Q2 Transportation Market Update

In this article, we check in on relevant topics that were mentioned in our Q1 Transportation Market Update. The year progresses towards what is a historically trepidatious time going into the November elections. Used pricing trends from January ‘24 are identified and compared to what we are seeing three months later. In addition to the normal value trend observations, we take a look at new truck pricing and how depreciation is trending with the price of new class 8 tractors at historic highs. Lastly, we turn our attention to the trailer sector for trends specific to dry vans, reefers, and flatbeds, as inventory levels across all mentioned categories are increasing as we enter the midpoint of the year.

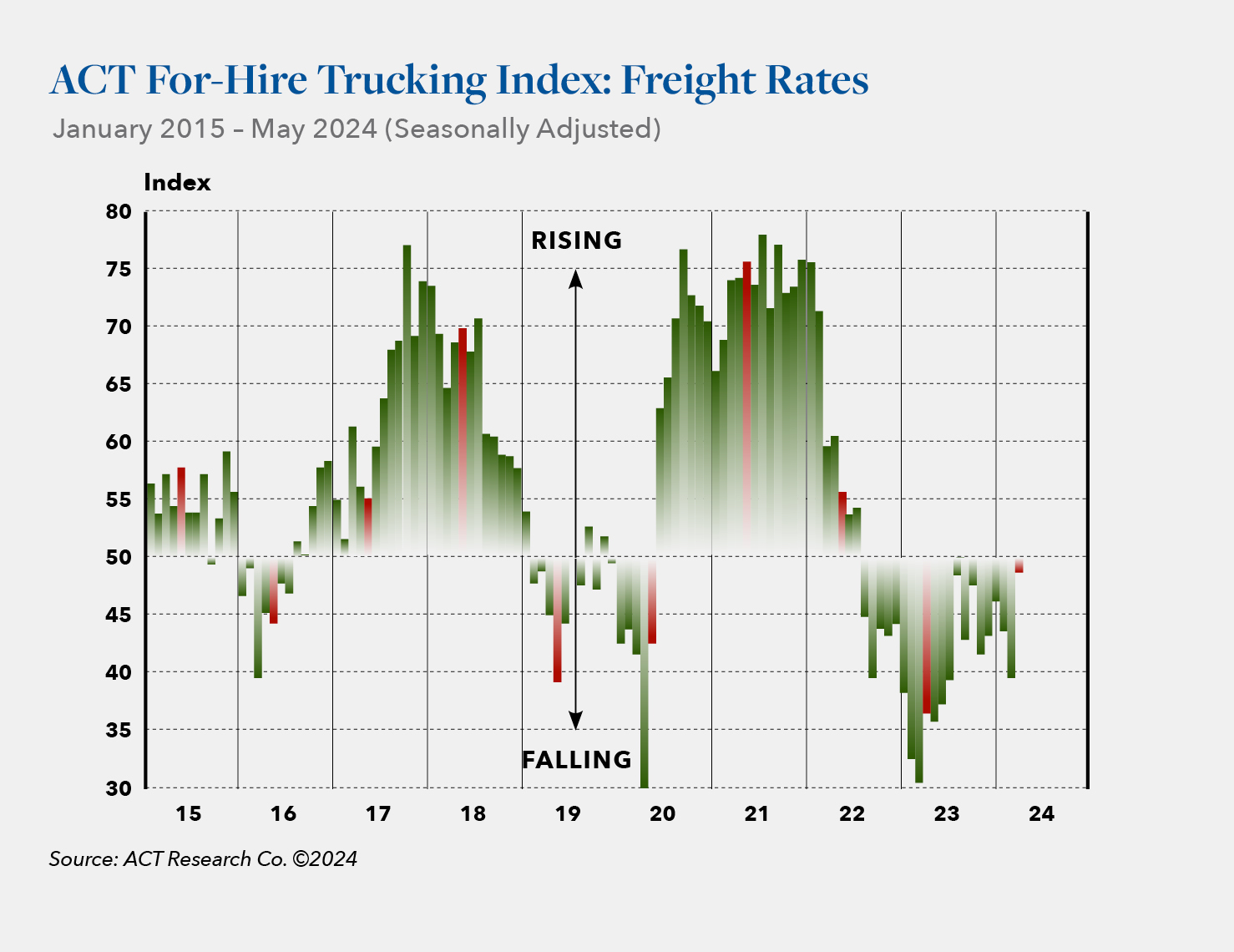

Let’s fast forward from January of this year when the average cost of a shipment was down -2.6% m/m and -18% y/y in the 10th consecutive month of double-digit y/y decreases. April data showed a -1.3% m/m (-1.6% seasonally adjusted) change and a -4% y/y change. Weakness in the freight world is slowing, but still – weakness remains. Class 8 preliminary net orders had a hiccup in April, dropping off 28% from March’s numbers, but are up an encouraging 12.5% y/y compared to last April. Freight rate stagnation and a tough market are still dreadfully harsh for many. For operators in most regions, there is just enough margin in their business to make a modest profit. From a new truck order perspective, transportation companies are pressing forward with new purchases and refleeting at a historically low rate. In ACT Research’s latest Transportation Digest report, only 20% of respondents said they plan to buy equipment in the next three months compared to the 55.3% historical average. Hilco still expects prebuy activity to be an aspect of purchase order resurgence in the mid-term, but we are not seeing those benefits today, and not likely within 2024. While it is difficult to say the exact percentage of new units that are purchased by the largest 10% of operators in the US and Canada, it represents a massive majority in the class 8 trucking space. This means there are far more operators who live and die by buying and selling, predominantly in the used space as the lifeblood of their fleet. So, any headwinds in new orders and purchases won’t be felt for at least a couple of years as those assets enter into the market on a used basis.

