Finding Certainty in an Uncertain Market

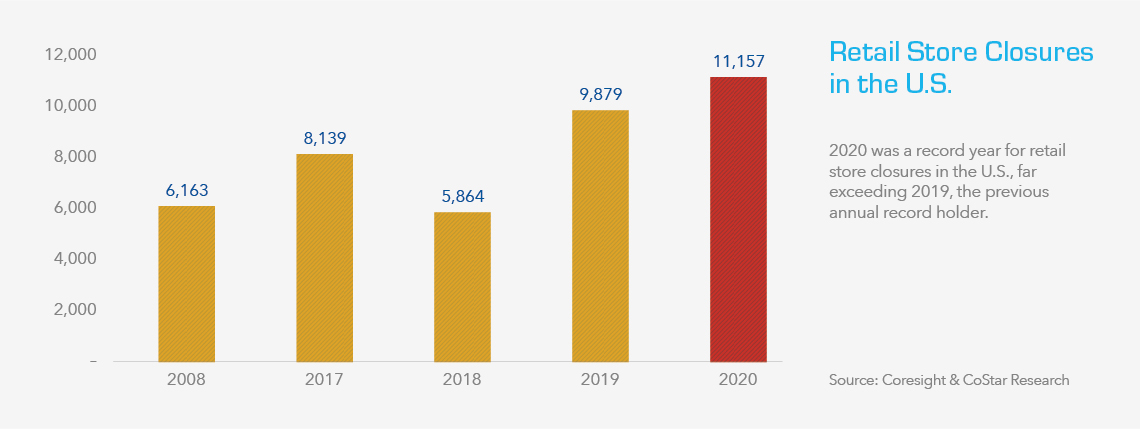

Prior to 2017, the largest number of retail stores to close in any given year occurred during the financial crisis in 2008. That changed in 2017, the first year of the oft described “retail apocalypse”, and new records have been set in every subsequent year but for 2018, which fell just shy of 2008’s number. Indeed, so many stores closed in 2019 that many industry experts didn’t believe 2020 would be able to surpass that high-water mark. But, with the help of COVID-19, 2020 set another record with over 11,000 closures.

The variability of COVID-19 lockdowns and restrictions due to the state-by state approach with which government responded to the virus created three distinct outcomes. First, lockdowns pushed the most distressed retailers into bankruptcy and a wave of filings occurred beginning in late April. Second, stressed companies such as JCPenney, without bankruptcy in their near-term outlook, were forced onto an irreversible path towards a filing or sale. Third, there was tremendous market uncertainty for retailers and lenders that forced quick and fateful decisions.

At the outset, the variables incident to these decisions – skyrocketing unemployment, changes in consumer behavior, store geography, store format, impact to GOLVs and NOLVs, and the market reaction to IP values — were all unknown. For retailers, lenders, and their advisors, the ability to quickly clarify how these variables impacted both business and asset values became key to informing transformative decisions.

Finding Certainty

As a market leader in operating store closing sales (Hilco was involved with approximately one-third of all 2020 U.S. closures in addition to stores in Canada and Australia), in acting as a buy and sell side advisor for retail IP, and in restructuring retail leases, Hilco collects robust and proprietary real-time market data. This data supports Hilco’s valuation and field exam professionals, creating a One Hilco approach to support our retail, lending, and advisory partners.

