been negatively affected by rising import freight costs and supply chain disruption, jewelry is more insulated. Imported diamonds are air freighted as opposed to transported by vessel and while all transportation modes have experienced increases in costs, the low cube, low weight, and high value of jewelry items creates greater freight expense absorption compared to other product types.

•While jewelry finished goods generally may not be materially affected by supply chain disruption and rising costs, the lender should understand the procurement approach by the borrower of jewelry presentation boxes and pouches, as well as other packaging material, if applicable. This product is more likely to be an import product transported by vessel and purchased in large quantities. Changes in lead times, transit costs, and general packaging availability should all be monitored. The absence of the appropriate presentation box on hand may influence an end customer’s purchase experience as well as recovery value. Beyond packaging, if the jeweler is opening new store fronts, delays in receipts of showroom fixturing driven by supply chain disruption (e.g. display cases and lighting) should also be monitored.

Weddings

2022 is projected to be a banner year for weddings after a period of pandemicrelated cancellations/delays for large Source: Monex Precious Metals Source: Monex Precious Metals Source: Monex Precious Metals events, including wedding receptions. Experts are currently projecting that approximately 2.5 million weddings will occur domestically in 2022, which is the highest rate in several decades.

•Engagement ring sales activity along with changes in Average Selling Price (ASP) and related customer buying behavior should all be monitored. Additionally, the borrower’s ability to transition the engagement customer to a wedding band customer and then further into becoming a “customer for life” should all be tracked. While a jewelry engagement sale is hopefully a oncein- a-lifetime event for the customer, the ability for the borrower to transition this customer into a center stone diamond upgrade program should also be tracked. Active customers likely represent a higher lifetime value for the borrower and are a key target market in a liquidation Sale event; therefore, the active customer listing and related trends (e.g., customer count, average transaction size, and frequency of transactions) should be closely monitored.

Precious metal price trends

As noted in the charts on this page, Gold, Silver, and Platinum have generally followed a similar trend to one another in recent months, rising from lower levels in January 2022 to a year-to-date high point on March 8, 2022. Gold is generally viewed as an investment safe haven and behaves in an inverse fashion as compared to the stock market. More recently, the stock market sell off — driven by factors such as rising inflation and the Federal Reserve raising interest rates — is also influencing gold pricing. Instead of favoring gold during a period of rising inflation, investors are flocking to other assets, such as real estate.

•The lender should understand the exposure to different precious metal types found within the borrower’s inventory mix. The lender should also understand how changes in precious metal input costs affect the borrower’s retail pricing strategy (and subsequently customer buying behavior) as well as achieved gross margin.