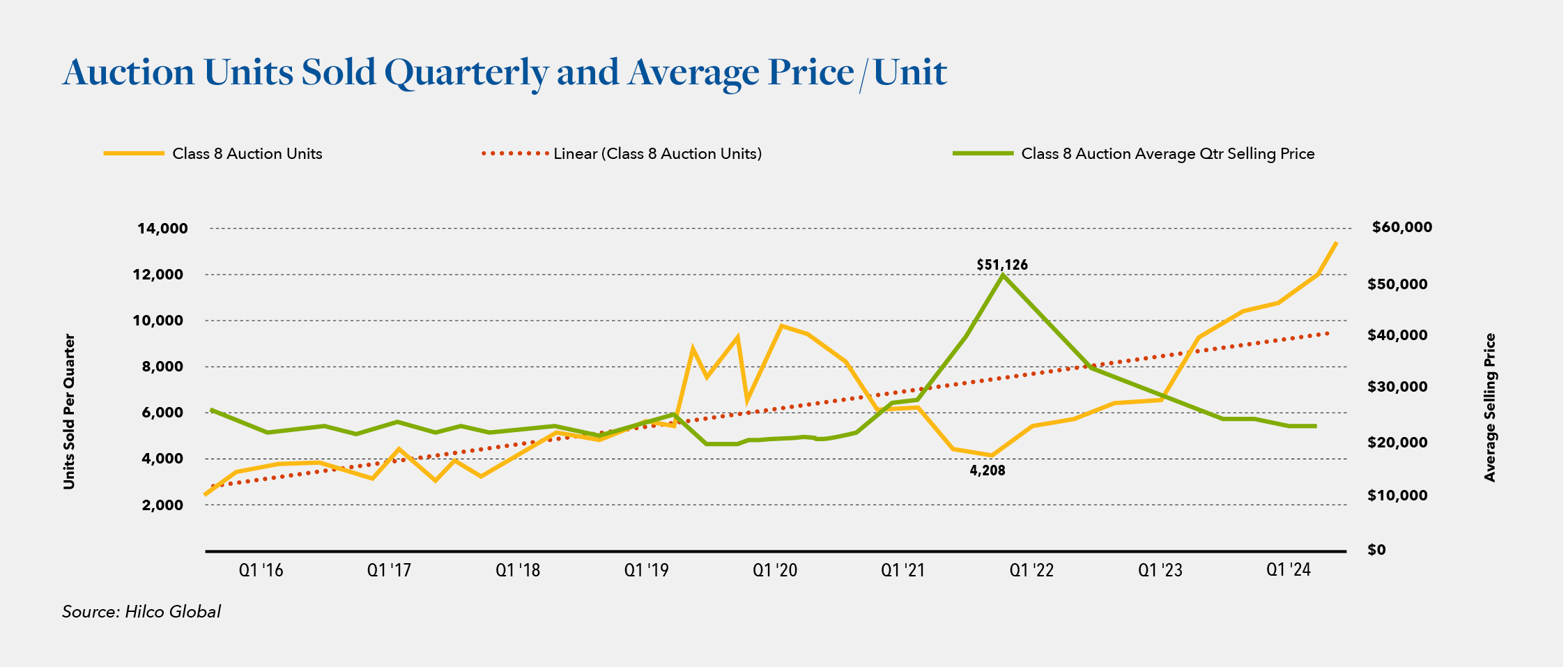

When it comes to the class 8 used values nothing tells a better story than leading trends in the public auction realm. Uninhibited raw data with a large enough market to create a stock market–type representation of the daily rate of demand, what is actually available in the market, and in what volume it is trading. According to ACT Research, raw data through May ’24, y/y change in gross auction selling price per month is down on average 29%. -36% in January, -25% in February, –30% in March, -24% in April. From a volume perspective, the number of units hitting the market is up 38% from 2023. According to Sandhills Global Value Trends, “The used heavy-duty truck market experienced a 3.87% month-over-month inventory increase in April. Inventory levels are up 16.15% YOY and are trending sideways. Asking values decreased 2.55% M/M and 16.9% YOY and are trending down. Auction values fell 4.43% M/M and 19.88% YOY and are trending down.” Additionally, the average truck age sold is actually marginally younger, with year–over–year adjustments 13% newer through May. And mileage is down 8%. To summarize, in 2024 at auction, newer lower mileage trucks are selling for an average of 24% less than in 2023 ,with a volume increase of 38% thru May. When examining the same wholesale and retail truck sales data separately, there is only marginal variability when compared to auctions.

Layered within the continuously softening market for used trucking is the reality that tandem axle, long haul, and sleeper truck tractors are more expensive now than ever before. The average asking price for an unused 2024 Freightliner Cascadia 126 tandem axle sleeper truck tractor is around $189,000 before any discounts related to volume purchases and other OEM concessions. Compare that to a one-year-old unit of the same make & model truck with standard utilization, and the average auction value is $115,000. That’s about 39% depreciation year over year for a one-year-old vehicle. The wild thing is when new trucks were selling for something in the range of 140K – 150K, a one-year older carbon copy would have a market value of around 110K – 115K (78.5% – 82% of new value). As an appraisal firm and fully invested market observer, the reasons for pricing increases are numerous. Just about everything that goes into making a truck has gone up over the past four years. But the truth is, used values are not following suit, and depreciation is experiencing a big falloff in the year immediately following production. It should also be reflected in market-based appraisals, especially for asset-based lenders. If you are lending against a fleet of brand-new trucks and they are going to work right away, fully expect and budget for a greater value change year over year.

