When It Rains, It Pours…Considerations for Lenders to Harness Intangible Collateral in Anticipation of an Article 9 Sale

Asset-based lenders face rough seas when borrowers default. Savvy preparation and digital asset safeguards can help weather the storm.

Asset-based lenders make loans to borrowers in the hope and anticipation of repayment. In fact, the majority of loans are repaid in the ordinary course. But the weather isn’t always sunny.

An asset-based lender can often see the storm clouds coming in. Perhaps the borrower stretches interest payments or delays delivering borrowing base certificates. There could be covenant defaults, an unsuccessful capital raise, or a sale process that does not result in a transaction. A default notice and a forbearance agreement may follow.

Within the workout groups of banks and non-bank lenders, the risks of non-payment and default are paths well-traveled. The loan officers in these groups often find themselves in a familiar but tough spot: a borrower defaults, the lender is left with an outstanding loan on its books, and there is no prospect of any forthcoming repayment. To be sure, in many cases there may be assets to monetize. But there are likely to be scant funds with which to run a sale process. And, if the borrower manages the sale process, there are often mismatched pricing expectations, where the borrower seeks to sell assets for substantially more than the outstanding loan balance.

The lender is in “no man’s land” – holding an unpaid debt and not holding the keys to the business. Given the borrower’s default, a sale of the lender’s collateral under Article 9 of the Uniform Commercial Code is on the horizon.

In an Article 9 sale, the lender transfers the borrower’s interest in the lender’s collateral to a foreclosure buyer with the proceeds of the sale being applied to the lender’s loan. But there is a clear distinction between the borrower’s interest in the collateral and what the lender can actually deliver to the buyer. For example, a lender’s collateral may include a borrower’s data, e.g., customer lists, transaction histories, descriptions of client engagements, marketing analyses, and the like. The lender may in theory have the right in an Article 9 sale to sell the borrower’s interest in the data. However, without an ability for the buyer to access the data, it is unlikely that a sale will result in a maximum sale price for the assets.

To maximize the sale price, the lender needs to know what it can actually deliver to the buyer as part of the sale. Is the sale nothing more than a naked sale of the borrower’s interest in the collateral? Will that be sufficient? In the case of trademarks and patents, the answer may be “yes.” In the case of certain intangible assets which are only unlocked through access to login credentials and the tangible components of intangible assets, the answer is probably “no.”

