The U.S. Automotive Industry Ends the Year on a Positive Note

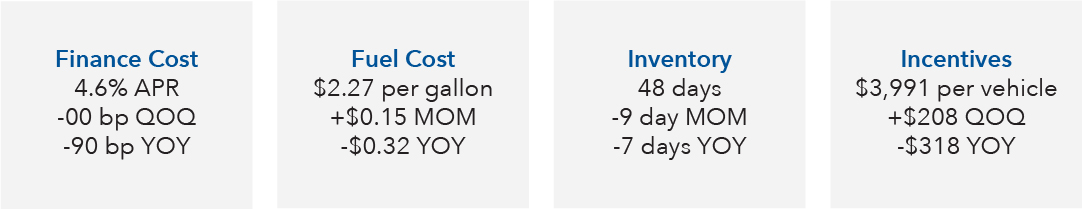

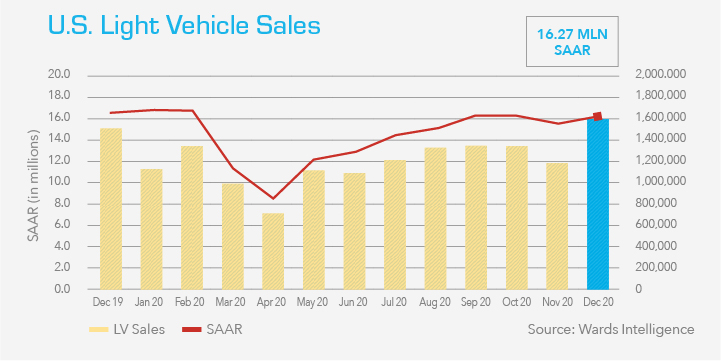

January 18, 2021 – The seasonally adjusted annualized rate of sales (SAAR) for light-duty vehicles topped 16 million vehicles in December for the third month since April, when the industry slumped to a 50-year low. For the full year, light-duty vehicle sales totaled 14.6 million, a decrease of 14% from 2019. Not great, but a whole lot better than analyst expectations in March when dealer floor traffic and assembly plant production was at a standstill, and every analyst had cut their forecast for the year from nearly 17 million vehicles to under 13.5 million vehicles. So what has changed since March?

Original equipment manufacturers and their extensive supplier network have once again demonstrated their ingenuity by figuring out how to restart production while respecting social distancing protocols that protect their workforce. For its part, the dealer network had been experimenting with various on-line retail models for years but, until now, failed to make a real connection with consumers. Suddenly, consumers were shunning public transportation and ride sharing options in favor of personal transportation. Additionally, those that could afford to buy were opting to buy bigger vehicles loaded with expensive options. The K-shaped recovery described by economists is playing out in the auto industry in real time. White collar employees that could work from home, found themselves flush with money that they could not spend on leisure activities such as dining and travel. The only nameplates to report year-over-year volume increases in 2020 are three luxury brands: Tesla, Volvo, and Alfa Romeo. The average transaction price set an all time record above $40,000 in December.

Looking forward, dealers say their biggest challenge is lack of inventory. The total U.S. supply of unsold new vehicles was 3.0 million at the end of December, a 48- day supply at current sales levels. Dealers prefer stocking levels of around a 60-day supply, anything less and they risk lost sales. Manufacturers say they would build more if they could but their biggest challenge right now is supply shortages, namely computer chips. Worldwide productive capacity for computer chips is constrained by the increasing demands from manufacturers of automobiles and consumer electronics. Much like automobiles, consumer products such as phones, game consoles, laptops and TVs are increasingly complex, requiring ever —more computer processing capability. Chipmakers favor consumer-electronic customers over automotive because those volumes are higher and the associated margins are fatter. Assuming there is some relief from chipmakers beginning in the second quarter, analysts expect the market to recover to 16 million vehicles in 2021. Some of the risks to the forecasts include the the roll-out of the vaccine, the continued strength of the stock market, and the resurgence of the fleet market.

For Further Information, Please Contact:

Keith Spacapan | 847.313.4722 | kspacapan@hilcoglobal.com