Some of these sliding values can be attributed to the ongoing purge of Yellow trucks into the market, accompanied by significant churn in rental/lease fleets. However, the figures mentioned above are big numbers and clear data-driven indicators that a correction from the pandemic bubble is still occurring and taking longer than many preferred or predicted as recently as earlier in 2024. In order to achieve true heavy-duty truck market stabilization this calendar year, value trends need to come roaring back in a positive manner. According to the CME FedWatch Tool, there is a good chance of rate cuts coming in September. However, the Fed announced on June 12th there is to be only one rate cut expected for the calendar year, with inflation holding strong and Chairman Powell stating, “The Fed does not have high confidence in their forecasts.” With the Fed holding interest rates steady in the fight against elevated inflation along with a majority of the population feeling uneasy about near-term economic prospects, we will need to see real positive movement to believe pricing improvement can occur. Will trucking and logistics sectors improve as America grows closer to November 5th, or will markets remain tight until the country knows if there will be a regime change? Right now, despite what seems like a perpetually optimistic take on new order trends and production (pundits always spin towards optimism) and slight improvement in freight rates, negative used asset value trends are not currently following suit – they are still sliding. Month-over-month depreciation across retail, auction, and wholesale outlets is averaging -2% through May. If this continues, we are looking at an average 24% depreciation in one calendar year, which is way outpacing what we consider a stable market. It would represent back-to-back years in which the average transactional value of tractors in the auction, retail, and whole arenas dropped more than 20%.

Now, we shift our discussion to trailing fleet. It is crucial to recognize the profitability headwinds carriers are facing. In today’s tight-margin environment, the slightest shift in economic or environmental conditions can jeopardize the viability of a trucking operation. Fortunately, the transportation industry has a long history of cyclical behavior. Operators, especially publicly traded carriers, take a portfolio approach to trailing fleets and offer a variety of freight solutions. The most common being dry van, refrigerated and flatbed. All with the goal of keeping trucks on the road and balancing sector volatility. Carriers are constantly shifting fleet levels to meet current and speculative demand. Unfortunately, that is not as easy as it sounds. With that in tow, let’s look at the current state of trailing fleet with a glimpse into the three most common categories: dry van, refrigerated, and flatbed. We will examine the market forces and the impact on asset value today and through the balance of 2024.

