Downward Valuation Pressure Mounting for Legacy ICE Manufacturers & Suppliers

In this second article of our series addressing the mobility market, we examine how downward pressure on the enterprise and asset valuations of legacy manufacturers and suppliers to the automotive industry is building and discuss how value creation can be generated and unlocked as the market evolves.

MARKET DEVELOPMENTS

As of mid 2022, the general consensus among automotive industry analysts seems to be that mounting downward pressure on the enterprise and asset values of Internal Combustion Engine (ICE) manufacturers and suppliers is destined to further shake-up the industry. While generating long-term enterprise value in the automotive market has never been a cakewalk, a seismic shift is now taking place for legacy ICE component manufacturers and suppliers and it could be transformative enough that a sizable number do not survive, at least not in their current state.

In a way, the automotive industry is experiencing its own form of long COVID, complete with lingering long-term effects, much like the aftermath of a serious illness. After passenger vehicle sales dropped dramatically — from averaging over 17mm units in 2015-19 to 14.6mm units in 2020 and 14.9mm units in 2021 — massive supply chain disruptions gummed up manufacturing schedules, inflation contributed to sky high gas prices, and a notably significant number of consumers decided that they are ready (sooner than expected perhaps) to switch to electric vehicles (EVs).

In the haze of the past couple of years, many manufacturers have struggled to remain profitable. While this is partly a result of how hard it is to wring value out of the legacy capital in the automotive industry, there is more at play. With inflationary pressure on raw materials, supply chain bottlenecks, reduced production levels, less inventory to amortize and fewer turns, gross margins are being negatively impacted and inventory and asset valuations are declining. Efforts to balance capital intensive infrastructure and legacy operations systems against reduced production volumes is a challenge that has been intensified by the dynamic shift toward technology driven design and mobility. ICE manufacturers and suppliers cannot simply flip a switch and transform their capital assets into meccas for building futuristic cars and components.

Currently, we are observing several electric commercial and electric recreational vehicle companies that invested hundreds of millions of dollars of capital into buildings, machinery & equipment, and research & development. Each are finding themselves with little to no cash remaining, delayed production plans and increasingly tight credit markets.

This may ultimately leave them no choice but to give up equity in order to find desperately needed financing, or face the potential need for liquidation in the relatively near future.

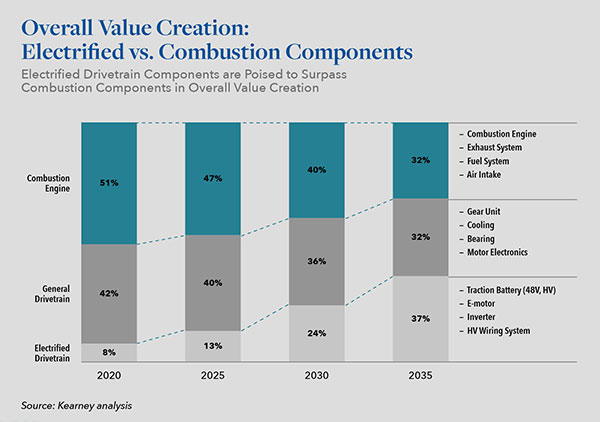

Industry watchers are increasingly supporting the thesis that future value creation in the automotive industry is directly tied to the manufacture of electric vehicles and the mobility technologies being designed for all cars. As we called out in article earlier this year about the evolving perils of auto supplier obsolescence, the car is, “embark[ing] on an unprecedented transformation from a human-guided, ICE propelled machine to a connected, autonomous, and electrified mobility device.” From an economic viability standpoint, many existing mobility technologies and those under development are designed to work across the ICE/EV divide, as ICE vehicles will still clearly continue to represent a majority of car sales during the ramp up of EV production over the next several years. That said, while EV and hybrid electric sales represented less than 10 percent of total new vehicles sold in 2021, sales that year grew by over 85 percent as compared with 2020 according to Kelley Blue Book. In the near term, the best performers will be those who figure out the ideal strategy for straddling both ICE and EV production.

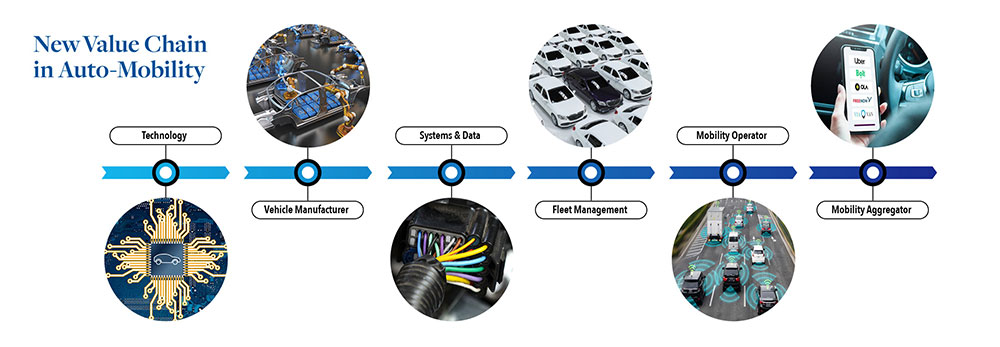

Not surprisingly, traditional automotive companies are not the only ones feeling the tremors. This new paradigm reaches beyond cars, extending into all aspects of mobility related to both people and goods. New battery power technologies and a host of sophisticated and innovative mobility platforms and applications and are being developed for trucking, shipping, busing, rail and aviation as well. While manufacturers across all of these industries are clearly vulnerable to the downward pressure on valuations of their existing core businesses, many are also ripe for growth given the burgeoning potential of mobility in areas including data tracking, connectivity, entertainment, safety and security.

