The Crisis in Perspective

While the COVID-19 pandemic is a crisis of immense proportion that is unique in many ways, this is certainly not the first time that sudden, unanticipated circumstances have resulted in drastic and abrupt changes in economic or consumer behavior. Key learnings gained through our work during multiple crises, including the two cited below, can be applied here.

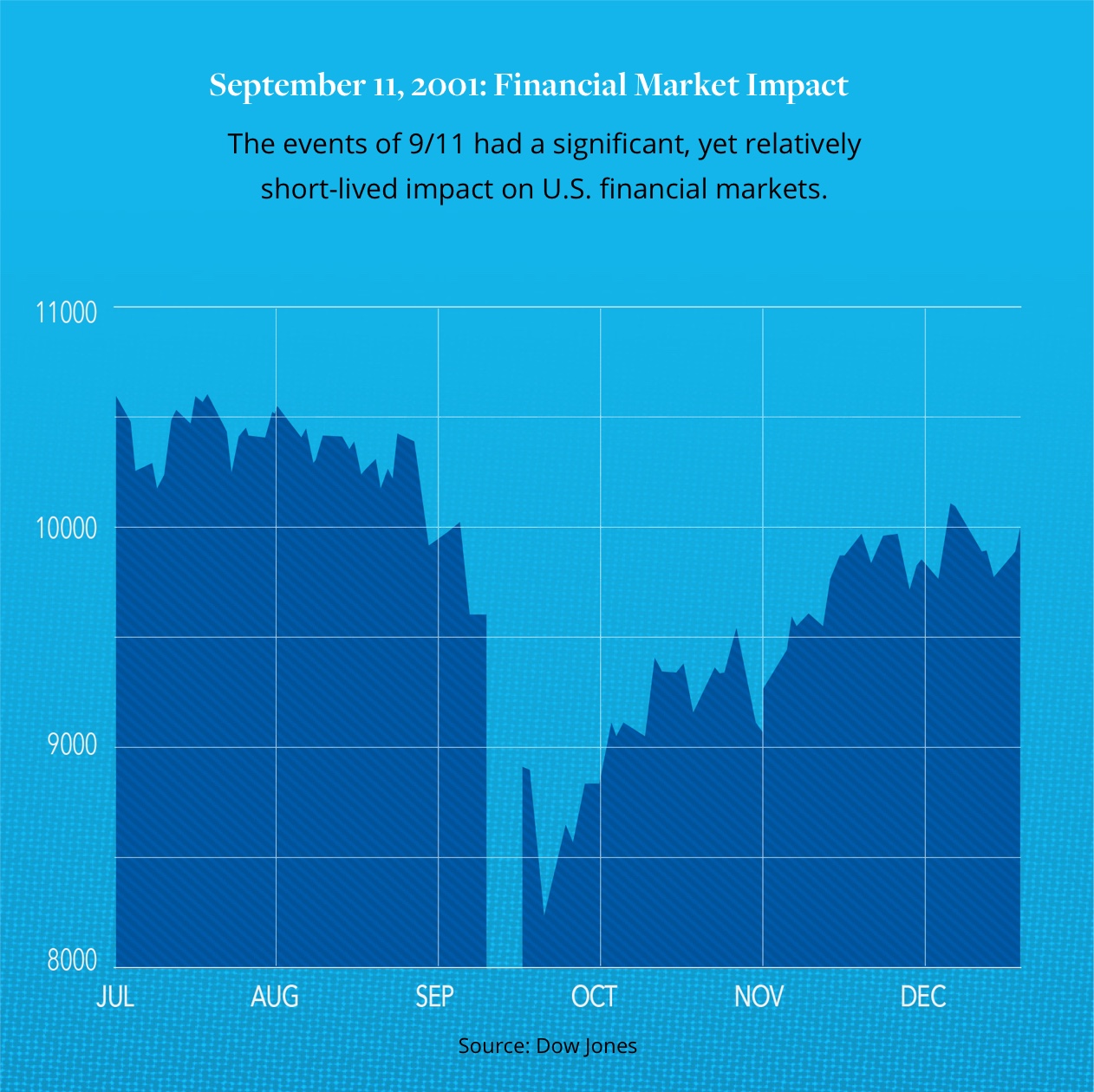

In 2001, As We Undoubtedly Will Never Forget, Certain Discrete Areas of the Country Were Significantly Impacted by the Events of 9/11:

- Public and private sector services ceased or curtailed operations.

- Consumer behavior changed dramatically as people began avoiding crowded areas such as malls and restaurants.

- Cost/retail relationships were not universally understood and unexpected losses in value occurred. Temporary POS discounts, implemented to drive traffic and sales in the short term, negatively impacted recovery values.

- Although some businesses failed, affected areas saw retail normalize and values return to customary recovery levels.

The Lasting Fallout From the 2008 Financial Crisis Was Quite Different:

- There was no definitive pause to everyday life for residents of the U.S. or to retail operations.

- Consumer behavior didn’t change much during the crisis, mostly resulting from:

- Unemployment remaining relatively low when compared to other countries.

- Availability of consumer credit.

- The recession emerging gradually as opposed to suddenly.