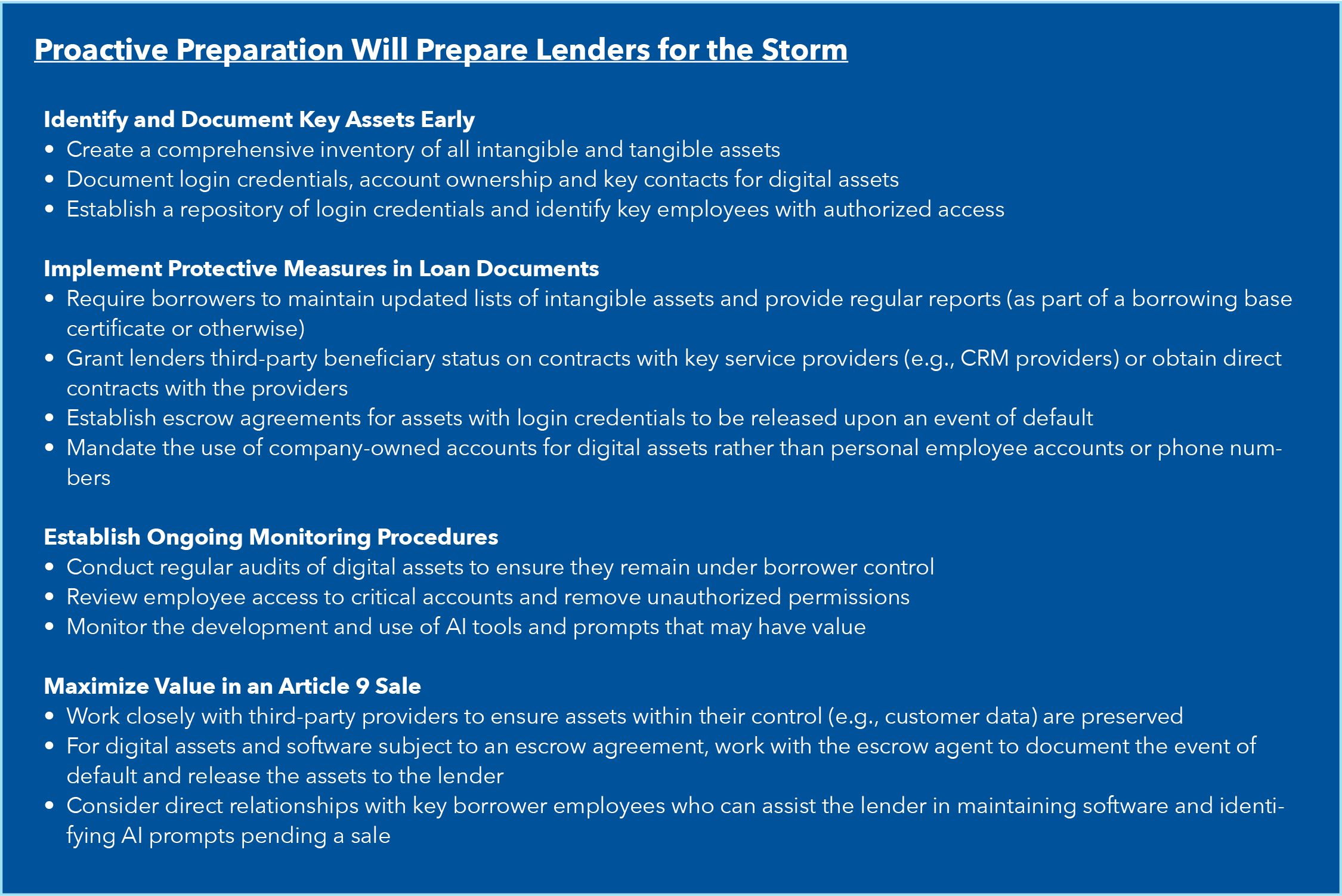

In circumstances where the collateral value is primarily tied to the borrower’s intangible assets, a redeployment of those intangible assets may lead to sunny days ahead. But, first, the lender needs to take certain important steps so that the components of those intangible assets – the data, the logins associated with registrars holding accounts bearing the borrower’s brand name, and software code – are preserved, before commencing an Article 9 sale. The best time to do this is before the storm, when the weather is sunny, and the loan is at its inception.

Lenders would benefit from implementing certain strategies before closing to ensure that, if they have to conduct an Article 9 sale, the deliverables include more than the borrower’s naked interest in the collateral. Implementing these strategies will allow the buyer – or the lender itself in the circumstance where the lender is the successful bidder in a public Article 9 sale – to promptly and meaningfully redeploy the assets, thus maximizing the sale price.

Leveraging Third-Party Data Solution Providers to Ensure Data Preservation

Data is the lifeblood of many companies. Retail and consumer companies often maintain purchase history data down to the SKU level. Financial services institutions, software companies and professional services companies use data to track client engagements. If a borrower has data, the data is often a valuable asset to be included in an Article 9 sale, subject to privacy restrictions.

As part of its diligence before making a loan, a lender will typically learn about the type of data that a borrower has, how it is utilized and who the borrower’s customer relationship manager (CRM) software provider is (i.e., Salesforce). Generally speaking, it is not advisable for a lender to maintain a copy of a customer or client database because doing so exposes the lender to privacy risks.

However, if data is a key asset that supports the borrower’s business, the lender should consider becoming a third-party beneficiary of the borrower’s contract with the CRM provider or obtaining an agreement from the CRM provider to provide a similar contract to the lender upon the borrower’s default. As a third-party beneficiary or direct contracting party, the lender should be able to gain access to the data if the borrower defaults and refuses to turn the data over, or if key employees needed to access the data leave the company before the sale closes.