Loose diamonds pricing trends

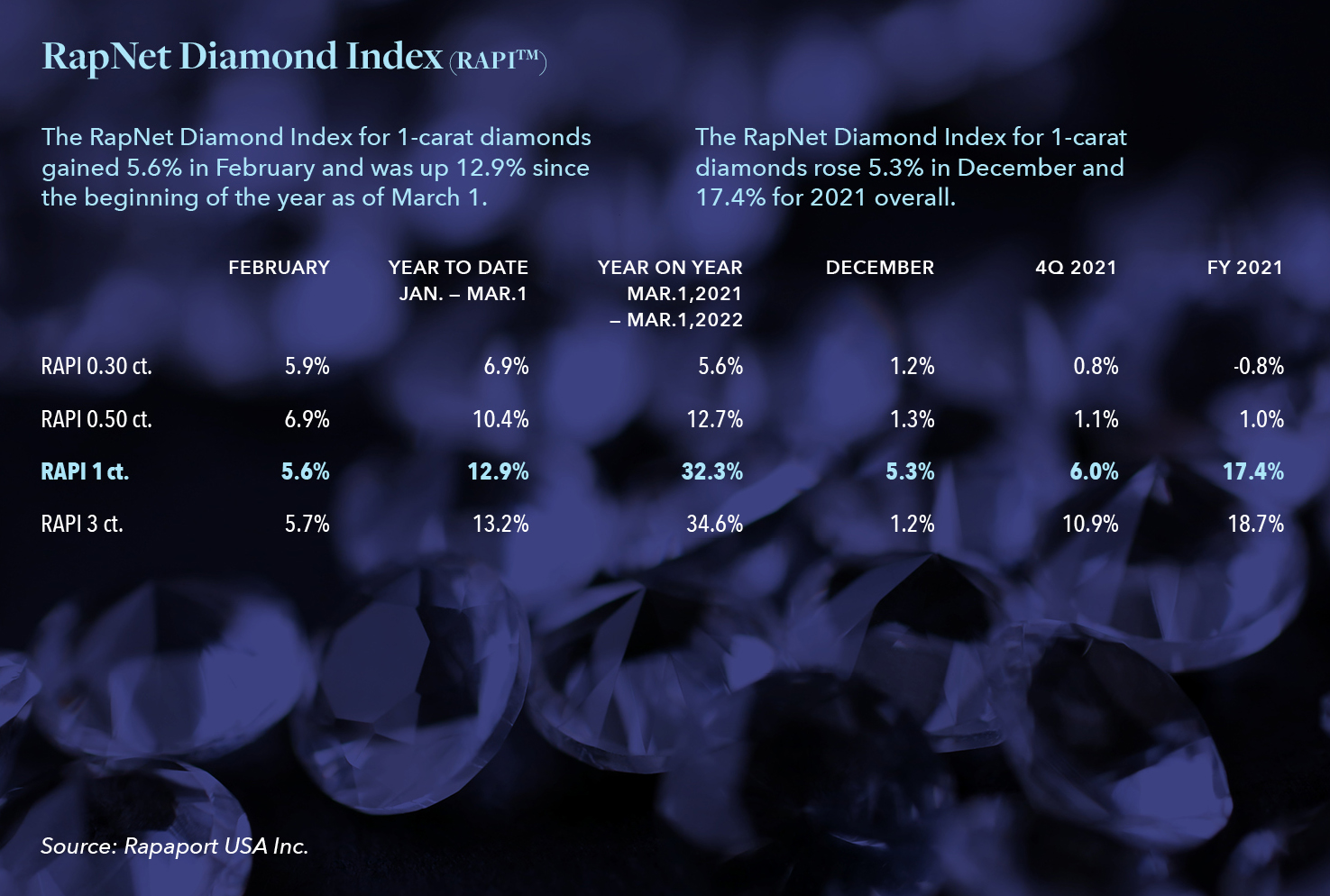

According to Rapaport (an industry diamond pricing source), average loose diamond prices increased 17.4% for onecarat and 18.7% for three-carat for 2021 compared to 2020. Conversely, 0.30-carat and 0.50-carat stones remained relatively unchanged. Supply chain shortages on the rough side, coupled with increased consumer demand, drove up larger stone diamond pricing. Hilco also noted continued diamond price appreciation into 2022.

•The lender should monitor the impact that increases in diamond pricing has on the borrower’s pricing model and the ability to pass vendor price increases through to customers. Generally, the more expensive the diamond, the lower the margin percentage becomes while the margin dollars increase.

Payroll

The jewelry sector, like many sectors, has been affected by the lack of worker availability and general wage inflation. Additionally, positions such as sales representatives, cutters, and gemologists are all trained positions that have different skill sets as compared to general retail sales staff or distribution employees in other industries.

•The ability to attract and retain skilled employees during the current tight labor market should be monitored.

•Increases in historical payroll run rates will influence the inventory appraisal liquidation expense structure for retained positions in a Sale and should also be monitored.

Advertising

Digital advertising, including payper- click performance advertising spend, has experienced a period of material inflationary cost increases throughout 2021.

•The lender should monitor the borrower’s advertising approach including advertising mediums utilized. Specific to pay-per-click, the lender should understand the profitability at a detailed level for the pay-per-click services. Changes in the borrower’s historical advertising run rates will influence the liquidation expense structure in an appraisal analysis. For ecommerce companies, this advertising expense impact is generally magnified.

Hilco Global, through its overall deal count volume and diversified platform of business verticals, conducts thousands of hours of senior executive conversations each month with borrowers. These management conversations provide a wealth of knowledge with up to the minute insights on the constantly changing market environment, which Hilco is then able to pass along to its clients. We are here to help our lending clients and borrowers leverage Hilco’s collective knowledge base to make critical and informed lending decisions.