- Demand for retail continued to exist as consumers sought a bargain.

- Multipliers and recovery values remained generally consistent with exceptions for certain discretionary goods such as jewelry.

- During this period, lenders were patient with borrowers where liquidity allowed.

- By 2009 and beyond, the fundamentals of many retail businesses were still sound and the businesses were not over-leveraged. Moreover, the shift to e-tail was still in its infancy.

The Fallout From COVID-19 Pandemic and the Anticipated Recession Will Be Different Than Both Crises

We can, however, still draw numerous correlations and apply learnings from these two events to the environment we are now facing:

- Predictable multipliers and recoveries have facilitated ABL’s evolution, which now includes FILOs.

- Retailers have significantly more debt than they did previously. A typical capital structure can include an ABL, a FILO, and tranches of term debt. This presents unique challenges for lenders:

- Retailer’s access to capital may be challenged.

- Workouts are more complex due to multiple creditors and new distressed debt holders.

- Life as we knew it has now changed abruptly and drastically for an unknown period, as was the case after 9/11.

- As was the case after 9/11, consumer behavior has and will continue to change. E-commerce continues to capture more retail business, and customers will undoubtedly turn to online shopping more in the coming weeks and months. This shift in consumer behavior will build new online shopping habits, putting further pressure on brick and mortar retail once circumstances begin to normalize.

- As was the case during the 2008 financial crisis, the Federal government is working to encourage consumer spending, avoid mass layoffs and stabilize markets.

- Nearly every retail sector will be impacted. Exceptions include e-tail, grocery, pharmacy and some other essential sectors.

- If recoveries and multipliers typically achieved will increase, they cannot also fail to return to pre COVID-19 levels due to online shopping.

- The extent to which online shopping habits formed during social distancing and shelter-in-place persist in the long-term will be a function of how long the current disruption persists. The downstream traffic effects on brick and mortar retail are unknown at this time. However, these factors may accelerate existing trends in consumer behavior and the use of technology.

In the interim, we want to help by providing real and practical guidance for you to apply to your daily challenges.

Through the Month of April 2020 Hilco Recommends That Lenders:

- Consider delaying collateral updates on existing appraisals until retail reopens. We advise this because the period during which retail may be closed is uncertain. Assess each loan on a case by case basis as not every retailer is created equal; we are happy to give you our assessment of any situation and complete collateral updates to suit your timing requirements.

- Consider the best way to protect your collateral, but try to get something from your borrowers in return for any accommodation you provide. Under these circumstances, information may be paramount to protecting your collateral.

- Advise borrowers to update employee lists and validate current contact information.

- Ensure that borrowers have identified key personnel needed to maintain operations, especially e-comm staff.

- Request your borrower work to provide separate reports for their e-comm business from both a management and finance perspective as this may become the most viable aspect of the business once operations resume.

- Make sure your borrowers are acting appropriately vis a vis their vendors and suppliers and not disproportionately asking for relief from you.

- Require delivery of these as part of any forbearance or other waiver or in consideration for any over-advances or protective loan.

- Consider enforcement actions only as a last resort.

- We can provide suggestions to help preserve and protect your collateral if you have concerns.

- Remain cognizant of the fact that it is very difficult to provide the impact on values without understanding the circumstances of each borrower. For example:

- Grocery would not have the same negative trend that fast fashion might.

- Supply chain and other unique factors will have an impact.

- Consider each asset class separately.

- Even if you don’t have a current lien on certain asset classes, you may be able to get one as part of a forbearance or as part of a DIP. Don’t be afraid of providing a DIP loan to protect your collateral and position. We can assist you in assessing the pros and cons.

- Make certain that proper assets, operations, and other documentation are preserved.

- Be diligent in ensuring that critical personnel and “tribal knowledge” are preserved.

Hilco can help identify the information and people needed. We can also provide estimates on values of other unencumbered asset classes.

From May Through October 2020, Hilco Recommends:

- Refresh all appraisals. Things have and will continue to change. Consumer behavior will change. Understand the impact on the value of your collateral so you can make fully informed decisions BEFORE the holiday season.

- Particularly in monthly borrowing base situations reported on the 15th or 20th of the following month, conduct targeted field exams to evaluate deal-specific issues including:

- Current collateral quality.

- Current levels of trade support and status of landlord obligations.

- Diligence of the e-comm administration and management infrastructure to assess its level of functionality and status of unique critical vendors.

- Affirming the current season’s performance and outlook for next season.

- Focus on preserving clients with strong or growing e-tail businesses. These are the retailers most likely to survive 2020.

- Don’t paint with broad brush strokes. Instead, evaluate each borrower separately.

- Don’t be afraid of chapter 7. We have successfully navigated several chapter 7 liquidations. In part, it depends on the jurisdiction in which the case is filed. Call us, we can help guide you and provide the pros and cons based on our real-world experience.

We Are Here to Help!

Whether you just need a sounding board or are looking for more strategic guidance during this unprecedented period, please reach out to our worldwide Retail Team. We are in contact with the market daily, working with key industry players on the front lines of this crisis and can bring you timely insights and actionable strategies based on those interactions and our own wealth of valuation and monetization experience. Call us anytime about any topic!