Unlocking Social Media Accounts and Domain Names

Social media accounts and domain names are often vital to a company’s business, particularly for a business-to-consumer company, connecting the brand directly to its customers. The borrower’s interest in the social media accounts and domain names may often be capable of being transferred and redeployed. However, if the seller does not have the credentials to access these valuable assets, a buyer may spend significant time trying to access the assets. As a result, if potential buyers know that they will need to go through an asset recovery exercise, they will often pay less for the assets.

To maximize the value of these assets, lenders would be well positioned to require that the borrower establish a repository of login credentials and centralize them so that they are accessible to not only certain trusted company employees of the borrower but also the lender.

Typically, login credentials for digital assets such as social media accounts and domain names are spread across the borrower’s organization, including within marketing and IT functions. In particular, company social media accounts are often associated with – and inextricably tied to – an employee’s personal social media account. Phone and text confirmations to access digital assets are often routed to employee personal phone numbers. Both borrowers and lenders would be well-served by establishing company-owned accounts with which to access brand-level digital assets, including master email addresses and company-managed phones with which to authenticate the accounts.

Social media accounts may pose a particular problem if the borrower does not have documentation establishing ownership to the accounts and a policy controlling who has access to the accounts to post content. In the Vital Pharmaceuticals bankruptcy case, the court determined that the debtor, and not its equity owner, owned certain social media accounts. However, because the debtor had not properly documented ownership or controlled access to the accounts, the court had to perform an exhaustive analysis of the use of the accounts to determine ownership.

Accordingly, lenders will want to ensure that the digital assets are documented as owned by and are registered to borrower and loan guarantor entities and that a regular audit of these accounts is performed to ensure that the documentation and registrations are maintained within the borrower and guarantor group with appropriate policies in place governing access to digital assets. For additional protection, a lender should consider implementing a digital assets escrow agreement to ensure that, upon an event of default, the lender can gain access to the digital accounts to preserve them pending an Article 9 sale.

While it is possible for the seller to recover digital assets during the Article 9 sale process, or for the buyer to do so, connectivity to the borrower’s customer base can be disrupted. In the case of one well-known fitness brand which went through bankruptcy, the estate owned the brand’s primary domain name but did not have access to the credentials for the domain name registrar. To regain control of the domain name, the bankruptcy trustee had to initiate a Uniform Domain-Name Dispute-Resolution Policy (UDRP) action provided for in the borrower’s domain name registration agreement. Upon the commencement of the action, the individual with access to the login credentials – a former employee – was revealed, paving the way for the trustee to reclaim the domain name and enable its transfer during the sale process. With some planning in advance, the need for the UDRP action could have been avoided.

Escrowing Source Code to Preserve Software Platforms

To be sure, software is one of the most difficult assets to preserve when contemplating an Article 9 sale. The reason is that the software development team is often the holder of all documentation pertaining to the current state of the software and that team has significant know-how with respect to the utilization of the software. It is also the team that maintains the software and is required to monitor troubleshooting efforts. The difficulty of harnessing and preserving software in an Article 9 sale may even impact the willingness of traditional asset-based lenders to lend to software-as-a-service (SaaS) companies. To complicate matters for SaaS companies, the software needs to be maintained and serviced. Otherwise, customers will stop paying for its use or will migrate to a new provider.

Nevertheless, lenders can position themselves to preserve software by establishing a source code escrow. Upon the borrower’s default, the lender can require the escrow agent to deliver the source code to the lender for preservation. The lender may then choose to independently retain members of the software team to preserve the software or bring on its own team to maintain the status quo pending a sale.

Thinking Ahead to Borrower’s Utilization of Artificial Intelligence

A borrower’s utilization of artificial intelligence (AI) tools is the next frontier of lending and, by extension, Article 9 asset sales.

It may be that a borrower’s proprietary AI tools will soon become an asset against which lenders will extend loans. Even companies that do not develop their own AI tools may have valuable AI-related assets – for example, prompts that assist with content generation (often used in marketing) or that assist with rote, repeatable tasks. In a sale of the borrower’s assets, potential buyers will begin to ask questions about what prompts make the borrower’s business more efficient and more successful. Lenders should position themselves to harness these assets through regular audits and sharing – or even escrowing – prompts put into AI tools.

This article was originally posted in ABF Journal.