BEING ASSET SMART DURING AN ACCELERATED PERIOD OF TRANSITION

With such a monumental shift taking place at such an accelerated rate, traditional ICE manufacturers and suppliers who have been slow to act have reason to be concerned. In fact, failure to pivot soon may find them feeling a bit like the mythological Greek figure Sisyphus, who was dealt the eternal punishment of forever rolling a boulder up a hill within the depths of Hades. A fruitless endeavor with no payoff in sight is not a pleasant prospect. Just ask those who occupied the C-suite at behemoths Polaroid or Blockbuster when the photography and film industries accelerated rapidly from analog into the digital realm. Resistant to change and reluctant to reinvent themselves, both companies ultimately filed for bankruptcy. Polaroid exists today only to provide its legacy film to a dwindling market, and Blockbuster is no more.

While most of the brain power associated with moving people and goods from one place to another has been focused for well over a century on advancing and improving the ICE engine and the vessel that houses it and its passengers, the mobility market presents an opportunity for manufacturers and suppliers to invest material amounts of capital in retooling production lines, repositioning factories and repurposing human and physical assets with a notable potential for upside impact. None of these promises an overnight fix or guaranteed win, but action is clearly essential for ICE manufacturers and suppliers seeking to stay integrally involved in the production of vehicles long-term or for those with an exit strategy that will ultimately rely in large part on the valuation and successful monetization of their manufacturing and/or production assets, facilities, technology and IP patents.

With a continued focus on providing ever-greater connectivity and ultimate autonomous performance, the need for suppliers capable of delivering high-tech parts and components across the mobility market and its supporting infrastructure is growing at a rapid rate. Source: Neckermann Strategic Advisors

Because most companies have already implemented short-term cost reductions, we expect to see more widespread structural and strategic initiatives across the mobility supply chain designed to repurpose, reposition, and in some instances shutter certain production lines/facilities and business units. These are going to be difficult decisions. The capital investment spending associated with this type of structural change can be risky and intimidating. A legitimate concern is that more traditional financial restructuring — like what the automotive industry has endured during bust and boom cycles in the past — may be seen as a default option. This approach could simply postpone the fate of those manufacturers who fail to capitalize on a limited time window in which to purposefully pivot and/or forge strategic alliances and partnerships to ensure their businesses’ place in the long-term mobility market.

Larger companies are typically better positioned to evaluate a suite of options, from selling off some assets, winding down divisions or business lines, or entertaining offers from jointventure prospects, while simultaneously allocating resources to focus on growth. Mid-size, small, and limited item producers whose product lines are on a likely path toward obsolescence may well be more vulnerable but may be able to position themselves for acquisition or pursue monetization of certain production, IP and other assets that have value either within or outside of their core industry.

Private equity has begun to enter the fray at a more accelerated pace and analysts are forecasting notable consolidation and a buyer’s market ahead. The key question on both sides of the equation right now is which companies’ businesses and assets are directly transferable or modifiable for next generation auto making and the broader mobility market, and what valuation can reasonably be placed on those to ensure their successful monetization/acquisition.

If your business or a business within your portfolio is involved in the manufacture of legacy combustion engine vehicle components, emerging EVs or the expanding range of products and services being innovated as part of the broader mobility market, a thorough understanding of how asset values are being impacted by ongoing shifts in the industry is perhaps more essential now than ever before. Members of the Hilco mobility team, who work across the Hilco Global platform of companies, possess a deep understanding of the factors that have historically driven value creation both within the broader transportation/mobility landscape and across other industries which have undergone disruption at an accelerated pace. With proprietary data on current and historical values and vast experience valuing, marketing and unlocking enterprise and asset value across a wide range of industries, we encourage you to reach out to our team to discuss your current challenges. We are here to help.

Industry experts from across the Hilco Global platform and Getzler Henrich are contributing to this Mobility article series, including: Tom Boniface (Hilco Valuation & Advisory Platforms), Geoffrey Frankel (Hilco Corporate Finance), Kevin Krakora (Getzler Henrich- Turnaround/ Restructuring), Keith Spacapan (Hilco Valuation Services- Automotive), Ed Zimmerlin (Hilco Valuation Services- Multidisciplinary). For more information, contact Ed Zimmerlin at ezimmerlin@hilcoglobal.com