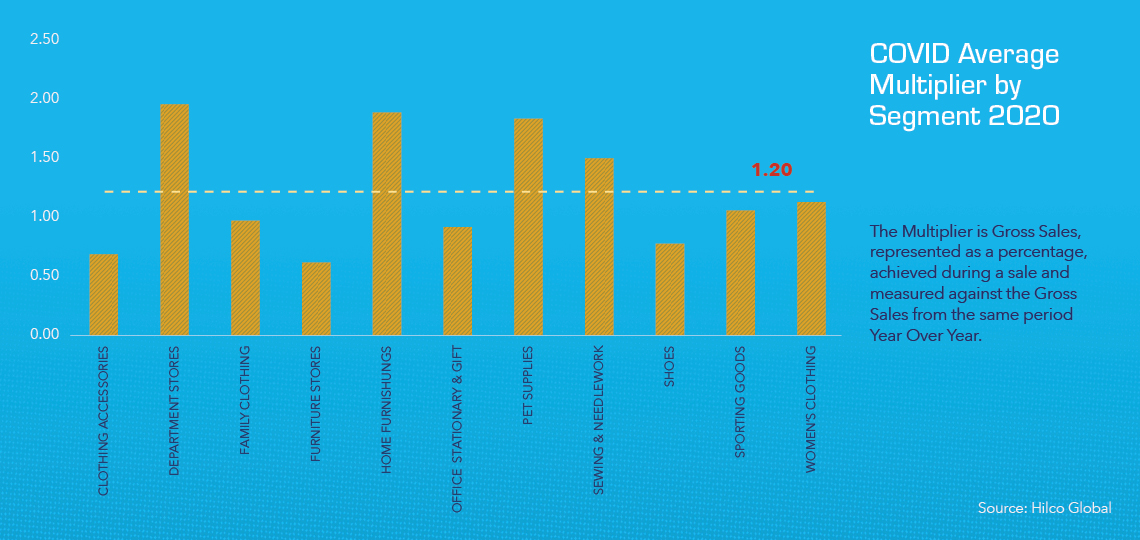

Monitoring over 11 retail segments during the early pandemic period store closing sales, Hilco quickly confirmed its early thesis that retail segments and store formats were not created equal. Certain segments and formats clearly performed better or worse than others as well as in comparison to their pre-COVID expectations. Hilco found that closing Department Stores – boosted by numerous value-oriented chains – were particularly resilient. 2020 Sales in a store closing or GOB context averaged almost 300% of the 2019 same prior-year period. Alternatively, and despite tremendous demand for outdoor goods, some Sporting Goods retailers barely achieved 100% of their prior-period sales in store closing and GOB settings. Hilco would have expected that number to approach 200% in a normalized environment, but team-oriented clothing stock fell out of favor with consumers while sports were shut down, hurting sales and driving less overall traffic.

Similarly, store closing sale performance across different store formats varied. Those that performed the best were anchor stores at malls (often times Department Stores), which are large, convenient, and have multiple entrances and exits. Specialty and in-line mall retail stores, which require customers to walk through anchor stores or main mall entrances, struggled. Only in cases where a brand enjoyed significant goodwill – loyal customers with a propensity to view the brand favorably and motivated to act on those attributes – did in-line mall stores see an appreciable lift as part of a store closing or GOB sale.

These insights and Hilco’s ability to gauge intangible variables like goodwill, which can materially affect asset values, helped to provide needed certainty to retailers, lenders, and their advisors as they considered their options and made determinative decisions.

Valuations & Field Exams

These insights and timely data sharing allow retailers to maximize their liquidity and asset valuations by increasing NOLVs and therefore ABL availability, while providing detailed information to provide comfort to their secured lenders. These data sets augment over 20 years of 1,000+ annual appraisal and field exam report data to enable all parties to make better informed decisions – open to buy, rent, payroll, or any other decision stemming from the balance sheet and liquidity – faster. Real-time data sharing was particularly important given market variability in 2020. In Q2, GDP fell 31.4% only to rebound by 33.1% in Q3. This reflected government stimulus and changing consumer behavior, setting a record swing. Owing to that volatility and to ensure they had the most precise values, many lenders doubled the number of their collateral updates. Those which had annual updates shifted to bi-annual while those with bi-annual shifted to quarterly. Because each update requires new data, management meetings, and store visits, limiting client friction is incredibly important. This is especially true in a rapidly changing environment.

streamlined data requests and store visits. This is relevant when conducting an appraisal and field exam or multiple appraisals (inventory, IP, FF&E, real estate) simultaneously by bundling data requests, visits, and store diligence into one streamlined event. Where physical visits are not possible, digital solutions can be utilized for interviews and DC test counts for field exam and borrowing base reports. When separate providers are engaged to appraise separate asset classes and to conduct field exams, friction and delays can result from the need to reconcile report inputs like definitions and data points.

When definitions for items like slow moving inventory, turn, and gross margin calculations do not match between workflows, it creates a considerable amount of work for the lender and the client in order to reconcile such issues in the final reports.

Leveraging one firm with collective market leading expertise alleviates these concerns, as Hilco did for its clients throughout 2020. Providing borrowers more time to run their businesses while delivering a better and more precise work product delivers much needed certainty in an uncertain market. That certainty is created with custom tailored reports that guarantee the appraised values for defined periods of time should the business liquidate, which was anywhere from 3-6 months in 2020 versus 12 months in normal times due to COVID uncertainty.

In a highly volatile market, the assumptions that drive valuations can be tested in unprecedented ways. In 2020, Hilco was approached more times than in any other year for “second look” appraisals – instances where retailers or their lenders questioned assumptions and results from an initial appraising source. In many of these instances Hilco was comfortable providing appreciably higher NOLV’s due to its robust in-market and real-time analytics driven from events it was concurrently operating. This capability provided retailers with much needed additional availability and lenders with comfort that their clients could withstand the current environment and should be supported.