Dry van

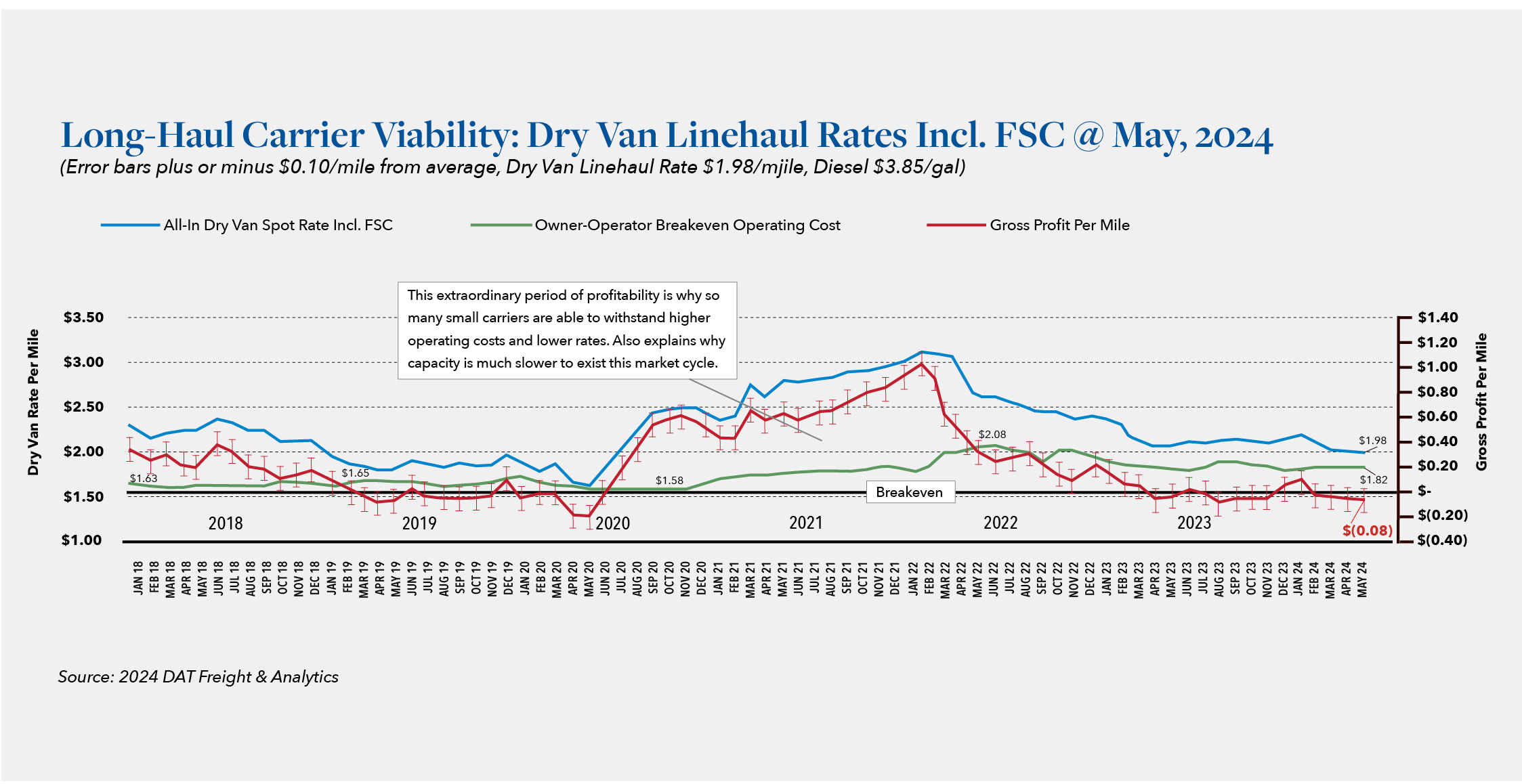

It’s complicated, especially for the owner-operator and small fleet. Carrier profitability has been challenged in the current freight cycle ongoing since Q3 of 2022. As rates continue to bounce along the bottom, operators (spot market) are forced to make a challenging decision: run in the red or park it. For many, the runway has been extended due to extraordinary profits at the peak of the pandemic cycle. The profitability and overwhelming demand of the pandemic have left the industry in a state of overcapacity. There is simply too much equipment to overcome downward pressure on rates.

