The Automotive Aftermarket Remains Cautiously Optimistic

March 1, 2022 This time last year the automotive industry was only cautiously optimistic. The last stimulus payment was to be made March 15 and enhanced unemployment benefits were scheduled to cease in September, so there was concern that sales might decelerate in the second half of the year.

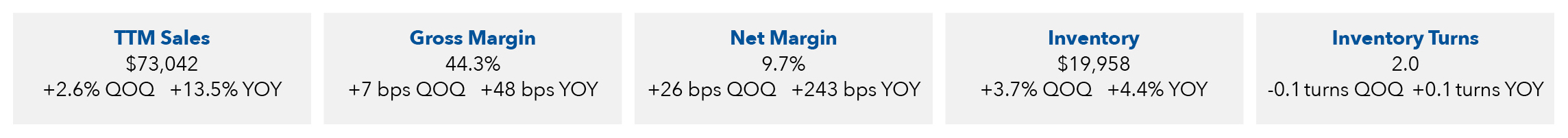

Instead, sales, profit margins, and inventory levels have all improved. For the six companies that comprise the Hilco Parts Index (the Index), net sales were $73 billion for the 12 months ending with the fourth quarter of 2021. Compared to the 12 months prior, sales increased 13.5% on a nominal basis. For stores open at least 12 months, organic sales were up 10% – 15% for the quarter and, in some cases, nearly double that on a two-year stack basis.

In 2020 the challenge was COVID-19. After learning how to co-exist with the virus, the challenge in 2021 became the supply chain. So far in 2022, the challenge is inflation that has been exacerbated by lingering problems with the supply chain. A significant portion of aftermarket sales are nondiscretionary and not sensitive to rational price increases. For now at least, the industry continues to successfully defend its margins by increasing prices to the consumer. However, the cost of labor inflation is acute and the ability to pass on these costs to the consumer is less assured.

Companies in the Index are reporting that the battle for talent is intense. The level of absenteeism is not the issue but the level of turnover and associated training is driving up costs. In the back half of 2021, companies in the Index reported inflation in the mid-single digits and their outlook for the 2022 calendar year is more of the same.

Sales demand improved sequentially throughout the fourth quarter of 2021 and, although we are only six weeks into the new year, it appears the momentum has spilled over into 2022. And why shouldn’t it? The vehicle population is aging, the supply of new cars is limited, and the number of miles driven continues to recover.

However, like this time last year, the Automotive Aftermarket remains cautiously optimistic. Last year’s optimism was dampened by supply chain limitations. This year’s optimism is being dampened by limitations in the labor market and the implications for inflation. According to some, the biggest risk to the 2022 forecast is talent.

About the Index: The Hilco Parts Index is comprised of six publicly traded companies that distribute aftermarket parts, namely Advance Auto Parts (Advance), AutoZone, Genuine Parts (NAPA), LKQ, O’Reilly Auto Parts (O’Reilly), and Uni-Select. Advance, AutoZone, NAPA, and O’Reilly are the four traditional parts distributors in North America with strong commercial (do-itfor-me or DIFM) and retail (do-it-yourself or DIY) programs. Uni-Select is a much smaller distributor with a strong presence in Canada and LKQ is largely a distributor of recycled (used) parts, as opposed to new parts

For further information, please contact Keith Spacapan at 847-313-4722 or kspacapan@hilcoglobal.com.