Intellectual Property & Real Estate

Early on, the largest open-ended valuation questions of 2020 were with respect to Intellectual Property values, one of the fastest maturing sources of lending availability. Physical restrictions drastically accelerated e-commerce adoption and quickly shifted both consumer behavior and expectations. Indeed, Hilco estimates that online adoption advanced five years in 2020 alone. However, increased adoption also cannibalized brick and mortar sales while being less profitable. Increasingly, borrowers and lenders looked to intangible assets to support additional or higher advances. Hilco’s IP valuation product continued to lead the market in providing conservative intangible asset valuations based on over a decade of IP disposition experience. In the second half of 2020, the IP disposition market benefitted from an influx of buyers seeking to capitalize on the growth in e-commerce adoption.

Traditional brand management platforms –Authentic Brands Group (ABG), Marquee, Bluestar, and others continued to disrupt the market in 2020, but were also met with new market entrants. These new entrants included digital marketing platforms looking to aggregate brands and operate them through a single consolidated central service infrastructure, landlords, strategic acquirers, and other licensing platforms. Overall, new and more diverse buyers fed IP recoveries and will likely continue to do so at least in the near term – a welcome development for lenders and retailers in search of increased availability.

Notably, after Hilco successfully partnered with Authentic Brands Group, Simon Property Group, and Brookfield (then GGP) in 2016 for the acquisition and subsequent operation of Aeropostale, landlords also reemerged as prominent market participants. Motivated by Aeropostale’s successful model, landlords became acquisitive to posture both offensively and defensively. No group better exemplifies this than ABG and Simon which, through their SPARC operating entity, purchased Forever 21, Brooks Brothers, JCPenney, and Lucky Brand during the pandemic to become the market leading landlord acquirer.

Posturing defensively, Simon and Brookfield acquired JCPenney to protect against losing an incredibly valuable anchor tenant. Understanding that losing JCPenney might result in previously unimaginable losses through direct closures and the domino co-tenancy clause effect, the group paid $800MM to keep the retailer alive. Separately, and for different reasons, SPARC looked to play offense in its Lucky Brand acquisition. In this instance, SPARC planned to readjust all leases, not just its own, to keep as many stores open as possible while ABG provided a mutually beneficial licensing structure. This structure allowed ABG to grow licensing revenue internationally while SPARC maintained the integrity of the store fleet.

Having spoken to and partnered with a number of acquirers, Hilco expects landlords and mall operators to remain acquisitive in 2021, potentially even purchasing brands and portfolios void of an operational retail or brick and mortar component. Landlords may continue to use the SPARC (ABG + Simon operating entity) model, leveraging liquidity to minimize vacancies, or create their own anchor tenants by combining multiple brands. It is also possible that landlords will license brands to operators within their malls, leveraging their ownership to maximize occupancy efficiency. In addition to acquisitions, landlords also spent time restructuring leases with tenants. Nearly all retail market participants attempted to renegotiate leases in 2020 with varying degrees of success. Professionals like Hilco have the advantage of working with the same landlords across multiple retailers, providing robust market data that enables the best deals to be reached. In 2020 alone, Hilco negotiated over 7,000 leases providing $1.5B in savings through new rent structures and lease terminations. Those that did not leverage professional restructuring services did not have this benefit, creating the possibility for additional negotiating room in 2021. Regardless of outcome, landlords are likely to commit to structures that keep as many stores in place as possible.

Year End & What’s Next

What’s next for retailers in 2021 remains to be seen. U.S. consumers showed considerable resilience as holiday sales increased approximately 2.4% YoY, while e-commerce sales increased almost 50%. But despite strong sales, many retailers are finding themselves in a worse cash position. Shipping, handling, and returns expenses make e-commerce sales less profitable than brick and mortar and many retailers are facing the ramification of being under-inventoried going into the holidays. Additionally, the promotional calendar shifted in 2020 from focusing on Black Friday to much longer sale periods that began around Prime Day in mid-October. Ultimately, less profitable e-commerce sales, longer promotional periods, and lack of inventory have left retailers in worse cash positions with higher loan balances than would be historically expected.