Carrier profitability combined with the high cost of capital are placing increased scrutiny on CAPEX. New trucks are costing more than ever and will see further increases with the implementation of new technology required to meet impending EPA regulations. According to a rapidly diminishing new trailer backlog and M/M and Y/Y reduction in new trailer orders, carriers are diverting CAPEX from new trailer purchases. All the while, fleets are closely examining fleet size, age, utilization, and executing disposition strategies. Underutilized dry vans are pouring into the secondary market. According to Sandhill’s most recent market report, inventory levels of used semi-trailers rose 5.07% M/M and 44.83% YOY, suggesting a growing surplus. With rising inventory levels, an increase in auction volume inevitably follows alongside pricing pressure. Sandhill’s stated auction values were 2% M/M and 22.88% YOY in March. It is important to note that these stats cover a wide range of model years. Hilco’s market valuation approach closely examines market data and tracks values based on manufacturer, specifications, and vintage. Depreciation is happening most rapidly in late-model dry vans tapering into aged equipment. It is important to mention the fragility of auction values and the impact of saturation. Major liquidation events like Yellow have an immediate impact on auction values and the motivation to sell. It is likely many carriers are in a wait-and-see position when it comes to de-fleeting. A decision that will likely prolong overcapacity and suppress rates. We expect these market conditions to persist through 2024.

Refrigerated

Spring, heading into summer, is peak reefer season. Produce is in full swing from the Southwest to the Southeast, down into Mexico, and just wrapped up in the PNW. After a rocky 2023, rates are showing improvement in 2024 thanks to a favorable growing season and harvest. USDA has reported a slight shortage of trucks in some regions, likely a result of the improved volume of produce from 2023. Decreasing diesel prices is helping to preserve margins in a lumpy rate environment. While the market for produce is often attributed to fluctuation in reefer equipment pricing, restaurant supply and cold storage bring consistency and/or counteract seasonal volatility.

Like the dry van market, there is an over capacity of reefer trailers. Carriers are actively de-fleeting aged and under-utilized equipment. Most of the used equipment at auction was utilized during the pandemic and extended beyond normal trade cycles. The volume of equipment entering the used market is outpacing demand and is reflected in auction values. A falling tide sinks all ships. Late-model equipment is seeing rapid depreciation. Buyers can be selective and are price sensitive; specs and usage matter. Hilco expects little movement in reefer values through the end of 2024. It is important to note significant regulations are on the horizon for refrigerated power units. Manufacturers will be implementing new tech to satisfy EPA 2027 and California Air Resources Board regulatory changes. California is a significant produce market, and carriers are going to be forced to operate new equipment and sell non-compliant assets. Expect to see carriers opting for lease and full maintenance lease programs.

Flatbed

Flatbed trailers represent the smallest market share of the three categories. By nature, flatbeds are versatile and transport a wide range of raw materials, building materials, chemicals, import construction and farm equipment, etc. Current rate performance is lagging in 2023 and more in line with dry van rates and, more concerningly, in line with the average spot rate in 2019. With today’s inflated operational cost margins more compressed than the previous bottom of the cycle(2019), from a seasonality perspective, flatbed rates follow historical norms. Consumer sentiment, rates, and election year woes are likely having an impact on load volume.

From an equipment valuation standpoint, flatbed values have experienced less volatility than reefer and dry van since 2020. At the time of peak demand OEMs were more focused on dry van and reefer production. As a result there is less of an overcapacity issue and depreciation is more in line with historical norms. This can be confirmed by manageable auction volumes and more stable pricing. Hilco expects flatbed values to hold through the end of 2024.

As this article outlines, 2024 is certainly a challenging time for the heavy-duty logistics space, with freight rates remaining low, equipment prices cratering, and inventory volumes continuing to be in oversupply. Long-haul trucks and trailers are a lifeblood industry in the US. Most who are long-standing players in the space understand the cyclical nature of the business they are in and are here for the long haul. However, being in the business is not for the faint of heart. Multiyear cycles require patience, persistence, and a commitment to operational efficiency. Hilco will keep an eye on market values as we round the corner into Q3 and check in again on the overall market at the end of September. In the meantime, we are here to provide frank feedback on specific situations related to fleet assets or the market at large.

Hilco Valuation Services is one of the world’s largest and most diversified business asset appraisers, valuation advisors and the largest in the market driven value space. We serve as a trusted resource to countless companies, their lenders and professional services advisors. Hilco provides value opinions across virtually every asset category imaginable, including extensive expertise across transportation, construction, material handling and related asset categories. Our proven track record in liquidation of fleet assets and direct investment in the ownership and operation of trucking and over the road fleet leasing companies makes Hilco uniquely adept at understanding current markets and how they affect asset value. Reach out to our team today to discuss your or a client’s business needs. We are here to help.