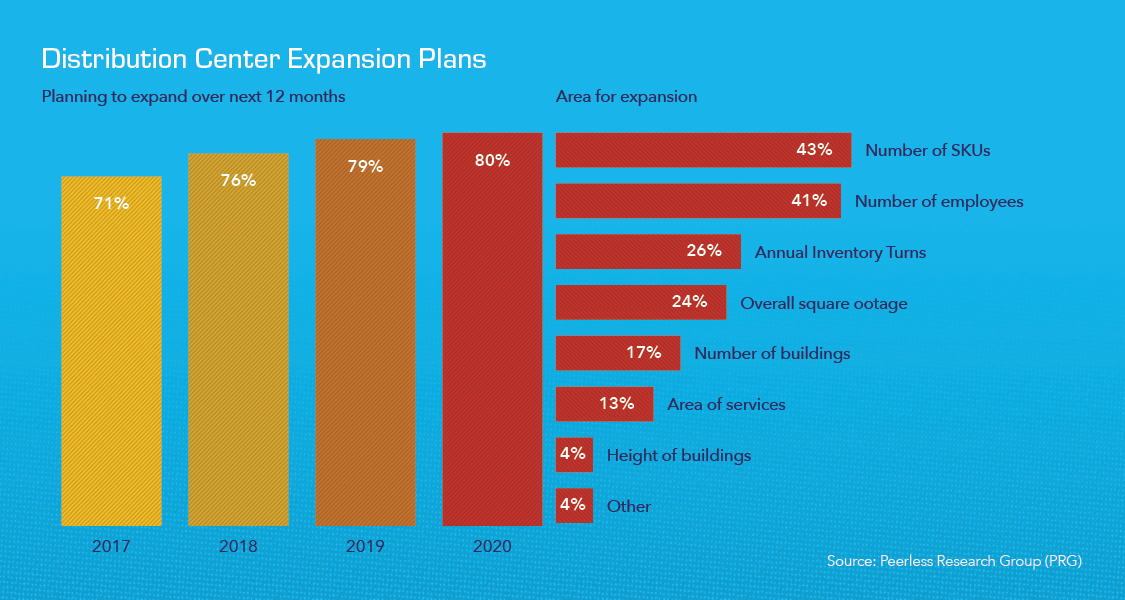

Retailers may be able to blunt that impact through their industrial real estate assets like warehouses and DCs, which have increased in value based on e-commerce fulfillment needs. Indeed, Tuesday Morning leveraged its industrial real estate assets and sold them above appraised value to help support its bankruptcy expenses and pay down creditors without wiping out equity. This trend is expected to continue as e-commerce sales approach $1.5 trillion in 2025, and Hilco expects other retailers will follow Tuesday Morning’s example.

Ultimately, lenders are scrutinizing their portfolios’ Q4 results knowing that the cash reserves usually built up at this time of year are not at historical levels. The pervasiveness of store closures will be largely dependent upon the profitability of e-commerce sales, the level of wealthy consumer consumption, and the extent to which lenders take enforcement action.

With vaccines here and the country eager to fully reopen and get back to some level of “normalcy,” many retailers and lenders will try to take a “wait and see” approach for Q1 and hope for greener pastures in Q2 and beyond. In the meantime, retailers continue to adapt by increasing buy online, pick up in-store (BOPIS), curbside pickup, fulfill from stores, and other consumer-friendly changes that enable consumers to stay safe while continuing to support their favorite retailers.

To avoid another record number of store closures in 2021, Hilco strongly encourages consumers to stay safe, but also to support their favorite local, regional and national retailers so they, in turn, can be there to support consumers with their favorite products when things ultimately normalize. The course of events over the coming 12 months and beyond will demand that retail operators work closely with both their lenders and select, trusted partners to ensure they access the best resources possible to optimize outcomes for their businesses.

Hilco Global is the world’s preeminent authority on maximizing the value of assets for both healthy and distressed companies. Our platform of over twenty specialized business units works to help retail companies understand the value of their assets and monetize that value. With a 30-year track record of acting as advisor, agent, investor and/or principal across thousands of retail transactions, we strive every day to deliver the best possible outcomes by aligning interests with clients and providing them strategic insight, advice, and, in many instances, the capital required to complete their deals. Whether you’re a lender with retail portfolio exposure or a member of the senior management team within a retail business itself, we encourage you to reach out to us for a conversation about the challenges you are facing in the current environment. The expertise of our Inventory Solutions, Valuation, Field Exam, Intellectual Property, Real Estate and Business Improvement teams is just a phone call or videoconference away. Our proven ability to develop a fully-integrated, collaborative solution custom tailored to the needs of your retail business, could make a big difference in the outcomes you achieve. These are difficult times and finding certainty in an uncertain